Today's Top 10 is a guest post from Martien Lubberink, an Associate Professor in the School of Accounting and Commercial Law at Victoria University. He previously worked for the central bank of the Netherlands where he contributed to the development of new regulatory capital standards and regulatory capital disclosure standards for banks worldwide and for banks in Europe (Basel III and CRD IV respectively).

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

See all previous Top 10s here.

That question: “Why did nobody see it coming?”

1. A couple of weeks ago, Paul Romer, chief economist of the World Bank, and a former professor at Stanford and New York University raised the red flag on the state of macroeconomic research. In his essay ‘The Trouble with Macroeconomics’, Romer complains about the lack of progress made in this academic discipline. According to Romer, macroeconomics has gone backward for more than three decades. He pulls no punches; he blames the discipline for creating lipstick-wearing pigs.

Romer attributes the trouble to macroeconomists who dismiss evidence that disconfirms views of the discipline leaders: “in macroeconomics, the disregard for facts has to be understood as a choice.” Ouch!

2. Queen Elizabeth: “It's awful - Why did nobody see it coming?” A perceived lack of progress damages the reputation of an academic discipline. I mean, if our Queen asks a group of British academics and economists why nobody saw the global financial crisis coming, then surely there is something very wrong.

3. That said, there is evidence that points to the contrary: Some people did see the crisis coming, and bet accordingly. The Big Short, for example, is all about investors who saw the crisis coming. Michael Burry, the investor featuring in the Big Short, made a fortune by predicting the crisis. He earned a return of just under 500% - when investing in the S&P 500 at the same time would return less than 3%(!)

4. Ignore at your peril (I) Lesson Number 1 from the Big Short: do not dismiss mavericks. Michael Lewis, the author of the Big Short, explains Burry’ s success: “I think it was an immunity to … social information like propaganda from Wall Street. … He has Asperger’s syndrome [a form of autism, ML]; he doesn’t like talking to people, … , everything is numbers and analysis of numbers. And he persisted. And so as a result he didn’t listen to anybody who said: ‘Oh, that Triple-A is Triple-A.’”

5. Too bad, however, that Burry would have not been employed by the Federal Reserve (or any other regulator) to influence the course of the GFC. For example, in his famous How a dog catches a Frisbee speech, Andrew Haldane, the revered Chief Economist at the Bank of England, makes a disturbing comment about people with autism:

This is embarrassing. Especially because Andrew Haldane gave the Dog and Frisbee speech two years after the publication of the bestselling Big Short book and four years after Queen Elizabeth asked that question. Haldane and his speechwriters could have known about Burry’s condition and the fact that he made a killing predicting the GFC. Instead of querying Burry and ask him how actually he caught the crisis on time, Andrew Haldane chooses to complain about the fog created by complex bank regulation, as if there will be a future without complex rules for banks.

Moreover, if I understand this blog post from Dan Davies correctly, the Bank of England will keep hiring well-mannered policy wonks who, to save their careers, will avoid admitting to having spotted an emperor without clothes, let alone catch a crisis before it is too late.

6. Ignore at your peril (II) Lesson Number Two from the Big Short: get your hands dirty, gather data. Michael Burry gathered lots of information about his investments, analysed data and acted upon it. The good thing is that it pays to collect and analyse data before investing. The bad thing: it is onerous, especially when it concerns banks. Financial information of banks is complex, difficult to understand, and often hard to get.

Many academics responded to the complexity of bank data by eliminating banks from their sample. For many years this was standard practice in many disciplines of academic research.

Ignoring banks for a long time obviously will prompt a Queen to ask that question. So yes, academics deserve some credit for failing to spot the GFC. But blaming academics for not ‘catching’ a financial crisis is not entirely fair. They are subjected to the relentless pressure to publish. Consequently, unless academics are given more time to study banks, the decision between examining the likes of Fisher & Paykel or examining HSBC, ING, and ANZ will be made in favour of the former.

7. It’s high-quality disclosures, stupid! Currently there are important differences in the ways that countries regulate bank disclosures. For example, the U.S. set a great example, see this website of the Chicago Federal Reserve. It offers a real treasure trove of bank data. Quarterly data of Bank Holding Companies dates back to 1986, call reports date back to 1976. The data is free, and highly standardised.

The data is also very detailed, there are thousands of variables. Fortunately, the documentation is excellent too. Anyone can instantly download U.S. bank data into a spreadsheet and start analysing.

8. Europe’s bank disclosures, unfortunately, are patchwork (to put it mildly). New bank regulation in Europe offers individual countries many choices regarding disclosures. There is no uniform frequency. Only the largest banks will have to publish selected data quarterly. European banks can decide to publish typical bank disclosures (the 'Pillar 3' disclosures) separately from the financial statements, or blended-in with the financial statements (Rabobank does this since 2015, ING did this for many years). Deutsche Bank publishes its annual financial accounts here, regulatory reporting information here, and information about capital securities here.) There is no central repository for data in Europe, and most of the data is available only in pdf format.

The lack of a standardised data, the absence of a central data repository, and the poor format of the data (pdf) make it virtually impossible to conduct sensible research on European banks.

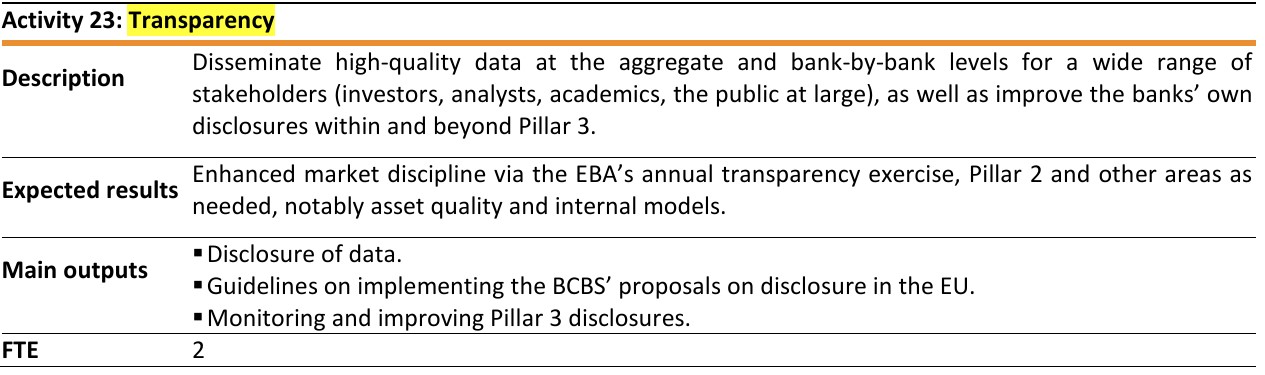

The European Banking Authority (EBA) tries to help academics, with limited success. For example, the EBA work programme for this year promises to disseminate high quality data for investors, analysts, and academics - see the picture below. Unfortunately, it is October, the EBA 2016 work programme expires soon, and I still cannot find the data.

9. How is New Zealand doing? Currently, the RBNZ publishes summary information for locally incorporated banks on a spreadsheet that goes back to 1996 – this is not bad.

The Dashboard. More interesting is RBNZ’s recently published consultation paper on bank disclosures. It says that the Reserve Bank strongly favours a new, electronic, ‘Dashboard’ approach to bank disclosures. The Dashboard would provide a side-by-side comparison of individual locally incorporated banks, according to key metrics, hosted on the Reserve Bank’s website and updated quarterly. The RBNZ believes that the Dashboard approach would enhance market discipline by presenting individual bank data in a more accessible and comparable way.

This Dashboard approach looks promising in that it resembles the U.S. approach, albeit that the Dashboard data will probably be less detailed. But, the Dashboard is clearly superior to the European approach, which precludes any meaningful collection of bank data.

That said, the Dashboard is still in consultation, and I urge readers to submit comments to help the RBNZ to improve this disclosure initiative. The consultation closes 1 December 2016.

10. To end on a lighter note. Stanford Professor Paul Pfleiderer offers a sobering comment on the importance of common sense in academic research. His Chameleons essay is definitively worth reading, not in the least because it contains many examples of academic folly. Paul Pfleiderer concurs with Paul Romer: economists struggle with facts. It is therefore much easier to just assume:

(From “Chameleons: The Misuse of Theoretical Models in Finance and Economics”, Paul Pfleiderer, 2014.)

So, if the Queen wonders why did nobody see it coming, I am pretty sure that many academics found it convenient to just assume that the price of risk would keep going down forever.

25 Comments

Economists have not yet let go the ludicrous assumption that banks are irrelevant because they are only intermediaries between savers and borrowers. They still do not recognise the impact of financial money creation (lending creates money).

The better ending to the classic joke is for the economist to say " let's assume we don't have to eat"

Too true.

In terms of monetary policy, Greenspan long ago recognized that there wasn’t any anywhere in the world. As early as 1996 in his infamous “irrational exuberance” speech, there was the “maestro” admitting that the very concept of money had long ago gotten away from central banking.

Unfortunately, money supply trends veered off path several years ago as a useful summary of the overall economy. Thus, to keep the Congress informed on what we are doing, we have been required to explain the full complexity of the substance of our deliberations, and how we see economic relationships and evolving trends.

There are some indications that the money demand relationships to interest rates and income may be coming back on track. It is too soon to tell, and in any event we cannot in the future expect to rely a great deal on money supply in making monetary policy. Still, if money growth is better behaved, it would be helpful in the conduct of policy and in our communications with the Congress and the public.

Did money ever become “better behaved?” Of course not, as it was just as unreasonable to suggest then as it would be to do so now twenty years later. We need look no further than Greenspan’s own words in June 2000 to settle that issue:

The problem is that we cannot extract from our statistical database what is true money conceptually, either in the transactions mode or the store-of-value mode. One of the reasons, obviously, is that the proliferation of products has been so extraordinary that the true underlying mix of money in our money and near money data is continuously changing. As a consequence, while of necessity it must be the case at the end of the day that inflation has to be a monetary phenomenon, a decision to base policy on measures of money presupposes that we can locate money. And that has become an increasingly dubious proposition. Read more and more

I found Greenspan's recent conversion to sound banking rather delightful. He now feels that all the risk models are useless and all banks should have 20-30% equity reserves instead. All rather uplifting.

That level of equity would make a lot more sense at it would require a more sound business model for banks. The risk weighting system (which is flawed and allows too little capital for housing) has never been operated correctly or competently. The leverage allowed for residential housing is completely mad for what is little more than some land with a depreciating house.

There needs to be a lot of regulatory changes for housing. Most houses on the market are rotting pieces of shit that have never been maintained properly since construction. Not really a sound asset to put $1m into, nor risk free like banks and regulators would have you think based on the risk weightings.

I made some similar points about risk weightings and bank capital in this article - http://www.interest.co.nz/opinion/80760/gareth-vaughan-argues-if-we-look-banks-housing-loan-exposure-financial-stability

The reason that some banks may be forced to shrink in real operations is because first they know they are vulnerable to RWA expansion through nothing more than the reverse process of what they undertook in 2012. As volatility rises without a realistic ability to hedge against it, RWA’s will be under pressure to be re-evaluated far less favorably.

To wit (h/t and thanks to M. Simmons):

Bank of Montreal, Canada’s fourth-biggest lender by assets, said on Tuesday it had amended its regulatory capital ratios for the first three quarters of 2016, a move that left the bank holding more risky assets than it had reported.

There were no changes to the BMO’s income statement or balance sheet apart from the level of its RWA, thus confirming something off in its models. It had reported CDN$260 billion of risk-weighted assets but was forced to review “procedures” about some of its portfolio holdings that were then reclassified to a higher risk “bucket.” The difference was an increase in RWA of about CDN$12 billion. Read more

Are our own banks facing the imposition of this reality given their part (and the RBNZ's) in creating the residential housing bubble, in addition to tighter foreign wholesale funding demands?

Link to Greenspan article:

https://www.ft.com/content/59b15ccc-49aa-11e5-9b5d-89a026fda5c9

https://www.ft.com/content/4d55622a-44c8-11e5-af2f-4d6e0e5eda22

In retirement however, Mr Greenspan seems to be learning the merits both of candour and clarity. Last week he exhibited both qualities in an article for the Financial Times in which he called for banks to raise substantially more equity capital. Funding 20 per cent of their balance sheet assets this way should not hurt them financially, the oracle opined. Indeed, it would make their lives easier.

I particularly liked this bit:

Well-capitalised banks need to be less fettered in their primary economic function: to assist in the directing of the nation’s scarce savings to fund our most potentially productive investments. Funding cutting-edge capital investments will engender growth in national productivity and standards of living.

What. Splutter. No mention of capturing a percentage of the debt serfs lifetime earnings, creamed right off the top.

They still do not recognise the impact of financial money creation (lending creates money).

My view is that they do now....

If u are holding ur breath for a repeat of the GFC... u might be holding it for quite a while.!!

No, there is no sign that economists have let go their banks as intermediaries assumption. See the quote on this comments page from Alan Greenspan, it is clear he has that view. Also in the RBNZ's paper on its DSGE model (DP2015/05), it talks only of intermediaries. In that paper there is actually no mention of money, loans, lending, or banks,- and boils down the whole economy into a few "optimising agents". Sad

In #4 ML says do not dismiss the mavericks. IMHO and experience mavericks are usually those who insist on telling the truth (as they see it) in the face of conventional wisdom, and against the tide of politics. History is littered with them (you could start with Galileo, although I am certain he is not the first), and as far as i can tell, also teaches us that history usually proves they were correct. Big organisations hate mavericks because the public would be appalled at what goes on behind closed doors.

The trick, however, is identifying the real mavericks from the contrarians and the crazies. There are always some people preaching against whatever the conventional wisdom happens to be (on any topic). There is always someone crying the end is nigh.

Sometimes they're right. But it's usually only in hindsight that you can separate the savants from the silly.

"..insist on telling the truth (as they see it) in the face of conventional wisdom.."

try Gail Tverberg at ourfiniteworld.com ... She wont fill you with much hope but she cuts through conventional wisdom

This is so true :- “in macroeconomics, the disregard for facts has to be understood as a choice'

There were so many tell-tale signs that things were going pear shaped that we chose simply to ignore .

Economists are like millenniums chasing Pokemon Go in that they are chasing an imaginary money system also created from nothing with electronic digits.

And after all that the world has gone through with the GFC and the ability to be wise after the event, have we really learnt the lessons that we need to and made changes accordingly? There is no point making mistakes, if we are not going to learn from them.

What is going on now that points to future problems? In Queen Elisabeth's terms "what should we be seeing that is coming" and more importantly what are we doing about it? Sadly I suspect that we have not learnt much, as we seem to face even more risks and are doing little or nothing about it. We still seem to be in the hands of "well-mannered policy wonks who, to save their careers, will avoid admitting to having spotted an emperor without clothes, let alone catch a crisis before it is too late."

Having said all the above one has to be careful to not to be jumping at every shadow and bouncing from one fear to the next. However I think that we are missing a lot.

The new macro economy is changing

The next manufacturing revolution is here | Olivier Scalabre

https://www.youtube.com/watch?v=AyWtIwwEgS0&feature=youtu.be&t=143

The people that can't see it coming are are making a lot of easy money, they become self important experts on everything. If you want people to support a failed economic system, print lots of money and pay some of the people handsomely to repress the masses and convince them that it's all going well. People think the economy is going well if they are making money, instead of questioning whether the current system is sustainable in the long run.

Am all for better and standardised disclosures as proposed, but one of the key risks that cannot be covered by the small bank reserves that are generally provided is the banks lending practice and policy. These are confidential but absolutely critical to assessing risk (e.g. of OBRs being imposed)

It is clear that recent lending by banks has been reckless: loans with excessive LVR and DTIs have been rife, and that is rocket fuel when poured into housing markets with low elasticity of supply such as the NZ housing market. Banks have made no allowance for the market elasticity when lending. Effective self regulation would not have needed LVR limits to have been imposed, and more limits are required given the banks evident woeful performance.

For as long as we cannot get a better handle on each banks lending policy, then we cannot see the largest risk, but there is every reason we should be worried.

Looks like evil planet destoying humans have sorted out lead. All achieved without a tax, Hollywood celebrities or a $1.5 trillion hysteria industry. "Pb contamination has been in decline for decades. Today, the surface layers of these bogs are comparable in composition to the “cleanest” peat samples ever found in the Northern Hemisphere, from a Swiss bog ~ 6000 to 9000 years old. The lack of contemporary Pb contamination in the Alberta bogs is testimony to successful international efforts of the past decades to reduce anthropogenic emissions of this potentially toxic metal to the atmosphere."

Don't want to put the blame on Clinton for the GFC,but the Cinton Govt had a lot to do with lowering the standard borrowers had to have for getting house loans.Things flowed from there.

Bill Clinton signed the repeal of the Glass-Steagall act. Which counts for a lot.

Maybe i should have put ''''ALL THE BLAME''''''

Romer's devastating blast is much stronger than 1 above suggests, it is rather technical but try this for size:

Once macroeconomists concluded that it was reasonable to invoke an imaginary

forcing variables, they added more. The resulting menagerie, together with my

suggested names now includes:

• A general type of phlogiston that increases the quantity of consumption goods

produced by given inputs

• An "investment-specific" type of phlogiston that increases the quantity of

capital goods produced by given inputs

• A troll who makes random changes to the wages paid to all workers

• A gremlin who makes random changes to the price of output

• Aether, which increases the risk preference of investors

• Caloric, which makes people want less leisure

With the possible exception of phlogiston, the modelers assumed that there is

no way to directly measure these forces.

Please. It is clear that many regulators, politicians and prominent economists missed the warning signs. But many economists were trying to sound the alert - most notably Raghuram Rajan - who was famously abused by Lawrence Summers for telling it like it was. Roubini is another that springs to mind. The problem is, no one wants to listen to the person telling you that the party is over and that it's time to go home.

So the idea that "no economists saw it coming" continues to be a crutch for lazy thinking.

#5 made me LOL. So many of the FRB staff would tell you that they are "on the spectrum"...

#1 Romer's critique has little to do with macroeconomic policy-making. You'd be sorely mistaken to think that Greenspan gave a hoot about the real business cycle models that Prescott made his career out of.

Ergophobia saw it coming too. And has a reasonably thick file of (olde hand-written) warning letters, dating from 2003, to central bankers. many did, it was not that big a mystery: 'tis just that the scum with their noses in the trough did not listen, or did (do) not care.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.