Competition between banks on mortgage rate offers started the year actively, but since the August Monetary Policy Statement (MPS), the main banks have stopped competing on price.

The challenger banks are still trying, with TSB currently offering -10 basis points (bps) lower than the main banks, the Cooperative Bank a bit less, and some of the Chinese banks are lower too.

Since early August, the Official Cash Rate (OCR) has fallen -100 bps. But the one year fixed rate has really only declined -25 bps.

August 20 MPS down -25 bps to 3.0%

October 8 MPR down -50 bps to 2.5%

November 26 MPS down -25 to 2.25%

None of the fixed rates are much affected by the OCR, although the one year is the one that can get some influence. But not this time.

The one year swap rate has moved like this:

From the August MPS, the one year swap rate has actually risen, from being 2.41% immediately after the RBNZ -25 bps cut, to now be at 2.57%. In that intervening time the OCR has been cut by -75 bps. But none of that has shown up the wholesale cost of money the banks are facing.

In the background, the NZ Government bond yield has gone from 2.91% after the August OCR cut, to 2.71% now, a -20 bps reduction in this benchmark.

The US Treasury one year benchmark has gone from 3.91% to 3.61%, a -30 bps reduction.

But financial market participants, the ones who make the swap market pricing, are apparently having none of that. At the same time, the NZ dollar has depreciated from 59.6 USc then to 56.1 USc at November 25, (although in the past week or so it has made a small recovery). So foreign investors have required higher returns to weigh against that -6% currency devaluation. The local banks have not been offered the lower rates in wholesale markets that the sovereign benchmarks have indicated.

Banks also fund mortgages from their deposit base and household deposits are the largest part of that. And within overall household deposits are term deposits and they comprise more than half all household deposits.

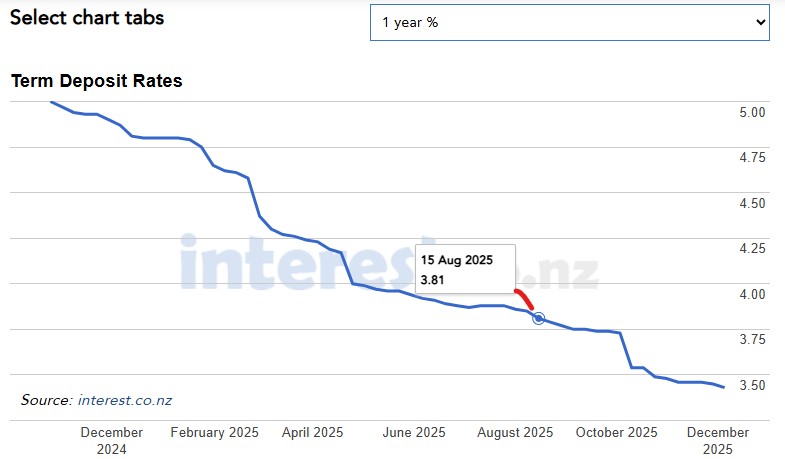

Over the same period, the one year term deposit (TD) rate has fallen -40 bps, far less than the OCR shift lower. The six month TD has fallen the same -40 bps. But banks are in a bit of a jam with term deposit funding. As we have reported earlier, savers have started withdrawing these funds at an increasing clip, down -$1.1 bln in the past two months in a sudden shift. So to protect this funding source, banks are under pressure to keep these TD rate offers higher than they would need to 'afford' lower fixed home loan rates.

So, even though the OCR may have been cut by -100 bps since August, banks have only cut their term deposit rates by -40 bps to retain this funding (and that hasn't been very successful), while wholesale funding has actually risen.

It has been drivers other than the OCR which have moved the cost of money - international money market rates, the exchange rate, and savers' growing reluctance to hold lower-returning term deposits - making it not possible to cut fixed rates.

In fact, there is more than half a chance that fixed home loan rates could rise from here, despite the November OCR cut. Bolstering that case is the rising demand for fixed housing loans. RBNZ data shows bank mortgage books are up at their fastest pace since July 2022 (+5.8%), which is a growth rate that is at a three year high. This demand needs to be funded.

And for the record, banks no longer have the "Funding for lending" pandemic support, at the cost of the OCR rate. Almost all this emergency funding has now been paid back to the RBNZ. It is the real world funding that calls the shots again.

And finally, in the marketplace, cashback offers have to be 'paid for'. Market heavyweight ANZ has a "1.5% up to $30,000" cashback offer out there until at least December 16, and all their rivals have been matching that. Bank margins are compressed further when banks pay broker fees, which average about 0.8% of the loan amount. Together these are a load banks will seek to recover by not letting the carded interest rate basis from also being added into the mix. With stronger than expected loan demand, the pressure is relatively off chasing rates down too.

10 Comments

Yip watching the swaps the past few months, it wouldn't surprise me (unless something significant occurs e.g. war, pandemic etc) if mortgage rates end up going back up again early next year.

I've been commenting that the swaps especially didn't buy into that last OCR cut - the went in the complete opposite direction. Some now up 50bps from their low a few months ago.

The US 10 year bond yield, also seen as a bench market for global interest rates and inflation has been pretty much flat now for 3 years at 4%.

https://www.cnbc.com/quotes/US10Y

Unless this changes, I think NZ interest rates might be back on the rise again next (also see the trend in the last 4 CPI reads here in NZ - the trend is constantly and steadily up right to the 3% threshold...and yet the RBNZ cut rates!! I was left thinking are these people mad? No change would have been a much better choice)

Scary times, possible stagflation. I thought we were over that, but maybe not.

Banks also fund mortgages from their deposit base and household deposits are the largest part of that. And within overall household deposits are term deposits and they comprise more than half all household deposits.

I know that this is the common phrasing, but it would be more descriptive to say that banks fund household deposits from their mortgage base. When banks make loans they create assets on their balance sheet (the mortgage) and liabilities (the deposits they create and add to customer bank accounts). They need the mortgage assets and the equity put up by their parent banks (mostly) to back their liabilities - the customer deposits.

The economics textbooks talk about banks lending out customer deposits - it's nonsense. Loans create deposits.

What's your projection for housing interest rates...?

Banks will manage the actual average mortgage rate down to just under 5% and keep their net interest margin at 250pts - so I don't think the 1 - 2 year deals will get notably better than they are now. I think there is still an outside chance of another rate cut, but my money is on RBNZ holding at 2.25% through 2026 as the housing market picks up.

"my money is on RBNZ holding at 2.5% through 2026 as the housing market picks up"

The OCR is at 2.25% now

And 4.5% for one year looks like a very good margin doesn’t it? Maybe I should start a bank, I wouldn’t mind taking 2% for nought.

their is a bit of a regulatory moat

yes, lol, corrected.

Government bond yields have risen at the short end over the last month or two. Hence why I opted for a 1 year fix instead of 6 months. I still think there's a reasonable possibility the recovery we're apparently in could stall because of:

1. Historically low net immigration.

2. No property boom as a result.

3. No alternative economic drivers to the above.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.