There could be a whole lot of pain in store for people looking to sell residential properties this summer, although buyers may be smiling.

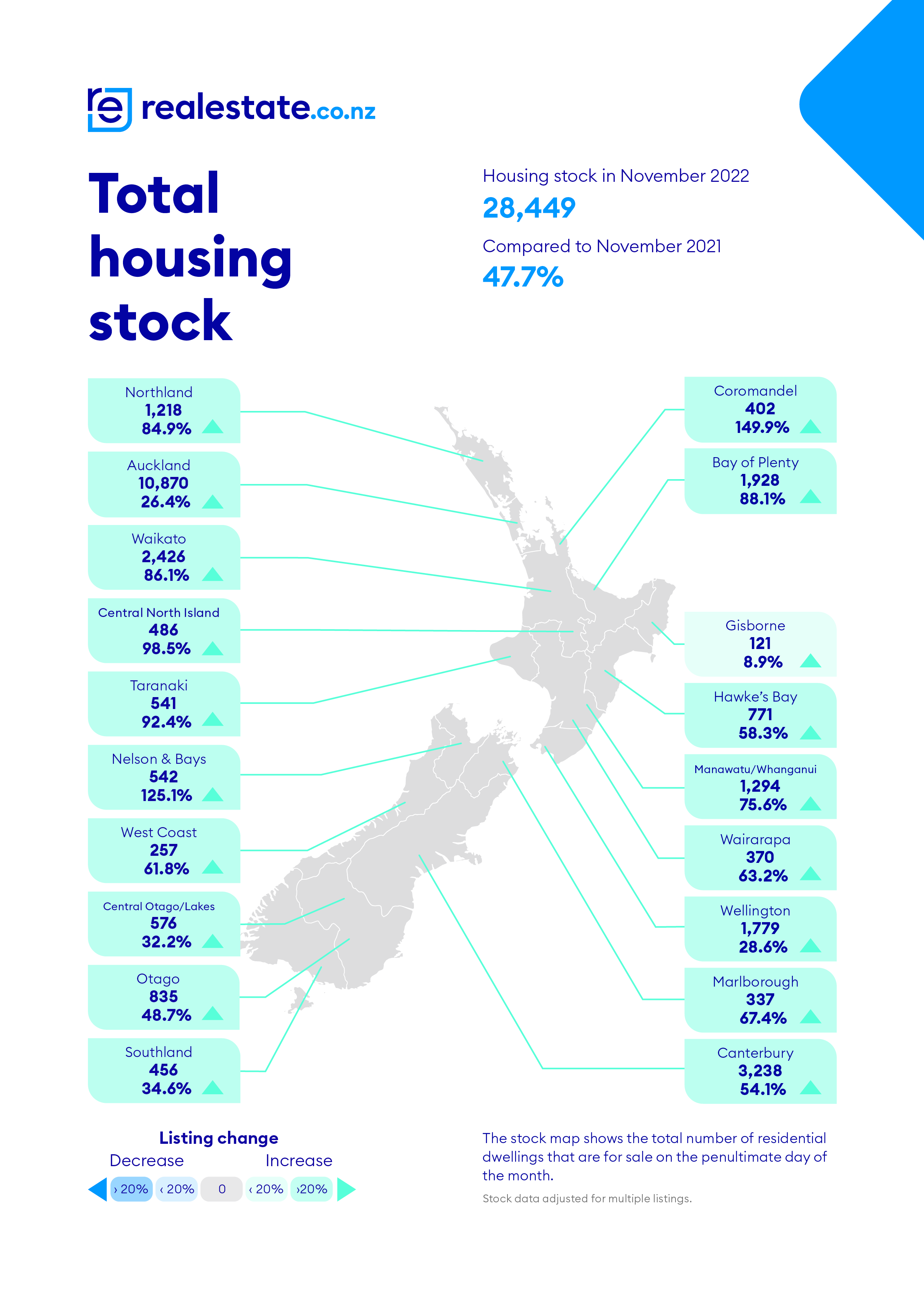

The latest figures from property website realestate.co.nz show it had a total of 28,449 residential properties throughout the country available for sale at the end of November.

That was up 48% compared to November last year and was the highest number for the month of November since 2015.

It also means stock levels are up 29% compared to where they were in November 2019 before the Covid pandemic disrupted the market. See the first chart below for the total stock levels in each region.

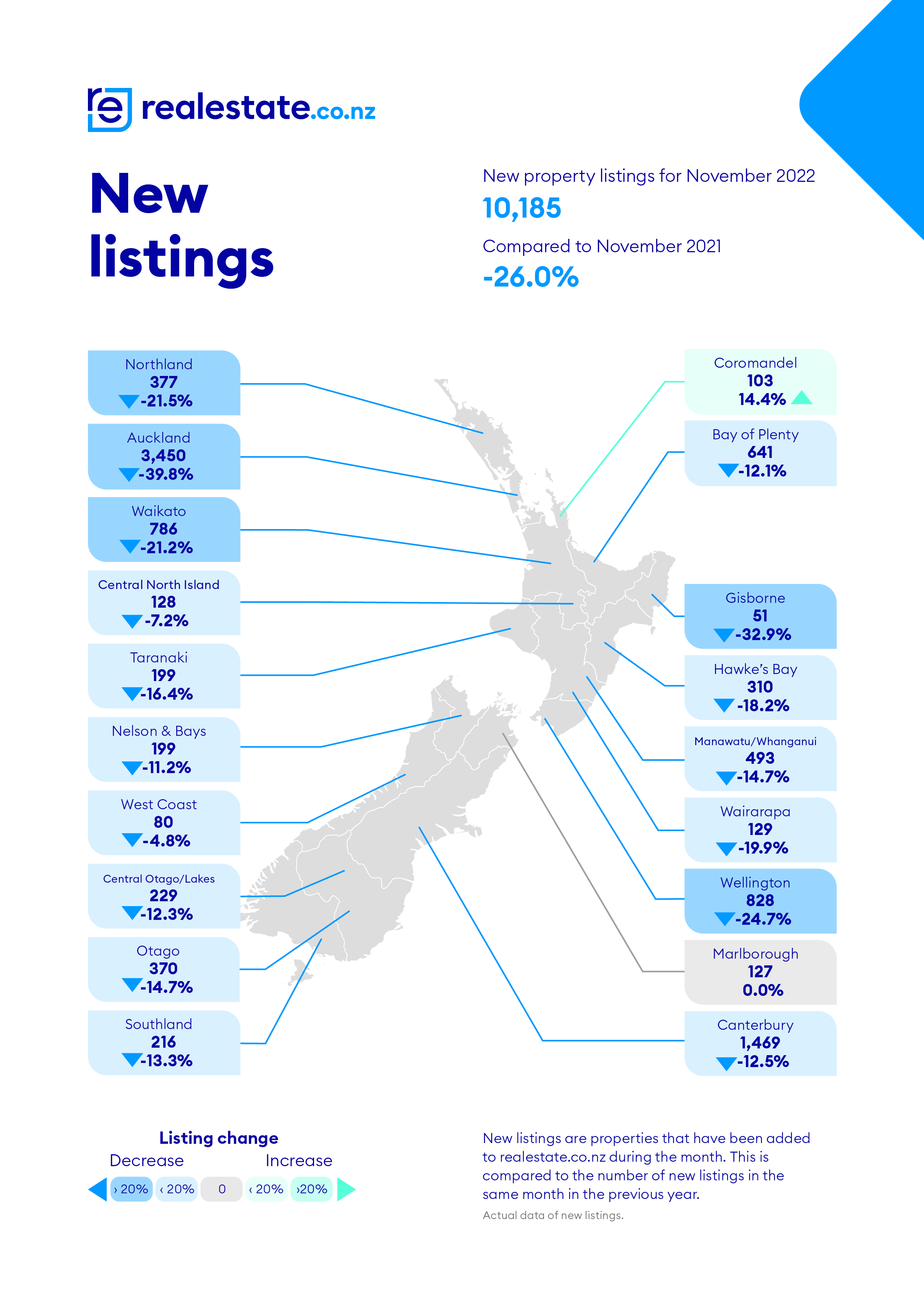

That high level of stock has built up in spite of the fact that the number of new listings realestate.co.nz receives each month has been in decline.

The website received 10,185 new residential listings in November. That's down 26% compared to November last year, and down 7.6% compared to pre-pandemic November 2019. See the second chart below for new listing numbers in each region.

That suggests fewer properties are selling and most are staying on the market longer.

But it's good news for potential buyers who will now have plenty of choice and the upper hand in sale negotiations.

The average asking price of properties for sale on Realestate.co.nz is also falling.

At the end of November the average, non-seasonally adjusted, asking price of all the properties for sale on the website was $921,770. That's down by $73,115 (-7.3%) compared to the peak of $994,885 set at the beginning of the year.

"Rising interest rates mean less credit is available for Kiwis looking to buy," realestate.co.nz spokesperson Vanessa Williams said.

"As a result, we have seen house prices trend downwards, likely impacting those looking to sell."

All of which suggests that regardless of what happens with the weather, the housing market is likely in for a rather cool summer.

The comment stream on this story is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

44 Comments

Those forecasting a "V" shaped recovery need to start pulling even harder on those levers before next winter - clear this bloating inventory. One member commented here that he buys parcels of 2-20 properties at a time. Maybe he's the answer. Personally, I think the longer this downturn lasts, the more likely it will be an "L" People will think twice before over exposing their finances to one commodity. The losses will only continue to mount as business's fail and unemployment rises. How many businesses are backed by equity in the family home????

Bang on RP. The second and third level effects haven’t even started yet. It will be a long way down followed by flatlining for an extended period.

No evidence? Didn't think so

Where is your evidence this is incorrect? Didn’t think so. Hang on when do you ever have evidence?

(p.s. evidence can be found on rbnz website, search for small business lending security categories) there ya go.

So we should be able to make any claim without evidunce or backup... because Kiwi Tim said so

Well that’s most of the comments on this site right? Including your own, so I was calling you on that. Doesn’t make a difference to me if you or anyone else has evidence, probably helps though, gives the argument some strength.

I met this bloke down the pub who apparently has been taking meticulous handwritten notes of every property listed for sale or rent in Auckland on Trademe every day for the last year or so. He reckons he's got it all neatly typed up in a csv file, wanted to know if anyone here was interested in doing some analysis on a data series of that nature.

I'm surprised he had the time to at the pub... and to also have a conversation...

Sounds like the sort of person who capitalises on their time well.

..but his family haven't seen him for nearly four days😆

Could be my old coworker.

He had a notebook he kept (the same one since the late 1970s) of every flight he'd ever been on, with exact records of:

- Flight number

- Aircraft number

- Seat number

- Scheduled departure time

- Exact time of lift off

- Exact time of landing

A fascinating chap, albeit a little bit obsessional.

Who knows? Might come in handy one day?

Pretty well every bloke has a story about a man they met in a pub.

Generally, pubs are great places for a chat over a drink or two.

TTP

We agree on something!

Commenter Zachary Smith might be interested. Although, if the results are published on here, they could be promptly removed.

At what point does an obsession become mental illness?

Guess everyone needs a hobby, and who knows, that info may be vastly useful in 10-20years

Cool, cooler, cold, colder, and we're back in winter..

Even the weather is playing its part. It's still very cool where we live. No summer this year.

House price is down but not out - Still holding though at a lower level.

Next leg when it happens should be meaningful.

The latest data shows the housing market is cooling off...... but not by as much as many of us would have anticipated, following a protracted period of buoyant trading conditions and steeply rising house prices.

Upward and downward corrections are healthy enough. They show that market forces are alive and well - which is in the best interests of promoting efficiency outcomes.

Social equity outcomes may take a little longer in the oven.

TTP

Exactly right mate, cause interest rates dropped substantially this week. Takes awhile to filter through to data so in March we should see a strong lift in prices. Wait, maybe it was other way round?

Good bach buying? Nelson & Bays, Central North Island and Coromandel look like they are the most over-stocked.

No one seems to be very motivated to sell beach properties yet - and we have been looking hard out. AirBnB / BachCare seems to have changed that dynamic - as they can be rented out over 12 weeks of summer for more than one can rent a decent house in Auckland for a year.

Well, the Coromandel Peninsula was the only region to have more NEW listings this November than one year ago.

Wait till after Jan. I’m picking there are lots of families who will have one last hurrah this Xmas then put the Bach on the market.

Indeed. But they are also the locations were people fought each other to buy sight unseen for silly money over the pandemic. Now they want to sell ...at a spec profit.

As rates and rise and rise, good luck with that.

It's not very useful comparing with November 2021 as were still doing alerts and lockdowns. Comparing to November 2019 is indeed more informative.

For what it's worth, AKL is now tracking 2018 stock levels very closely.

That's interesting, realterms, because Auckland house prices started racing ahead from mid-2019 through 2020 and 2021......

TTP

After the RBNZ starting cutting the OCR in mid-2019, yes. In late 2018 and early 2019, Auckland prices were (gently) falling.

Couldn't have prices falling in those halcyon days. Just wasn't sport.

Can you even imagine how much better off we would all be as a nation if the RBNZ had not intervened to boost the housing market from 2018 on?

What a clusterf#@! we now find ourselves in, all because the RBNZ deliberately pumped a bubble.

Most corrupt RBNZ ever.

Whilst I was extremely disappointed with Orr at the result of his first MPC (as it looked like their intent was to re-ignite the housing bubble), it should be noted that the US also dropped their rate by 0.75% that same year. They just did it in 3 meetings vs our 2.

I somewhat doubt the US were thinking of us when they did so.

Orr has done more to pump the bubble than just following the FED down.

I could write a list of at least 20 bubble pumping interventions that the RBNZ has made in the last few years. But not now, appointments call.

Most corrupt RBNZ ever.

Hi Fitzgerald,

Many of us wouldn’t be better off at all…..

We’d be dead.

TTP

by tothepoint | 2nd Dec 22, 10:29am 1669930160

Hi Fitzgerald,

Many of us wouldn’t be better off at all…..

We’d be dead.

TTP

By 'we' do you mean your Property Brokers business?

Where I live which is a regional capital in the North Island I am noticing the higher priced homes are not selling unless they are exceptional. Large character homes in good locations, near new large executive homes and some very nice lifestyle properties. Why are people moving on from them? Have they taken on too much debt for their ideal home? And who can afford to borrow enough to buy them and with confidence as we head into a possible recession. Very interesting times.

Probably figuring they should downsize before they lose too much potential capital gains and get a more modest home then bank the gains and grow them elsewhere since the house isn't gaining in value anymore.

This article is inaccurate!... It only uses REINZ data which has less listings than Trademe and combined " other sellers" that use other methods of selling. IE - private sellers, REAs that only use there own site, agents not aligned to REINZ, house builders like Generation/ signature...

The total is closer to 40k than 30k.

A quick count - 38,269 for sale on TM and 9,897 for rent.

i thought this level of analysis was interesting and like some of the graphics. Who wants to copy for NZ?

https://twitter.com/epbresearch/status/1598397107567988736?s=46&t=TSm_j…

Interesting link - many people in the US I talk to from my time there, think US houses are overpriced. I send them photos of our million dollar average homes (and their low quality) here and they think we've all completely lost the plot.

In the words of rockers Bachman-Turner Overdrive.....

"You ain't seen nothin' yet......"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.