Buyers will likely retain the whip hand in the housing market over winter with the number of homes for sale at an eight year high while prices and new listings continue to fall.

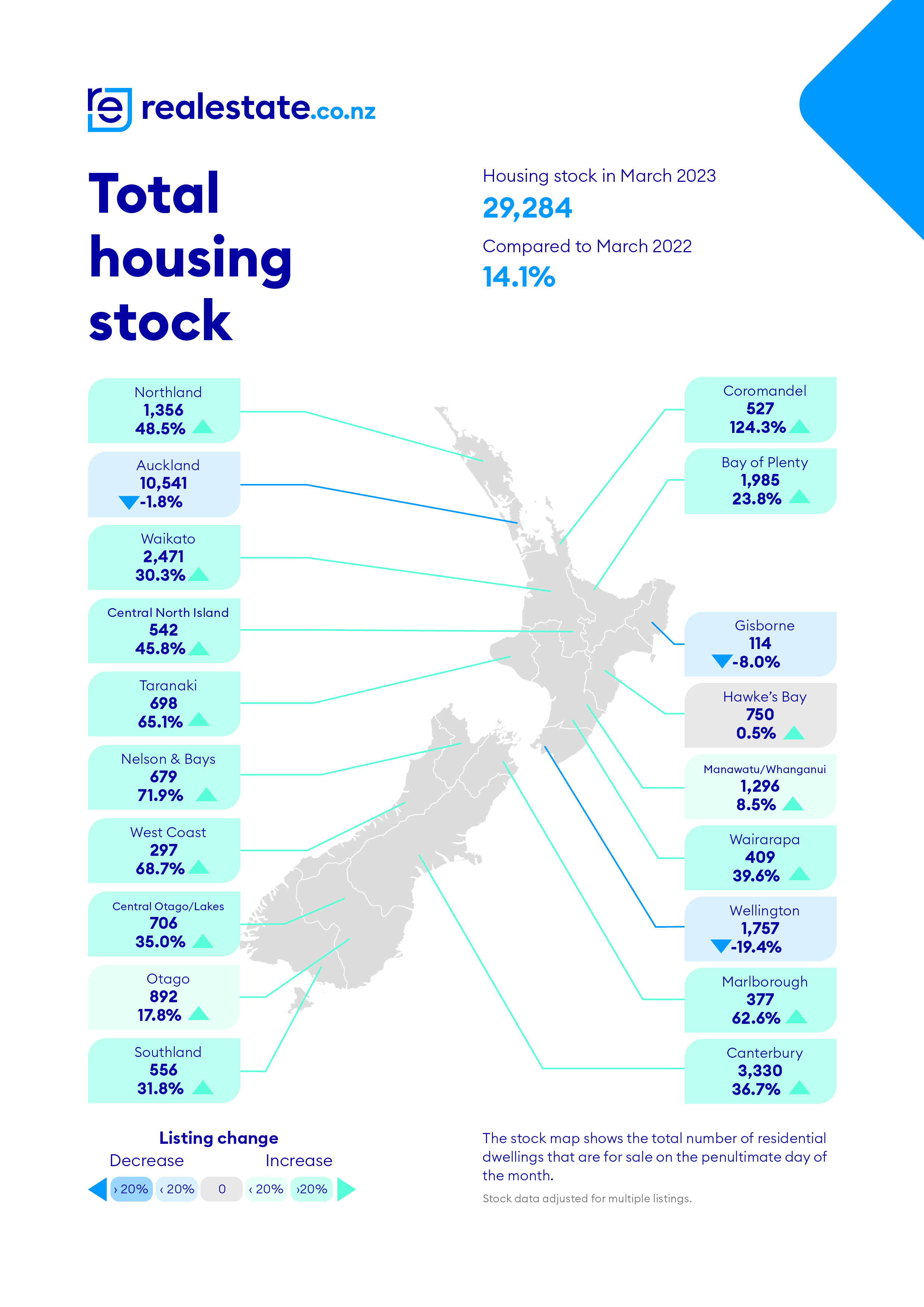

Property website Realestate.co.nz had 29,284 residential dwellings available for sale at the end of March, which was the highest number in any month of the year since November 2015 and up 14.1% on March last year.

The biggest increases in housing stock for sale compared to year ago were in Coromandel +124.3%, Nelson & Bays +71.9%, West Coast +68.7%, Taranaki +65.1%, Marlborough +62.6% and Northland +48.5%.

The only regions where stocks levels in March were below a year ago were Auckland -1.8%, Gisborne -8.0% and Wellington -19.4% (see the chart below for the full regional figures).

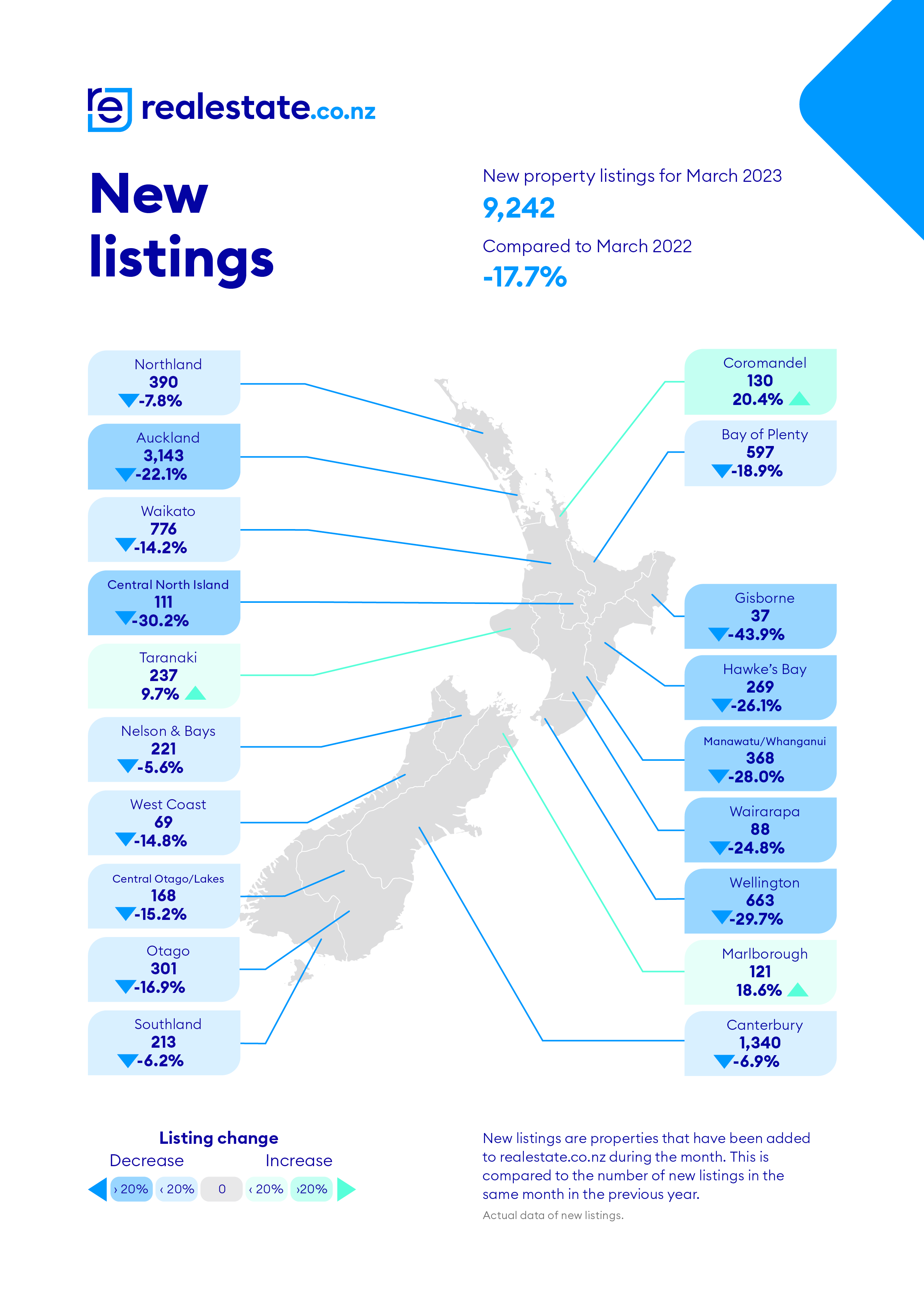

That mountain of stock for sale has accumulated even though the website received just 9242 new listings in March, which was the lowest number of new listings it has received in the month of March since it began collating the data in 2007 and was down 17.7% on March last year (see the second chart below for the full regional figures).

Adding to the bearish housing market sentiment, asking prices are continuing to fall.

Realestate.co.nz's national average asking price slipped a further $15,271 last month to $883,823 (non-seasonally adjusted) and is now down by $111,062 from its peak of $994,885 achieved in January last year.

The above figures paint a particularly grim picture of the housing market because February and March are usually the busiest months of the year for the residential property market, with sales then starting to decline as it heads into autumn.

However the bright spot is that buyers will have plenty to choose from and should be well placed to negotiate a sharp price as long as they have the finance lined up.

The comment stream on this article is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

151 Comments

Despite low sales Auckland and Wellington are already below 2022 levels of unsold properties. Wellington is well below (19.4%). Add to that, New properties coming to market are at 15 year (2008) lows

Given the headlines "savage winter", "mountain of homes...at 8 year high", I was a bit surprised when reading further down

Come for the hyperbole, stay for less titillating facts.

Well, these places the market has frozen. Stalemate. Very few new listings. So it is kind of grim.

Agreed - only those that must sell are listing. Most of the upgraders etc are waiting for the election to be over, hoping a change of government will reinvigorate the market...

Also need to factor in the suppressed demand of sellers who want to sell but can't because they would lose money and not be able to get a new mortgage. HUGE numbers involved.

Pent Up Supply

Yep, know of 3 couples in this situation. Have all taken their homes off the market after getting no bites close to their minimum.

Gonna be a brutal winter

Hi Agnostium (and others),

We also need to factor in that mortgage interest rate increases are levelling off - and that mortgagee sales are minuscule. (Notably, mortgagee sales simply haven't soared to the levels that the DGM have been - forever - predicting.) Further, rents have remained high/ resilient. I hear that in Wellington, for example, there are currently queues of people lining up to bid for the few rental properties that become available.

Add to the above that the labour market has remained tight - and that the vast majority of businesses continue to foresee difficulty in recruiting staff.

Finally, population projections warn us that we can expect very high population growth in Auckland and Wellington over the next 20/30 years. Local authorities are planning for this outcome by creating provision for much more high-density zoning than we've seen in the past.

All considerations taken into account, property is destined to become an increasingly scarce (and coveted) asset.

Those who buy in the autumn/ winter of 2023 will buy well - and they're well aware of their impending good fortune.......

Conversely, those who foresee a "savage/ brutal/ vicious/ bestial/ sadistic/ ferocious/ merciless winter" immediately ahead will, in a few years, look back on the winter of 2023 as a winter of "short-sightedness" and "lost opportunity". 🥴

TTP 🥂

You went quiet for a while TTP, now back posting again with a confident tone. Welcome back

Thanks, HW2, I'll be here plenty - including over the weekends.....

Sorry you missed me. 😉

Cheers!

TTP

👍

Get a room guys (maybe you could hang out with the basement boys). It's really uncomfortable for everyone to catch you in flagrante with your spruiking fetish.

If its ok for the mouse and IT Gay to talk about changing their sexuality then perhaps its ok for me to say welcome back. Anyway back to the topic

by HW2 | 3rd Apr 23, 12:16pm 1680481008

If its ok for the mouse and IT Gay to talk about changing their sexuality then perhaps its ok for me to say welcome back. Anyway back to the topic

Thats offensive HW2

There is no intention of offending anyone

I withdraw and apologise

Just as well!

TTP house price’s are still falling and will be for quite a while, many people who purchased over the last few years will already have seen value of property down around 20% these same people might of fixed mortgage at 3% for two years are now refinancing and will be paying more example million dollar mortgage at 3% $970 per week and at 7% $1530 per week this is a massive amount from weekly income you are dreaming if you think this is not going to cause house price’s to continue crashing. Will probably be down 40% from high by end of the year.

If what you are saying is actually true then that means the RBNZ will continue to raise interest rates.

If anyone wants to research history, then focus on 1986-1989 inflation, interest rates and unemployment data.

And at that time we had a labour government that understood economics. Shame the current labour government doesn't understand it's policies are adding to the inflation spiral

TTP,

What would your buying criteria currently? yields are still terrible

IS build to rent the only option say 7 townhouses or 3 townhouses for below under new unitary plan in AKL

Would you buy a 1000m2 property or 2x500m2 - which will have most bang for buck in 10 years?

Those places are where we're going to start seeing mortgagee sales en masse.

People in negative equity either won't or can't sell, and are hoping something external changes affecting that before the bank forecloses. Foreclosure takes a long time - I have family in this boat, but future cash-flow projections show trouble doesn't arrive till re-fix in August, and it'll be at least another year of hard yakka after that before a foreclosure might happen - assuming they keep their jobs.

Only people who need to sell will be listing atm (and need includes desire to get out before prices fall further).

We are listing but want to buy and sell houses of equal value. Just to move to another area.

Its very interesting - we obviously are happy to sell ours at whether price the market will pay (so can afford to be the cheapest in our category of house) as long as we find a vendor with similar aspirations. Because there are a lot of houses that have already been on the market a while and arent well presented or marketed (strange - only a year ago everything was staged and perfect but now house flippers and certain peropl seem to want to get out asap before prices fall any more - without bothering to tidy) - its very possible we could do well out of the move. Also is a more interesting time to buy a house needing some work - as we are finding tradies and builders are very responsive on timing and price vs the FOMO days of last yr.

We will be doing the same, we have bought a very modest house in 2020 as we saw prices become unrealistic and the the difference between “price” and “value” just got too wide. We then began plans to build until the build price of the house we wanted became higher than the price we considered we could ever sell it for. We are now looking to buy 21/2 years later - we can fund a purchase from cash, but a cash deal seems that we hold all the risk in this rapidly dropping market - if we buy without knowing what we can sell the modest house for.

I have been thinking lately that those who are successfully buying-up are doing so with conditional contracts. Both your purchase price of the new house and sale price of current homes are set at time of purchase, if you can’t get the right price for your current house you don’t need to proceed with the sale.

There are a few going through here like that but it seems the purchase prices on these sales are still high. I think paying a high price is the age-old problem with conditional offers. So we might try a conditional offer on one or two, but suspect we will just wait a while longer until prices stabilise a bit.

Our experience here so far is that vendors are not being realistic about price… unless they “have to be” and if they “have to be” realistic then they are looking for a cash deal with a quick settlement.

From my observations loads of lower value houses coming on the market, generally older houses in expensive areas (so likely highly leveraged). Initial thoughts are these were rentals and the owners are jumping before interest deductibility is phased out. That would explain the drop in average prices also. Hard to know if it’s a sales mix issue also at this stage.

Buyers want fully reno-ed, not do-ups. The costs are too high and the time inputs too great. Not many flippers and fewer developers are in the market

Worst house in best street used to be a popular way to get on the property ladder, not so sure now.

If you were prepared to do something up in bits and bobs in your own time, yes.

If you have to pay someone else to do everything, no.

That's not really a new story though, paid renovations have never really been that profitable an exercise for the home owner. It just makes a house more marketable.

Part of it is about financing. Pay 20 percent for fully reno-ed home vs pay 100 percent of reno costs yourself.

Buyers probably don't think that deeply though. They want it all and they want it now is more likely

Finance, and escalated costs of doing Reno's.

Reno costs are already falling. lots of builders and tradies are starting to lack work and worry. materials too. nobody is building new anymore... and the brakes are on high paid and flipper projects.

Funnily enough, before the market went crazy, 20 years ago you'd subtract the cost of reno from the price you were willing to pay for the house.

Have friends who used to do this as a business model, and in the absence of capital gains, I expect to see this return - particularly for FHBs.

It's another way high materials costs won't underpin second-hand houses, despite our resident spruikers' claims.

20 years ago people would do that, but the Reno cost was double expectations. And once they factored in the time expended, they coulda just bought something slightly more expensive that got a recent spruce up.

A few anecdotes like your mates are around, but mostly people have lost money doing Reno's.

It'll be the same now. Maybe worse.

this is bang on and happening to do ups and houses that have issues now.

if they need to sell they have to take the market price less current cost of renos.

New world.

the owners are jumping before interest deductibility is phased out

Why would they want to jump out before interest deductibility is phased out? I'd think phasing it out makes it more enticing to hold the property

In the short term.

I'd say at this point Healthy Homes compliance is more of a factor than interest deductibility.

Because of the maths. Currently the interest deductibility rules havent made any difference to people's pocket (in terms of paying extra tax) because the step down in interest deductions has been offset by the higher amount of interest charges being deducted. However, this is the last year that this will be so, from next year owners will start paying more tax, and more people will be forced to sell. So now's your last chance to exit before the rush.

eg. a $1M loan, interest at 3% a year with 100% interest duductibility means you can deduct $30,000 from your rent in Year 1. Interest at 4.5% a year with 75% deductibility means you deduct $33,750 from your rent in Year 2. Interest at 6% a year with 50% deductibility means you are still deducting $30,000 in Year 3. Its only when you get to Year 4 and 7% interest and 25% deductibility means you can only deduct $17,500, and you will be paying tax on the non deductible amount.

That old chestnut.

Completely misses the point that holding costs are about to be higher just due to the increase in interest rates. The focus on tax is a strawman argument.

Just my opinion, but investment businesses should pay commercial rates. My business just borrowed 500k @ 8.79%. Try that on for size.

Well at least there is a bright spot for buyers, though they an endangered breed these days......

Who'da thunk a 20% fall in prices would be met with an 80% fall in buyers.

Actually that was always inevitable.

Yes exactly. Good come back there Pa1nter

Everyone got so excited with the prospect of lower prices they forgot that's directly tied to people's ability to buy them.

Or they are just waiting as house prices are still crashing and it doesn't make sense to buy overpriced asset when you know you'll get a better deal if you wait?

Based on the jump in failed mortgage applications, and declines in affordability, it's far more likely my scenario than yours.

There will be some buying opportunities for those with the means, but people thinking this is some sort of pivot point where the unwashed will get into houses will likely be underwhelmed.

Because interest rates have gone up considerably faster than house prices have fallen. People are trying to borrow at current house price levels, and being declined because...shock horror.....the house prices cannot be supported by current interest rates.

In other words, these declined applicants if they had applied for a $200k mortgage instead of a $500k mortgage do you think they would have still been declined?

"Because interest rates have gone up considerably faster than house prices have fallen. "

But in reality, house prices have fallen more than what people think. Its just they don't know it yet because the web site estimates have yet to catch up with what the sale price would currently be..

As we discussed, Starrider made the claim that 95 percent get turned down.

Seems banks are just as implicated for the boom-bust volatility.

There's no way 95% of people are being turned down... Perhaps they're being turned down for their requested max borrowing number, however they'll likely walk away with a lower approved borrowing amount. Banks are keen to lend...affordability is the crux for borrowers.

How would you not anticipate the number of borrowers to decrease as the cost of servicing debt is going through the roof?

We're already seeing them have to drop deposit requirements down to 5%.

It's a temporary dip because prices haven't fallen enough yet.

Banks will lend, but a smaller amount. House prices will drop until the amount willing to be lent matches the sale price.

The reverse happened in the boom, the house prices rose to match the amount banks were willing to lend.

Nailed it.

And where are the preachers who were so sure that there was a housing shortage driving prices up?

If you think there is a lot more to go you better check out the Aussie housing market

"If you think there is a lot more to go you better check out the Aussie housing market"

What color are the shoots?

The color of "u" pops

Where's your grammar sir... and dont say, in the front room watching telly

All that you can reply with is some Ad hominem? How about something rare from you - Insight - lol!

Why, on the ride down, is the Australian market of influence to the NZ housing market? What are you predicting this week?

Pops, you make ridiculous comments and then expect deep insight back in return. Funny

In this instance by expecting a insightful rich comment from you was asking a bit much.....sad. The challenge is always there for you to comment beyond your typical "it always has, so it always will" depth..............................

Ok boomer

How are those 50 basis point increase "green shoots" looking right about now?

The Aussie market is not influencing the NZ market, both countries are commodity exporters and this is the common factor.

Relevance?

There are plenty of superficial similarities between Aus and here. But some notable differences.

One of the key ones being that prices never got as far out of whack relative to income in Aus, compared to here.

Another is... that they are down 5.1pct from the all time highs

"We dont know how lucky we are"

If you think there is a lot more to go you better check out the Aussie housing market

Depends what you want to check out.

Whereas lenders can and do often hide defaults by extending and pretending (restructuring borrowers’ loans so that no formal defaults show up in the official data), the insolvency time-series does not lie. Another data source that does not lie and which we study closely is the monthly arrears reported on the circa $90 billion home loan-backed bonds, known as residential mortgage-backed securities (RMBS). We compute our own compositionally adjusted arrears indices for all Aussie RMBS, which reveals a striking recent increase in the 30 days-plus arrears rate.

https://www.livewiremarkets.com/wires/corporate-and-rmbs-default-waves-…

It's a temporary dip because prices haven't fallen enough yet.

Banks will lend, but a smaller amount. House prices will drop until the amount willing to be lent matches the sale price.

The reverse happened in the boom, the house prices rose to match the amount banks were willing to lend.

If we look at past instances of downturns, its really unlikely to be a favourable outcome for most prospective house buyers - it's a net bad thing, because amoung other relationships there's a decent one between house prices and the fortunes of the citizenry.

A downturn in fortunes for over leveraged speculation - absolutely (a small part of the population). For those tired of being exploited via higher house prices and ever higher rents, they are happy to see that decline (a bigger part of the population). Those debt free are also happy to see inflation slow down and not destroy the value of their savings, especially in their retirement years (an every growing part of the population).

Bring. It. On.

The happiness and exuberance will be very short lived. Hollow even.

The sort of mindset to put someone in that level of anticipation won't be improving their ability to perform and compete in the economy, that's for sure.

Not at all. But try looking in the mirror and repeat that twenty times as a self affirmation. Does it make the sick feeling in your stomach feel better?

Pretty good here thanks, I'm not holding much debt, and despite my wishes for things to get quiet, there's still way too much work to do.

I just hear your attitude a lot IRL, and the dudes holding onto it have managed to give themselves enough excuses so as to be barely productive.

Just because rates were at emergency levels and people could get a mortgage for a million plus for a small three bedroom house In Auckland maybe they should of stopped and thought what happens when we get back to normal rates or this is a bubble and this house is not worth what I paid for it. Now the price’s have dropped 20% so far the fortunes of housing market will not be for speculators but for people who need a home and by the time it hits the bottom all the population who did not get caught up in the FOMO will be better off unfortunately for anyone who did purchase over last three years huge financial losses will occur.

I couldn't believe it either. I questioned it myself. One in 20 mortgages approved. I don't know how many they normally reject.

But what must be happening is FHB, and owners wanting to buy an investment property;

-had a good idea of what they could afford in 2021/22

-Have continued to search at that price level.

-Finally make an offer subject to finance and the bank says "No, you can't afford an 8.5% mortgage at this amount."

The bank stress tests add an additional 2.5% to the rate that you are applying for.

"had a good idea of what they could afford in 2021/22"

This is the crux, their "good idea" of what they could afford was wildly out of line with what they could actually afford. It's based on the spruikers advice of what they could afford, hence the ridiculous applications.

Correct. And the fact that the stress test rate was 4-ish% and is now knocking on 9%.

If I was a bank I would be stress testing at 10% right now.

It’s pretty telling using a mortgage calculator right now, and inputting a 600k or 700k loan, at 9% over 30 years.

The answer the calculator provides tells anyone why both the housing market and the residential development sector are toast.

The spruikers spruiked too hard, too fast and too high. Now it's "Time To Pay the Piper" TTPP

Starrider

I am asking for third third time: what is the source of your claim that "one big red bank is rejecting 95% of applications".

To my knowledge - over forty years involved in property - I have never known a bank stating such data and I don't believe that it is information that they would release.

You present this as fact - hearing something around the water cooler or bbq is most likely baseless hearsay.

You and your statement lacks credibility unless you can substantiate a credible source.

Insider contact. They can't share officially. I have no skin in the mortgage game and am simply passing on a data point.

Given that the stress test is almost at 9%. Is it really that hard to believe? What would a prudent bank do in this situation?

Nifty

Agree with your comment.

This “95% rejection” of mortgage applications by a “big red bank” as posted by Starrider is gaining traction.

It’s made up fanciful BS.

At the time and on a subsequent occasion I have asked Starrider the source of this information and he has not responded.

I have never known a bank to release such information and doubt that they would.

To me, both the 95% figure and Starrider have no credibility.

I have no doubt many are struggling to meet bank leading requirements but a claim of 95% rejection is bull.

HW2 it’s not that the banks are not wanting to lend; lending is their business - it’s that borrowers can’t afford to pay the repayments on the loans they need at current asking prices. This is a good thing, we don’t want anyone borrowing too much on an asset that is still dropping in price.

You don't want someone getting a debt they can't service, first and foremost.

The value dropping is less concerning.

The banks' outlooks do influence their willingness to lend. How heavily influence I am not sure.

When they throw out publicly, as they have recently, the market will drop more x percent thats going to make them restrictive. They also carry risk of loss

On the other hand I am intrigued that low equity loan approvals are at a high. I realise that contradicts the above. Probably tells you the banks see stable employment and minimal recession

Or they are desperate to replace underwater mortgages with people who are at least motivated to make the next year's payments.

Never try to catch a falling knife.

Yes and dont wait for the knife to hit the floor and then make a grab for it when others do. Thats very dangerous indeed. Likely to be bleeding ... bleeding cash

Up to you, see if I care

or the banks willingness to lend on them in this market! --- i owe 200k on a 2mill property and wanted to leverage 100K to buy something aroudn 320 in Waverly -- proving a bit of a mission to get things in order -- even with no issue on servicing and the 200K is fixed for another 3 years at 2.99 - had five originally -- but dragging stuff out makign extra hoops for me -- no wonder few buyers about

True, we just need prices to fall 80% so buyers are only reduced by 20%. Clear the decks.

When you are in free fall you reach for the rip cord to deploy the parachute. Many yet to realise that the parachute can only deploy as a 2015-16 price.

More listing, less buyers, higher rates for longer. Do the math.

Popcorn.

Popcorn

So far this is one of those movies where you think it'll get good and it's just bleh.

It's going as you would expect. Miguel had a good graph showing month by month declines from house crashes around the world.

More like a Shawshank redemption thing, not a box office hit years after the event widely regarded as a seminal work.

I'm less confident about how satisfactory the ending will be.

OK, I sort of agree with you about how good the ending will be.

My point (badly made) was that at the time it doesn't seem that interesting but after the event there is a general consensus that it was a pretty significant event, significant enough that people still talk about years and years after.

"Time and pressure"

My point (badly made) was that at the time it doesn't seem that interesting but after the event there is a general consensus that it was a pretty significant event, significant enough that people still talk about years and years after.

People seem to have largely forgotten about covid, even though it's still having a very large effect on our economy.

Covid and the Covid response which attempted to mitigate it's worse potential consequences just postponed (probably exacerbated) the moment of truth for the housing market, when, like the emperor, it was seen to have no clothes.

Yeah I mean see, perfect example, it's already being looked at as a housing event by many, when there's a far bigger game in play. Because housing gets well and truly the lion's share of attention with the economy.

Not for those sick of being exploited by the miss allocation of capital, with a (declining) side order of being a tax avoidance bludger.

Its popcorn with caramel butter

There's a good way to stop being exploited and it's not by eating high fructose enriched corn kernels.

When you wipe the crumbs from your T-shirt and wonder why nothing got better, maybe the penny will drop.

Cope and Seethe landlord. I'll come knocking to buy when you offer 2016 prices.

Not if the interest rates 12% you won't.

What hapened to Hemi ti wire?

He was a freaking good commentator on this stuff

He Kept the "mob" honest and was never woke.

Anyway, the housing market situation was predicted by many here Despit many so called experts saying otherwise.

The likes of Tony Alexandra are just analysing the wrong data. He should grt out of his office, use logic and refer to simple maths.

Common sense...

Supply v demand

Numbers in v numbrs out

Sales days

Listing dates

Price dross

T Aexandra...

Inflation

Reserve bank directions

LVR

Finance matrix numbers...

Use one login IT GUY, its easier

Regarding Hemi TW, maybe he is that 74yo trans pensioner on the run from the cops

He will be hiding at an open home, pretty safe, no one goes these days.

6 day old account. Only question is it Hemi talking himself up under a new pseudonym, or as HW suggest, another poster running troll accounts.

I though it was Hemi, based on post style over the last few days..

Hemi who? Nobody cares.

This is the first post of Shafts I've seen, the joys of minor household jobs turning into slightly larger jobs with several back and forths to Bunnings to get the right bits.

👍

Do you have a loyalty or association account to make the savings at bunnings and elsewhere.

No, I meant to get the powerpass via the Facebook property investor group (its why I subbed to the page) but haven't bothered, so far been hilarious watching the Hopium from some of those investors, and watching them rage at Labour and the DGMs that post in there.

No major renos that i'll be buying the bits for planned so no real need. Small jobs with minor material costs so the few dollars here and there that i might have saved don't add up to much.

Happy I'm settling today on a house I sold.

Congratulations.

Thanks agnostium

You'll regret that in 10 years...

Probably!

Let's run the thought experiment I ran a few months back.

Let's take our god send couple, a couple in their late 20s with one kid, who is now 2. Dad is earning $130k as a senior software engineer, mum is working an office job for 70k. Both are contributing 10% kiwisaver and their employers pay 3% on top of their salary. Kid goes to daycare for say 800 per fortnight. Let's say they are trying to save for a house so they live with one of their parents for no rent in exchange for house work, so no outgoing expenses other than food. Let's base them in Wellington.

So dad is putting $500 into his kiwisaver per fortnight, let's say he still has a student loan which is nearly paid off, so he brings in $2628 per fortnight. Mum puts $269 into her kiwisaver, has a student loan nearly paid off and gets 1624 per fortnight. So their combined income is $4252 per fortnight. Easily saving their deposit at say $2500 in cash + 769 kiwisaver employee contributions. They save for 18 months from $0 kiwisaver to get a 20% deposit. Total fiscal austerity to save for this place.

They are easily in the top 10% of income earners in NZ, they would like to buy a decent first home in the Hutt Valley. A former state house built in the 50s with good bones, the sort of place their grandfathers might have owned as a first home working as an apprentice. The house they are looking at is listed for 650k, they want to offer 600k. At 7% interest rates, with 20% down. Mortgage of 480k, paying a minimium repayment of $1565 over 25 years. That is sustainable at these current salaries.

But what happens if baby number two comes? Well suddenly, a second income is gone from the household. Dad cuts back to 3% kiwisavers once the house is settled, is the sole income earner and he pays off his student loan. So he has $3,472 coming in. If interest rates jump to 8% (a likely scenario), he has to pay $1709 just for the interest on the place. Just under half of his income to a bank for its cut.

Even with these completely ridiculous conditions which most New Zealanders couldn't dream of having, this circumstance is unsustainable. And the vast majority of Households don't earn anywhere near that. So a guy in the top 10% of income earners can barely pay his mortgage with half his income to live in an ancient starter home. How on earth does this make sense for anyone to buy?

It doesn't, and it won't improve until boomers, speculators and landlords start throwing themselves from the paper imagined value of their oh so special houses to the real value of their houses, which will break many bones and be fatal to others. But that is Capitalism.

Why contribute 10 percent KS after buying your first home. Its funds that you can't access and thats a huge mistake

I cut down the amount to 3% after they purchase the house, i'll clarify. Point was to imply they were saving as hard as possible.

Sounds like your imaginary couple need to change what they're doing and where they're doing it.

Like what? What are they expected to change given the circumstances are what they are? What could they do differently?

The pull yourself by your bootstraps thing here isn't coherent.

His $130K is increasing at 5-10% per year plus another bump up 10-20% in a few years when he gets a promotion.

By then the wife will be back at her office job and the oldest child will be at school so childcare costs are back to $400/fortnight, and a couple of years later they'll be down to $0.

So it's tough for a couple of years but it is sustainable because their conditions improve over time.

If the partner is back at school the childcare costs are still there for after/pre school care.

How dreams become nightmares. Now I’m closer to understanding what happened to Travis in Paris Texas.

Cause 0 outgoings but food is realistic, with a kid lol.

Two people I know are getting into the negative equity space with the "investment" they bought in 2021. They are now on the market. Good luck.

Total housing debt was still increasing in February, from $346.15 billion in January, up to $346.55 billion. In 2021 was increasing $2-3b a month. Perhaps March will see the first monthly decrease in a long time, I think that happened once or twice around 2010. Kind of race between increasing interest rates pushing one way and falling new loans pushing the other.

Another stat - current account deficit in 2022 was 8.9% of GDP, higher than the worst years of the GFC (7.8%). Average during 2010-2021 was about 3%. https://www.stats.govt.nz/information-releases/balance-of-payments-and-…

The graphs on that page really drive the point home. Wow.

I have started tracking mortgagee properties for sale. Its amazing to me that everytime I turn on trademe the number keeps dropping.

Now currently 33 and 17 for national and auckland numbers. This was 40 and 19 recently

People tend to have to lose jobs before mortgagee sales increase. Job losses (think warehouse, sky, mediaworks etc) have just started to happen now so there will be some lag before you see mortgagee sales rise substantially.

JamesM was reporting that 90 mortgagee sales were lined up through Ray White. Which obviously is just one agency. Meaning that many more than that would be handled through all of the agencies and appearing on TM

The numbers are going down not up

It takes a Bank a lot longer to get to Mortgagee sale now vs 2008....

The average number of mortgagee sales listed on trademe for NZ for the last three years is 18. So although (~33 - 40) is the peak for the last three years, it doesn't look like mortgagee sales are really kicking off yet.

Anecdotally the numbers in New Plymouth are way up, and viewings were down.

Went through some open homes on Sunday, and the quality is amazingly low (even by NZ Standards), yet still expecting premium prices.

A lot of unconsented work and idiotic rennovations. Kitchens, garage conversions, and extensions that were all clearly done for a specific purpose, but do not fit either the house or the target market. Most had terrible sections, and clearly no maintenance since they were built (outside of aforementioned dodgy renovations).

The newer houses were better in terms of build, but even <5 year old houses were noticably worn and dated. There are also some very unique layouts/aspects, that wouldn't be easily rectified.

Definitely nothing that warranted further enquiries.

In Auckland there are a huge stock of poorly maintained (renovated) houses. Think most of browns bay etc which where built in a period of constrained spending. Most of these are worth land value only or perhaps a bit more as a land bank etc..... Hence the value needs to drop a long way as developers are now offering 60% of the peak price per square m...... Plus you will need to speed 50k plus to get rid of the house unless its transportable.

The council values land plus improvements, the next round of RV is going to be brutal as Land is often about 80% plus for many of these old dunggas

Yes there’s potentially good buying opportunities for developers if they are cash buyers. But you would want to buy 30-40% lower than peak 2021 value as you say to get it to stack up.

Even then it’s a marginal development proposition, for now, in many instances.

But some developers will be able to position themselves well.

Buy the land, and start planning. Monitor the market perhaps with the intent of getting consents early / mid next year, with the possibility of marketing late 2024.

All of course subject to regular monitoring of the economy. Build costs will need to drop, as will interest rates.

whatever happens to the price of houses

the current industry structure cant supply a new one at an affordable price for many New Zealanders......and our next problem will be food

and without a crash nothing will change

but crash it will....its all built on a sandy base of widespread soft corruption and the banks

a royal commission should be held into it

Just got a quote for a build of a smallish (130sqm) moderately spec'd house in Chch. Price per square meter $7,160.

Bloody hell.

$7k/m2 doesn't sound like a modestly speced price.

What are the basic specs if you don't mind me asking. Beds, Baths, Cladding, how many levels? Flat ground with no major earthworks required?

$7160 x 130m2 = $931k. A million to build on top of land you already own?

I thought I was taking the piss when I put the rebuild cost of our place at $650k for insurance. Might have to bump it up again at renewal time.

Yes I was surprised by that but not totally shocked

I thought around $5,500 per sq m is the typical rate for moderate spec, but who knows these days. ChCh has typically been 20% lower than Auckland, too…

If it really is 6-7k then the construction slump will be even worse than I thought.

I heard the new insulation standards add 25k. Maybe even more in chch

And the windows now have to be thermally broken, and there are a heap of new rules around having to waterproof areas like kitchens and laundries plus restrictions on what you can use for flooring. I think I read that the new building code will add about $50k to a basic house.

Go back to simple vinyl flooring, floor tiles are an absolute pain and need heating which is also a big cost to install and run. Standard shower tray, unless you have to have level entry.

I haven't heard what an acceptable solution in kitchen area will look like. There was someone having a scream about it to Pete Wolfkamp on the radio

Yikes. Get a second/third quote...?

Yes, those are coming, but suspect they may be similar. Not sure if the builders are taking the piss, or if the price of materials has increased dramatically.

Hi JavaBoy.Tell them there dreamin.

Buy an existing house, don’t build

Nov '22 price per m2 for new builds - as per the building economist.

Christchurch per m2

-Basic $2,670

-Med quality single story $3,150

-Med quality two story $3,250

-Executive two story $6,890

A friend recently got a small 3m lean-to built by their shed as a wood shed, paid cash for labour and got the materials at wholesale via a friend. Still cost 7.5k and that is only for roof and framing. Majority of the cost was the materials. And we wonder why nobody sees any appeal in cold old overpriced houses.

You'll never see a royal commission of inquiry into the banking sector, at least not until it's far too late.

You don't ask questions you don't want to know the answer to.

It may not be a buyers market for FHB. Last I checked through all the unsold listings in my area, the majority were those tiny two bedroom new build townhouses that nobody wants to live in; and with investors not wanting to touch them either, they are sitting there with no buyers (while the developers slowly go broke). Whereas the number of 3 bedroom detached older homes are still selling quickly, and usually for less than the prices of those crappy townhouses.

I would have thought the new build townhouses would be great for investors, unless they are not new enough to qualify for interest deductability?

Potentially they are if you can get them at a price 25% lower than that advertised. Otherwise the yields - around 4% gross - simply aren’t good enough.

Talk of income supporting debt for investment.....well done. As you state, its a long way back for anything to stack up as a worthwhile investment.

Thats what happens when the bubble bursts and people have to actually make the payments based on yields vs cap gain..... its about 60% off peak if you do a spreadsheet

It's good to see the government have addressed the supply issues that have plagued us. The smart policies they have implemented have worked. Lower house prices, increased supply, higher wages, low unemployment. Even our comparison to difficult global strains is looking amazing. It's very hard to fault. The ghost house next door to me is up for rent after being empty for the past 8 years. Amazing news and great to see our country on the right track.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.