It has been more than ninety days since the US Federal Reserve -25 bps cut to their key rates. That was the spark that ignited the down-trend in international rates at that time. And the one year swap rate responded with its own drop at that time.

It was preceded by the RBNZ's -25 bps cut to the OCR on August 21. That brought its own swap rate reduction, as did the RBNZ October 9 similar reduction.

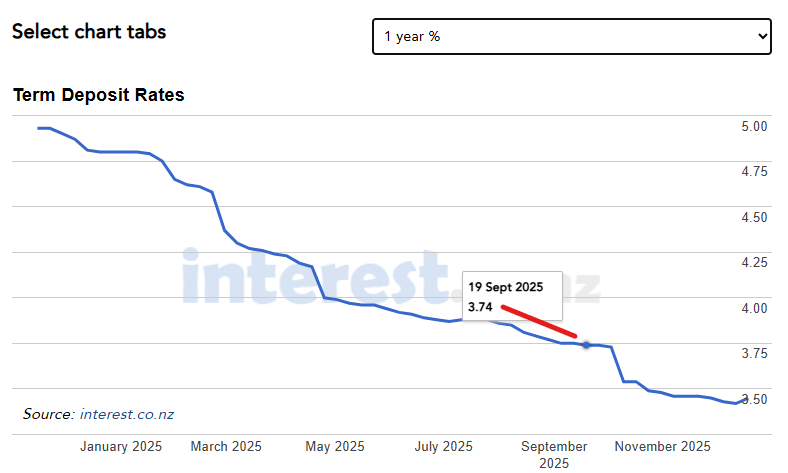

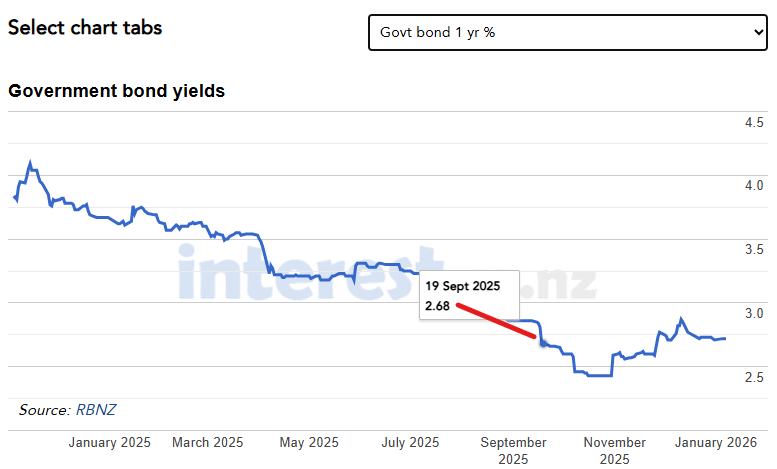

But the US Fed's September 19 cut is a benchmark even though there have been two more similar -25 bps cuts since then. The reason is that our own 1 year swap rates started rising from November 26, right at the point of that day's further -25 bps rate cut. The rise was all about the RBNZ commentary and signaling about future prospects - the easing cycle was said to be ending.

And now our one year swap rate is back to that September 19 level - despite the lower OCR. And it has held there for more than a month.

There has been a lot going on in international financial markets, mainly around the pricing of risk. The US is pursuing irresponsible fiscal policies. The US Fed is under attack by the President and his minions. Most Fed members are maintaining their independence despite those attacks. But risks are elevated.

That means background risks are higher and demand greater reward. This is relatively tough for a small peripheral economy like New Zealand, a net debtor. So our wholesale money costs have risen, and have not followed the RBNZ pricing signals.

The question for early 2026 is, will our term deposit rates follow these signals up? So far they haven't.

And they may not. But they may as well. A lot will depend on local loan demand. If it picks up with the expected 2026 improvement in economic activity, banks will need to fund that demand. They can raise wholesale funding, but they will pay the rising rates international lenders will require. Or they can compete harder for local funding, and the key way to do that is to raise TD rates.

But if the 2026 expansion falters, they will have much less need to offer higher TD rates.

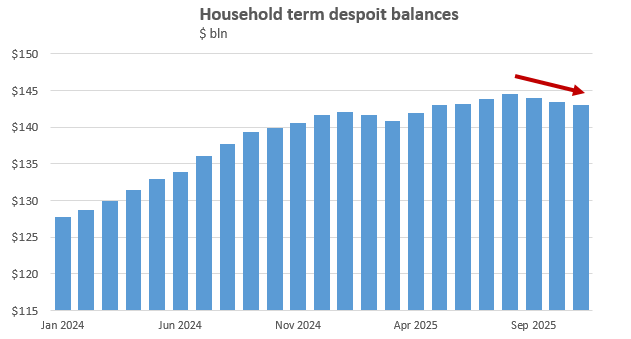

Savers have good alternatives which may force their hand however. There may be no capital gains in housing anymore, but there certainly have been in equity investments. Savers just need to look at their KiwiSaver balances (up +15% in a year, up at double-digit rates since mid 2023) to see an easy alternative. Some have been taking that option and we have seen household term deposit balances falling since August.

This trend will be challenging for banks. They may be able to stem the outflow, and build back that funding source by offering interest rate rises that at least match the swap rate rises. That would be +25 bps rise just to get back to mid-September levels again. They may need to do more to get savers to reconsider their equity fund options.

Investors in NZ Government bonds have yields back to their September 19 levels. But TD savers do not.

We start 2026 at an interesting inflection point. Savers have alternatives. Banks do too, but banks really need growing household savings to keep their liquidity profiles in a balanced state. And households have been starting to play hard-to-get, unsatisfied by being left out of the rising rate environment,

It would not surprise us if by May 2026, current one year term deposit rates are +50 bps higher than where they are now. Remember, we get OCR reviews on February 18, April 8, and May 27. The influence of new RBNZ governor Breman will be showing through in this period, probably charting a different path to 2025.

She will be certainly watching election year promises/bribes and their likely influence on fiscal outcomes. She says she is an inflation hawk. With partial ("selected price indexes") December CPI results due to be released next week and the food component expected to come in at +4.6%, with the full CPI the following week (January 23) and likely to be higher than September's 3.0%, we will in for an interesting few months.

Savers could well be on the 'good' end of all the reactions.

4 Comments

At ANZ you need $10,000 to start a term deposit. I'm sure the limit used to be lower? Are all the main banks similar?

rolande,

No. ANZ is the only one with that minimum. Just have a look at the TD rates here.

If the govt and central bank were more responsible and took a more proactive stance, they would educate the public on their relationship with retail banks so people would learn that they're 'creditors' to banks. That would mean people would learn that banks are not custodians of people's cash savings. Arguably that would make banks more accountable in terms of how they reward their creditors for their capital.

But it's not in the ruling elite's interest to educate people. They would prefer people to remain ignorant.

True. Banks are one of those supposed service providers where you often wonder who the customer is after an interaction with them.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.