Content sourced from the World Gold Council*

The first half of 2018 proved quite eventful for financial markets. Stocks experienced a few pullbacks during the first quarter as geopolitical tensions rose, but have been generally trading upward since the start of Q2.

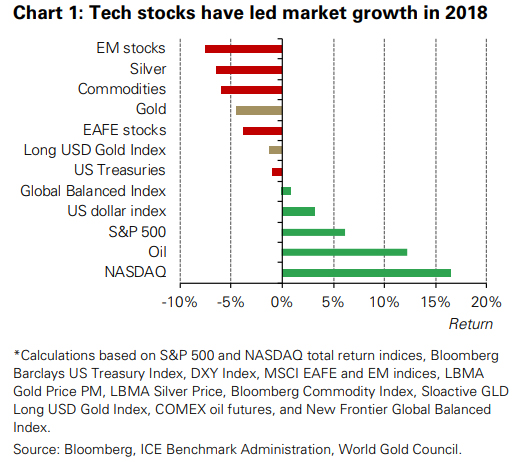

This was especially true in the US and Asia where tech stocks captured most of the growth (Chart 1). So far, investors seemed to have shrugged off the escalating trade war rhetoric between the US and many of its trading partners or, at least, discounted the effect it may have on long-term economic growth.

Gold has thus far moved in the opposite direction. Its price rose by more than 4% in the first few months of the year, only to finish in June down by the same amount. This downward trend has continued during July as gold dropped almost an additional percentage point. But while gold’s volatility spiked in February and April, it has been moving in a relatively low range since. Gold’s performance has been driven by a combination of factors. Three stand out:

• A strengthening US dollar

• Higher investor threshold for headline risk

• Soft physical gold demand.

At the same time, gold’s price momentum and investor positioning in derivatives markets has accelerated its descent. We believe, however, that there may be reasons to be more optimistic during the second half of the year.

Gold’s dual nature amidst mixed economic signals

Gold’s long-term returns are positively linked to economic growth but its short-term performance is more sensitive to risk and uncertainty (Focus 1). And gold's dual nature could benefit from key macroeconomic trends developing in the second half of the year. We see investors positioned for:

• positive but uneven global economic growth

• trade wars and their impact on currency

• rising inflation and an inverted yield curve.

In addition, gold’s recent pullback is supportive of consumer demand, as low prices tend to spur buying; at the same, it may provide attractive entry levels for investors.

Economic growth is accelerating albeit unevenly

Global growth has generally been increasing over the past couple of years. But this growth has not been consistent across regions. As we look forward, however, we see support for gold from key regions.

As China has transitioned from an investment-driven to a consumption-driven economic model, its growth rate has slowed slightly. However, as it becomes less dependent from foreign investment and solidifies its leading role in Asia, China’s economic expansion will likely be more robust. This confidence, combined with the size of the Chinese local market, is likely to prove positive for gold.

In India, the second half of the year is usually positive for gold as the harvest and wedding seasons during the autumn provide seasonal support for the market. In addition, the economic policies rolled out by the government to draw the informal, cash-based economy into the formal sector are starting to translate into stronger economic growth: India’s Q1 GDP growth rate was close to 7.7% – making it one of the fastest growing economies in the world.

The US economy has also been expanding, making consistent gains since mid-2016 – even if at a more modest pace than either India or China. With this expansion comes an increased demand for gold jewellery and we expect this pace to continue.

By contrast, the European market may remain soft, as there are signs that political turmoil and increased uncertainty regarding Brexit may slow the acceleration the eurozone experienced last year. 3 China's jewellery market – quietly improving, June 2018.

The US dollar's rise may not last forever

The dollar has strengthened over the past few months, making its most significant appreciation since the last quarter of 2016. It would be easy to apportion this trend to higher US interest rates, but rates have been increasing consistently since the end of 2016 – a period during which the US dollar generally depreciated. Instead, the dollar strength is due to a combination of two factors:

• continued easy monetary policy in other parts of the world

• a perception that the US may be better placed to benefit from trade wars, at least in the short term.

Interest rate differentials matter, and the strength of the US economy has allowed the Federal Reserve to continue its path to policy normalization at a fairly consistent pace: raising its Fed funds rate mostly every other meeting since December 2016.

In addition, in the face of ongoing rhetoric over trade agreements, the market seems to have taken the view that the US will likely benefit from renegotiations.

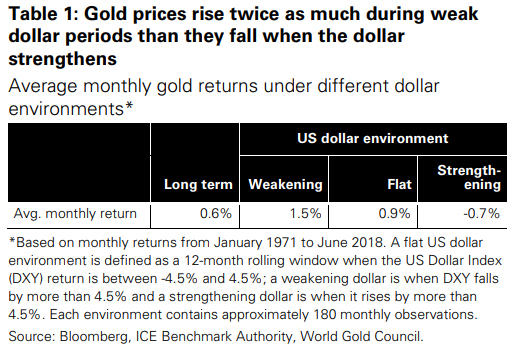

Even if this turns out to be the case, many economists believe that an increase in tariffs will eventually have a negative impact on economic growth. And while this could decelerate gold consumer demand somewhat, its effect may be lessened by a weakening in the US dollar.4 Historically, a weak dollar tends to provide a stronger boost to gold’s performance than the drag created by a strong dollar (Table 1).

Rising inflation and an inverted yield curve

Inflation has been slowly but surely increasing over the past years and is now close to 2% in Europe and China, 2.9% in the US, and 5% in India, to name a few examples.

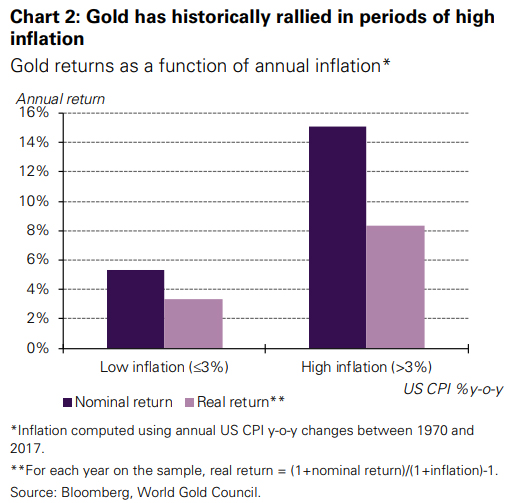

Looking forward, the expansion of protectionist economic policies has significantly increased the risk that inflation will accelerate further. And companies facing higher tariffs will likely pass the bill to consumers. Historically, investors have used gold as an inflation hedge, with the result that its price has increased substantially when inflation rises above 3% (Chart 2).

The combination of high inflation and a deceleration of economic growth can create a complicated scenario for central banks. This is especially true for the Fed, as its mandate includes price stability, full employment and moderate long-term interest rates.

In the face of continuing stock price rises, US bond markets seem to be placing greater probability on higher inflation and lower growth. On the one hand, TIPS and TIPS breakevens (a proxy for inflation) have continued to rise, but the nominal yield curve has flattened significantly and is close to becoming inverted. An inverted yield curve has been shown to be a precursor to recessions in the US. And while it’s impossible to time the market, investors have generally benefitted from holding gold during periods of economic deceleration.

Momentum may be turning for gold

We believe that the confluence of key trends, as highlighted for the second half of 2018, could be supportive of gold demand.

In addition, gold’s recent pullback will likely support consumer demand as lower prices have historically increased jewellery buying. For investors, gold's current price range may offer an attractive entry level, especially since net longs5 linked to COMEX gold futures are at their lowest level since mid-2017. And money manager net longs, a subset of the broader metric, are close to zero – a level not seen since 2015 when gold hit a multi-year low. Historically, such a scenario has coincided with a rebound in the price of gold, as even a small catalyst for investment demand may caught speculative investors with a large exposure to short positions.

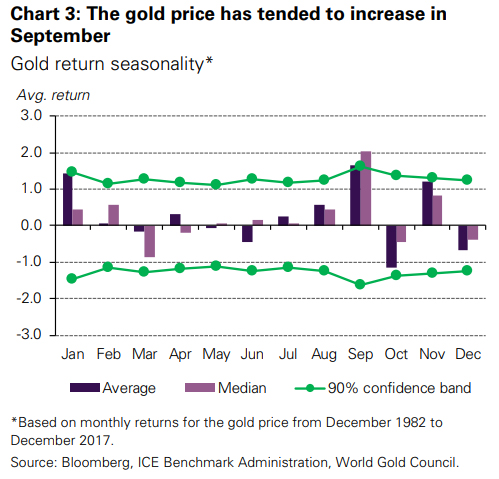

Finally, while the summer period tends to be a quiet period for gold buying and trading – as seen by softer seasonal demand, lower trading volumes and sideways price movement – the gold price has tended to increase in September as consumers prepare for a traditional buying period and investors rebalance their portfolios before the end of the year (Chart 3).

This article is a re-post from here. The original article also has detailed Notes..

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.