2022 has opened with more talk about an impending "credit crunch".

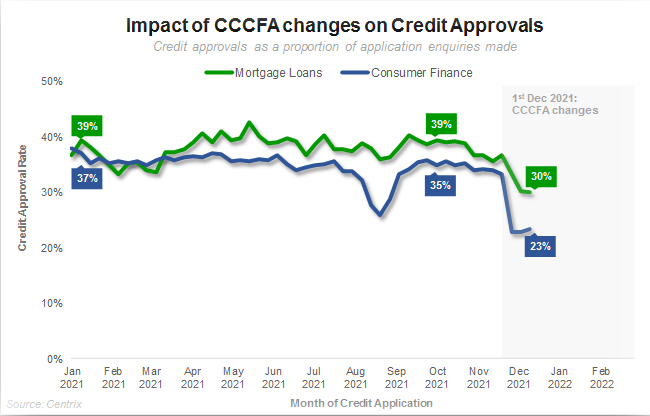

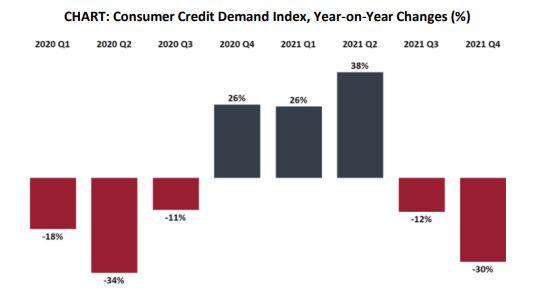

Credit bureaux Centrix and Equifax have both made holiday releases pointing out how much and how fast the pullback was in December in loan applications.

Equifax described it as a "plummet", Centrix is noting a "hard hit", specifically from the CCCFA changes.

Here are the Equifax observations. Centrix is seeing 1 in 5 mortgage loan approvals hit by the new CCCFA regulations (i.e. consumers that were previously approved are no longer under these CCCFA changes), and 1 in 3 consumer finance approvals have been impacted by CCCFA.

For mortgages, they see a lending commitment slowdown of -23% of almost -$2 bln (going from $8.3 bln per month to $6.4 bln per month.

The CCCFA is getting all the blame. The mortgage broking industry is worried about what it will do to their business model and is organising its clients to petition officials. The Commerce minister is rattled.

Of course, all this is superficial. The base from what all this is being measured against is probably unrealistic. The CCCFA is just one of a series of measures put in place to restrain rampant credit growth and an unsustainable housing market. The object is to arrest the trajectory, and in 2022 we may be seeing the fruits of these policies - finally after decades if ineffectual action.

But if a credit crunch is coming, as unusual as it might be in New Zealand, it is probably wise to understand what it really is.

With apologies to Wikipedia, here is how it is described there.

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises).

Causes

A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investors in debt when the loans turn sour and the full extent of bad debts becomes known.

There are a number of reasons why banks might suddenly stop or slow lending activity. For example, inadequate information about the financial condition of borrowers can lead to a boom in lending when financial institutions overestimate creditworthiness, while the sudden revelation of information suggesting that borrowers are or were less creditworthy can lead to a sudden contraction of credit. Other causes can include an anticipated decline in the value of the collateral used by the banks to secure the loans; an exogenous change in monetary conditions (for example, where the central bank suddenly and unexpectedly raises reserve requirements or imposes new regulatory constraints on lending); the central government imposing direct credit controls on the banking system; or even an increased perception of risk regarding the solvency of other banks within the banking system.

Easy credit conditions

Easy credit conditions (sometimes referred to as "easy money" or "loose credit") are characterized by low interest rates for borrowers and relaxed lending practices by bankers, making it easy to get inexpensive loans. A credit crunch is the opposite, in which interest rates rise and lending practices tighten. Easy credit conditions mean that funds are readily available to borrowers, which results in asset prices rising if the loaned funds are used to buy assets in a particular market, such as real estate or stocks.

Bubble formation

U.S. house price trend (1987–2008) as measured by the Case-Shiller index. Between 2000 and 2006 housing prices nearly doubled, rising from 100 to nearly 200 on the index.

In a credit bubble, lending standards become less stringent. Easy credit drives up prices within a class of assets, usually real estate or equities. These increased asset values then become the collateral for further borrowing. During the upward phase in the credit cycle, asset prices may experience bouts of frenzied competitive, leveraged bidding, inducing inflation in a particular asset market. This can then cause a speculative price "bubble" to develop. As this upswing in new debt creation also increases the money supply and stimulates economic activity, this also tends to temporarily raise economic growth and employment.

Economist Hyman Minsky described the types of borrowing and lending that contribute to a bubble. The "hedge borrower" can make debt payments (covering interest and principal) from current cash flows from investments. This borrower is not taking significant risk. However, the next type, the "speculative borrower", the cash flow from investments can service the debt, i.e., cover the interest due, but the borrower must regularly roll over, or re-borrow, the principal. The "Ponzi borrower" (named for Charles Ponzi, see also Ponzi scheme) borrows based on the belief that the appreciation of the value of the asset will be sufficient to refinance the debt but could not make sufficient payments on interest or principal with the cash flow from investments; only the appreciating asset value can keep the Ponzi borrower afloat.

Often it is only in retrospect that participants in an economic bubble realize that the point of collapse was obvious. In this respect, economic bubbles can have dynamic characteristics not unlike Ponzi schemes or Pyramid schemes.

Psychological

Several psychological factors contribute to bubbles and related busts.

- Social herding refers to following the behavior of others, assuming they understand what is happening. As John Maynard Keynes observed in 1931 during the Great Depression: "A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional way along with his fellows, so that no one can really blame him."

- People may assume that unusually favorable trends (e.g., exceptionally low interest rates and prolonged asset price increases) will continue indefinitely.

- Incentives may also encourage risky behavior, particularly where the negative consequences if a bet goes sour are shared collectively. The tendency of government to bail out financial institutions that get into trouble (e.g., Long-term Capital Management and the subprime mortgage crisis), provide examples of such moral hazard.

- People may assume that "this time is different", which psychologist Daniel Kahneman refers to as the inside view, as opposed to the outside view, which is based on historical or better objective information.

These and other cognitive biases that impair judgment can contribute to credit bubbles and crunches.

Valuation of securities

The crunch is generally caused by a reduction in the market prices of previously "overinflated" assets and refers to the financial crisis that results from the price collapse. This can result in widespread foreclosure or bankruptcy for those who came in late to the market, as the prices of previously inflated assets generally drop precipitously. In contrast, a liquidity crisis is triggered when an otherwise sound business finds itself temporarily incapable of accessing the bridge finance it needs to expand its business or smooth its cash flow payments. In this case, accessing additional credit lines and "trading through" the crisis can allow the business to navigate its way through the problem and ensure its continued solvency and viability. It is often difficult to know, in the midst of a crisis, whether distressed businesses are experiencing a crisis of solvency or a temporary liquidity crisis.

In the case of a credit crunch, it may be preferable to "mark to market" - and if necessary, sell or go into liquidation if the capital of the business affected is insufficient to survive the post-boom phase of the credit cycle. In the case of a liquidity crisis on the other hand, it may be preferable to attempt to access additional lines of credit, as opportunities for growth may exist once the liquidity crisis is overcome.

Effects

Securitization markets were impaired during the crisis. This shows how readily available credit dried-up during the 2007-2008 crisis.

Financial institutions facing losses may then reduce the availability of credit, and increase the cost of accessing credit by raising interest rates. In some cases lenders may be unable to lend further, even if they wish, as a result of earlier losses. If participants themselves are highly leveraged (i.e., carrying a high debt burden) the damage done when the bubble bursts is more severe, causing recession or depression. Financial institutions may fail, economic growth may slow, unemployment may rise, and social unrest may increase. For example, the ratio of household debt to after-tax income rose from 60% in 1984 to 130% by 2007, contributing to (and worsening) the Subprime mortgage crisis of 2007–2008.

Historical perspective

In recent decades credit crunches have not been rare or black swan events. Although few economists have successfully predicted credit crunch events before they have occurred, Professor Richard Rumelt has written the following in relation to their surprising frequency and regularity in advanced economies around the world: "In fact, during the past fifty years there have been 28 severe house-price boom-bust cycles and 28 credit crunches in 21 advanced Organisation for Economic Co-operation and Development (OECD) economies."

Like much of Wikipedia, this content is very US-focused. But it is instructive all the same.

What is clear is that currently we aren't at a full "credit crunch" situation yet. The fact that mortgage brokers are not able to do as much business as they used to is not part of the definition of a credit crunch - and it isn't necessarily a bad thing.

Decades of not dealing properly with "the housing crisis" has always meant that when effective action is eventually taken, some people will be hurt more than if proper action has been take much earlier in the cycle. That however should not stop eventually taking proper action.

There has grown a political penchant to only take corrective public policy action so long as no-one actually gets hurt. Obviously that is a very poor way to fix a very large public policy problem. The sooner a big correction is behind us, the better - if affordable housing is the objective. Houses should always only have been 'shelter' - when they became an "investment" and a tax-dodge after the Clark/Cullen income 39% tax rate, Kiwi DNA changed. It needs to change back.

148 Comments

Agree it needs to change. Access to debt is a balancing act and some credit process will alway occur, but it has swung way to far to protect speculative valuations. When did the term "income fundamentals" become a forgotten word for accessing debt?

Brokers complaining are vested interests. Interestingly Banks are closing branches and not replacing lending staff thus forcing borrowers to use Brokers. Speculation, but perhaps the Banks are in prep mode for a change in lending cycle....

Banks just want to remove overhead by closing branches and dumping staff. You can still deal with them for mortgages, but yeah if your circumstances are tricky you will likely need a broker.

Like someone said earlier, you don't hear the banks complaining. They know interest rates are rising. They know house prices need to fall so people can afford the fortnightly payments. It's a balancing act.

Honestly at this point it's probably best the public believes the banks are just being too nitpicky about the rules, than realise what's actually going on and panic sell, creating an actual crash.

The banks are complaining in a round about way. By being pedantic about loan applications the government are going to have to water it down as no one wants to go through hoops to get a mortgage just to save some of the small number of mortgagee sales a year (and I’m sure most are due to change in circumstances not couldn’t afford it).

Agree it needs to change. Access to debt is a balancing act and some credit process will alway occur, but it has swung way to far to protect speculative valuations. When did the term "income fundamentals" become a forgotten word for accessing debt?

Bit late to be talking about change, balance, and fundamentals now isn't it? Stanley Druckenmiller (if you don't know who he is, see below) was talking about the bursting of asset bubbles globally being a potential savior against inflation.

Interesting. One of the key points is "nothing hurts the poor and middle class like inflation". Last 12 months it really looks like Labour is allowing its core voting block to get hammered by inflation to protect their rental portfolios. PM and Deputy must be fans of the term chardonnay socialist. Shameful

Inflation is great if you are getting pay rises, particularly if you have debt. Stagflation is the one to watch out for.

Surely the worst thing they could do to create inequality is to limit debt to the rich only (as they just have). The rich are free to borrow and invest while the poor must save their pennies to try and get ahead, good luck with that. I wouldn’t have a fraction of my current wealth had I not been allowed to borrow and I’m sure that goes for all the others commenting here that want to shut the door behind them.

remember those stories of boomers buying their first house and doing it tough with no phones or avocado on toast etc. well now you would not be allowed to even get a mortgage in that scenario as it would be considered risky. Welcome to rentsville millennials.

Jimbo, Guess what happens if most peoples can't get a mortgage

builders stop building, economy goes into recession, high unemployment. Not sure that helps inequality either. Unless you are one of those who thinks the best way to solve inequality is to make everyone poor.

The worst possible outcome is that interest rates go down due to a recession and the rich get to borrow and invest at stupidly low rates while the poor have to explain every roll of toilet paper they but before getting their loan declined.

I think you missed the part that what recession is actually about. If the rich still get to borrow to invest at stupid low rates, I don't think they are in the recession cycle anymore. They are probably in expansion cycle where allows them to borrow, invest and expand. That's after recession. Sure they can invest after recession, but the condition is that if they can survive through the recession. Lol. But if they are carrying huge amount of debt, I don't think it will be easy for them to survive through recession.

I’d be happy if they raised interest rates or dried up credit in a fair way. But telling poor people (or even average people) that they are too poor / dumb to get a loan is the worst outcome IMO.

Not to worry, you will be happy to know that those poor (or even average people) will have the banks lending them enough money when the house prices come back 50 to 60%. Nice, though that you are so concerned for the poor (or even average people).

Gen x: I genuinely am. this policy doesn’t affect me at all as I don’t intend to get any more debt (although circumstances can always change I guess), and if house prices dropped it wouldn’t either as I only own the house I live in which I don’t intend to sell. But I am in a relatively good situation due to being “allowed” to borrow from the bank when we had a fairly low income (wife was still studying). I think this policy will only make inequality worse.

The status quo is no longer viable and even the RBNZ and Jacinda know it. House prices are coming down and it's better to not lend out money until that correction has occurred. This protects the most vulnerable and when prices do come down their loans won't have to be as ridiculously large.

Fair enough, if that’s what happens then all good IMO.

I agree Jimbo, it was like that in 70's if you were trying to buy a farm but had no farming family back ground. Nearly impossible. Late 90's things changed and banks were easier to deal with and workers like myself were given the opportunity to buy, providing of course that you had saved for that reason.

Not convinced it makes much difference whether the poor are allowed to borrow in the same way as the rich. The upper classes pull ahead regardless because the poor are offered less favorable terms - think loan sharks, credit cards. low deposit mortgage rates etc.

This good piece on inequality and the monetary system: https://sahilbloom.substack.com/p/how-the-rich-get-richer

The Wikipedia article is well-written, I can see why you've quoted it at such length. Although it may be US-focused, I'm sure a lot of Kiwis will relate strongly to some of the concept it describes (such as "Ponzi borrower").

The above has New Zealand written all over it.

Tick tock.

The tide seems to have turned since the Evergrande crisis... Fingers crossed we don't end up like Ireland pre 2008 crash.

It does appear as if a credit crunch has cast a shadow. Good job, since all that cheap money the past year was just too glorious.

It does appear as if a credit crunch has cast a shadow. Good job, since all that cheap money the past year was just too glorious.

It's not just the 'last year'. There's been at least 20+ years of open-bar cheap, easy money.

You do have a good point... I was being subtle. 12 years ago I had three mortgages. Was a piece of cake!

Back to one mortgage now and it's hard getting the 2nd one again. Last year locking in @2.19% means it costs only $25 per week for us and that's P&I. Seems too good, but the crunch means it's harder to borrow. Times are a changing.

This can result in widespread foreclosure or bankruptcy

Tell me again why a government manufactured credit crunch which results in people losing their homes and businesses is a good thing? Two years ago they intervened by dropping interest rates to historic lows, rolling out funding for lending programmes, removing the temporary LVR restrictions (though only temporarily) etc.

It seems this volatility is created by their constant interventions and regulation. How about a commitment to stop intervening and create a stable regulatory environment so households and businesses can make their own financial decisions without having to constantly speculate on what government will regulate next?

The problem is we're now used to using monetary policy to give some level of employment continuity. The damage from boom bust cycles is deemed worse than fluctuating credit availability and conditions.

The lending environment seems similar to 2009/2010 in the wake of the GFC when banks tightened up perhaps fearing price crashes or perhaps a global constraint. E.g. asking clients for a formal employment letter even after the client has had their salary direct credited for years.

Would be great if credit was directed to more productive investments such as new businesses, innovation, inventions, IT, primary industry, aquaculture, etc.

Kiwis have buried themselves too deep in unproductive speculative property "investment " egged on by the banks, RE agents and politicians

Unfortunately it's the opposite. Accessing lending for business is like pulling teeth, the lending rate is higher and the repayment term is shorter.

Largely risk based.

Accessing lending for business is like pulling teeth, the lending rate is higher and the repayment term is shorter.

The ruling elite has believed that rising house prices are good for lending to SMEs because they provide a capital base. The collapse of housing bubbles is a double-edged sword.

Perfect time for a rent strike to thank all those landlords who so cheerfully raised their rents last year.

https://thedailyblog.co.nz/2022/01/15/will-labours-appalling-handling-o…

If voting seems too hard then the ramifications on defaulting on your rent payment is like climbing Everest.

'When the anger grows the fear goes'. Threats don't frighten people who feel that they have nothing to lose.

As I've said before, conditions for something like an Arab Spring are miles from what renters in NZ get to experience.

I think conditions elsewhere, particularly food shortages, could create Arab Spring type events in the near future. I don’t see such factors in NZ and, even if there were, I feel our population is too compliant and complacent to protest let alone trigger regime or constitutional change. Only the “far right” seem bothered by what’s happening; everyone else seems keen to fawn, yawn and move on.

The arab spring was created because the west sunk millions of dollars in the encouraging and promoting regional tension between countries ruled by super authoritarian despots. And only because said despots are sitting on most of easily accessed remaining oil reserves.

NZ exports the vast majority of the food that we produce. NZ is a long long long way from a starving populace, like actually going hungry.

If the shite hit the fan (like really hit the fan), we are one of the better countries to be if it really meant completely cutting ties with the outside world etc.

We will starve ourselves of our energy supplies, before we run out of food.

For sure, the CIA and others were encouraging regime change. But hangry people demand change. I agree that we won’t run out of food in New Zealand and that’s one key reason we won’t see an Arab Spring type event here (as well as increasingly being an apathetic bunch only clamouring for subsidies).

The phased removal of mortgage interest deductibility is going to squeeze the balls of the debt stackers soon enough.

Yip, That’s the reason most landlords increased their rents last year.

Looking forward to that 100% indeductibilty and flood of new builds.

Perfect time for a rent strike to thank all those landlords who so cheerfully raised their rents last year.

That was well written and Bradbury seems to have a good handle on things.

Stop blaming landlords and start blaming policymakers. Go on, get out in the streets and protest against Ardern, Robertson and Orr. Demand change.

Can't I just sit in my room and listen to Rage Against the Machine?

Sure. And don’t forget to cross-post to reddit how shit your circumstances are.

Don’t do what they tell you

Would be interesting if you happen to be one of my tenants.

Your posts get more despicable by the day. What on earth is this supposed to mean?? You get labeled a troll on a weekly basis, I’m starting to agree.

Don't you find it interesting to have a tenant who's anti-rent paying but still pays?

Why would it be despicable to find that intriguing?

Not really. They are not anti rent. They are anti over the top rent.

Im not sure if the cost of renting in Auckland has reached its upper limit yet, depends what happens with salaries and inflation, but I’m thinking it must be pretty close based on ratios of what people earn.

CWBW,

"Would be interesting if you happen to be one of my tenants" . Why? Your comment has a vaguely threatening tone to it.

sorry but suggesting that we all stop paying rent that you legally committed to pay is just plain dumb. Sure prices for houses are spastic, but encouraging mass contract-breaking is just stupid pie in the sky thinking. What's that going to achieve?

Commitments are important if society is to function. What else you want to just ignore whatever laws don't suit?

This is not the French revolution. We are not a colony governed by overseas tyrants. And debt cycles are normal and part of life.

Time to get some perspective.

And if you are still so motivated then do something meaningful, like : Organize a protest : Organize a think tank and promote/lobby your ideas on facebook : Join a political party and change from within. Hell start your own political party.

All things that are possible because you have all the rights your already need to make a difference without breaking legal commitments.

Its called inflation.

And your groceries have gone up in price more than I've put my rentals up.

Petrol, insurance, food, internet, clothes. My already high day rate...

Everything is more expensive now.

Don't suppose you are going to expand your protest by not paying for your next shopping bill, power bill or internet supplier?

Great article

A huge number of people have borrowed to much and anyone who is over leveraged will be struggling.once people go into negative equity bankruptcy’s will come,this will send housing market spiralling down. Other crashes will seem like a tea party compared to what is coming as million dollar mortgages are commonplace and on kiwi wages if interest rates and inflation keep going up it will not take long to bring this down this market.

Lucky we have full employment then.

likely it will play out over 2/3 years. The downward march will not be a sudden fall.

"In fact, during the past fifty years there have been 28 severe house-price boom-bust cycles and 28 credit crunches in 21 advanced Organisation for Economic Co-operation and Development (OECD) economies" - Prof.R.Rumelt

Generalisation is also a cognitive bias, NZ is exceptional- housing only got a hair cut of 10.9% correction in the great GFC which it fully recovered in the span of 9 months!

Houses should always only have been 'shelter' - when they became an "investment" and a tax-dodge after the Clark/Cullen income 39 tax rate, Kiwi DNA changed. It needs to change back.

That's about the same as saying cars should always only have been a transport from point A to point B and should never be used as a taxi or Uber.

The OCR was cut from 8.5% to 2.5% for the GFC.

You think this time will be different?

Yes.

Good for you (and me).

That's about the same as saying cars should always only have been a transport from point A to point B and should never be used as a taxi or Uber.

People don't temporarily rent out their stationary uber vehicles with the expectation they will 'double in price every ten years'.

Neither did the general housing investor had a expectation of doubling in capital values- it just happened to turn out that way.

People do rent out (lease) vehicles for Uber purposes with an expectations of good returns and this is one of many.

You have not double values until you sell them. The housing you have could easily lose 50% hopefully what’s left is yours and not the banks

In the same manner, I won't be losing 50% if I don't crystalise that loss by selling.

However, in the event it goes up another 50%, I don't get the misery of trying to fight a rising market to get back in.

The cost of what you have borrowed will go sky high and if you have purchased one to many million dollar boxes and are over leveraged things will be lost before you can sell them. Not a good place to be CWBW

For that to happen (at least on my end), the market value will need to fall 65-70%.

Oh well, it's only money. Easy come, easy go.

For that to come to fruition, a bunch of things have to happen:

- prices need to tank

- interest rates need to rise to the point where you are unable to cover the mortgage, either by rent, other funds, or a combo of both

That sort of environment would be bad mamma jamma for everyone most likely. Most everyone's lives accompany a healthy property market.

The problem is our entire way of life is potentially hugely unsustainable, owner, investor, renter or whomever maybe we can't get away all living such a rich life. Especially considering we've now got whole industries full of nothing jobs who pass the costs amoung each other.

Uber (transport) is not a core human need and also dosent get used to exploit a basic human need (shelter). It also dosent rely on excessive debt leverage forcing endless serving (rent and tax avoidance), while pulling up the ladder for following generations thru ever increasing entry price.

If transport is not a human need, how do you go see a doctor?

Hire purchase and leasing also involves debt and landlords does pay taxes.

Buying too many cars are also in a way pulling up the ladder for the following generations who can barely afford one as it pushes the prices of cars up.

Your issue is with your personal income, not house prices.

Walking is good for you. Done regularly it has all sorts of upsides including reducing Dr visits.

Many LLs have loaded up with debt just to have the tax offset on their day job. This is 101 for the prop cheer seminars to help push developer returns up. This is highlighted by the crappy yield available at today's prices.

You may be right about cars, especially classic cars. They have ballooned along with other assets subject to speculative behaviour. New and near new cars are more subject to parts shortages, and the damage from excessive money printing.

>Many LLs have loaded up with debt just to have the tax offset on their day job. This is 101 for the prop cheer seminars to help push developer returns up.

Yeah, nah. You realised this was killed off years ago right?

The only reason house price’s have climbed over the last few year is interest rates have been kept low now with inflation and rates set to go back up a reversal will occur just as quickly so any one who has purchased in last few years will see deposit gone and be in negative equity. The NZ government will not be able to do anything about it the NZD is already taking a tumble.

I think you missed the memo from RBNZ asking financial institutions to prepare for negative interest rates.

And you think Orr would try that after the unanimous castigation he received for his last calamity.

If he doesn't do it on the next calamity; perhaps, someone else will.

The system is already in place- just a button away.

Orr is just behaving like a great number of central bank governors over the past 24 months.

The rates weren't dropped for shits and giggles.

The parochial us vs them mentality is pretty tiring. Go start a movement or mow an old ladies lawns or something.

The rates were dropped purely to save the Ponzi. The Ponzi is up. Trademe listing just shy of 23'000 today, I am calling over 24'000 by next Sunday. If this comes to pass then I believe that the bubble has burst and its all over rover.

There's usually a lull in listings between early Dec and Mid Jan, then it climbs till Autumn, for what should be obvious reasons.

You're pretty good on the rhetoric but short on actual insight.

Exactly, the lull has not lasted as long as it normally does. The acceleration of sales has started much earlier this year which usually means that people are desperate to sell.

Be Quick!

Most people start coming back to work around the second week of January.

Also what are the numbers historically, going back 20 years? I don't know, but it seems to me like there are around 30% less listings than say, 2 years ago. So potentially a massive undersupply.

Don't worry, it'll happen, without your predictions.

TradeMe

Hamilton For Sale Rent

3/1/19 693 432

22/1/19 748 464

17/1/21 742 581

Don't have 2020 dates close enough to the above to use. Would expect for 4 sale to rise regardless as it hit 1,007 by 26/3/19, 756 as at 25/2/20.

If we accelerates about 1,000 in the next month or two then I'd say its all on for the exits.

Spot-on, David Chaston. "The CCCFA is just one of a series of measures put in place to restrain rampant credit growth and an unsustainable housing market." Something long overdue. The Minsky Moment not too far off? Hardly a day passes by without the media trotting out sob stories of mortgages declined seemingly on frivolous grounds. Can sniff a concerted campaign against CCCFA , no doubt in alignment with vested interests . But, I am sure these anecdotes don't tell the real story. There must be more than what meets the eye in this selective reporting. Banks know.

People like Harry Dent had been saying that since the recovery of GFC. And I lost how long Martin North had been saying that the ANZ market is doomed this year, every year.

A broken clock is right twice a day but 91.7% of the time it's poor and broken while the rest of the chronographers laughed to the bank.

Governments have just printed money move the crash along now inflation has come and they cannot kick can down the road any more. So crash will come in next few months and the time on clock will finally be correct ( panic time for over leveraged)

The thing about broken clocks is that it may come a time it's right. However, the moment time attempts to move forward onto the next second, it's wrong again.

Example, March 2020.

I have sympathy for those who panic sell at that time but couldn't help myself to buy another one that went on sale.

Hopefully that sale should at least make up for some coming losses.

Have you considered going short on the housing market?

I steer well clear of the NZ housing market as I prefer ethical investing.

Its already happening in China. 3-4 months now of prices heading back. The amount of money being lost now (on paper) there makes the US GFC correction look like a walk in the park.

Im curious how much of the NZ market is actually propped up by marginal buying chinese investors.

Interesting year ahead.

Yeah I remember a video of Martin North in Tauranga years ago and man did he get it wrong. That guy needs to give it up he is a total loser. Sure if he keep banging away on the same tune for the next 20 years he is going to be right one day.

Kiwis would prefer to die of starvation over selling there houses $1 less than what they bought it for.

It ain't going to happen, I will keep watching with interest.

Date on this letter may 2020 a lot has happen since then inflation and interest going up all over world. You seem to be living in hope if you are over leveraged sell what you can quickly but you being a experienced investor you would have completed this already

You have got to feel sorry for the HODL'ers, they just couldn't let it go. They are a bit like the hoarders on TV. Their greed eventually devours them. I actually pity them, they should have sold when the going was good.

That was in the early days of covid when an economic and housing meltdown looked like a real possibility.

As far as I am aware CWBW 10.9% has been the largest house price drop ever in NZ. No wonder that is all people can see as a safe investment. Very difficult to think of anywhere to put surplus funds out side of your own business.

Real house prices fell 40% between 1974 and 1980, masked by general inflation.

Now that we have the world's most unaffordable housing and legally mandated targeting of general inflation the drop will manifest itself in nominal prices.

Less credit, higher interest rates, building consents at record highs, no immigration… doesn't bode well for house values, once FOMO goes there's very little left to keep house prices up

We will know in 6 months time to be certain.

mind you build costs will not follow the same trend so less new build

So existing houses with good land will hold up prices

Thoughts on growth/decline in prices 2022-2025 ie short term? Value your thoughts

I find it very hard to see reasons why NZ houses will increase in value come June 2022. A crash generally happens because many are under duress and therefore have to sell at any price. Employment figures are far too good for now for this scenario to eventuate. Predicting 2024 - 2025 ? Good luck, I think there are far too many variables, I would just say that having a buffer and being financially comfortable (not stretched out) seems like a really good idea to me.

Landlords under duress due to withdrawl of tax deductibility.

Mortgage holders under duress due to steeply rising rates.

Developers under duress to meet increased building costs.

Any other time in the last 60 years if inflation was at 6% the OCR would be at best 8-9%. People in the bond market are loosing Around 5% a year the fed are large buyers at the moment but this is going change this could be moment for the crash.

And yet in jurisdictions that have removed the major restriction which is poor land access and consenting policies, interest rates falls or increases have relatively very little effect on house prices which remain stable and affordable, right across all housing types.

Interest rates et al are accelerants that have no effect if the housing fuel is not first ignited by poor land-use policies.

So let's take the most recent land use change, allowing three houses on a single section in major centres where previously there was only one house permitted. Is this sufficient to have the desired effect on house prices for FHB's?

Suppose I live in Auckland and I'm not too happy about the prospect of my neighbours selling their plots and townhouses going up all around me with all the attendant noise and behaviour problems to follow. I think- perhaps I could do the subdivision myself and sell off the one house and two lots. I'd have to get some finance for this and for the place I want to buy in the Waikato to get away from the plebs. I have a shocking experience at the bank where I'm informed that I'm too old for a really big mortgage like I used to have and perhaps I should go through a broker.

The broker wants to know every detail of my financial life so I tell him I'll get back to him and I go home and tell the wife maybe we should think about this and come up with another plan. A couple of years go by as we wait for the world to come to it's senses. Meanwhile my wife inherits a small house in Matamata that she rents out and we spend weekends looking at bits of land south of Auckland as we decide what to do.

Most of our Auckland neighbours haven't sold yet like we thought they would, because their options aren't to their liking either.

House prices are sticky. The housing market has many moving parts. You can make it desirable to move away from somewhere but people have to have a place to move to. Transactional finance has to be available within the housing market.

Politicians of today react to what happens but don't make plans for the future. When there is a right wing or left-woke politician that does make plans for the future we are all in trouble because the plans never make any sense for the progress of the nation as a whole.

'Is this sufficient to have the desired effect on house prices for FHB's?'

In short, NO.

The price of all housing is set on the fringe, ie the price of the land price just beyond the urban boundary, or put another way, the price of rural land converted to urban land use.

Without the restrictions on supply on the fringe removed, land closer to the CBD never becomes cheaper relative to what it should be if land restrictive policies were removed.

Counter-intuitively, compact city restrictive land policies encourage sprawl as people are forced to move to the fringe and beyond to find more affordable housing. Resulting in all housing being relatively more expensive.

Loan should have been controlled but who will be effected by it.....only FHB.

Government and RBNZ policy to contra ok demand / over borrowing is by killing FHB.

Congrats Mr Orr and favourite PM -Jacinda Arden.

‘

Decades of not dealing properly with "the housing crisis" has always meant that when effective action is eventually taken, some people will be hurt more than if proper action has been take much earlier in the cycle. That however should not stop eventually taking proper action.

There has grown a political penchant to only take corrective public policy action so long as no-one actually gets hurt. Obviously that is a very poor way to fix a very large public policy problem. The sooner a big correction is behind us, the better - if affordable housing is the objective.’

Perfect.

The easy decisions become the hard decisions later.

let’s face it... the politicians will do nothing

my guess is inflation will be make the hard decision for us

Absolutely true!

Inflation will make the hard decisions and the correction will come via house prices staying about the same with inflation eating away at the true value.

Why house prices rises are never reported with inflation subtracted seems crazy to me, as this is the only way to accurately measure real price rises.

Inflation will make the hard decisions and the correction will come via house prices staying about the same with inflation eating away at the true value.

How do you know? This appears to be the 'easy way out', but it doesn't necessarily mean a sensational crash may not happen (which ultimately may be best for everyone in the long run).

Crunch o'clock.

These are the problems when you build an economy on the wealth effect rather than strong economic fundamentals. I read that the RBA has conceded that the reversing of the wealth effect would be more disastrous for consumer spending than much higher unemployment.

Most Kiwis have been too myopic and want to focus on justifying the bubble rather than facing the reality.

Yep, and credit is a central part of that 'wealth effect'.

It's now getting a lot harder to attain, and is getting a lot costlier.

They seem to get wealth creation and wealth transfer mixed up in this country.

Wasn't the thinking that all ships have risen, just at a much lower rate for people that don't own property?

Wealth is created by actually producing things, not by currency debasement.

So like buildings and stuff, or wheat and corn?

Ask Evergrande

Construction, manufacturing, farming. Yes.

Manipulating asset prices through financial engineering and currency debasement. No.

The entire economy has been buoyed by that process.

Security and stability comes at a price. We'll all be paying for it.

Sorry the place didn't hold your beer for you.

We are discussing what real wealth creation is, not whatever clown nonsense about beer you are gibbering about.

Drowning his sorrows early maybe?

If someone borrowed money to buy whatever "real" doodad you create, did you create any wealth?

It's just funny watching you make a million and one assertions about the place because it doesn't fulfil your expectations.

Yes. Creating something from nothing is wealth creation. Why would a subsequent transaction have any bearing on that?

All I'm really saying is a regurgitation of the old proverb that "the country won't get rich from just buying and selling houses from eachother".

Did you have anything intelligent to add to the discussion or is it just the usual low IQ drivel?

You didn't create wealth if no one buys what you're producing, you actually lost money.

We can see that roughly 2/3 of the world's economies have been running negative trade balances, and those in surplus aren't making up the slack, it's being carried by debt.

There's a larger issue there outside of your own personal bug bears relating to your inability to secure the sort of property you expect after years of YOLO.

Housing issues will likely stabilise over the coming years, but the larger issues around late stage capitalism and years of QE will remain. You'll have your flash new pad then though, so it'll all be kushtie.

If the item (or service) produced has utility to me, or to somebody else, that is wealth creation. It does not need to be sold to exist.

The point that you still seem to be too s1mple to grasp is that bidding the price of existing things higher with debased monopoly money is not wealth creation, it's wealth transfer.

It's a bit creepy how obsessed your thoughts are with my personal circumstances, typical kiwi tall poppy syndrome and envy by the look of it.

Your inept attempt at belittlement suggests an "inability to secure". Incorrect. The issue is simply that what is being sold is such low quality crap at such silly prices while the stores next door have much better value propositions at this time.

You do only live once so everybody should make the very most it.

Housing here will fall back towards fundamentals here in due course. It may get ugly for those overinvested in it.

Why does the webpage keep re adjusting up and down when reading posts?

Is this due to my browser or the adverts ?

Its the stupid adverts closing and opening.

It would be interesting to hear what the bank economists have to say about a credit crunch? How would they spin it? No doubt they've had this built into the projections...right...

Indeed.

I suspect it's a bad news story that's very hard to spin.

Nothing new. Been here before. Relax and remove borrowing standards so all and anything that moves can borrow whatever the house seller wants for his/her house. Does it not look good to see everyone owning their own homes regardless of their ability to continue to sustainably service their generous loans. The authorities feels good that they have all peasants housed and authorities position is secured. For how long though. The banks got nothing to loose. we all know who loses out in the end. The ex governor, wheeler avoided this after the 2008 gfc, but he left and we walked our way into this mess. We lack leadership from the likes of English who gained the most votes but sadly got kicked out.

With MMP having been used in this country since 1996, to not understand how it works suggests willful ignorance. edit: spelling

It would be interesting to hear what the bank economists have to say about a credit crunch?

The ANZ economist Zollner does a little DGM dance now and then, but nothing that I can remember about a credit crunch. I always find her narratives to be a contradiction. She harps on about prices getting frothy; high levels of debt; etc. But let's remember that it's her employer that is essentially "allowed" to lend all this credit into existence. Never once does it feel like they share any responsibility.

It's just empty virtue-signalling, J.C.

I guess it will be another year of the blame game with everyone trying find a scapegoat...

Robertson & Orr are probably sharpening their pencils now for their next letter to one another.

Most economists seem to think the economy will be fine this year, and if house prices drop they will be only minor drops.

Maybe we are all just being DGMs.

It's going to be interesting to see how the year plays out.

Come end of year, were the economists right, or if not were they wrong because of bias or professional incompetence.

My money is on them not being right, because they usually aren't, and it will be the usual mix of bias (probably unconscious) and incompetence.

Not to sure which economists you are referring to , but with inflation and interest rates going up and the money printer slowing I don’t think so HM. I don’t think we will have to wait long before a financial storm hits all markets and the big ones here is housing market and NZD both will take a tumble.

Pretty much all of them, bank economists and independent.

I can't recall any of them saying it's going to be a problematic year for the economy. They all seem to think things will generally be ok, if not great.

They might be right!

Which of these economists that we commonly hear from in NZ aren't making a living off RE industry?

My bank used the word “sensitising” to explain the change in mood and new concern about increased rates.

wouldn’t be surprised they start stress testing at 10%.... or have already and these Nz Herald articles are the bankers associations way of telling us

The Cantillion Effect: How the wealthy get wealthier

A breakdown of what it is, how it works, and why one should care.

Houses should always only have been 'shelter' - when they became an "investment" and a tax-dodge after the Clark/Cullen income 39 tax rate, Kiwi DNA changed. It needs to change back.

Can someone elaborate on this? I'm assuming they put the high earner tax rate up so then people started buying negatively geared properties to put themselves down a tax bracket??

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.