By Daniel Hynes and Soni Kumari*

Highlights

-

Aggressive monetary tightening and a stronger US dollar are keeping the backdrop challenging for the gold market.

-

We see the USD benefitting from the deteriorating geopolitical and economic situation, as a haven asset.

-

Technically, bearish momentum is likely to continue, short term. Prices are likely to fall back to the previous low of USD1,620/oz.

Outlook

The backdrop for gold remains challenging. Persistently high inflation is likely to keep the US Federal Reserve on an aggressive monetary tightening cycle for an extended period. This should keep real rates positive across the curve; a key drag for gold.

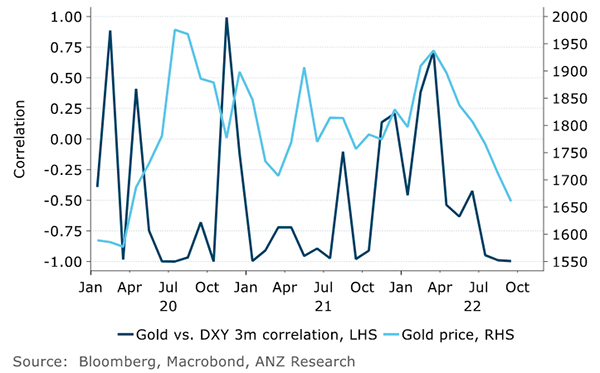

The USD’s relationship with gold has strengthened recently. This is likely to put pressure on gold, as further rate hikes should seethe USD continue to strengthen. The wildcard is central banks defending their currencies by selling US Treasury bonds. That would be an upside risk to our view.

Rising geopolitical and economic risks are having limited impact on haven buying. Instead, investors continue to seek protection in the USD. Investment flows have been negative for the last two quarters. This could continue with exchange traded funds (ETF) as elevated holdings still leave room for further liquidation. Nevertheless, lean investors’ positioning in futures looks less of a concern. Physical premiums in Asian markets are also strong, suggesting solid demand amid tight supplies. However, this looks insufficient to counter investment outflows, in our view. We see the gold price falling to USD1,600/oz by end of this year

Gold 3m rolling correlation with DXY

Q&A

How long is gold’s bearish trend likely to continue?

Gold is facing twin headwinds of rising US yields and a stronger US dollar. Strong US job data and persistently high inflation will likely lead the Fed to a fourth consecutive rate hike of 75bp at the upcoming FOMC meeting. This would support real rates and makes non-yielding gold investment unattractive. Further, tightening monetary policy will be a tailwind for the US dollar. The macro backdrop is likely to remain challenging for gold until the Fed eases up on its aggressive rate hikes.

Do we expect investment outflows to continue?

Gold has seen strong outflows of investment this year as the USD hit a 20-year high. ETF holdings fell 95t in September, a fifth consecutive month of outflows. It was also the largest outflows since March 2021 (107t). Year-to-date ETF holdings are now down 30t, despite strong inflows in the first four months of this year. However, at 3,000tthey are still high. Further rate hikes and a stronger dollar could see more outflows.

Could strong physical demand offset weak investment?

Central bank buying has been robust. We expect purchases to reach 500t this year against 463t in 2021. Currency market volatility and increasing geopolitical tensions would motivate central banks to increase their gold reserves. Turkey has been the major gold buyer (+84t) so far this year, others are Iraq, India and Qatar.

The physical market is also improving. Imports into China and India are rising, as reflected in the strong premiums for physical gold in Asian markets (Figure 24). Retail investment has been strong too and coins are fetching a high premium.

Nevertheless, given strong physical gold consumption in Q4 2021and growing fear of a global economic slowdown, achieving net growth for this quarter looks difficult. This will likely see physical gold demand fall short, this year, compensating for investment outflows.

Why is the spot gold premium in Asian markets high?

A recent correction in the gold price is encouraging importers in emerging markets to stock up ahead of peak demand season. Although liquidation in developed economies due to rising interest rates is paving the way for metals to flow into Asian markets, logistical challenges are keeping supply tight. According to industry sources, India’s gold stockpiles in vaults are currently low and this is keeping the spot premium elevated. Sellers are also diverting gold to markets where premiums are higher. We expect premiums to remain high until near the end of the year.

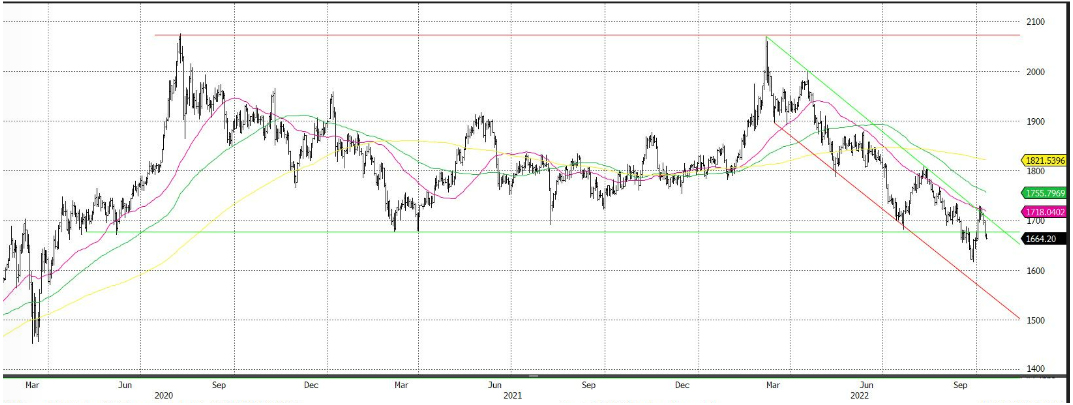

Technical

Bearish trend to continue The gold price has been moving inversely to the US dollar. Weakness in the greenback saw gold prices touch a high of USD1,715/oz in early October. However, strong US job reports, and higher inflation led the price resume its downtrend, and it is likely to fall below USD1,600/oz.

Immediate support lies at USD1,620/oz, the previous low. A break of this support should see prices touching the lower bound of the downward channel, which will be below USD1,600/oz.

On the other hand, immediate resistance is at USD1,715/oz, and an upward break of this level would see the next resistance point at USD1,800/oz, which will also mark a reversal of downtrend.

Figure 1. Gold daily technical chart

Daniel Hynes and Soni Kumari are commodity strategists at ANZ. This article is a re-post from ANZ and is here with permission.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

Precious metals

Select chart tabs

11 Comments

Despite Keynes describing it as a 'barbarous relic', gold still has many supporters. We live in an age of fiat currencies and ballooning global debt levels. This surely cannot continue indefinitely, so would it be technically feasible for the world to revert to a gold standard?

I invite those more knowledgeable than me to respond.

Very unlikely as Gold holdings are not evenly spread amongst countries. New Zealand doesn’t even feature in this list https://tradingeconomics.com/country-list/gold-reserves

There are stories of Russia and China buying to possibly back their currencies with a margin of gold. I’m not sure how that would work in practice.

Rex Pat,

NZ has had no gold holdings since 1992. I asked the RB some years ago and was given that answer.

I guess we could mine it if required. Interesting that list of holdings by country. So plenty of people still believe it is relevant.

Beanie,

Well, we do produce it; some 6000kgs in 2020 mostly from the Macreas mine in the S island and the rest from Waihi.

The amount of gold available globally IIRC is equivalent in volume to 2 Olympic swimming pools. Insufficient amounts to back the current value of global currencies.

100% incorrect - current money has 0 residual value - it exists based on the ability of government to tax its populations.

We will neve havd a gold standard simply because no government could ever allow itself to be constrained by a limited supply of money. That and the global central bank regeme does not want people to have the power of money they cant debase.

I think if you wanted to try and hedge inflation, you'd be better going harder than just gold, given it's limited utility. More things like:

- Decent growing land

- Water

- Electricity generation

- Other capital investments (as they will only get more expensive to conduct over time)

It's all relative I guess. Let's look at the price of gold in JPY.

Past 3 months : +2.5%

P6M : -1.5%

P12M : +19.8%

P2Y : +30%

P3Y: + 57%

P5Y : +68%

Gold is a Tier 1 asset now. Why would it be classed as a Tier 1 asset?

My guess is that it is in preparation to possibly revalue money back to a gold standard again, or a portion of it at least.

With America's dollar so strong, other countries may cash in their USD and if enough USD flows back to America it could cause big problems. That's when the role of Gold will be better understood. Only, physical is getting drained now and by the time one wishes to purchase, it will be either unobtainable or too expensive.

(3) Why Are Central Banks Around the World Hoarding Gold? With Andy Schectman - YouTube

Look up Andy Schectman, if you want to be educated, very smart person.

My gold and silver is happily sitting in a box as an emergency asset just in case

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.