By Elizabeth Kerr

What happens if you spend more money than you earn? You know the answer, right? ... eventually you have to buckle down and pay it back.

It doesn’t matter if you’re a household, a business, a government or a bank. *sigh* Okay maybe not if you’re a bank ...

There are some whispers of a new GFC about to start late this year from economic commentators around the world. The problem is that without a PhD in Economics majoring in linguistics it’s almost impossible to make out what they trying to tell us all.

So to help break it down this is the Elizabeth Kerr version of what you need to know about the GFC2.

Like all good sequels it promises to have more blood, more gore and more despair for all our favourite characters.

So What Are Economic Commentators Trying To Tell Us?

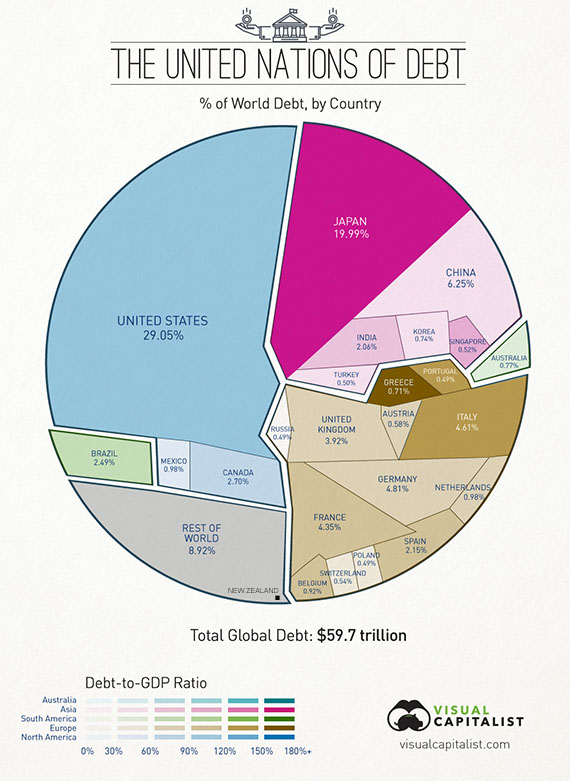

Global Debt levels are too high – The countries that make up the global economy already have massive personal loans in place for spending that they have already made in the past, not to mention the extra loans they had to take out to get through the last GFC. The total amount of debt floating around the world as of 2015 is about $200 trillion (12 zeros if you’re wondering) and increase of $57 trillion since 2007.

The last GFC did not force people to pay back debt, instead governments printed some more money and we all just took out a few consolidation loans and kept spending.

And what’s worse, that debt was so cheap that nobody stopped to think about how they were going to pay it back – they figured they’d sort that bit out later when they had some extra money floating about. (Doesn’t that sound familiar *wink*)

Global Budget Deficits are too wide – You’ll hear this lots as well.

Each economy doesn’t have enough money coming in from their day-jobs to meet all their expenses - let alone pay down the debt on their loans.

We all know if we spend more than we earn and can’t pay our loans and credit cards then we’re in big trouble. A lot of this debt was to get them through the last GFC whilst anticipating that the future was going to be full of sunshine and roses, their incomes would increase and they would be able to pay back those loans. But it didn’t. World growth is forecasted for a paltry 2.8% (note: a global recession is activated when growth is just 2.5%). Everyone say “Eeek”.

What else is hurting us all?

Global Oil Prices Fell. On the face of it as long as it’s cheap at the pump you don’t care right? Wrong – you need to care about this!

The countries that produce and sell the oil now don’t get as much income to pay their own expenses, causing them to have to cut back on how much they can buy from everyone else, so then those countries have income issues and have to cut their prices to export their products and everyone looses. The countries that buy the oil might be getting it cheaper but cheap oil cheapens their economy in the end so it’s a loose-loose situation really.

China’s Debt Too Big for Its Boots. It’s tempting to just blame China for all our woes and there would be very good reason considering it had ownership of approximately $28trillion of that debt in 2014. Most of this debt is linked to their property (lets not forget the ghost cities), shadow banking (meaning risky loans) and government debt. When revenue in China falls, paying this debt back is impossible so whilst they have had some boomer years they are currently just scraping by financially and this causes everyone to worry. China is a big customer to a lot of other countries and buys about $12million of stuff from NZ (2014), second to Australia at $13m. So we need them stay profitable and keep buying. The fact that they aren’t causes shock waves around the world, and companies are downgrading their profit estimates as a result. Cue the start of a global recession via lower stock prices maybe?

So, How Did NZ Get Through The Last GFC?

Well thankfully leading up to the last GFC we had amassed a few budget surpluses and had some money stocked away, like a personal emergency fund (like the one you have right now?!!!) So they used that to help pay for the rise welfare payments that came about, and to absorb the shortfall of income no longer coming in. That was handy then but now we don’t have that kind of money saved away so the government would be forced to cut spending/services to see us through. Imagine a world where our taxes actually increase, taking kids to the doctors is no longer free, and the retirement age has no choice but to go up. This kind of government spending changes is referred to as austerity measures.

Real Estate Bubble. The last GFC took everyone totally by surprise because Real Estate was considered the safest of investments, until someone peeked under the sub-prime mortgage thing (watch The Big Short to understand that one). So now the attention is on making sure that doesn’t happen again and one thing in our favour in NZ is the fact that the RBNZ introduced Loan to Value ratios on real estate. Making sure people had a deposit which was tied to the amount of house that they could purchase was intended to stop people paying super-silly prices for any old dunger. The benefit of this is that should house prices take a hit hopefully they will not slide below water. Below water means that a person is paying a loan for a house which is more than the house is actually worth. This may make some people nervous. The really low rates of interest being paid on bank savings combined with the very low interest rates on mortgages is all a bit déjàvu don’t you think? Maybe it’s a good time to consider selling that holiday home you used your equity to purchase in the last 2 years? Just saying….

The OCR Rates Lever. Lowering the OCR rate essentially makes borrowing money from the bank cheap. The RBNZ does this so we have more money in our pockets to spend elsewhere (or pay down our debt ... But only a few of us actually does this, right?). When goods and services are being purchased our economy hums along nicely. The problem with this is that we’ve pulled that level already and now the rates are already too low at 2.5%. Everyone say “Eeek”

So folks in closing today we have covered off the following:

- Big Global Debt

- Global Budget deficits

- Falling Oil Prices

- Chinas declining revenue

- Corporate Failure

- Lowering NZ OCR rates

- NZ Real Estate

There is so much more to this story but the basic message we’re being told is that the math just doesn’t add up to give us any other option. “Winter is coming”. There is going to be a GFC2 but the question on everyone’s lips is WHEN will it hit, and what does this mean for you personally? It is not necessary to start stock-pilling food and building an underground bunker, but I do want you to think about how this might effect your purchasing decisions and your money machines.

When do you think, and what can you do to ready yourself? Comment below or email me at Elizabeth.Kerr@interest.co.nz or find me on Facebook.

80 Comments

A great summation of the performance of JonKey as Prime Minister - absolutely brilliant speech - watch it here https://www.greens.org.nz/news/speech/gareth-hughes-debate-prime-minist…

As much as I dislike the politics of John Key and his Nat party, speeches like this are total BS. It is so easy to highlight all of those points and mock the current government from the sidelines. Fancy hard left socialists complaining about increased debt and a decreasing standard of living. These people offer nothing new, just a much more hardcore version of the statuesque and a far quicker road to ruin.

No politician survives pedaling unpopular, unselfish, politics like austerity, responsibility and nationalism and yet we complain about our situation with wonder..

In the end the New Zealand public have a very limited understanding of what is going on. While John Key is popular he is a weak statesmans leading MPs with very limited understanding of the world. The National Party has made disastrous regulatory changes that are negatively affecting people. The Government barely understands what they have done. The opposition parties could have capitalised on this but they understand even less.

If the opposition was savvy they could tear apart the Government but then anyone who has an understanding of what they have done isn't interested in talking to the opposition. That and after the DIA published the Loopy Rules Report the opposition is blind to the powder keg that the Government is sitting on.

It's clear that all of the current MPs are completely worthless and are too lazy to do any work that would put them in power.

"It’s a real accomplishment and you must be now thinking how history will remember you.

Just outside of this debating chamber are the portraits of our great leaders.

From Seddon, to Savage and Fraser to Kirk how do these giants who established universal suffrage, a caring state in the midst of a depression and world war and a modern independent, bicultural New Zealand compare with you?

Is the flag it?

Your desperate, lumbering, grasping attempt at building a legacy with a flag won’t mask the realities.

Hungry kids up

Inequality up

Pollution up

Debt up

Housing costs up

Electricity costs up

Foreign ownership up

Corruption up

Once you may have been a national leader but now you look like just a National Party leader.

Once you attacked the nanny state of efficient lightbulbs but then presided over the most wide reaching mass surveillance state in our country’s history, passed the Skynet law, sacked elected councils and then refused elections.

You’re our first selfie PM, our first comedian PM - a derping, planking, rape-joking expert at getting us on late night American comedy shows.

At a time of growing inequality, rapid global change and systemic economic problems we got basically a chilled out entertainer.

On Election night 2011 you first thanked your pollster.

You are our most poll-driven PM ever, yet after all these years we still don’t know what you stand for bar the jokes and three line slogans.

Do you see more for New Zealand than just China’s dairy farm and America’s spy station?"

Sums things up well.

Still waiting on any factual refutation ...

I agree BB, an absolute ripper of a speech. Lays out a few home truths.

I hear it has been getting widely circulated around social media and the like but not a peep out of the MSM. I suspect there is an increasing number of people that are starting to see through Key and that this year might finally be the year his mask of invincibility starts to slip.

Actually Shagger one of the most inept speech the guy's made. Full of criticism of someone who has lead NZ infinitely better than most countries (which one would you have preferred to live in the past 8 years), but mostly, yet another speech coming from a Greens Party that has never offered one practical solution to the ills of the world

Grant, Im no cheer leader for the Greens but we better hope they have offered some practical solutions given Key has just committed $2.5b of our money to a rail project in Auckland that the Greens have been advocating for ages.

Caleb here's why speeches like Gareth Hughes matter;

http://www.stuff.co.nz/national/politics/opinion/76837125/can-john-key-…

http://www.stuff.co.nz/national/politics/76851206/us-official-john-key-…

This is the level of our media's scrutiny of Key.

You have to wake the electorate up to create the groundswell for change.

You are right in the sense that the opposition parties need to be able to articulate a coherent alternate vision and in that they have some work to do. However there has been some early signs with Labours tertiary education policy that we might be starting to see that happen. The TPPA also creates an interesting political faultline for which the govt appears to be getting much greater than anticipated pushback. It feels to me like we are at some sort of tipping point and Hughes speech brilliantly articulates the reasons why.

This Gareth Hughes ?

Im sorry David but that looks suspiciously like a diversionary tactic.

A video ad hominem in the wild ...

Quick, attack the messenger!

I agree. A young person finding his way in politics is all this is. but I guess some prefer the polished sound bites of most MPs where the media training has perfected their art of saying nothing.

.......shows how far he has come.

There is a lack or criticism alright, just not from a different point of view, like saying JK is doing it wrong and our purer version of the same, will be better.. For mine, change needs to happen across all systems. Capitalism needs to be broken down and rebuilt, there needs to be some form of constitution to limit the infiltration of corruption and greed. Socialism does not reduce what makes people poor and seems to only create dependence, things like Family, Charity, Education and Responsibility need to become more valuable than budget lolly scrambles. One thing for sure, change is in the air..

While I agree with your sentiments the problem is it is hard to get consensus as to what those sort of changes look like especially against the power of vested interests. The political landscape overseas suggest that people all over the world are grappling with those same thoughts and looking to force change through the ballot box. This whole Trump/ Sanders thing is phenomenal, the American voters are going rogue. I suspect we are seeing the first signs of that washing up on our shores with the strength of the anti TPPA stuff.

"It is not necessary to start stock-pilling food and building an underground bunker, but I do want you to think about how this might effect your purchasing decisions and your money machines....."

Can we do John Key/TPPA bashing another day?

:)

The tpp a may well become the rallying point representing all that is sick with this govt. I suspect you are getting the feedback on this site as main stream media are completely ignoring the anger. Take it as a compliment that people bother......we need to vent somehow!

Well, if it's on topic you want (OMG you're so unreasonable), the other week I had a term deposit mature, and with interest rates so crap, decided it'd be better invested in useful stuff that'll hold its utility value instead of being eroded away by inflation. New bed, because the old one was due replacing anyway, couple of pairs of good-quality walking shoes, wool coat, good-quality linens, couple of cases of wholesale olive oil soap from Greece, etc. If financial apocalypse happens, come to me for soap. I'll see you right.

I've been thinking the same thing. If money will lose its value, the stuff itself can't be eaten. So better to invest in some quality items, clothes, shoes, linens, tools (that's a biggie, get some spares). If you're a bit plush, get an acre or two, or three. Need some land to grow your crops. A pasture to graze your horse and milching cow.

A few trees for a wood supply for the burner.

get as self sufficient as you can

I know it's doomsday thinking, but there's nowt wrong with making sure your food supply is in your own hands, from pasture to plate.....

This whole subject reminded me of a book that I read at primary school in about 1982 which made a huge impression and has always stayed with me. Could remember whole plot, but not title or author. Anyway, google tells me that it's Noah's Castle by John Rowe Townsend. About a bloke who sees total meltdown of the economy coming, cashes up everything, buys big house out of town, constructs a secret cellar, and sets about hoarding supplies for the family, despite laws being passed forbidding hoarding. His obsession ends up alienating the family, who abandon him one by one to pitch in and share with the neighbours. One of the daughters steals a can of beans or something from the hoard for her boyfriend's family, who are starving, and he's so angry that she leaves for good.

A financial apocalypse does force one to stick to quality non-negotiable needs (i knew i could weave it in the comments somewhere this week lol)

No mention of big screen tv's, latest iphones or the ninja bullets from anyone is pleasing.....

This paper does a great job of dispelling common myths with regards to macro debts and deficits...

https://www.gmo.com/docs/default-source/research-and-commentary/strateg…

Myth 1: Governments are like households

Myth 2: Printing money to finance budget deficits is inflationary

Myth 3: Budget deficits/high debt lead to high interest rates

Myth 4: Budget deficits are unsustainable

Myth 5: Debt is a burden on future generations

I love that you have sourced and provided an alternative point of view. I've always told myself never to trust anyone wearing a Hawaiian shirt. But I promise to read this tonight for you :)

what makes my small brain hurt is: 1 persons debt is another persons asset.

How can the whole world be over indebted? It should be zero sum shouldnt it? Someone must of lent the money and have the corresponding asset.

Most lent money coming from the fed, or otherwise 'printed money' created out of thin air?

How does this add to my confusion about one persons debt is anothers asset?

Fed creates debt by lending, but also an asset for themselves in the loan ; net/sum ZERO.

Is it simple a case of relativity; The absolute size of each persons (countries) debt is irrelevant, its the relative size of compared to each other? And floated currency accounts and adjusts for a country being out of wack, over its head, more risky relative to others. (note how it would be impossible for ALL countries currency to plumet due to over indebted-ness!! Hightlights the relative aspect Im leaning towards). The closest thing to 'ALL currencies plumeting' would be seen in gold prices (and other hard assets such as wait for it... REAL ESTATE) being worth more in all currencies (as all currencies lose purchasing power, or supply of currency globally grows at a great rate, whereas gold or more to the point, land, grows little if at all, apart from those sand islands chinas been making).

People knock the fed printing press, which essentailly is a debt printing press, but I'm not so sure the likes of Bernanke who are students of the great depression are as clueless as some say. Its easier to fight inflation than it is deflation

debt can be created for a fraction of the amount saved its not 1 for 1 if it was we would not have the debt mountain and interest rates would be much higher.

as for gfc its more like GFC1 than was never fixed but instead papered over and kicked down the road

But $1 debt created and put on the books of the lender (based on security of a fraction saved as you put it) is still an asset to the person who lent the money, and a liability to the person taking the loan; this is 1 for 1, net effect ZERO.... apart from the fact that money has been created out of thin air, which is inflationary (money losing purchasing power) in nature. Where this money flows to first, then second, then third (think water filling a pool with odd shaped floor) determines how asset prices inflate in response to this. Real estate and stock market has been popular to start with, to a point (lowest point in floor or swimming pool), then yields (or P/E) gets too far out of wack, then next lowest point gets filled (another round of QE?).

Above focussing on debt created out of thin air... If someone has 100k and lends that 100k, 1 person gets 100k in debt and the other persons position is unchanged (100k asset in cash, moves to 100k asset in form of a loan) ;

So i guess what QE is doing is diluting debt that is 'genuine' (i.e 100k cash in bank that was then lent, or invested in company (lent to company for their use in return for dividend) with the 1:1 debt created out of thin air that is inflationary (adds to money supply)?

Does this just help the lender (person who had the 100k cash and lent it for a return) by making his loan safer or more likely to be paid back, but also hurts the lender by adding to inflation, so when it is paid back that 100k is going to buy him less gold/real estate than it would have?

Please google The Hidden secrets of Money...Please Bernanke is a academic fool...please google Ron Paul asking Bernanke is gold money...J.P.Morgans Quote...Only GOLD is money EVERYTHING else is CREDIT there in lies the problem refer Hidden Secrets of Money...Printing money is inflationary which is nothing more than theft by stealth...

http://www.marketwatch.com/story/is-kanye-west-53-million-in-debt-2016-…

We owe him a huge debt...to his credit.

Sorry Elizabeth, I get that you have gone to great lengths to do a fine summary of the economic threats that are looming. Dont they say cash is king in these scenarios?

However the things you outline are mere consequences of political policy making globally. Worrying about what asset class to be in is deck chairs on the titanic stuff. That is why although Gareth Hughes speech is off not topic because he is challenging the PM to front up with some actual solutions to confront the challenges of our time and that is a theme that is playing out globally with Sanders and Trump being the highest profile examples. Ultimately politicians created this mess, think abolishing glass stegal etc so I think our highest priority is to find some who have credible plan to reset the system and get us out of it.

I really would love to believe our little PM at the arse-end of the world might have the sway to fix a global economic meltdown.

Agree - Cash is king (provided you don't have it sitting in a bank teetering on the edge of insolvency and no deposit insurance). But how would you know......

Maybe under the mattress is looking good right now...

Re the PM, you misinterpret my point. I am not suggesting he alone has the power to influence global events, of course that is ridiculous. However the theme of the article is what to do to avoid the fallout from a collapse in global economic meltdown which is ambulance at the bottom of the cliff stuff. Its a result of politicians and central bankers (ultimately accountable to govts) who have completely screwed up and have done little else but kick the can down the road hoping the problems will go away by printing more money and perpetuating the status quo egged on by their multinational corporate sponsors.

I saw John Key just the other day at an elaborate signing ceremony for the TPPA signing just such a deal that will entrench status quo policies. However outside I saw the people rising up to challenge these orthodoxies. They realise these policies are ultimately failing and they are not alone as the voters in the US, UK, Canada, Greece, Spain etc etc all doing the same. GFC 2 is already upon us its avoiding GFC 3 that needs to be our focus and we can only do that through the ballot box.

Diversification is king, if you have anything to diversify and if you are not too late, because starting now would be a tad late.

However, I do not think that within this system of ours there really is a way to ensure personal prosperity, not even if you are educated, smart, dilligent. Anything material, any asset you have can easily be taken or broken by political mismanagement. Changing the political system e.g. towards much stronger elements of direct democracy must be very high on the agenda, even your personal one, if you want to have a stable life for yourself, your family and everyone else.

With a Govt Gtee that is only as good as Govt's ability to raise taxes or print enough money people trust (not) and if the proverbial hits the fan increased taxes and money are an impossible dream.

Apologies - Only just realised I posted that Gareth speech in wrong thread.

Back on point - yes would real estate not be classed as a first choice hard asset that would be preferred over shares, or placing your money in a zero or negative interest rate deposit account. Seems to me that say sub 3.5% mortgage rates and a Zero interest deposit rate would only make real estate an even more obvious choice?

It does. And that's why this is all so interesting this time around I reckon. Dare I say income to debt ratios? What else do they have?

PS: that speech was well written and delivered - i can see why you like it.

I have just bought a gross of baked beans and have sharpened the shovel to start digging the bunker

and you have your FAL sorted, an AK, 30 mags and 20,000 rounds? Or do you plan that the effects of the baked beans will keep people at bay?

In that chart above breaking down the $60 trillion of debt - the three major holders of that debt are USA, Japan and China - Japan now in total shitstorm, China heading that way and USA left holding the baby with the greatest exposure. Cannot see any way that debt could be repaid in a generation - perhaps would have been best to let everything to collapse during GFC1 cause GFC2 ain't gonna be pretty!

Certainly cannot see how higher interest rates mooted by Shambeel Equaab could be helpful at all.

http://i.stuff.co.nz/business/opinion-analysis/76843420/Kiwis-have-fail…

Listen to a RNZ interview last Friday about 9.15am when a leading UK economist explained that Deutsche Bank Germany's largest Bank had exposure to 20 Trillion Euros of derivatives (3 times the size of Germany's economy) so if 5% went bad Deutsche Bank would be wiped and perhaps Germany would be wiped if it all went bad. As the derivatives are fragmented amongst the buyers or sellers the collateral damage would be widespread and the uncertainty would likely cause a global run on Banks - then cash would really be King just like in Greece were withdrawals pre the restriction to 60 Euros a day (Allowance) for ATM withdrawals leading to a lot of cash under the mattress with the usual consequences. The 2008 GFC will probably be recorded in history as the opening act to the Tsunami of financial mayhem of 2016/17/18 or whenever the general public stop trusting Banks.and the death toll may be considerable amongst those deemed responsible.

good to know David Chaston is so unbiased that he needs to defend JK with unrelated attacks. Good journalism

Perhaps David could list his top 20 amazing things Jonkey & his govt have achieved for our nation? Anyone else got a list?

I haven't voted for JKs Nats but can think of 2 or 3 good things they've done. Can't think of any, offhand, that Helen Clark did.

they paid down debt and started the Cullen fund to forward fund baby boomers.

I wont mention the shockers though the list is looooong

Didn't Labour start the Cullen Fund and then the Nats stopped the top up for new members? John Key's main contribution has been to smooth out all the wrinkles in the Nats and stop them imploding. The list of the shockers is indeed looong.

If indeed there is a next GFC is Key and his team the best choice?

I can think of many really Bad things Clarke & the wicked witch Wilson did.

Getting back to Elizabeth Kerrs' column, Where does one put their savings 'store of value' to protect it from the possible impending destruction? Not shares or property, nor cash, bonds etc Gold? Nothing seems to be bullet proof yet you know that if this does happen, the superwealthy will survive. How come???

you got it gold and silver...the super wealthy will survive maybe...

everything else will lose value...gold vs barrel of oil is a good chart to watch...also the Baltic dry charts...

My issue with John Key and his government is that they're not working in the long-term interests of the country. He is focus-group oriented and will do exactly what his pollsters tell him marginal/switch voters want him to do.

Pension age? Kick the can down the road. Address the infrastructural risk of global warming? Ditto. Maintain a surplus? Massage the figures until they fit.

Then when it comes to the necessity of doing something, scream blue murder that "Labour's running a deficit, spendthrifts etc..."

I need a government that runs the country like a business with a longterm strategy that ensures continuity.

This one is anything but that.

I agree except the bit "like a business" I dont agree here exactly. A Govn should not run a country like a business, it needs to run a country to support businesses and its people. So to clarify a Govn should not aim to make a profit but support other entities to do so. An example would be electricity, it needs to be low cost, sure but also resilient ie a business can depend on it being there 24/365 which is important, this allows a business to function.

No mention of Lehmans, The ratings agencies, several global banks and the ineptness of most current economic theories

But also the write down on fossil fuel stocks because of global warming fears.

Marks for effort.

But trust me dear readers, its all your fault...God Bless....

Lehmans, ratings agencies, global banks..... agreed. They deserve a mention. One step at a time though - i have a word limit :)

Global Oil Prices Fell. On the face of it as long as it’s cheap at the pump you don’t care right? Wrong – you need to care about this.The countries that produce and sell the oil now don’t get as much income to pay their own expenses, causing them to have to cut back on how much they can buy from everyone else, so then those countries have income issues and have to cut their prices to export their products and everyone looses. The countries that buy the oil might be getting it cheaper but cheap oil cheapens their economy in the end so it’s a loose-loose situation really.

AHAHAHAHAHAHA! LMAO! - Are you trying to tell me that because Saudi Arabia, Nigeria, Venuzu..wharever and other dumps et el, are such big consumers of finished products that their cutting back on purchases will cause 1st world countries to drop their prices?!?!

AHAHAHAHAHAHAHA!

BTW - did you mean "lose - lose"?

lose - lose as the benefits all go to the oil consumer and we can't have that. Oil prices have to be high to justify all the green energy boondoggles. Even actual environmentalists, rather than the chardonnay ones, have had enough

http://www.telegraph.co.uk/news/earth/wildlife/12149242/2bn-wind-farm-f…

Ah, I see. I though the article was referring to the size of the barrel such that the oil didn't fit properly in it. Hence the use of the phrase "loose-loose" instead of "lose-lose"

a) It is the RSPB so it might actually be a subset of environmentalists only and the majority of them are actually on the other side of this argument, I guess we do not know. Sure we can see that there is concerns on animal/bird welfare and yes there needs to be a balance stuck or the problem solved and we move on.

b) Most electricity is not generated with oil. Hence its price doesnt matter too much as solar, wind, hydro and geo-thermal competes pre-dominantly with coal and nuclear and it seems it is winning on price now as that is what is being put in even at these low fossil fuel prices.

Fair enough. I should have used the term "energy" rather than oil. If renewables can stand on their own two feet go for it. There are just so many projects out there that are negligible benefit or in wind/corn ethanol/Drax etc. do more harm than good.

Yes indeed it would be nice to see a level playing field. However, depending on your view of what a Govn should be doing, part of my view is long term outlook and setting goals and laws to get there. In this case oil output will decline within a few years at most, plus growing climate change issues means pumping CO2 into the atmosphere is clearly getting a very bad idea.

The debt and governments of many oil producing countries need oil revenue to keep things ticking along.

The companies that buy cheap oil start undercutting each other to get a bigger market share thus cheapening their market too.

And yes - Lose Lose. Well spotted.

You do realize that the oil producing countries, all put together, are a fraction of the rest of the world economy? Their consumers going away is negligible compared to the benefit derived from low oil prices.

All of OPEC, put together, has a GDP of 3.5 trillion (nominal), which makes them 4.5% of the world economy of $75 trillion (nominal). Add Russia, at $1.2 trillion (nominal), and they're up to 6%.

Whereas, China, India, EU + US, are about 62% of the world economy. The US is a large exporter of oil, yes, but the energy industry is about 6% of the US economy.

Seriously, A != B.

Transportation is such a huge cost of the modern economy, it boggles my mind that you would treat it becoming lower as a negative.

I cannot let these errors go un noticed!

USA is an Oil producing country. So USA is lumped in with your para 1.

USA is a net importer of oil. So your para 3 is just not true.

To elaborate further, the US does export some 'petroleum products' but you are correct that it still imports a large amount of it's oil (approximately 7.2 million barrels per day).

Uh its exporting crude now.

I'm referring to net imports vs exports. It exports a small amount to refineries better suited for the blend but overall it remains a net importer by a considerable margin.

"It doesn’t matter if you’re a household, a business, a government or a bank."

Actually it does, but its extremely interesting you dont think so, which really sums up why I dont bother with your posts by and large, you dont do strategic. Anyway there is an interesting thread that a Govn always running a small deficit in effect makes a nation's economy grow better and longer. Note that however it seems it has to be small and contained ie 2% or so and that's it.

The *sigh* gives away that I do think it matters.....

Oh Steven, I know you really love my columns!! It's okay, we're all friends here. I wont tell anyone I promise. (I always look out for your comments too). *wink*

This is an excellent, thought-provoking summation of our present situation: comprehensive and concise but not too technical or clouded with esoteric statistics; it's elicited many thoughtful comments.

Rod Oram gets it.

http://www.stuff.co.nz/business/opinion-analysis/76821748/rod-oram-econ…

Rod Oram clearly DOES NOT get it.

'At times like this, central banks should be playing crucial roles in stimulating economies. They certainly tried during and after the GFC. A mere 0.5 per cent was the highest intervention rate the central banks of US, EU, the UK and Japan have used since 2009.'

See below.

I see that almost NOBODY understands the financial system and the energy and resources that underpin the financial system, and why collapse is inevitable.

A very brief summary of the root causes of present predicament:

1. Establishment of the Bank of England in 1694 on the basis of Fractional Reserve Banking, whereby reserves do not equal paper notes in circulation, yet interest is charged on money created out of thin air. Where does the money to pay the interest come from? (I'll answer that if you can't work it out.)

2. The shift from locally-sourced energy to overseas-sourced energy to run Britain's navy in the early 1900s (and subsequently almost everything else), leading to the need to control the Middle East, commencing with Persia (Iran). Britain managed to get out of the overseas oil trap temporarily via North Sea oil, but that peaked around 2000 and is in steep decline, putting Britain into a worse predicament than ever.

3. Establishment of the US Federal Reserve as a privately-owned money-printing institution in 1913 (rather than the government controlling the issuance of money and debt, as per Lincoln's Greenbacks).

4. Imposition of the US dollar as the global reserve currency following Bretton Woods 1944.

5. Decoupling of the US dollar from gold under Nixon in 1971, following France's demand to have its accumulated dollars redeemed in gold.

6. The peaking of US conventional oil extraction in 1971, and the subsequent shift from easy-to-extract oil to difficult-to-extract oil. Expansion of the consumer economy, leading to greater dependence on imported oil and the printing of money to pay for it (resulting in ever-increasing debt levels).

7. The closure of UK, US, European manufacturing and shift to low-wage Asian countries -especially China, creating a false boom in consumer nations based on manipulated currencies and importation of 'deflation'..

8. The repeal of Glass-Steagall under Clinton in 1999, allowing banks to operate more like casinos and create highly-leveraged derivatives which have no intrinsic value.

9. The peaking of global conventional oil extraction over 2005-2008, and the subsequent expansion of unconventional -tar sands, fracking, deep-water- (high-cost) extraction to hold things together.

10. The exposure of fraud in the US market over 2007 to 2009, leading to near collapse, and Paulson demanding TARP to prevent an immediate meltdown.

11. Kicking the can down the road for 6 years via expansion of government debt at historically low interest rates (ZIRP, now morphing into NIRP) whilst fighting oil wars and currencies wars to prevent immediate collapse.

12. Compounding the predicament has been the population overshoot from under 2 billion people to over 7 billion people resulting in greater demand for rapidly depleting resources (not just oil).

13. Underpinning all this madness has been an unusually benign climate period, which allowed hunter-gatherers to settle and become dependent on growing grains and subsequently to establish industrial civilisation. That benign climate period is rapidly coming to an end as a consequence of all the carbon dioxide that has been put into the atmosphere and oceans over the past 200 years or so, as a consequence of burning coal, oil and gas..

We will know by August this year whether we are in for super-fast environmental meltdown, or whether we have a few more years before planetary overheating eliminates all the ice in the Arctic region and heralds a period of super-fast Abrupt Climate Change and 'the end of everything'..

Not only is Arctic sea ice at a record low but it is currently melting when it would normally still be forming.

http://nsidc.org/arcticseaicenews/

One thing is certain; nobody in a position to do anything to prevent planetary meltdown will do anything to prevent it because the dominant meme is focused on maintaining (or even expanding) the systems that are causing meltdown. The same applies to the economy, of course.

Pity the next generation.

That ticks all my boxes.

Nice to see someone who has studied the subject , Glass Steagall is an unknown to the masses.

Must recommend " The 13 Bankers " and " The Money Masters "

Thought everybody knew by now what Clinton had done during his presidency. I mean, there's a good reason why Hillary is well loved by Wall Street...

.

Of course, the argument goes that the Act had been so undermined by loopholes since the 1960s, that it really was just pro forma, signing it away...it 'was pretty much ineffectual already, anyway".

.

Famous last words, eh.

The inevitable outcome will be that the one-trick-pony central banks will yet again do the only thing they have been doing for the past decade: print money, go yet more negative with interest rates etc. This will continue until the concept of arbitrarily printed paper money is so compromised that trust in the foundations of our financial and political system are eventually shattered. At that point in time a lot of people will suffer.

It was a terrible mistake not to let market forces decide the fate of bankrupt banks and countries in the previous GFC - and let them go bankrupt. It would have triggered a major disruption, but mid- to long-term for the good. Now we are in a position in which lousy economic management has been perpetuated so intensely that most of us think it is normal.

At the same time, NZ might still get away with its own incompetency, because it is so small that a few corrupt Chinese officials on the run may still safe our "economy" by hiding their loot here. Whether this is a good thing, I am not even sure. It would be better for NZ to stand on its own feet, for example by learning from a place like Switzerland which has a world-class education system, a direct democracy based political structure that puts the people first and no out of control welfare state that entrenches dependency and dole dynasties. Sadly, our society does not seem to have the ambition to live to its full potential. So, welcome GFC2.

The glaring take-out from that graph is by far the bulk of global indebtedness is Western-World

dp

Perspective, quite literally from the cradle of human civilization, where they have had the longest to develop effective government and for the inhabitants to prosper from free markets.

How bad is your government and how secure is your property as a store of wealth?

“I sincerely believe that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

― Thomas Jefferson

“Everyday is a bank account, and time is our currency. No one is rich, no one is poor, we've got 24 hours each.”

― Christopher Rice

A few of many famous banking quotes

Henry Ford

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

― Henry Ford

Terry Pratchett

“Do you understand what I'm saying?"

shouted Moist. "You can't just go around killing people!"

"Why Not? You Do." The golem lowered his arm.

"What?" snapped Moist. "I do not! Who told you that?"

"I Worked It Out. You Have Killed Two Point Three Three Eight People," said the golem calmly.

"I have never laid a finger on anyone in my life, Mr Pump. I may be–– all the things you know I am, but I am not a killer! I have never so much as drawn a sword!"

"No, You Have Not. But You Have Stolen, Embezzled, Defrauded And Swindled Without Discrimination, Mr Lipvig. You Have Ruined Businesses And Destroyed Jobs. When Banks Fail, It Is Seldom Bankers Who Starve. Your Actions Have Taken Money From Those Who Had Little Enough To Begin With. In A Myriad Small Ways You Have Hastened The Deaths Of Many. You Do Not Know Them. You Did Not See Them Bleed. But You Snatched Bread From Their Mouths And Tore Clothes From Their Backs. For Sport, Mr Lipvig. For Sport. For The Joy Of The Game.”

― Terry Pratchett, Going Postal

tags: banks, cruelty, death, justice, life, philosophy, sport, wisdom

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.