The cash is there and they can grab it - but fewer of them are.

After two years of sharp increases in KiwiSaver withdrawals by the over 65s and then consolidation last year, this year the amount withdrawn by the boomers has actually decreased.

And this is despite that fact that over 13,000 more people (a 7% increase) were eligible for withdrawals.

The Financial Markets Authority's latest KiwiSaver annual report covering the 2024-25 year (the figures are to March 31) shows that members aged 65 and over "are increasingly drawing down their KiwiSaver funds gradually (also known as decumulating), rather than taking it out as a lump sum".

In the year to March 2025 the over 65s withdrew $2.992 billion, down (1.3%) from $3.031 billion last year. The number of withdrawals fell from 36,652 to 31,470 - a 14.1% decline.

This is a far cry from the period between 2022 and 2023 when the amount withdrawn by the over 65s shot up from just $1.221 billion in March 2021 to $2.849 billion in March 2023, when there were over 20,000 fewer eligible members than there are now.

It may not have been a coincidence at all that the big surge in withdrawals came at a time when term deposit rates were rising fast. Now, of course, they coming down again.

In the FMA KiwiSaver annual report, the FMA says the latest patterns now being seen "may suggest a growing preference for retaining funds in KiwiSaver post-65 and using it as a retirement income stream".

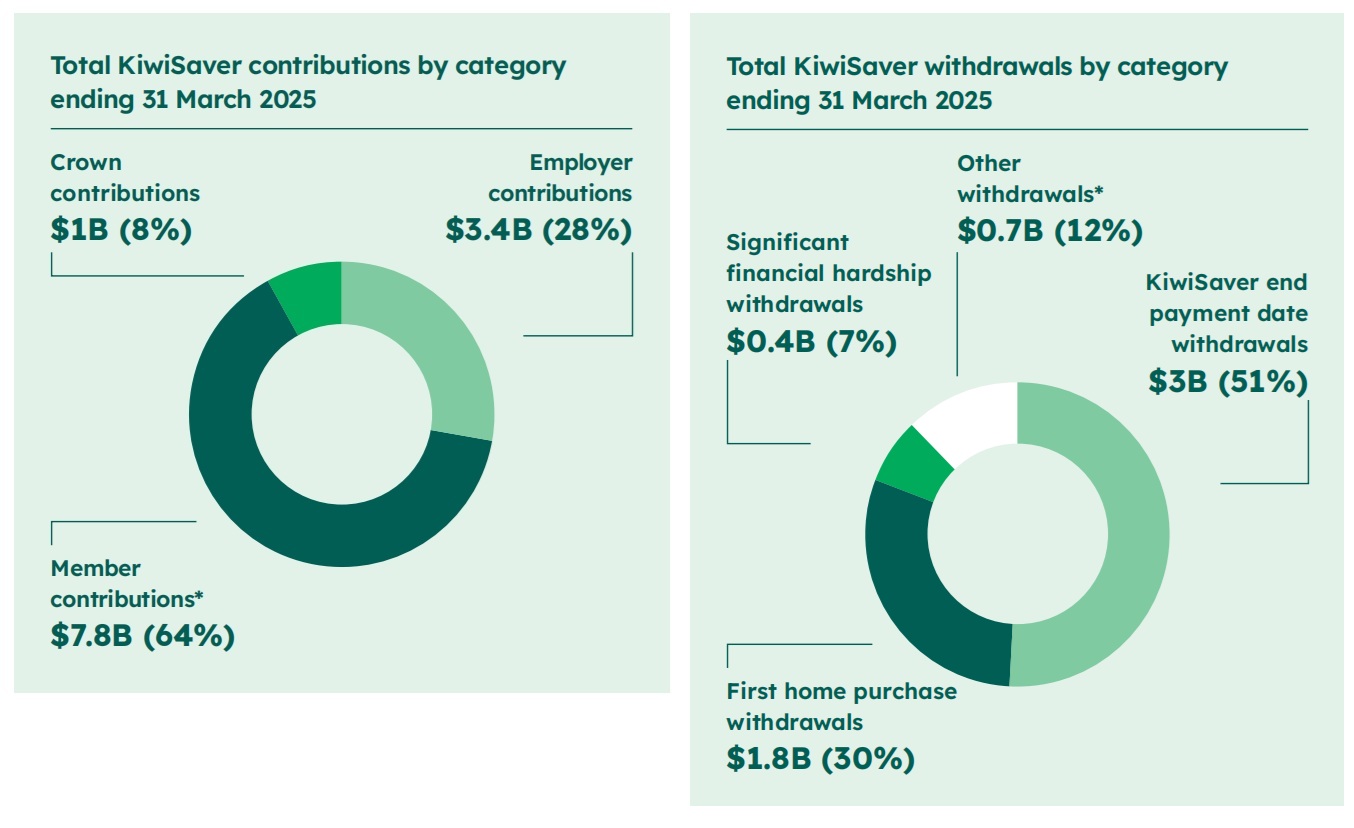

The $2.992 billon withdrawn by the over 65s was still the biggest source of withdrawals, at 51% of the total - but two years ago the amount taken out by the over 65s accounted for about two thirds of the total.

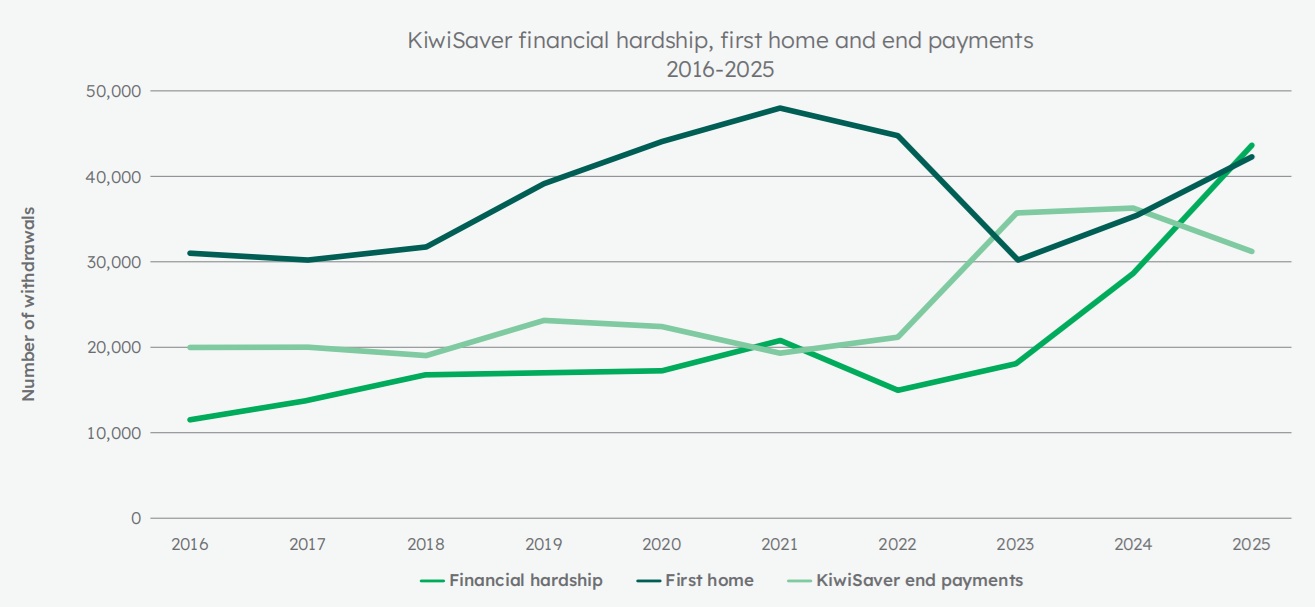

In the year to March 2025 the next biggest share of withdrawals was for first home purchases. Nearly $1.8 billion was withdrawn by 42,811 members for a first home.

"While the peak for the number of first home withdrawals was in 2021, with 48,475 people, this year saw the largest total amount withdrawn, up 22% from the previous peak in 2022," the FMA said.

"The average withdrawal amount is now at its highest level, nearly $41,000 per first home withdrawal, and up 18% from last year."

Hardship withdrawals increased sharply in 2025, increasing 50.8% to 44,099, with a total of $443.6 million withdrawn - up $179.3 million from the previous year. The average hardship withdrawal amount reached $10,058. Successful applications were made by 1.3% of total KiwiSaver members.

"This continues last year’s upward trend and reflects the more challenging economic conditions and labour market," the FMA said.

FMA Chief Executive Samantha Barrass noted some room for improvements with KiwiSaver.

"The number of non-contributing members continues to rise, with 30% of members of working age not contributing. That’s up from about 20% in 2010. Even among active choice members, there are 1.2 million who are not currently contributing," she said.

"We remain concerned about the long-term opportunity cost of foregoing retirement contributions. If this trend continues, we risk a stark inequality between the contributing and non-contributing members of our national retirement scheme."

The rising number of these non-contributing members may well reflect the economic headwinds currently impacting New Zealanders, while the rise in hardship withdrawals was also noticeable, Barrass said.

She said the industry had a role to play in lifting contributions.

"For default KiwiSaver providers, there are obligations to engage with default members throughout their retirement savings journey, including during times of volatility, and near the end of a member’s savings suspension.

"Sharing information with members about their contribution options and planning tools available to them better enables people to plan their long-term retirement goals.

"By providing support and evolving to meet the needs of members, providers and the FMA can ensure KiwiSaver continues to work as intended, helping New Zealanders build long-term savings and independence in retirement," Barrass said.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.