By Daniel Hynes and Soni Kumari*

Highlights

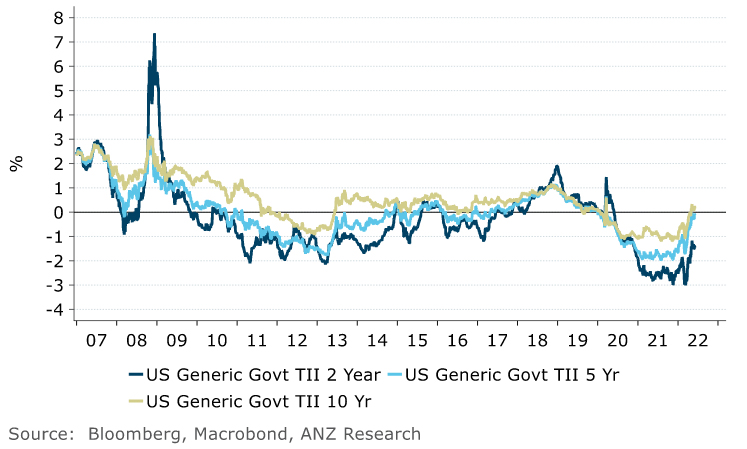

• Rising real rates and a stronger USD are capping the upside in gold prices.

• Geopolitical risks and emerging stagflation should see haven flows.

•Technically, prices are consolidating, and the range looks indecisive. A break aboveUSD1,900/oz confirms an upside move.

Outlook

Central bank rate hikes, tightening money supply, rising real rates and US dollar strength are current headwinds for the gold market. That said, geopolitics and stagflation risks should remain supportive.

The US dollar is losing strength, and we believe its current cycle has peaked. The market is now assessing how high the fed funds rate will go, considering the sharp tightening in financial conditions. Recessionary risks are rising. The European Central Bank is turning hawkish, which should cap US dollar gains.

Investment flows should turn positive on macro uncertainties. Year-to-date exchange-traded fund (ETF) net flows have reached221 tonnes, despite recent investor liquidations. Futures positions are lean, suggesting there is room for fresh longs to buildup.

Weaker emerging market currencies and lower disposable incomes should see physical demand moderating in the second half of 2022.India’s imports are likely to fall in June after a strong jump to 101t last month. On the other hand, lingering lockdowns are likely to keep spending on gold jewellery low.

Figure 1.US real rates are turning positive

Q&A:

Gold prices are struggling to hold above USD1,850/oz. Does this suggest the beginning of a bearish trend?

We acknowledge that hawkish central banks, rising real rates and a stronger US dollar have taken the shine off the gold market. Withdrawal of unprecedented fiscal and monetary support is also weighing on sentiment. Our gold valuation model is showing fair value is USD1,400/oz. That’s driven primarily by the collapse in US bonds, which has seen yields on 10yr Treasuries rise from 1.5% to 3% in recent days. A stronger dollar has also played a part. It’s likely that haven buying is propping-up gold, from a geopolitical view and an economic one. If this buying dissipates, gold could suffer a sharp correction.

Mounting geopolitical and economic risks, due to the ongoing Russia-Ukraine war, should see gold reasserting its haven status. Supply shock driven inflation could offset the impact of rising rates, limiting a rotation back to yielding assets. Fears are rising that economic growth will fall if central banks hold their tightening stance. With such an uncertain economic backdrop, investors may look for a safe store of value.

That said, if haven buying abates, we could see a sharp correction in gold prices.

To what extent is a stronger US dollar a headwind for gold?

Normally, the US dollar is inversely correlated to gold. It touched a 19-year high last month, which saw gold prices coming under pressure. However, this relationship can weaken during crises, during which both gold and the US dollar can rise. This was evident during the GFC in 2008 and at the start of the pandemic in 2020.

Nevertheless, the current USD cycle has likely peaked. The US Federal Reserve may be on track to deliver further rate hikes, but markets are now reassessing how high the fed funds rate will go, considering the sharp tightening in financial conditions. Growth concerns are rising, with the US equity market discounting a reasonable chance of a recession. Further eroding the dollar’s appeal is the European Central Bank’s hawkish pivot, which is prepping the market for rate hikes and pushing the EUR higher. This should provide some relief for gold prices.

Are liquidations of ETF holdings and long futures overdone?

We believe investment demand is still benefitting from gold’s relevance as a risk diversifier. Uncertainties around economic growth and inflation remain elevated. Year-to-date, gold ETF net flows are still positive at 221t, despite investors liquidating holdings since late April. We expect net inflows in gold exchange traded funds. Futures positions look low following a selloff by money managers since early March. This suggests limited room for selling in the weeks ahead.

How is physical demand responding to the recent fall in the gold price?

Physical demand has responded well to lower gold prices. India’s gold imports rose to 101t in May as lower prices coincided with Akshaya Tritiya and the wedding season. This may be as good as it gets, with a weakening rupee keeping the domestic gold price elevated, and higher inflation squeezing disposable income. We expect gold imports to fall in June and demand to remain muted in Q3 2022.China’s demand has suffered due to strict COVID-19 lockdowns, with jewellery sales severely restricted in April and May. Metal Focus expects jewellery fabrication to be down by 20%y/y in May. If COVID-19 outbreaks ease gradually over the course of the year, this would equate to a 14% fall in 2022.This assumes consumers remain cautious in their spending, as the economy reopens.

Technical

Trading in a tight range:

Gold has in range of the USD1,800–1,850/oz since mid-May. Prices have retraced 23.6% of Fibonacci levels from its sell-off in March, but is struggling to test the next level of 38.2% at USD1,895/oz. The current price range of USD1,800–1,900/oz will not provide any clear direction until prices break either side of the range. The downward trend that started mid-March is still intact, while we see prices are showing a kind of exhaustion near USD1,850/oz levels. A convincing break of above USD1,900/oz, which is also a trend break-out, will be required before a short-term bullish outlook can be called. Once this level breaks, prices could touch the previous highs of USD1,950 /oz and USD2,000/oz. Key supports are at USD1,800/oz and USD1,760/oz.

Daniel Hynes and Soni Kumari are commodity strategists at ANZ. This article is a re-post from ANZ and is here with permission.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

Precious metals

Select chart tabs

2 Comments

I'm waiting for crypto to start hemorrhaging as it gets sold for fiat to cover people's highly exposed arse in other areas.

In the old days, that gold would lose its lustre, inconceivable. Gold and gems, the treasures of kings and pirates.

Today average Joe have choices, from fiat currency to crypto, stocks and other innovative funds.

Who knows what other choices AI can come up with.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.