Inland Revenue regularly releases Technical Decision Summaries (TDS). These are summaries from its Adjudication Unit in relation to dispute cases of interest between Inland Revenue and taxpayers. These give good indication of Inland Revenue thinking around particular topics and how it might react to a transaction.

TDS 22/21 released last week is particularly interesting. It involves a two-lot subdivision carried out on a property by a taxpayer. He had initially purchased the property when working offshore for the purpose of renovating and extending it to live in with their extended family. Once the property was purchased, the extended family moved into the dwelling and the taxpayer joined them later on his return to New Zealand.

He then started planning to extend the property, but it emerged that there were problems with drainage and asbestos. Instead, it was suggested that the taxpayer should subdivide the property into two lots, constructing a new dwelling on each lot. And that's what happened during which time he was working overseas and visiting intermittently. Once one of the new properties was constructed, he occupied it for 8 months. Shortly after the subdivision was completed one property was sold and the taxpayer and his extended family continued to live in the other property for a further five years.

Inland Revenue argued that the taxpayer had entered into an undertaking or scheme with the dominant purpose of making a profit under section CB 3 of the Income Tax Act. This provision is outside the normal land tax provisions, which is slightly unusual. Inland Revenue also ran the argument that the property was acquired for the purpose of intentionally disposing it under CB 6, which is within the land taxing provisions. The question arose whether there was relief available because it was a main home. And finally, Inland Revenue also raised the question whether the sale of the subdivided lot and the property was subject to GST.

It seems part of the issue here may have been Inland Revenue just didn't believe what they were being told. The Technical Decision Summary reasons for the decision opens with a reminder that the onus of proof is on the taxpayer to prove that an assessment is wrong, why it is wrong and by how much it is wrong.

This case turned out to have a good outcome for the taxpayer, because the Adjudication Unit ruled that the taxpayer did not enter into an undertaking or scheme for the dominant purpose of making a profit. Therefore, the gain wasn't taxable under section CB 3. The Adjudication Unit ruled the taxpayer acquired the property for the sole purpose and with the sole intention of creating a home for themself and their extended family. Therefore, the sale of the second lot was not taxable under section CB 6. It followed that as the property had been occupied mainly as residential land prior to subdivision, an exclusion applied. Finally, the taxpayer did not carry out a taxable activity for the purposes of the Goods and Services Tax Act, so no GST applied to the transaction.

The taxpayer won on all points. But there are several interesting points here. First is that Inland Revenue even took the case and the arguments it ran. This transaction appears to have happened before the Bright-line test was introduced, the TDS isn’t clear about the timing. The attempt to apply section CB 3 is unusual.

Secondly it highlights that Inland Revenue is paying attention to just about any property transaction and it's prepared to use all provisions that are available to it. The case is a reminder to keep good records. I think the taxpayer struggled initially because not enough evidence was available, but they were eventually able to persuade the Adjudication Unit of what had happened.

Tax professionals vote for a Capital Gain Tax

Moving on, the Technical Decision Summary does point to an ongoing strain within the tax system around the taxation of capital gains. In many jurisdictions that have capital gains taxes the issue we've just been discussing would be not on whether or not the transaction was taxable, which is an all-or-nothing proposition, but what proportion might be taxable.

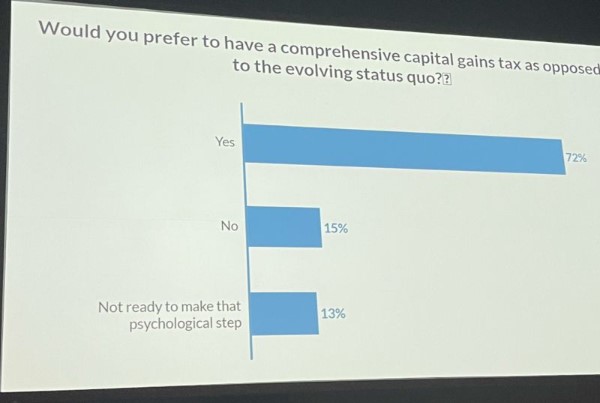

It’s therefore interesting to see that at the Chartered Accountants of Australia and New Zealand's National Tax Conference recently, a poll was conducted on the introduction of a capital comprehensive capital gains tax. The question was put would you prefer to have a comprehensive capital gains tax as proposed to the evolving status quo, which is actually a very generous description of the evolving state, still, to be frank.

(Photo by Richard McGill of PwC)

I wasn't at the conference. I would have voted yes, although plenty of caveats around how we might go about it. It’s also tempting to respond, “Well, that is a lot of self-interest by accountants voting for such a measure.” I know that I've seen similar comments pointing out when I raise the issue that of course I would support it because I get extra work out of that. I find it ironic to be accused of acting out of self-interest when the flipside of it equally applies people who don't want a capital gains tax would also be saying so out of self-interest. Self-interest arguments cut both ways, in my view.

I do happen to think that self-interest is a problem in the tax system around this whole area. It's very difficult to see how parliamentarians owning substantial capital assets are going to ever going to vote for something which is directly against their own self-interests.

The feedback from the CAANZ conference was that it's necessary to keep our tax system comprehensive and robust. And it would actually simplify quite a lot of measures that we see right now. For example, if you had a capital gains tax, you wouldn't have to work through the bright line test and its various iterations. You could remove the foreign investment fund rules, another set of rules which are complex and not well understood. And you would also probably remove, or certainly reduce the need for measures such as restricting interest deductions. This has been introduced partly as a response to the absence of a capital gains tax.

In my view, there's a lot of distortions in the tax system because we don't tax capital gains, and we are seeing more and more of that. At last year’s International Fiscal Association’s annual conference many of the issues we were debating really revolved around the strains on the edges of the tax system produced by not taxing capital gains.

A CGT is not going to be popular with politicians or for those who would be affected. But the rest of the world manages these strains. So, to pretend that we can get by without a CGT and continue the current incoherent approach to taxing capital gains, is a position that just simply isn't sustainable in the long term.

Updates on global tax coordination

Now, moving on, in international tax news the OECD released its latest corporate tax statistics. There's a lot to consider here which I'll discuss next week.

The OECD also released data relating to the latest Mutual Agreement Procedure statistics covering 127 jurisdictions and practically all the mutual assistance cases worldwide. These Mutual Agreement Procedure cases arise when two or more tax jurisdictions want to resolve the tax treatment of a transaction or entity where each jurisdiction thinks they have priority. Transfer pricing issues are often involved.

According to the OECD, approximately 13% more Mutual Agreement Procedure cases were closed in 2021 than in 2020. But fewer new cases started this year, which is a small, unusual trend given the internationalisation of the global economy. But these Mutual Agreement Procedure cases do take some time to resolve, on average, about the 32 months for transfer pricing cases and 21 months for other cases.

But amidst all this, there's some good news, including an award for Inland Revenue which together with Ireland was awarded the prize for the most effective caseload management. The most improved jurisdiction was Germany, which closed an additional 144 cases with positive outcomes - that is, the matter was fully resolved.

These awards seem a bit of fun, but actually it's a pretty important matter because with the Base Erosion and Profit Shifting and the hopefully soon introduction of the Two-Pillar international tax agreement, the role of Mutual Agreement Procedures in resolving disputes is going to be important. It’s encouraging to see jurisdictions are making progress and cooperating better

Paying tax & the right to vote

And finally this week, the Make it 16 win in the Supreme Court over the potential voting rights of under 18 caused quite a stir. David Seymour of ACT jumped in with a rather ill thought out comment “We don’t want 120,000 more voters who pay no tax voting for lots more spending."

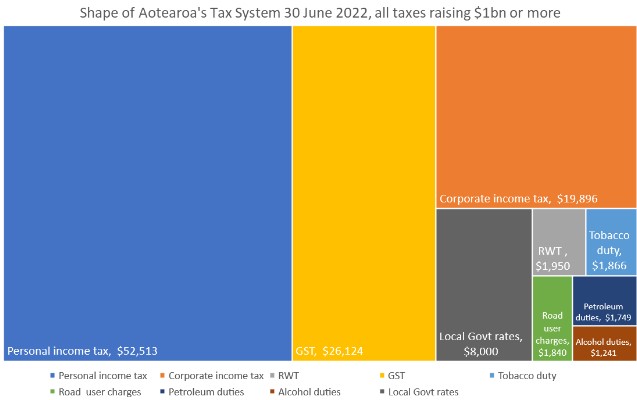

From the first time a child uses their pocket money to buy an ice cream and dairy, they're paying tax. It's called GST, which at over $26 billion is a quarter of the Government's tax revenue. And as I pointed out on Twitter, lots and lots and lots of under-18s pay GST.

(The total of local government rates is an estimate. It appears the true figure is just over $7.3 billion)

The Make It 16 group made an Official Information Act request to Inland Revenue about how much tax 16- and 17-year-olds pay. And according to Inland Revenue over 94,600 16 -and 17-year olds paid a total of $82 million in income tax during the year ended 31 March 2022. That's not an insubstantial amount of money (and doesn’t take into consideration the GST they also paid).

Given that 16 is the age of consent and 16 year-olds may drive, I don't see much logic in saying that's too young to vote. The kids are all right in my book.

And on that note, that's all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

*Terry Baucher is an Auckland-based tax specialist with 25 years experience. He works with individuals and entities who have complex tax issues. Prior to starting his own business, he spent six years with one of the "Big Four' accountancy firms including a period advising Australian businesses how to do business in New Zealand. You can contact him here.

40 Comments

The different in NZ are confusing, I prefer the system in Switzerland where you're considered an adult from 18 yo, you get freedoms like driving, voting, drinking, living independently, paying taxes etc and you also get the responsibility of being judged an adult if you break the law.

I agree the Swiss system is the ideal.

If the voting age is reduced to 16 then surely parental guardianship, drinking age and criminal responsibility should all be reduced to 16?

I personally find your articles heavily biased to the left. Your footnote should include your prior paid presence on Labour initiated workgroups and the co-authoring of a book on Tax with Deborah Russell, a current Labour MP.

Says the guy who would (based on their own utterances) likely judge Oswald Moseley a communist sympathizer, Margaret Thatcher a socialist stooge and Augusto Pinochet a mealy mouthed left winger............

Deflection. I don’t post articles on this site. I do repeatedly say that the current PM and Government are the worst in living memory, and I mean it. Baucher made a political dig at Seymour. I’m pointing out he’s not apolitical and readers should be advised of that in the footnote.

Why does someone need to be apolitical to have a dig at David Seymour.

It's good though that you intimately know this reporters' details, yet frequently make false statements about all manner of subjects you could've done your own legwork determining, presumably because you swallow whatever you hear on ZB.

You do not need to be apolitical to take a dig at any politician , including David Seymour .

The problem here is that TB positions his articles here as something written from apolitical / professional / technical perspective whereas he is in fact a politically engaged person on the Left.

I think it's refreshing to read a tax professional who isn't innately right wing and into business boosterism.

He doesn't seem to me all that much further to the left than Roger J Kerr is to the right!

And I read both of them, and most other contributors too.

Good on interest.co.nz publishing all sorts of views.

We're grown ups on this site, aren't we? Surely, we can figure out people's biases all on our own thanks.

Not really grown ups. We have this festering issue in New Zealand where politics turns people into narcissistic pricks, "partisan narcissism".

I suspect it's evolved from our deeply rooted Rugby culture where people cheer for one team and take the mickey out of others, but at least with Rugby the jibes are generally civilized and respectful.

The IRD...when you're a hammer, everything else looks like a nail.

Not going to see many capital gains from properties purchased in the last two years anymore, so then that begs the question of how do you address a huge drop in asset bases for the tax system? The argument has always been CGT would allow you to drop tax rates, but if asset values drop across the board, then you're not going to be collecting much revenue - so you could arguably end up with both high income taxes AND capital gains taxes, along with all the complications, valuation days and other rubbish that comes with it.

This constant pitching of a CGT when we can't get indexing income tax, zero-rated RWT thresholds or taxing Kiwisaver upon exit right - which are arguably the absolute minimum level of reform required - is one of the reasons our tax system is stagnating. There's a broader purpose that means everything can be deferred, even if it means stealth-tax increases at a time of exploding living costs.

Let's walk before we can run, if only to check we still have the right number of legs. It's been so long since our tax system got a once-over that I've forgotten what exactly that is.

Do brightline sellers accrue CGT credits when they sell at a loss ?

Just asking the question.

It’s a good question. I would say guess no.

You accrued a loss to offset against a future capital gain under the Labour CGT plan. i.e. there was incentive to continue doing the thing you were doing (property investing for 'incidental gain') otherwise you were leaving a loss carried forward on the table. You couldn't offset it against PAYE on regular salary or wage earnings.

Unsure of the mechanism under the Brightline.

Furken winkers!!! Asking rich Accounts about introducing a CGT is like asking Greenies to give up thier right to breath!

Thr biggest factor in most businesses failures over the years has been Accounts!.. they always look at ways to cut spending and increase taxes versus make money and spreading the wealth.

CGT could be applied to everything sold... Oh it is! GST!, General taxes, rates.....

"The biggest factor in most businesses failures over the years has been Accounts!."

Yes the bottom line showing a loss...which the owner of the business is in charge of, not the accountants.

Cashflow is where its at. There is nothing else more meaningful in small business land. Showing all the profit in the world and not a dime in the bank is the biggest cause of failure. Undercapitalised.

As always, great article and very informative. Can't wait for 16 and 17 year olds voting.

Can't wait for 13 year olds voting as well. Every time they buy a pie or a sausage roll from a tuck shop they too are paying GST every single time so they should get a say. Also because all teenagers' opinions are their own from their own life experiences/research and have not been swayed by their teachers viewpoints thoughout all their lives. We know every teachers are selfless, have absolutely no agenda to push and just solely focuses on the academics :D

Capital gains tax makes sense, the wealth tax of the Greens does not. The latter-which includes the family home--would simply kill investment in NZ and result in people who invest and live here leaving for Australia. The threshold for the Green wealth tax is only a million dollars. Many retired people's homes have inflated to that value. Which means that not only their home but also their retirement savings would be taxed not just for income, but for total value.

CGT is a recipe for employing tax lawyers and accountants - where in the world does it actually raise a significant proportion of the total tax take? It also will fluctuate with inflation so given a recession when the govt needs more income is when least will be raised by a CGT.

A wealth tax makes more sense. Avoidable when the wealth is something easy to transfer from country to country (yachts, gold) but low admin cost for property. We already have one called council rates. Just double the land rates and give half to the govt. (BTW I hope that does not happen since I'm writing this comment in a house with Rates based on property of $150k on land worth $950k.)

That would be most houses in Auckland. It would also mean that people living the exact same house in a smaller, less interesting part of the country would be paying a fraction of what people in the biggest city in the country pay, where other costs are way higher as well.

Yes, it might incentivise better land use over time, but it's going to be a long long time for urban regeneration to make that happen. Until then it's just a cash cow for something that previous Councils have spiked out of control because they could.

Very informative…. Thanks Terry

Who likes making money for someone else? Who finds it difficult spending someone else's money? Who likes paying more tax?

Accountants will be the ones making money from the exemptions and loopholes used to prevent paying for that capital gains tax.

There will be a laundry list of reasons for exceptions.

- Upsizing as your family expands? Exception as long as you buy a bigger house.

- Transferring ownership through trusts so the property never changes hands.

- Donating property to a charitable trust (see above) prior to death, etc.

These accountants will make a killing off CGT. Land Value Tax is the only fair land taxation.

Wouldn't people then try and rort things by acquiring land with cheaper land tax then over capitalising on the property.

Reminds me of Vietnam, in years gone by their tax structure dictated smaller and smaller widths of land, so everyone just went and maxed out heights so you have these pencil thin, but quite tall structures.

LVT is essentially proportional to the improvements on the land and is relative universally applied. Cheaper land will always be worse for services available and require more improvements to reach the same level as more expensive land. It largely drives people to push their land to be productive in some form.

If the value of the land is contingent on its improvements, then essentially you're not just taxing the value of the land.

Except it doesn't. In Auckland, the land and zoning shortages the Council has overseen has contributed far more to land values exploding than any individual could possibly mitigate with changes in land-use. What you are saying is we should hand a bill to any land owners for the failure of regional authorities over decades - which they've already been stung for in the form of the vastly inflated cost of the land they bought in the first place.

Yes. Landowners should improve their land and make it productive. If they were stupid enough to find themselves negative equity from their own decisions, that is capitalism. Why should we privatise the profits and publicise the losses?

Because the failure here is in the public system that artificially strangled land supply. I fail to see how there's any moral high ground in punitively taxing individuals because the state allocating of land has been broken for years.

Slugging someone with 400sqm of section for a land-tax that makes up 80% of the CV of their property is a poor outcome; one that will result in urban taxpayers in Auckland paying squillions and people with much bigger sections in other places paying next to nothing. I'm not sure you're going to see a whole heap of 'improvements in usage' in postage-stamp sections that already had a super high price tag due to the inefficiencies above.

The explicit intention of the policy is to force property prices down and reduce land yields while raising revenues, making it cheaper for poorer people to buy land while also funding the improvement of that land as well as surrounding land. It incentivises productive use of land instead of speculative land banking.

Intensification is an appropriate solution, but again, Intensification is hampered enormously by lack of public infrastructure. I.E. lack of trains to transport people to work, the lack of incentives to build supporting business and public infrastructure in new developments etc.

As a former tax professional I realised a long time ago who wrote tax law and why it was heavily weighted towards income and the worker, and highly favourable for the owners of capital.

It made sense for that period in time, it enabled the construction of the modern world and the various infrastructure required to service trade and commerce etc. It was also just an extension of feudalism whereby the owners got rich off the labour of the serfs. Unfortunately it has also become severely unbalanced and created an uneven playing field, somewhat a zero sum game.

We do not need a capital gains tax. What is needed is the removal of the revenue/capital distinction and the various loopholes and exemptions. Income is income no matter what it is derived from and therefore subject to income tax. A business or venture reliant on tax incentives and associated structures is obviously not a viable business.

Of course it won't solve our ethical issues but that's a whole other story.

CGT: don't ask publicans if opening hours should increase.

We purchased a section in Lincoln, Selwyn ( we were renting during this time) to build on. Plans were drawn up etc. then the build cost blew out and my partner was made redundant and the section had to be sold.

We sold the section privately and had to move cities to secure a good job.

We bought a old run down house to renovate and had some money left over to start the renovations.

We have just paid almost 90k in Brightline Tax including provisional tax and penalties ( very confused about this & IRD seriously uphelpful)

Yes we did consider hardship and spoke to professionals however hundreds of dollars in penalties was being added every week so we took out a mortgage to pay the bill.

Yes we made a profit on our section but seriously we are hardly wealthy investors.

To say it has been stressful is a understatement and I still feel sick about it.

My approach with the IRD is to pay up in full or over and then dispute. That way one is not out of pocket with penalties at a ridiculous interest rate. I would encourage you to consider this if It its not too late to contest it now.

If you had to pay $90k in Bright Line Tax, then you must have made a decent profit. Not bad for just holding a bare section and doing nothing productive. Maybe a bit of perspective wouldn't hurt...

I support CGT with qualifications. I don't like Labour or the Greens so it has little to do with politics. I rather call CGT levelling of the investment decision taking ie Is this investment sucking more tax than that one. I'm paying capital gains tax on certain shares and its non realised. Why shouldn't an investment property pay tax on relised capital gains, irrespective of the time held?

TBs article is specific to residential property, a subject dear to Kiwis hearts. I wonder how many IRD has gone for on share capital gains under the CB3 catchall?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.