The average asking price of properties listed for sale on property website Realestate.co.nz has declined for two consecutive months, providing further evidence the housing market is cooling.

The average asking price of all the residential properties listed for sale on Realestate.co.nz in May was $841,193, down by $22,203 from the March average of $863,396.

It was the second month in a row that the national average asking price on the website has declined.

In Auckland, the country's largest property market by a substantial margin, the average asking price also declined for the second month in a row, from $1,132,716 in March to $1,105,635 in May. That's a decline of $27,081 over two months.

Other regions where the average asking price was lower in May than it was in March were Northland, Coromandel, Waikato, Bay of Plenty, Hawke's Bay, Central North Island, Wairarapa, Marlborough, Canterbury and Southland (see the table below for the full regional trends).

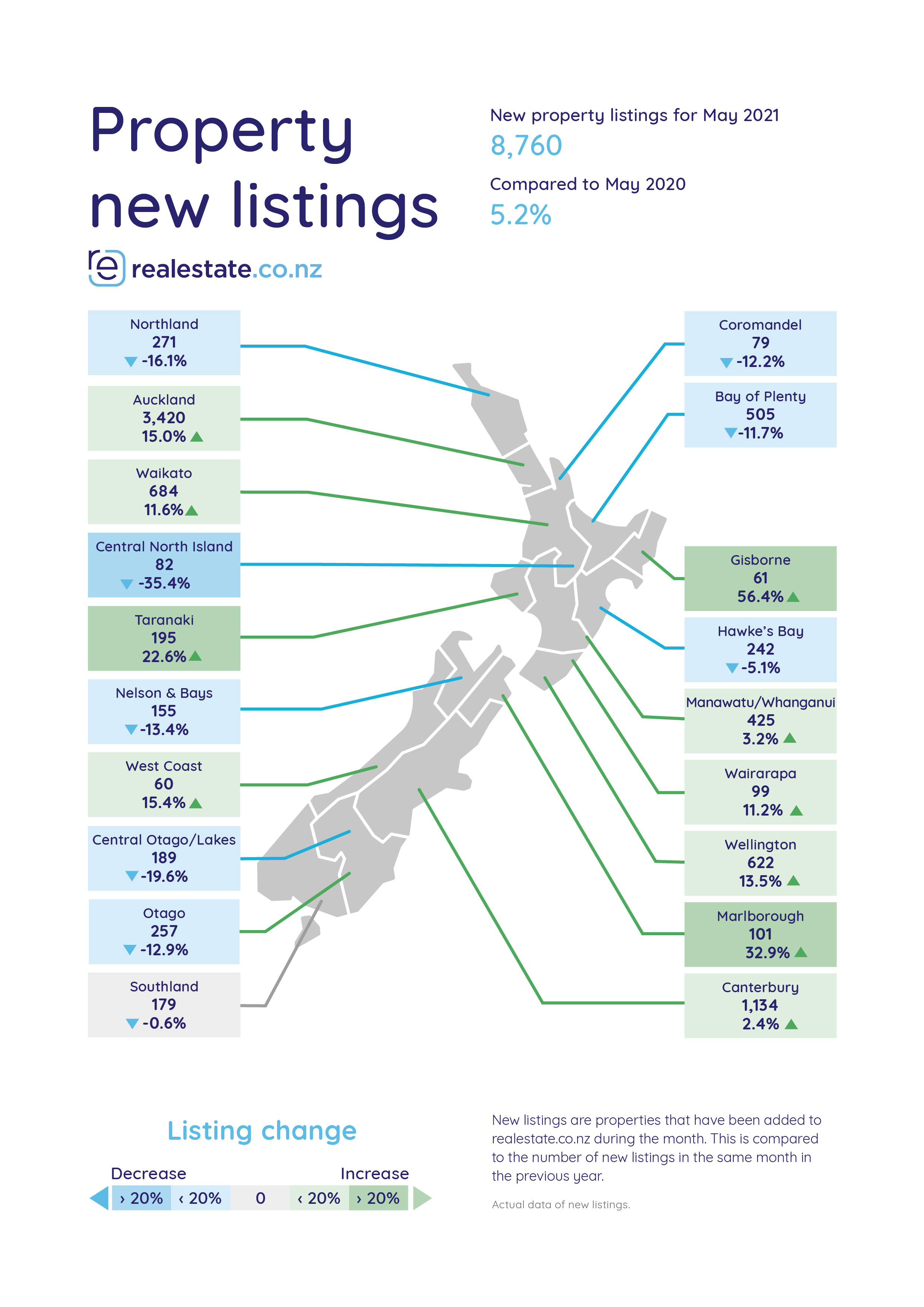

The number of new listings received by the website has also declined for two straight months, from 11,322 in March to 8760 in May. And the total number of properties available for sale on the site declined from 19,437 to 14,883 over the same period.

Note: The prices quoted in this article are the non-seasonally adjusted averages which means they may vary from seasonally adjusted prices quoted elsewhere.

The comment stream on this story is now closed.

67 Comments

Is realestate.co.nz privvy to reserve/vendor expectations at auction before listing on their website? Or is this based off of the small number of properties being sold for an asking price? Genuine question

You can search and filter on realestate.co.nz by Auction listings only, between a certain price range, and sort the results by price ascending/descending. In order to do this they must have some information about the price expected at auction.

I think with trademe the agency puts down a number for search purposes even if hidden (auction). They would usually put somewhere in the appraisal range... or lower to generate more interest

Kinda... The problem is, that price range can be set up so in order to attract more attention, to fill up open homes and auctions with 'dummies'. A certain B&T agent in my area loves doing this... Houses with CV over 1.5 million show up in searches up to 1.2 million.

Exactly

The Canterbury deluge is about to hit Auckland and other overpriced cities hard with an ensuing flood of properties hitting the market like a torrent.... sarc

This data likely to be better reflecting Government's announcements (and on set of winter) than yesterday's delayed CoreLogic's data. Seems that vendors may becoming more conservative in their expectations.

Sale prices - rather than asking prices - are a better reflection of the market. The REINZ data out later this month which will include the first significant number of sales agreed to after Government announcement will start to show the impact of those announcements.

At this stage auction data (numbers and success rates) tend to suggest a definite cooling of the market but seemingly possibly some but no significant correction/fall.

It's interesting isnt it the difference between the house price indexes. I was looking at the corelogic data of 895K for lower hut yesterday - thinking having watched the prices for a couple of months that seems artificially high vs what i was seeing selling. I looked at Trade me and with 210 houses on the market - I found the median price listed was just $799 000 (100K difference) - just 69 houses (35%) have a higher price than 900K .

The problem with averages is that you can sell 9 houses for 1 million and then sell one house for $2 Million in an area and the average house price jumps to $1.1M - even though 90% of the houses sold for less than that.

You'll also notice that there's less listings as well. Wellington city overall is now below 400 listings, which is the lowest it's been for a while.

That's why the median is the way to go

Actually a Trim Mean could be a better way to measure changes in property values. Calculate the mean excluding lowest 5% of sales/listing prices and excluding highest 5% of sales/listing prices. Or calculate a mean excluding any value that is +/- 2 standard deviations from the mean.

However reading RNZ this morning, "Average house price tops $1 million in Wellington". Property prices in Wellington increased a further 3.1% in May. That's roughly $1000 a day, after years of rapid increases.

Even if asking prices are dropping and monthly increases are slowing, actual prices are still going up, up, up.

I'll not be changing my plans to get out of here just yet.

Unless there are compelling personal/family reasons, young people in middle income professions would be well advised to consider Brisbane, Perth, Adelaide or even Melbourne.

Far more opportunity to forge a better life.

Totally agree. Especially if one can secure remote work.

The usual suspects blather on on this website about destiny being in your own hands blah blah. But many people are not business minded, nor want to be.

Lots of people still work in middle income roles such as teaching, healthcare, care etc. Many love their work, and we need these people working these critical roles. Unfortunately, this country doesn't act as if we need these people. It effectively treats them with disdain.

My cousin has just left Auckland for a teaching role in Adelaide. His salary isn't much different but the cost of living is much lower. He will probably still work 50 hours plus per week, but his wife will only need to work part time rather than full time, a saner work life balance and more time for the kids. The same applies in Perth and Brisbane, and to a lesser extent Melbourne.

You probably aren't any better off in Sydney than Auckland, but some will still go due to the amazing appeal of that city.

I will be surprised if there isn't a mass exodus, and then we will truly develop a crisis in staffing for education, healthcare and care roles.

Watch this space, and don't say it hasn't been coming.

More "wealth effect" victims. So many thrown under the bus so the few can feel wealthy. How is this even happening under a Labour government? I never thought I would see the day. Shame on you Jacinda Ardern!

https://www.newshub.co.nz/home/new-zealand/2021/06/nearly-one-in-three-…

I won't ever vote for Labour again (note I vote Green last election).

Btw, different issue but still talks to government incompetence, what is happening with the vaccination roll out? My 81 year old father was supposed to receive it early May, now he's told it's July...useless

My wife was invited to get her first dose last Friday. I went along as well. Yesterday, I got my own invite and had to ring to say I’d had my first jab. Both well under 65 and no health issues. Meanwhile my mother can’t get a jab. She’s 80.

I am 79 with various health issues. Cant get a respose to a query on when I could get vaccinated

Depends on where you are at. On the day I was given the jab, there were walk-ins being done it over 65. Centre at 105 Leonard in Auckland. Get there early and be pushy.

So if a property goes to auction, how does realestate.co.nz know the exact asking price? This is the majority of Auckland property...

My understanding is when you list on the site you normally put in an approximate price for the property. Some will list using the current house valuation, others may use a recent house price (ie what a similar house in the same suburb sold for in the last 4-6 weeks) a few dubious real estate agents use the RV/ CV (which would be pointless at the moment) Both realestate.com.au and trademe index then take the average price of those listings. It is just a listing price its not an indication that the house you want will go for that price, however REINZ price index and realestate.com.au listing prices do seem to be closely aligned each month.

I have seen many house's estimates spike just when they go on sale, this makes the data totally useless.

Asking prices are not sale prices.

However, REINZ does know the differential but does not publicise it much.

Investor inhibition since 23.3.21 probably driving the differential lower somewhat.

Sales and prices not growing as they were pre January

The curve is subsiding from its peak and will continue to do so over winter.

Strange how this coming winter is seen by some as "normal" decline but last years entirely atypical and bizarre booming winter (compared to normal) was not seen as atypical.

Listings on RE nZ down over 20% in 2m.

Higher prices (inflation) will now be eroding household budgets and impacting credit assessments of mortgage calculators re disposable income.

The cork (the economy) has indeed rebounded but remember that GDP has been falling or flat for 6m and there are v few tourists. Revised GDP by time we get to Sept, I suspect, will show things not as rosy as Treasury forecast.

Good news. The mania is slowing (or in reverse depending on the metric used).

I've got this theory that half the problem is the fact we are are stuck in country, so those marginal buyers with surplus income (asset rich 50+) are spending all that holiday planning time/money on house activity. So once the borders open people in that category will have other things to focus on rather than property.

I also don't see immigration effecting this in the future. Not many people are going to move to nz now because the cost of living is better here than at home. We are now well out in front of most the developed world in this measure.

Difficult to judge state of sale prices v asking price because 45% of Auckland sales being made at auction and hence no sale price listed. Could look at what CV was relative to sale price, on average, but this too is not a commonly referred to metric. Could then use that to see how over-enthusiastic buyers were.

When REINZ does release figs, bear in mind that sales last May were probably 25% of normal, so this years' need to be compared to average of 2016-19 really, for May.

Homes.co.nz just updated their house price estimates yesterday and the upward trend continues. They also appear to have narrowed the max/min values as well to a pretty narrow band.

Homes.con.nz

The narrowing of the min-max range just means there was a highly comparable sale to the property you are looking at, they go up and down over time, ours is currently -6.6% to +7.5% on homes, it has been as small as +/- 2.5% before.

Coromandel down 10.8% in 2 months, maybe just a blip but holiday regions are often an early indicator of a downturn, owners are willing to let go of their baches not their main place of residence. New listings are still very low though, they will have to go up to confirm a downtrend in prices.

You buying Yvil?

Just sold my bach in the Coromandel, settling in 2 weeks. Sad to part with it though.

Looking to buy? You back property on here big time, so interested to know if you are walking the walk.

After all, you can't lose with property, right?

Classic spruiker.

Yes I'm looking to buy in Auckland, not easy there's little stock.

About your comment "you can't lose with property, right?", yes I back my previous comments, that if you want to buy a house to live in, "now" is always the best time to buy. That doesn't mean house prices can never go down in value but the thing is, nobody knows when they go down in value and 90% of the time, they go up rather than down. Also by buying "now" rather than later, you start repaying your mortgage sooner and you will therefore be mortgage free earlier.

Cool. Owner occupied house I assume.

How about investment properties? You sound like a wealthy man, so given your great confidence in housing why not buy an investment property or two?

Yes I'm looking for a house to buy for myself. About the investment properties you mention, I have been investing in both commercial and residential real estate over the last 25 years, that's what gives me the confidence to say, RE is generally a very good investment.

Cool. I bet the next 25 are nothing like the last 25.

Yes, "a blip" XD

Still not a good sign. I sold my house in May last year for $730,000, well over predictions. Looking at homes.co.nz today the middle of the predicted range for the same house was $955k. $250k increase in 1 year for a median 3 bedroom house?! Even if sale prices dropped $150k the new owners have a paper gain of $100k in a year. That's still bonza for them

A house in Christchurch sold in May 2019 for $661k. It sold again last week for $982k. No changes to the property were made. Thats a 50% gain in 2 years.

What next... 40 year mortgages, then 50, then perhaps legalise polygamy? All of the old kiwi morals are going out the window to keep this ponzi charade going. The whole system is corrupt. The youth have been betrayed.

It's a clusterf%$k of the most epic proportions, Groat.

Does anyone have some facts on the average loan term in the 1970s - 1980s?

I see in the below article Bernard Hickey assumes a 33% deposit on a 15 year mortgage for 1975. Further down the article he writes:

We assume a 20% deposit and a 25 year home loan, which is now the norm.

Kinda makes a mockery of comparing loan affordability between periods if all we've done is stretch out the loan term and dropped the interest rates....

https://www.interest.co.nz/news/44330/opinion-why-golden-oldies-are-wro…

Pretty sure the mortgage Mum got to buy the state house back in '82 was a 30year mortgage, with 9 years of below market mortgage rates, have the paperwork at home somewhere.

nzdan and Pragmatist

Common feature in the late 1970s early eighties was BOTH a first and second mortgage.

First mortgage commonly 25 to 30 years and second mortgage 10 to 15 years.

Read a RBNZ article recently: deposit compared to number of years earnings required is now far higher, but although the amount borrowed in the 1970s and 1980s was lower, the higher interest rates (although variable) meant that the percentage of average wage to meet mortgage repayments is reasonably similar.

Currently saving a deposit is the bigger hurdle for many FHB at the present level of interest rates.

A common feature of the early 80s was also Housing Corp Mortgages, and only a 10% or even 5% in some cases deposit from cashing up your child benefit. Effectively no saving required, and a subsidised mortgage.

Isn't it funny how despite high term deposit rates, FHB still had to take out second mortgages. Could they not save a little harder? Probably too busy pissing their money away. Fast forward to today, they're often the first to claim the younger generations are frivolous.

It was probably more due to FOMO and wanting to buy ASAP before prices went up further.

Also there were far more woman not working in the 80's and earlier. My parents were telling me that they only took the husbands income into consideration, and not the wifes !

Yes, a closer to truth metric might be the % of total wages over a 20 year loan paid out in interest and capital repayments.

As prices have tripled and wages have not, things have become much more unaffordable in those terms

Except interest rates have been decapitated, you can now get a <2% loan. a 2x income mortgage at 18% was 36% of your income to service, for the same servicing cost at 2.2% interest rate it now takes a 7x income mortgage on a 25yr term. The deposit is the killer now.

From memory longest term mortgage available commercial lenders was 20 years....there was a 24 year mortgage available from state lender IIRC (mid eighties)

Actually, if you look at the interest.co.nz affordability reports, its even worse, they are now using a 30 year term.

“A butterfly can flutter its wings over a flower in China and cause a hurricane in the Caribbean.”

Now apply the butterfly effect to the NZ bubble so you're emotionally and mentally prepared for potential outcomes beyond what they tell you through Granny Herald.

Looks like Realestate .co should have a serious talk to Barfoot's who racked up another great month in May not to mention another massive increase in prices by 2.07% to $1.07M. So much for the banning of foreign buyers, and punishing speculators and investors. The pointy heads are targeting the wrong people. It's the Mums and Dads selling their own homes who are the biggest speculators of the lot.

https://www.nzherald.co.nz/business/barfoot-thompson-data-auckland-hous…

Weird how such an honest profession has so many contradicting stories?

Interesting how the NZ herald didn't publish other stories showing the data with falling prices in April....

Well, Mums and Dads are buying and selling in the market. If prices were $10 million or $100 million or $1 billion it would make little difference to them (except for upgrading) as they're effectively trading houses. If home owners were immortal then we could continue to have record months forever.

Except at some point in the chain, there is a first time house buyers, or some investors (plus mum and dad investors now entering the market), who are actually buying at these very high prices. Once that slows down, I wonder if it will cause some congestion to the market. Except the problem is currently very low inventory. We really need house prices to drop back, but it seems they don't want that to happen.

Barfoots showing prices flat in May, compared to April

Should the average asking price even be considered a thing that is reported as news.

I'll go list my house with an asking price of $100 billion, watch the average asking price for my area increase.

Yes yes, it'll be excluded as an outlier. But maybe I'll round up all the neighbors and have them too list for $100 billion.

Some people are asking some insane high prices at the moment, trying it on. But some of those houses aren't selling, so to a lessor extent, that could already be happening.

I am guessing these stats are solely based on those properties that actually have an asking price or BEO. As most will either be auction, tender or deadline sale during these crazy times. Otherwise can't agents just put in a figure that could be lower into the hidden 'expected sale price' field, to generate more attention in the search listings? Or is there actually a requirement for agents to enter in their market 'appraisal price' into this field, which should be the actual expected sale price. IMO they should be required to to be fair to buyers.

Certainly seen a lot less Auctions and deadlines in April/May and more BEO style sales methods in the Hutt areas. Just received sales reports for Welly/Porirua areas and more so a decline in number sold, not so much in the average sale price - 1.06M in April and 1.05M in May.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.