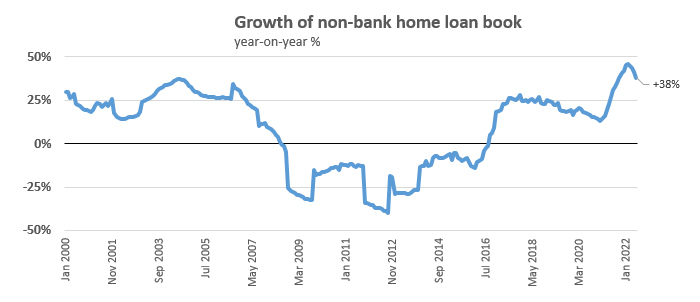

For 15 of the past 16 months, non-bank lenders have written more than $100 million in home loans each month, and probably more than 250 new loans in each of these months. That is their best sustained period since 2006 when they achieved this in 14 of 18 months.

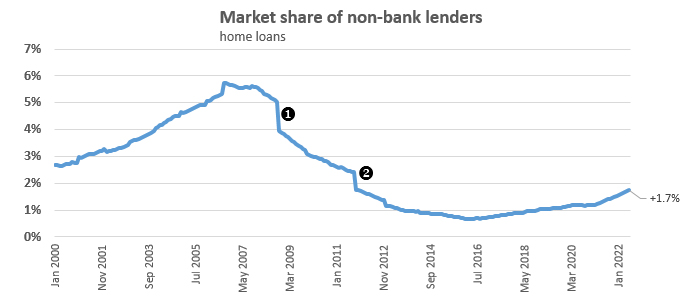

It is hard to call this a rising trend however, given the new impetus 'builds' their market share to just 1.7% of all home loans.

Non-bank lenders include building societies, credit unions, and finance companies. The first two lend like banks, with their principal focus on the ability of the borrower to repay. Finance companies involved in housing lending tend to be more 'asset lenders', more focused on the mortgaged asset value and prepared to be more 'flexible' with the income sources of the borrower and/or blemishes in their past credit history.

Almost all finance company home loans will end up packaged into securitised pools for investors. That is how these lenders refinance their funding requirements.

Over the years, the institutions in the non-bank sector have shrunk, not only from the global financial crisis fallout, but SBS Bank converted from a building society in 2008 (one on the chart), and Heartland Bank made a similar transition in 2012 (two on the chart).

Despite its quite small footprint in the New Zealand mortgage market, the recent expansion has been its best-ever period however.

This recent surge comes as restrictions on banks has them struggling to find growth opportunities. In 2022, non-banks have been writing almost 10% of new home loan business, picking up borrowers who can't make the grade with banks. The broker channel is how those borrowers find the non-bank options.

Of course, this shift comes with a cost to borrowers. The interest premium is 'real'. Typically, non-banks lend on a floating-rate basis, encouraged by brokers who undoubtedly tell clients that when their financials improve they can switch back to a bank loan. But non-bank lenders do offer fixed rates, and those with the best financials will pay a lesser premium that way. But it is hard to see why a borrower with prime financials would be a non-bank prospect.

| Loan book | Banks | Non-banks | Share |

| $ bln | $ bln | % | |

| Jun-02 | 70.674 | 2.395 | 3.4% |

| Jun-07 | 138.139 | 8.171 | 5.9% |

| Jun-12 | 171.256 | 2.637 | 1.5% |

| Jun-17 | 235.835 | 1.922 | 0.8% |

| Jun-22 | 333.531 | 5.878 | 1.8% |

12 Comments

Successful millennial investor who bought 50 properties, was reported to have bought cheap do-ups. Repaired and renovated them, and had valuations done. By doing so he was able to borrow more.

Yep, that's how you grow your portfolio, buy a cheap place, do the hard work by adding value, then you can rent a nice place instead of a crappy one, and ask for better rent. What's your point?

To be fair the whole house flipping was working until about a year ago. Any decent reporter would ask for the addresses of a few of those "50 houses" anyone can access the owners details on the various local council websites, its not confidential information unless you as the owner request it.

No one his talking about "house flipping". Pay attention, he bought old houses, then renovated them, rented the nicer house out at a higher rental, got the nicer house returning higher rent re-valued and then borrowed from the bank to buy the next house. No "house flipping"

You too could do the same. If only a bank(s) allow you to borrow$××,xxxxxxxx dollars for multiple rentals.

Its simply another sign of a speculative bubble that could crash and cause widespread harm to the entire economy and society.

And that's without access to the FLP.

David, I think it would be interesting to add a table comparing typical interest rates for various terms, between standard banks and non bank lenders, so that the premium paid to non bank lenders becomes more obvious.

Wow. I would have thought that if a potential buyer didn't measure up to the standards of a main bank, then that should be a clear message to stay out of the market, and not to get caught by the goolies being contracted to a lower tier lender.

But then again, if that were true these vulture lenders wouldn't exist. Do they really want repayments, or do they make most of their money picking the life, soul and bones out of defaulters?

The banks have some strict income policies. ANZ was the only bank that would lend to me as a contractor with less than 2 years history. I had $150k income (combined over $200k) and a 250k deposit in cash. I also had equity in a property that could have been used. In the end they pre approved me for over $1m which was more than I wanted to borrow. I did get an offer from a non bank lender which was viable but a higher rate. The whole process of getting approval from the bank probably cost me $50k due to the prices increasing over the 6 months it took. In some ways I would have been better off with the non bank lender and then refinancing after a year or 2. I didn’t due to what happened with finance companies during the GFC.

The CCCPA is pushing people from the banks to the dodgy lenders who were the cause of the problem to begin with. What a success.

Agreed, yet another example of this clown car of a Government’s interference in a fairly well functioning system. The list is endless.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.