What can history teach us? Does it repeat? Does it rhyme?

Knowing what happened in the past can be instructional, even if it doesn't always repeat.

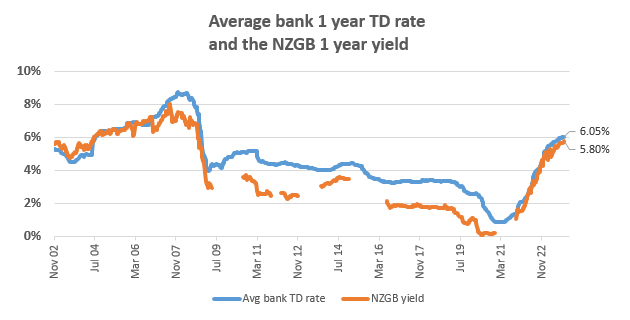

The pattern of interest rates in 2023 looks a lot like patterns prior to 2008.

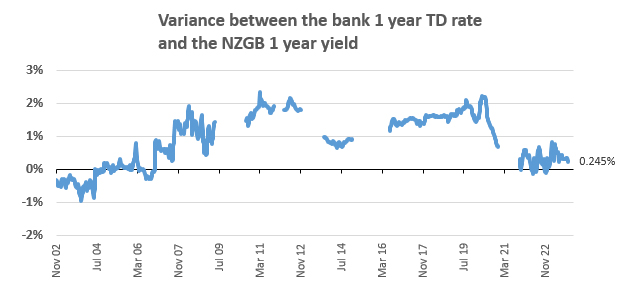

Prior to 2008 we had a long period where term deposit rates were a minor premium to benchmark Government bond rates.

After the GFC, that premium rose sharply, mainly because the premium for safety rose. Benchmark rates were very low. The domestic (local currency) credit rating for NZ Government Bonds stayed at AAA (even if the foreign currency credit ratings fell from that). But the main trading bank credit ratings were two, then three notches below that.

There have rarely been Government guarantees on bank deposits in New Zealand, so it makes sense that savers were rewarded with an interest rate premium for the risks involved. It has been more than 100 bps (1%) for more than a decade.

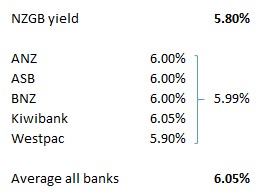

But now those premiums are disappearing again. And they are smaller for the main banks.

Why?

There may be a number of reasons, but it is a 'market' induced change. The actions of savers and lenders together, which generate fund flows in a competitive environment, are the actual source of these differences.

Market motivations can be influenced by regulatory actions.

Perhaps the impending arrival of a Government Guarantee for bank deposits is making depositors realise they will become essentially risk-free, so the premium between TDs and Government bond rates doesn't need to be much of a difference.

The Government announced its intention to bring in deposit insurance in mid 2020 and Cabinet approved the plan in 2021. It will be in place next year.

Regulatory de-risking of the banking system, through enhanced capital requirements, tighter liquidity and core funding standards, new conduct & culture expectations all also push the difference between 'risk-free' government debt and private sector bank debt closer together.

All these actions of the past 5-10 years make the current environment for savers quite different to the historic environment.

Savers probably should come to expect much smaller premiums from bank term deposit offers in future.

20 Comments

Lovely summary. Thanks

TD @ 6.3% for 12-months with Rabobank. Another good reason for some to bask in the sun, I say.

Que the "negative returns when adjusted for inflation critic/s who, to date, remain void of any relatively safe investment alternatives in the current and highly uncertain environment. Unless of course its already in the rear vision mirror.

I think FHB's should continue to save and watch it all unfold from early 2024 and consider making lowball offers. Those who undertook a save and wait strategy from early 2022 are certainly not regretting it.

Bitcoin: scarce, fungible, portable, indestructible,, divisible.

Unregulated, volatile, priced in a foreign fiat currency, subject to extensive platform risk (and fraud), used for money laundering, focus of law enforcement, potentially challenged by regulation, taxes uncertain, etc.

Priceless!

Super!

B-b-b-but D-D-D-David, if you store your Bitcoin seed phrase offline where nobody else can access it then it's safe!!!!

You just end up being torn between sharing this information with your partner/spouse. Risk that they divorce you and clean you out. But if you don't share that information and you die, then your pot of coins becomes consigned to the 4 million or so other Bitcoins supposedly lost. There ain't no bank involve that'll verify identities.

If you have enough BTC where this was a consideration, this problem was solved a long time ago.

If you were actually interested, I would suggest reading about multi-sig solutions.

This can be done easily and cheaply yourself, or in a even more secure and comprehensive way through a specialist company like https://unchained.com/

Thanks. I have had a read and I stand corrected! As long as the keys are written into a will and kept down at Public Trust.

Public Trust ? 😂

Good grief 😊

So Nzdan, you hide assets from your partner. ?

Our own personal savings are not hidden, but my wife would struggle to access my personal savings account and I'd struggle to access hers (outside the house savings account which is joint).

What about Kiwisaver? Those assets are "hidden" from my wife?

I really wish you would spend some serious time looking into this David. I would never advocate replacing TDs with BTC, but these comments are surface level thinking.

As a very brief rebuttal off the top of my head:

"Unregulated" - Regulation doesnt stop constant fraud in other areas. It helps to protect some people for sure. And as some of your other points mentioned, it is coming anyway.

"Volatile" - You're welcome to invest in TDs if you want the opposite,the maximum upsides are very different, volatility is the price you pay. But the worstcase scenario is still zero in both cases... Volatility is reducing anyway as the market grows. Any asset class with such a small market cap will see the same volatility, I see just as much or more movement in my small cap stocks.

"Priced in a foreign fiat currency" - This is a strange comment. You can 'price' BTC in any worldwide currency you like, or cows, or exchange it directly for goods or services.

"subject to extensive platform risk (and fraud)" - The BTC Network itself, effectively ZERO. Yes you should be very aware of counterparty risk when not holding your own coins.

"Used for money laundering" - The VAST majority of all money laundering is done with USD and local fat currencies. It's not even the same ballpark. Even as a % this argument doesn't stack up. The latest Chainalysis numbers estimate that illegal transactions made up 0.12% of the TOTAL cryptocurrency transaction volume in 2021 and 0.24% in 2022.

"potentially challenged by regulation" - There's no doubt regulation will come, certainly to the areas they can oversee. Probably a good thing for the masses and doesn't change much.

"taxes uncertain" - That is not the case, it's pretty clear what your obligations are in NZ. As with in the US. They may change. Just as we are likely to see tax change in other areas.

You missed market manipulated by large owners and the biggest Ponzi of all time.

(Double Post)

It is going to take time and unfortunately more pain for people to understand this.

I often feel you're a wo/man with limited vision and fixed in your ways. And then you confirm it with statements like this:

"Que the "negative returns when adjusted for inflation critic/s who, to date, remain void of any relatively safe investment alternatives in the current and highly uncertain environment."

I'll ignore the first part and address the second. A basket of quality stocks (shares) - say 40 - adjusted annually - will be just as 'safe' and will outperform money in the bank by quite a margin. Holding cash that you don't need to use very soon, even in TDs, is mind numbingly dumb. All my retired relatives and friends hold share portfolios.

Banks must love you. Why don't you buy bank shares?

"I'll ignore the first part and address the second"

Why are you ignoring the first part? How mind numbingly convenient.......

How does giving reference to your retired cohorts supposed to help saving FHB's? Do you even care? I'm beginning to understand the origins of anti Boomer sentiment.

In the current environment @ 6.3%, the returns after tax are banked and interest compounds. With interest rates still rising, shares in the short to medium term are at very best flat, worst - toast.

Is this seriously your investment advice for saving FHB's?

“Holding cash that you don't need to use very soon, even in TDs, is mind numbingly dumb.”

Most financial advisors would suggest having cash or equivalent bonds to cover 3-5 years of expenses thereafter load up on equities.

GetFeeling-respectfully why don’t you describe your financial success to date? More inclined to follow the advice or listen to someone who has stood on the podium.

RetiredPoppy-I’m more aligned with your thinking. Enjoy retirement.

Huge advantages in Bitcoin, but they are all psychological.

Excitement at the massive rises for no reason at all. The "Masters of the Universe" feeling and being in the inside group. Being able to look down on "Normies". Makes that empty feeling inside just go away.

Reminds me of the guy in Vegas, excited to be there, with a glint in his eye. But never worked out why the casinos keep giving him weekend stays for free, with flights.

Then when the BTC price does nothing dramatic, eyes locked on the screen see no buzz, the friends there fade away, and that emptiness returns.

And the normies have known a thing or too. Dammit.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.