The OECD has noted the lack of success thus far of the KiwiBuild initiative and is urging the Government to focus more on low-income renters.

As part of its latest survey of New Zealand, the OECD has looked at the housing affordabilty issue here.

Andrew Barker, New Zealand Desk, OECD Economics Department, says the government has taken a more active role in the delivery of new housing supply through KiwiBuild. But...

"Despite taking on considerable risk through underwriting or purchasing new homes, KiwiBuild is yet to deliver a substantial increase in affordable housing."

The Government is currently working on a "reset" of the Kiwibuild policy, which it has now been talking about since January.

"The reset currently underway is a good opportunity to re-focus the programme towards mitigating risks that developers are not well placed to manage, such as aggregating fragmented land holdings," Barker says.

"Better targeting of government programmes (including KiwiBuild) through focussing more on low-income renters would enhance overall well-being."

Barker says social housing supply is low by international comparison and there are poor outcomes for at-risk groups, including overcrowding, low quality housing and high homelessness.

"Further expansion of social housing in areas where there are shortages has the potential to deliver improvements across a number of well-being dimensions, including health, education and life satisfaction."

While the Government has been tightlipped about what the seemingly much-delayed "reset" will entail, Housing and Urban Development Phil Twyford has indeed hinted that low income renters might be more of a target.

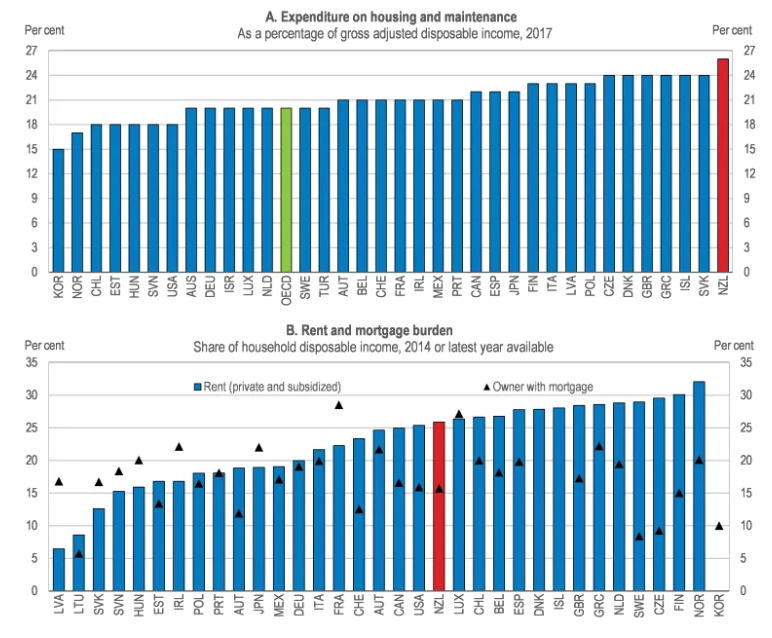

The OECD's Barker says over the past two decades, New Zealand has experienced one of the largest house price increases among OECD countries, pushing up housing expenditure as a share of income to very high levels.

"Affordability for first-time buyers and renters has suffered, particularly in Auckland.

"This is a problem for well-being as it reduces household finances available for other uses, can harm health through various forms of deprivation such as poor nutrition, and adversely affects labour market inclusion. There are also negative distributional consequences, as increasing property prices benefit owners at the expense of renters."

Barker says "weak supply responsiveness" in the face of strong housing demand has been responsible for the escalation in prices.

"Rapid population growth due to net inward migration has combined with record-low interest rates to push up demand.

"Restrictive and complex land-use planning, infrastructure shortages and insufficient growth in construction-sector capacity has impeded new housing. The result has been persistent growth in the number of people per dwelling in Auckland, and in the rest of the country too over the past five years."

Solutions should therefore focus on removing barriers to new housing supply.

"The government has taken a number of promising steps through the establishment of an urban development authority and the Urban Growth Agenda, further implementation of which will be key to achieving its ambitious goals. Strict regulatory containment policies should be replaced with rules that facilitate densification, while infrastructure funding and financing tools available to local governments need to be expanded," Barker says.

The OECD has also made a number of recommendations on NZ's migration policies. These include:

• Require employers to be accredited before they can recruit migrant labour.

• Revise job checks to ensure that migrant labour is only recruited where there are genuine shortages.

• Align the immigration, education and welfare systems to encourage training and employment of New Zealanders.

• Make it easier for migrants on employer-assisted temporary work visas to modify their visa so that they can more easily change their employer.

• Complement Regional Skills Matching Programmes by mentoring and bridge programmes.

52 Comments

"Build an economy that lifts the incomes of all New Zealanders" much, much easier said than done. How? what will you change? increase income tax rate for the rich? For every 1% you add to the top income tax rate of anyone who earns more than $150k a year (lets call them super rich) you can get $241m more in tax revenue (assuming that increasing tax rate will have no impact on taxable income of these rich people, which is a huge assumption). Based on IRD information, 1.91m people earned less than $32k in 2016. If we distribute all the additional tax from the super rich to this group, for every 1% of additional income tax, each low income person will get $126 a year. Even if we increase the super rick tax rate to 60% (an increase of 27%), the low income people will only get $3,400 a year. That is very unlikely to be a game changer.

in 2016, total personal income tax declared was $158,227b by 3.7m taxpayers, If this income was to be distributed equally between all taxpayers, every person would have got $43k a year. Not too bad. All we need to achieve this is to tax everyone's income over $43K at 100% and pay it to everyone else.

@ believer. Tax is the only tool some can imagine. Pity. Here is a non tax idea. Change the thought process we hear all the time which is more or less. "to increase the economy we have to keep wages down" leads to promotion of immigration with two results. Low incomes. Housing shortage.

Yes. Higher wages would mean some businesses would cease. Not a bad thing.

Would like to see city's get involved. I outline a way to fund and build social homes here, in a way that would moderate the house price cycle: https://conorhillformayor.wordpress.com/2019/04/26/build-some-god-damn-…

Okay. Fair. But also very different.

For one, tax is a lot more complicated than "well because women pay 15% on nappies, the arbitrary land profit tax must be at least equal to that."

Second, how do you fund social housing when there is no land profit?

Does social housing cease to be an issue then? Or, perhaps do we still need social housing even when land prices are declining? I'm inclined to think the latter.

My point being, there's nothing wrong with wanting to be the next naive Chloe. However, there is something very wrong with naive policy.

Millennial men buy nappies too bro! :) You'll love that. Well, most of the best taxes are simple actually. Broad base low rate is generally the favoured approach of mandarins isn't it? That's what everybody on the right of politics would tell us. I mean GST is a very straight forward tax and John Key loved that one. Pretending things are complex is more a distractionary ruse.

As to the rate, taxing capital gain at a rate around our lowest taxes seems fair, and would not bankrupt anybody. I'd say it's probably on the low side to be honest. There is no good reason the first dollar you earn and everything you buy should be taxed higher than capital gains. That's just status quo bias.

If Wellington city land values are falling, it'll probably be because housing supply has outstripped demand, ala Sydney or Melbourne right now. In that case yeah we might not need additional social housing (additional being the vital point). If it's the next GFC, all bets are off, and I hope we have a government who responds in a logical fashion.

Nothing naive about the policy. It is simple, I'll give you that, but that's a feature not a bug.

Tax on assets and tax on consumption are fundamentally different things. An equitable rate of taxation is a rate consistent with our marginal tax rate.

Having a simple flat rate lower than that incentivisrs capital allocation to land speculation and away from productive enterprise.

I dont think a supply induced price response means that suddenly social housing issues are resolved. Supply induced price reductions in Sydney and Melbourne haven't meant everyone now has a house.

It's not that there's a lack of housing in cities like Auckland, it's the lack of "Affordable Housing" yes we all know that. Yet we have more than 33,000 Auckland dwellings officially classified as empty, based off the 2013 census (Wouldn't be surprised if that figure was double now). How to fund Social Housing and Affordable Housing > Target those who caused this mess in the first place, tax property speculators with empty homes.

So there's one really really simple way to address the housing shortage especially in large city areas and that will help provide revenue for housing development. The way you do that is to introduce a "Empty Homes Tax" and target inner city areas, AKL would be the best place to start, that revenue can be used to build new homes and it may help to persuade to rent out or sell on if they want to avoid the this tax. Empty homes taxes have already proved successful in other countries going through the same issues that we've faced. Take Canada's Vancouver for an example, In their first year of the empty home’s tax they generated revenue of close to $38-million, eight million more than they originally expected to collect.

Well remember that the height of the property market was around mid 2016 and continued on until late 2017, most of which was generated by overseas speculative investors and there was nothing to stop them from buying up existing housing stock in our main cities. Ironically it was Mr Key that largely stopped local Kiwi/resident Landlords from buying in Auckland by imposing big deposit restraints on them in late 2015. Hence why Hamilton, Queenstown and Tauranga suddenly became popular investment areas. Also overseas Investors tend to leave their properties empty which is why I think we're going to see very interesting results from the 2018 census.

According to Stats NZ:

In 1998 we had a population of 3,815,000 and 1,440,000 private dwellings (377 dwellings per 1000 people)

In 2018 we had a population of 4,758,000 and 1,885,000 private dwellings (396 dwellings per 1000 people)

By those numbers, there are a surplus of 85,000 private dwellings in New Zealand. Take out Air BNB (there were 19,000 listings nationally in 2017 >Link< so at worst if a property on average receives 2 listings a year that's < 10k properties) and you're still left with an extra 75,000 properties somewhere?

I'd include those properties listed from Air BNB, since they'd be unlikely to be rented out longer than six months of the year. Which is the restrain and classification placed on empty homes with those countries with existing "Empty Homes Tax", otherwise a lot of Overseas Investors would be using Air BNB as a tax dodge vehicle.

I know that the Canadians are closing the loopholes within their empty homes tax system and so far it's created a lot of revenue for them even in their first year. That revenue could be used for new affordable homes, rather than making us the resident tax payers fork out for them.

From Tony Alexander BNZ

The government, having failed to build affordable housing with KiwiBuild, is looking at contracting

large construction companies to build high rise apartments for ownership presumably by institutions,

with those apartments to be used only for rental purposes. Would an increased supply of rental

properties place downward pressure on rents? Yes.

Would lower than otherwise rents help suppress rises in house prices? Yes.

HI Colin - source?

I'm a little skeptical about 'build to rent'. Firstly, I struggle to take anything this government says on housing seriously.

Secondly, I'm skeptical on the extent to which the private sector will get into this. It's a niche area, and I'm not convinced it's scaleable.

It's still subject to the whims of the market and financing.

I'd much prefer that the government stops mucking around with private sector partnerships (like this and KB), and rather just gets on with building housing itself.

The OECD has a cruel sense of humour, they know our government (both sides of the house) have failed to construct policy with any impact. The only way we are likely to succeed is looking outside of New Zealand for advice and following the exact instructions we are given.

Surely it's more or less as simple as those that hold the power to do those things recommended by the OECD, to create affordable housing, are also those who benefit the most by not doing it. And then have their assets rise in value. You don't really need some complex explanation of why it's gotten this way. So if anything changes in this regard, it won't be much.

Hey come on now. 83 homes built. 378 under construction. In one year. That's a decent effort. The problem arises when you say silly things like 'We will build 1000 homes in the first year', then you say 'Actually 300', then you say 'We never had specific targets', then you say 'one year is an artificial deadline', oh and you say this when you're the elected government of a sovereign nation which campaigned on delivering affordable houses to your country. Yea, then it looks incompetent.

I do agree however that 1 or even 2 years is a stupid deadline, they should have been more careful with their promises.

3 years should be enough time to have at least started building 10,000 new houses (not ones that would have been started anyway). So by election time we should be able to vote on the success or failure of Kiwibuild. At the moment we are really only commenting on some over enthusiastic promises (I'm sure they aren't the first politicians to do that) rather than a policy failure.

Not entirely, they got elected as National were doing a great job building property bubbles and allowing our waterways to be polluted by cattle farmers. Then they stabbed Winston Peters in the front, back and middle when they thought they would get an absolute majority themselves.

trying to destroy WP was the biggest mistake they made, then to invite him over for tea and cake to discuss joining up, were they kidding.

that's what cost them the election

and national still have not learned in MMP you need partners

as for kiwibuild what a flop just scrap it.

start again and go back to the past build whole subdivisions like they did in the fifties

House prices peaked before the 2017 election. And house builds under National went from ~10000/year inherited from Labour after they had scared off all builders to Aus to ~30000 a year, enough to meet population growth. It takes time to grow bricks-and-mortar industry - as Coalition have discovered with their kiwibuild fiasco. There is no evidence that National 'stabbed Winston in front, back and middle' other than Winston 'all mouth no trousers' Peters' bluster. No promised prosecution. He is reviled by large majority of kiwis so could just as easily have been a civil servant or Labour apparatchik sick of his decades of bullshit and exploitation of low-information elderly voters and eager to see the back of him. He is possibly even Machiavellian enough to have done it himself to garner some sympathy and media attention.

"There is no evidence that National 'stabbed Winston in front, back and middle' "

Glitzy might be referring to when Peters was exposed double dipping the pension declaring he did not have a partner when he did. He claimed that was Paula Bennett who exposed him .... shame on her!

Well this is the sort of statistic you get when you self servingly elect successive governments that encourage you to be self serving. Of course that only works on the assumption there isn't a bigger fish thats more self serving than you. Someone has to lose under that system and in the case of housing the Key govt had some very big fish waiting in the shadows to buy all our housing stock from overseas and thanks to Lvr's many kiwis lost their ability to progress up the property ladder. I think that Knighthood should be stripped!

I repeat, ad nauseam: there is a shortage of good quality rented housing for families in particular.

The government knew this when elected.

Kiwibuild is nice shiny policy for FHB in Auckland and its failed. Too expensive. Not a good look for the Labour Party, after all their bleating b4 the election.

Homeless in Auckland: pretty quiet on that one now are they not?

"Units to go" and others waiting to make houses and getting b all incentive from government.

Builders are building $800k plus 4 bed places that families in bottom two thirds of income distribution cannot afford. So, there is a shortage of 3 beds at $700k or under.

Reality I am afraid is that on any major policy requiring implementation via Agencies, this government is too damn slow. Others were same and reason is quango-isation of the State. Arms length non-responsible organisations accountable to none it seems. Nightly reporting that Labour cannot get budgets spent and and also that Agencies of all kinds are not doing job: work and income; Prisons; Police; INZ; Stats NZ; treasury: Highways and RTNZ. One sorry tale after another. Ring up about something and its pass the parcel "not us gov"

I would say Labour are incompetent trying to fix the mess we find ourselves in, but I find the previous government fully competent of increasing house prices into the stratosphere where no average kiwi can afford a property unless they get themselves into a lifetime of debt. John Key knew what he was doing bringing in foreign buyers and ramping up immigration so he could conveniently flick off his Parnell property for 20 mill.

Well done that man, insider trading at its finest. Greed is good. Good for Gecko and Key anyway.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.