The housing market remains mired in a protracted slump as it heads into winter, according to the latest figures from property website Realestate.co.nz.

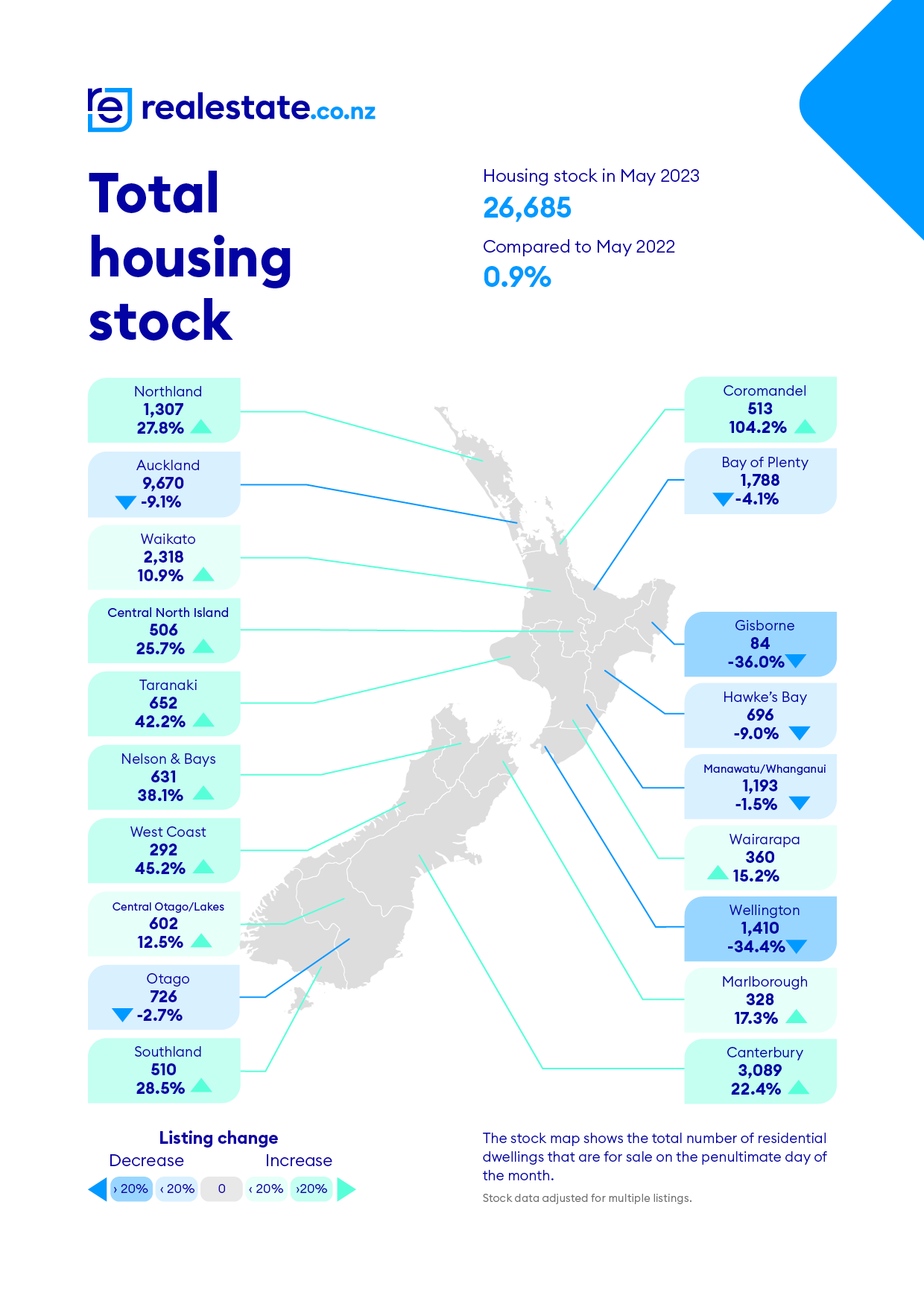

There were 26,685 residential properties available for sale on the website at the end of May, the highest number for the month of May since May 2015.

Stock levels were also up 81% compared to May 2021 when the market was approaching the peak of the recent boom.

A bigger concern for the real estate industry is that the current high level of stock for sale has occurred when new listings have been at their lowest level ever.

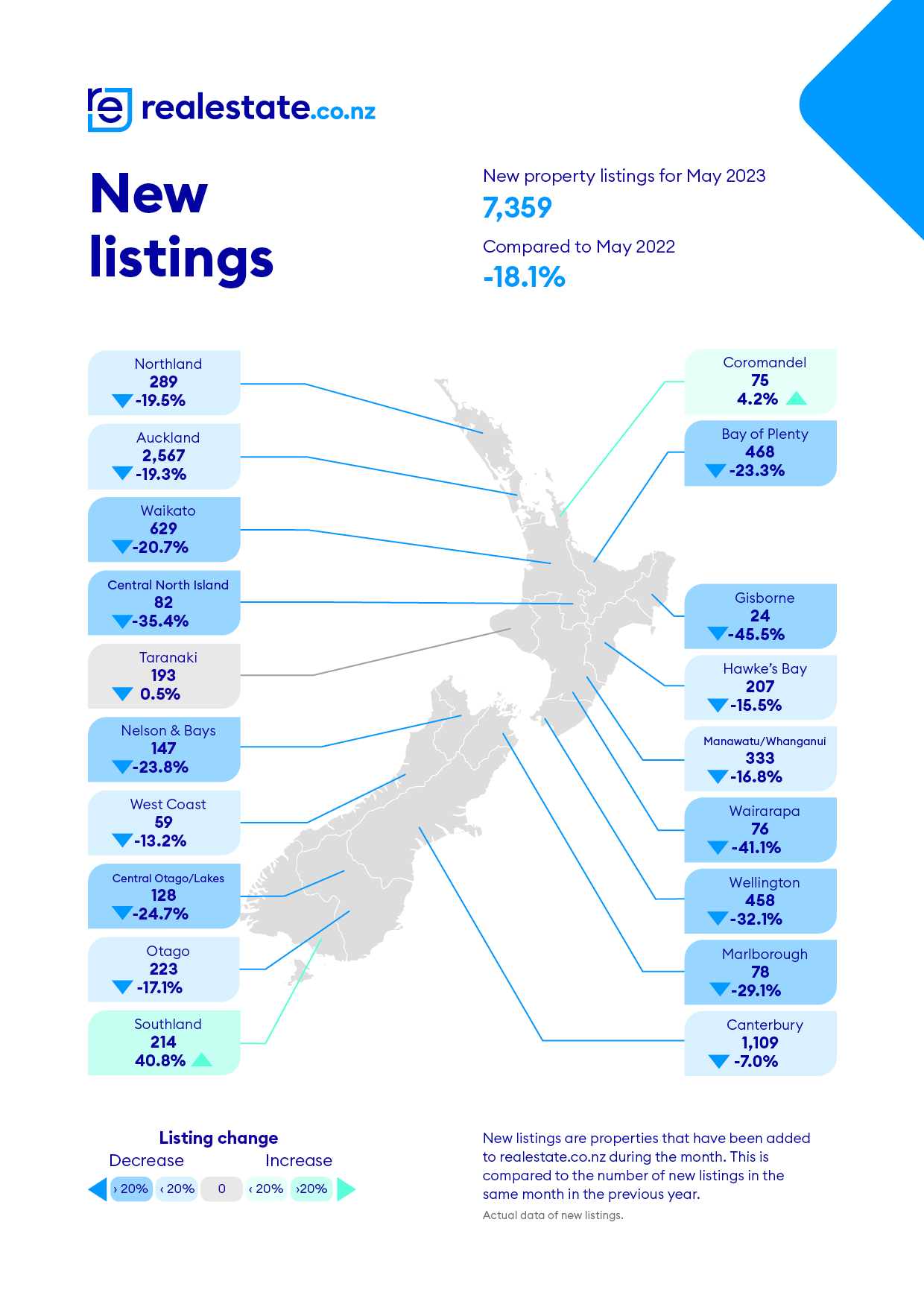

Realestate.co.nz received just 7359 new residential listings in May.

That was the lowest number of new listings the website has ever received in the month of May and was down 18% compared to May last year.

That means the number of homes coming onto the market has almost halved since 2008, which was the year the Global Financial Crisis hit.

The fact that stock levels are so high and new listings are so low can mean only one thing - properties are sitting around unsold.

Anecdotal evidence from agents suggests the biggest problem is vendors with unrealistic price expectations refusing to accept how much the market has changed over the last 18 months.

There is a general feeling among many in the industry that vendors with unrealistic price expectations need to bite the bullet and accept a lower price than they had been hoping for, or take their properties off the market and stop wasting everyone's time.

Realestate.co.nz spokesperson Vanessa Williams said the low number of new listings was a symptom of the uncertainty in the market.

"Kiwis are known for delaying buying and selling decisions during times of uncertainty," she said.

"And from interest rates to who will be in government next term, things are difficult to predict right now.

"The combined total of new listings coming onto the market nationally during March, April and May (autumn) this year was just 23,743.

"We typically see around 30,000 new listings added to the [Realestate.co.nz] site between March and May and have done so for the last 16 years, so this is a significant drop," she said.

The comment stream on this story is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

223 Comments

From an aged article by Michael Pettis (and well worth a re-read), and if we only cared to stop and take a hard look at what we've done to our economy via the Property Sector, then perhaps we'd better appreciate what's coming.

The economic problems associated with rising debt is that it can encourage and accommodate a rise in fictitious wealth . This is often the most damaging consequence of rising debt because this fictitious wealth creates distortions in economic behaviour both as it is created and, much more importantly, as it is destroyed. When this fictitious wealth is eventually destroyed, the process can occur either quickly, in the form of a financial crisis, or slowly in the form of lost decades of stagnation and low growth.

What's the solution? Thousands of rundown government-owned Stalinist flats like the old East Germany?

Not sure where you got that. Perhaps thousands of reasonably priced homes, like everywhere else in the world.

I like how the instant response to fixing a broken system is for someone to claim the complete worst case scenario polar opposite, that it will only result in a Stalin like totalitarian state with mass repression and ethnic cleansing.

...meanwhile the same people cannot fathom that by pulling up the ladder behind them they caused a great deal of the social disorder being witnessed.

Indeed. Narcissistic me me me to a T, and damn the torpedoes. Probably the same people complaining heavily about crime right, not realizing that destabilizing the basic need for shelter helps drive that. Add in complaining about poor healthcare and education, not caring that nurses and teachers cannot afford to live in main centre's anymore.

How did we get here indeed. Bank profits doing well though...

Interesting to see one set of people blaming a particular group of people and not seeing this is all by design with the mass printing and dilution of currency. Trying to fix something you don't fully understand or know the root cause of is always going to have unintended consequences. Politicians are more like activists these days with their own agendas and focused on making a name for themselves rather than actually serving the people. We are all victims, just some people are trying to be less of a victim by actively doing something rather than asking for more crappy rules and regulations that does not even come close to the root cause of the issues.

Please explain what drawbridge and who?

Your gas lighting

Probably. Private landlords who provide the vast majority of rentals have very good reason to exit/not invest

Auckland tenants who fell $62k behind in rent have to pay it back over 40 years | Stuff.co.nz

Not sure where you got that. Perhaps thousands of reasonably priced homes, like everywhere else in the world.

That's a great article, didn't understand it all, but thought Galbraith's linked phrase 'psychic wealth' rang very true for NZ's housing market.

"Vendors with unrealistic price expectations encouraged to bite the bullet on price or take their property off the market and stop wasting everyone's time". Agreed, the buyers cant pay the time wasters prices on 6.5% interest. I have noticed some advertised for over 18 months now. Interest rates will determine this market, as always.

There really should be a govt fund using t/p money to reimburse innocent scam victims. It was a good plan selling the house and hoping to buy cheaper.

'They tricked me': Scam victim who lost $330k feels he’s failed his children and wife

https://www.nzherald.co.nz/nz/spanish-man-feels-hes-failed-his-children…

What hell that family is going through.

There really are some scumbags in the world.

FYI, there are a lot of scams from people trying to enrich themselves and steal from people.

Best course of action is to be aware and remain vigilant.

1) https://youtu.be/MsYTRZSlfi0

2) https://youtu.be/iVHLiVT4eeM

3) https://youtu.be/PMenb4TU5xI

4) https://youtu.be/U4kCN7TZ6us

5) https://www.cnbc.com/2023/01/07/phishing-attacks-are-increasing-and-get…

Agreed, although 13.5% returns?

“The idea was to keep it safe."

I suspect it will continue the way it is until October. A change of government is coming and then the whole ghastly merry-go-round will start again.

Vote TOP for some kind of change.

Spot on. As a potential National voter I do find their pro-property policies very hard to take.

The property problem runs deep into every aspect of society.

Do they have any other policies other than pro-property policies? I don’t think they do….

The Labour Govt collected $22m in extra tax from their non-interest deductibility rules in FY2023. Meanwhile their spend on emergency housing has gone from $30M a year in 2018 to $365M a year (more than $1.2 BILLION since they took office). On what planet does that make financial sense?

Not to mention that the quality of housing experience for the poorest New Zealanders is unlikely to have improved by being shifted from suburban homes into crowded motel rooms alongside gang members and meth addicts.

On a planet where people became homeless because the State Housing managed stock levels fell from 67k to 63k in the 2 years prior to them taking office? 4000 dwellings no longer subject to subsidized rent. Remember all the motels raking in $2k per week? These people had to live somewhere.

The supply of social housing has decreased.

The supply of social housing is also very slow to increase.

Meanwhile the demand for social housing changes at a faster rate than social housing supply can increase. Government has to build a sustainable supply of social housing and not to have excess inventory when there is reduced demand for social housing. The temporary shortfall in social housing can be met by Kainga Ora renting housing from the private sector.

What causes an increase in demand for socialised housing?

1) rising prices in the housing market make house prices unaffordable to buy, thereby causing people to rent

2) rising prices in the private rental market make rentals unaffordable to rent - hence the need for social housing for those on lower incomes.

3) if there is insufficient social housing, waiting lists for social housing increase.

In a recession, the demand for social housing increases, as more people have lower incomes or lose their jobs.

The number of houses for social housing should rise with a rising population - there will always be a need for social housing due to lack of affordability and this cannot be met by the private sector which are motivated by profits.

If there is a change of government that will be very bad news for the next generation of buyers who may need another 200k again.

What?,!... another covid boom.?

Keep smoking the hooch mate.

The property boom has lifted the smart people and more people from so called poverdy than labour has,!

Ther are more propped up people's in the - I can't afford my dope- poverdy zone under labour thanks to Arderns " be kind/ let's sleep in my car option to get free hotels" ideological crap trap than National ever caused...

But don't let the facts feck your logic up bro

And don't let your biases and property hype get in the way of actual facts

Really 100bucks, I think Nationals proposed removing tax on rent again, moving the bright line back to 2 years, the old rock star economy trick - immigration, and tax cuts, could easily push house prices back up 200k as interest rates are easing at the same time.

Tax changes are unlikely to push up prices. Immigration will - but Labour has already opened the doors to everyone from the third world with a pulse, so I really cant see how National will make any difference to that. Both Canada and Australia have Labour (Left) Govts, open slather immigration, and increasing house prices. The only reason NZ doesnt is that people are leaving the country faster than people are arriving to replace them. A lot would have to change before that reverses, and its up for debate whether or not National even have a hope of reversing the damage that Jacinda & Co have done to this country. Any Govt changes that makes NZ a more attractive place for immigrants is also likely to make it a more attractive place for current residents. As opposed to electing the Maori and Greens and watching more people join the exodus of people to Australia.

I know people who see the tax on rent as the main factor. Therefore the election result is huge either way for property investors. The proven formula has been to have the maximum mortgage and leave it there to avoid tax on the rent, and of course tax free capital gain.

You must be smokin hootch mate. None of those policys bought the housing market down interest rates did. A change of government wont change the market.

The interest deduction plus closing off tap to overseas buyers also are a big part...all of which the Nays will reverse. Enjoy ya bong

Right-o, will do.

By voting top is a wasted vote

Yeah you gotta vote for one of the two choices who have held power ever since elections started. Thats the only way to keep them in power and make sure your vote counts...

Each election, if a new party gains a bit more support, more people see it is not wasted...

Some of us have to take the lead.

Luxon the waffler may just be capable of losing an election that National should win. His inexperience about politics and communicating with the voting public will need a lot of help soon if National is to win.

You ain't seen nothing yet

Fictitious wealth... I like that ...RE..there will be some that pumped and dumped and are waiting for the stars to re- align...alas there are also many that are carrying the can presently...plenty needs to happen to get the F.I.RE blazing again... cannot see the election outcome dramatically influencing anything...stag Nation....lol

Honestly, in this diving market, unrealistic vendors and moaning agents will be wasting each others time. Agents are the worst offenders by way of online and leaflet propaganda - I’ll give you a free appraisal, we have an extensive database of buyers, we can get you a higher price, we are local experts, see my excellent reviews, we are expert negotiators!, looking for houses in your area now!

Those free appraisals make me laugh. If you visit an open home and ask the agent what they think it will sell for they more often than not will say they have no idea.

Great point!

Typical " we're never to blame," REI to throw the vendor under the bulldozer blaming them for thier high expectations

FFS WERE DO VENDORS GET THEIR EXPECTEATION FROM.?

1. THE AGENTS SALES PITCH

2. HOMES AND ONE ROOF ALGORITHMS

3. COUNCILS OVER INFLATED COVID VALUATIONS

IM PICKING 100% THAY ARE PAYING 3 % OFF THIER PROPERTY S EQUITY EXPECTING ACCURATE GUIDANCE FROM AGENT X FROM ,,"MONEY GRAB REAL ESTATE"

Real estate agents are incentivised to suggest a higher valuation to vendors in order to get the listing.

Seen many properties subsequently not sell for the vendor to then subsequently change real estate agent.

As above agent promse the earth to get the listing. Then there is the paid agent manipulation of the property on Homes.co.nz. very visible as a massive straight line jump in the estimated price around the same time the listing was secured. Very obvious and very fake.

Accordingly the independence of that platform is a joke.

And what do you do to promote your business Averageman? (I assume you work or even better own your business). Do you talk it down and tell your customers how bad things are?

Started with and continue with the truth. Spelt INTEGRITY. What you are imply is marketing and lying are both ok because they end in "ing".

Speaks volumes....

Golden rule for every consumer is CAVEAT EMPTOR (buyer beware)

This is most important when the size of the transaction is large relative to their own net worth, and large relative to their own net income.

Real estate agents say auction is the best way of selling so they can get a half page ad of themselves and up to 6k of marketing and pick up thier fat commisions , they also over price houses and dont really care about the vendor who is selling .

I know of a real estate agent that priced a house for auction at 1.2 mill and the vendors did not accept 945.000k

Fictitious wealth? Nice term, dig deep and it’s pseudo-economics. Your house (or any other asset) is worth what you can sell it for ‘today.’ There may be a mismatch between expectations and reality but we don’t need these made up terms. Hell, Jacinda normalised ‘social licence’ and it makes me want to puke.

If you borrow against equity in your house to buy a depreciating asset (car, boat or holiday), you’re an idiot.

NZ is rife with idiots.

If you borrow against equity in your house to buy a depreciating asset (car, boat or holiday), you’re an idiot

Very well put!

For various reasons, such as the declining/vanishing equity you mention, the economy craves for these "idiots" more than ever and the service sector job losses are now kicking in. Looks like a perfect vicious cycle in the making. One only has to look at the number of "rip off" Mega home improvement stores out there. A scale geared to the boom times of yesteryear.

Does borrowing against vapor equity for more speculation during a depreciating market also make you an idiot....?

Even more so when your house is also depreciating in value.

If you want to buy a house sometime, do it this year, 2024 is going up, guaranteed!

Hello Mr agent, are you on the verge of losing your job? Don't sound so desperate

That's exactly the kind of nasty comment I have a problem with. You may not agree with his view, but there's no need to rejoice in others potentially losing their jobs.

PS, I just saw DGM doubled down on this nasty comment below, really not good.

Moral high ground again Yvil? Lets not mention your self indulgent rants. You know, those frequent episodes when labeling others here "Bludger's", "DGM's" left leaning, envious property hating rentiers then shall we?

Its self reflection time.

You forget to mention lambasting ‘NIMBYs’ on the North Shore, and yet being one himself.

So you guys think DGM's comment is acceptable?

Has your mirror broken?

It's the internet. I'm sure Harvey is not curled up in a ball because some random moniker on the internet called him a real estate agent.

I don’t really like the comment, but I understand the place it is coming from.

But I also don’t like your comments about ‘bludgers’, ‘NIMBYs’, ‘DGMs’ etc etc.

The big difference HM, is that my comment was in reply to an insulting post towards property owners, because I get tired of the constant landlord, RE agent, banker, economist etc... bashing. DGM on the other hand, starts these nasty comments without any provocation.

How about when you call people bludgers or NIMBYs?

You don’t think those are offensive terms for people who might have valid positions or life positions?

HouseMouse

You sanctimonious hypocrite.

For considerable time you have slagged-off others.

How about one being "brainless" amongst others . . . and don't deny it (as you tend to do) because I am happy to embarrass you by providing some examples.

You need to tidy up your behaviour before you criticise others

P.S. Given your behaviour "sanctimonious hypocrite" is a valid description and not slagging you.

Cheers

haha I never denied slagging off others. In fact I have been far more admitting of my human frailties, imperfections and occasional poor predictions than the likes of yourself or Yvil, neither of whom I have heard any admission of error or imperfection from. Many weeks ago I committed to cleaning up my act, and have generally complied with that commitment haha.

So it’s all ok Printer8 (the master of misrepresentation), take your sedation pills and put on your slippers, nearly time for bed. Both you and Yvil take yourselves far too seriously

Contrite and humble until the last paragraph then the old angry Fritz turned up

Youll love this too the Dow jumped 2.12 and Russell2000 3.56 percent overnight hahah House always making the wrong calls Mouse

Why dont all you poofters harden the Fork up and grow some tolerance balls .

🤣🤣🤣🤣🤣😂🤩

HM is not the one bawling his eyes out over name calling.

No, they are entitled to their opinion (the real estate fella that is). It reflects the nasty side on NZ that has developed under labour, partly through their handling of Covid.

WHAT STORM

That's exactly the kind of nasty comment I have a problem with. You may not agree with his view, but there's no need to rejoice in others potentially losing their jobs.

I'm with you Dr Y. Taking pleasure at someone else's misery is wrong.

That being said, selling houses should not be seen as an easy meal ticket. It may well be that the golden age of realty has passed us.

It's a cutthroat game now. And in the immortal words of Blake in Glengarry Glen Ross, 'coffee is for closers'.

It's funny because I would love to lose my job. Being made redundant would be a dream come true.

Zac, during your annual performance appraisal have you mentioned this seemingly evident lack of passion? Seriously Zac, you might joke about it now, its still a different reality when it happens.

I'm very close to retirement and have a generous redundancy agreement signed back in the eighties.

You're a lot closer than me (57). I tried early retirement and found I preferred work. It's a sense of purpose thing I guess.

If work gives you a sense of purpose that suggests your life is not full. Can’t you find things of value and enjoyment outside work?

Music, sport, travel, family-friend interactions? Jesus, the list is endless.

I think you've run ahead with some assumptions there. While I enjoy my work, there is weekend badminton, walks, regular bike rides, op shopping and road trips in our classic with my wife. I'm just enjoying life the way I/we want to and full employment still forms a crucial part of that :) There are some people out there actually enjoy there jobs!

My bad. If you like work, that is great. Alas I hate it and have different drivers.

Wow, I'm finding myself in the unusual position of defending RP. Fulfillment can come in many forms, and if RP finds happiness in working, then good on him. It's no better or worse than finding fulfilment in family or friends or charity or travel or sports or whatever !

So the same employer for over 40 years and generous redundancy offered when you were young. Good odds that makes you a govt or council employee. Explains how you can spend so much time here...

Nope, private company, been through many mergers, buyouts, surviving every purge. I'm unlikely to get redundancy. Computer engineer so pretty much online all the time. Working all the time, even on days off, start at 4am couple of days a week to get things done before the customers get to work.

Being online is a plus as you can work remotely. Work from the comfort of your home or pretty much anywhere you choose?

You have my respect for your work ethic ZS

40 yrs, private, multiple mergers without a new employment contract changing redundancy. A very very short list.

For a lot of the younger (naive) generation, the coming downturn is about to get very real. Nobody wants to see others lose their jobs, the impact on immediate family and the wider community is difficult to fathom. One only has to relive the dark days of 1991 under the then Finance Minister Ruth Richardson. I was employed within the banking industry at that time and I witnessed a lot of fear not only from within the bank but the customer base. Trust me, its not pretty when a deep recession hits.

My husband got made redundant in 1991, I was 4 months pregnant with our first child it was terrible. I really hope we don’t the same again.

Bwanker, I might have guessed 🤣🤣🤣😘

That disappointing comment says more about you than him.

What does it say about me,,, that I said something in jest. That you didn't recognise that says something about you??

FFS! You kids need to get a brain...

Flipping houses probably is NZs biggest industry and thectrades are kpt afloat by it. ..and it's not easy and in fact, it's quite risky,

Every year it gets harder?

Of course it's easier if you've got a rich mummy and daddy backing you, but tthen everything is easier spending someone else money. I hate the silver spooners!!

its a big risk big fail / reward just like marrige, car flipping or buying anything.

Everybody who gets on the housing train will become wealthier over time sooo...

Do you punish the flippers?... WE freaken already do! It's called the brightline test!

Do we kill the housing bubble by natural force or by new rules?

I say natural non RB/ government intervention will get the poor into houses and the rich nullified in a better way than taxing your way into oblivion

Car flippers must have a dealer's license if they sell more than 6 vehicles in 12 months. Let's license house flippers.

Let's do the opposite. Remove the BLT and let the market rip.

Oversupply= cheapest prices

Your narcissistic attitude is on display again

Do you mean because I know I'm the greatest?

Greatest what?

Meteorologist?

From your comments on this site, you wouldn't know the meaning of greatest..

Great time to scout around if you've got the cash, there's a lot of pain out there.

Is it a great time? Prices are still above pre covid.

And crashing.

Are there stats to show the "age" of listings?

I'd suggest that anything beyond 1 yr on the market is not really a motivated seller...

I'm my experience, people who not really distressed sellers , can sometimeswait yrs for the mkt to get to their price...

Plenty of people move unnecessarily because they get bored, seen it time and time again with a house I purchased and the owners moved just up the road, same with my mothers place the owners never even moved out of Orewa. Don't get it myself, takes me a few years to get the place set up and sorted then quite happy to stay for 10 years plus. Maybe now without the huge capital gains, sellers will not move as much because forking out $20-$30K in RE fees is no joke every few years.

Agree, been in same house 20 yrs. Could aspire to move to “ posher” suburb or to lower maintenance or newer but don’t need to. So not.

21 years. Emotion says ‘Buy a new house, get an extra room, more floor space. Park a nice SUV in the drive. Look like a winner.’

Rational voice says ‘ f:ck consumerism. Stay put, sleep well. Retire next year.’ Rational wins everytime with Cheetah.

1.5 years in current house, 3.5 years in previous house. Moved from 80 sqm 3 bedroom on 1/5 acre to 185sqm on 1/4 acre, closer to schools/train station etc.

Me personally, I would have preferred to stay but priorities are wife + child. Otherwise, I'd be happy cooped up in a small chicken box with a bed, food and my gaming computer.

All good reasons to move up. Family is an important dynamic.

The greedy spruikers say buy multi properties and then sell one later to pay off the debt.

Yeah that really worked,,, wait a minute.

HW2, is this your subtle way of regurgitating something that happened in the past and is guaranteed to do so in the future?

Falling like raindrops in a 1 in 100 event, fast and strait down

Do you consider yourself obsessive.

OMG that's too funny, you made my day FH !!!

TM listings are dated but the slimy RE agents relist for free to fool us

The oldest is 11 years in kerikeri. Private listing and polystyrene cavity systems.

Started 11 years ago a 509k now at 1.2mill

Yeah slimy REA

Love the headline of the article.

In simple words should be put as "Get back to your senses"

The RBNZ's meth mixed cola of low interest rates is gone. So can't be high on drugs anymore.

No change in the total listings in my area, its pretty much where it was pre-Covid. Took a big dive during lockdowns but has bounced back to where it should be. Some regions now looking pretty desirable compared to Auckland if you can escape the rat race.

I am tracking 57 houses passed in at auction yet got what I thought were reasonable bids. Excluding the last 10 as they haven't had much time to sell yet and concentrating on 47 of them I note that 18 have since sold. Four revealed a selling price so far. One just over 100k more and others 12k, 26k and 28k more.

To be honest more have sold than I was expecting. It certainly pays off for some to not accept a low bid.

Zac. Although, for whatever reason, you're unwilling/unable to post hard evidence (links ideally) to reinforce your claims, you're still a soldier to your vested cause :)

In the past whenever I posted more details and links my comments were deleted.

They were of such good quality that I was accused of being a professional.

Yes, you're certainly a professional. In the trade so to speak.

Probably a professional of concocting stories

Yes! If you don't match the sites owners thinking on such matters you are not entitled to a opinion.

Take the very average data used to paint a picture of the house auction sales it ignores more than 50 % over auctions NZ for the ẁeek.

How anybody can get a accurate vibe from this data is mind blowingly stupid

I could compile better data by googling auction results by RE agency in àbout an hour.

Take northland. The data here is one agency of 11 + auctions run each week.

I suspect it is barfoots data used yet auctions from harcourts x2, ray white x3, bayleys x2, eves x1, real x1, lj hooker x2 plus 5 other irregular auctions are run every week

Compile s new list would you 100 bucks... on a new website preferably. There was another one I heard of here, you know which one? It had hard facts to weed out the gullible

Show me the money and I'll whack one out every week.

Hello Mr agent, are you on the verge of losing your job? Don't sound so desperate

I imagine agents would really, really, rather the vendors accept any bid at auction. Makes very little difference to their commission.

Again, I'm just recounting what I observe. I am but a humble computer engineer.

Hi Zachery,

"One just over 100k more and others 12k, 26k and 28k more."

Over what?

Over the final bid that was received before the property was passed in at auction. One property got a bid of 900k and was passed in. It was then put up for sale "by negotiation". A month or two later it sold for 912k.

I've bookmarked almost 60 Auckland properties that got serious bids that were rejected.

Im not sure how you would be privy to info on sale and purchase agreements after auction. Certainly not wait till its posted/not posted on homes.co

I check B&T auctions. Note the properties that passed in with decent bids and bookmark the advert and record the bid in the bookmark. I have to wait a couple of months or more until sale price appears on on QV or homes.co.nz. Sometimes it appears on the agent's advert as well.

A really keen person could call the agent too but I don't do that.

Why do I do this? I guess it's like watching a a Hero's Journey or a Greek tragedy.

Admirable ZS

1. Use TM account and save listings. Then you get notifications every time something happens to each saved property. Price changes etc ..

2. Find sold prices via homes map red markers or try an account with valuation nz

3. I've noticed last week that Ray White have stopped publishing sold prices across all it's sites. To embarrassing for owners who have their " high expectations undies around their ankles " and the RE magazine ," slotted back and centre"

That started well but by number 3 went down screaming

I LOVE THAT your fcken nuts

Thanks, beware of the man who's got nothing to lose and a strange gllint I his eye!

Thanks Zachary. So the price over is over what you thought was a reasonable bid not CV or peak homes estimate, etc...

How far below the CV and Homes estimate were they?

Highest bid 1150K, sold 1178K, QV 1160k, CV 1250K

Highest bid 900K, sold 912K, QV 880K, CV 940K

Highest bid 1000K, sold 1026K, QV 960k, CV 1050K

Highest bid 1040K, sold 1135K, QV 1260k, CV 1475K

Was the risk of holding worth it? Certainly for the fourth one.

The prices they eventually got were not far off the highest bid confirming my feeling that they were taking a risk that I would have been reluctant to take which qualified them for my watch list.

What these figures forget is the hundreds of houses that are withdrawn from the Market

Year to year stock from 22 - 23 is virtually unchanged SFA at 0.9%

Prices are crashing still. Houses I monitor have fallen Another 10% in 3 weeks according to Homes.co s estimate algorithm which uses local sales data calculated daily. ( this fall is attributed to 6 low baĺl sales that have bee sold at well below RE expectation

Likely many expecting a market uptick are hopeful imported wealth will turn the tables , problem I see is Australia is likely a more attractive option to those on the global trot...

Go to immigration/ resident/ income site search òn stats NZ and there is no wealth coming In. Most are poor people escaping poverty? True poverty!

They are on our most wanted workers list.

They'll be used to living frugally while they pay off their mortgages then?

Zack, I think we'd all know if zero deposit,100% mortgages were back in play.

Thankfully new listings are still very low, that's a sign of people not struggling (yet). An increase in listing (if it comes) is an early sign of prices dropping more steeply. For those who think "great, I'll be able to buy a house cheaper", I'd like to point out that it will also mark the beginning of the long awaited deep recession, including job losses, and credit to buy anything, drying up.

New listings are being masked by withdrawn house.

My target area 12x unlisted this month 11 listed, 8 x unlisted the rented

Lack of listings is due to owner occupiers being unable to secure mortgage lending to buy another house. They are stuck in the one they currently have, as they will no longer meet the new mortgage servicing requirements for higher interest rates that would enable them to buy a new house. They are mortgage prisoners.

lots of stock + low buyer interest + winter energy rort + rising interest rates + taxes + high inflation + fuel levy removal + election + ? = 💥💥💥💥💥

go on punk? Make my day... buy buy bye 👋

There he is, Hemi "This Is My Last Post Ever" Te Wire.

Didn't say ever.

Who's hemi?

The mega credit cycle is now being replaced by an economic cycle. Strong employment numbers from the U.S overnight will mean the Fed hike cycle is still ongoing for 2023. Oz will probably have to hike next Tuesday due to a secondary inflation surge coming from the fuel rebate coming off. With a collapsing kiwi dollar, all time highs for NZ property prices probably won't be reached again until the mid 2040's, if we are lucky.

There's never been a property decline for 20 years in NZ. I avoid psychics like the plague, because they're invariably wrong. There's plenty of areas right now where developments are going to occur where canny punters can make lots of money.

This Market is going down like a FAT Dog on Wet Lino

🤣🤣🤣🤣

IT GUY, that's the funniest comment of week!

LOVE THAT.

Spruikers too

Can I replace ‘dog’ with Robertson? Gone come October.

Plenty of opportunity out there at current prices. Great time to buy if you check out where the next big developments are going to occur, but not much in rural towns or depressed areas. Riverhead is one of those areas where there's going to be plenty of action.

You've said it 3 times already. No one is listening, they can see the data.

By the time the doomsayers reckon property's a buy the next property boom will be over and they'll have missed the boat. Seen it several times in my life. That's how people make money, betting against the herd......it's not brain surgery.

I remember a colleague telling me prices were nuts and he would never buy when they were about 75k.

Many years ago I was about the 3rd person to build in what's now West Harbour. A suburb that has exploded in the last 20 years. As I was building my house a guy wandered up to me and advised me that "nothing will ever happen out here".

You've come to the right site, the vast majority of armchair, popcorn eating commenters here, will also tell you that, whatever you do, won't work.

Agnostium, I think you've inadvertently kicked off a Spruik fest....😂↘️

Just because our generation have made a bomb on paper, doesn't guarantee the next generation will in equal time. Why are some people so keen to trivialise the risks facing a growing number of FHB's who bought recently? Houses are for living in, not speculating on. Speculators timed their entry, To avoid overpaying, FHB's should time their entry for when speculators are in financial distress. Low ball offers from early 2024 people!

So right, hear hear

Hammer on nail

Early 2024 is when I will be aiming for to buy a home. If massive floods and storms and mother nature pummell the country this coming summer, desperate and pressured homeowners will capitulate and sell fire sale style. Interest rates won't have come down. A clean up job dirt cheap

Anyway were still under a.economic storm surge. Housing and construxtion is slowly collapsing. The farming economic arm is under the pump with the gubmint whipping their arses over climate. Its lucky for them the gubmint can't get their act together, I heard today the He Waka Eke Noa crap is not going to happen after 5 years of discussions and reports. WTF. But just as well for sheep, beef, organic and regen farmers, while the dairy guys are getting off scot free 🤣🤣🤣🤣🤣🤣🖕

But dr yvil, or drivil, your oneof then tòo. Everyone's allowed a opinion.

Wingman out down the meth and listen

Besides Auckland " labours be kind housing cluster" the market is stalled

Buy now when the market has not bottomed is shear lunacy.

The REINZ are just spinning it to create a buyers frenzy... But can't see that everybody, except you and a bunch of loonies, is waiting for the 3 month uptick inorder to be sure the bottom has been hit.

No one rings a bell when the market hits a bottom, it's only visible in retrospect. I'm going to make a killing, Riverhead is on its way, big time. Massive retirement village approved and a Fletchers consortium want to build 1800 houses....hello!!!

Get the chequebook out and join the fun.

BE QUICK

Knock yourself out bro. I use cash myself.

And there is a distinct time when to buy for the smart investors.

It's so obvious and proven to work every time. And you will now it when you see it. .. if you're either wise or experience! So I suspect you will Buy buy buy while the smart wll wait.

Get the checkbook out, but remember to keep a few leaflets back, as you will need them to wipe your a** when you know you're broke..

Not a chance, I've owned lots of properties, probably about 14, I've made money on all of them. I still own a property in West Harbour that cost $140,000 to build including land, and I've had years of rent off it.

I can't wait to get started on my next project that I've just purchased. Fortune favours the brave.

It does flavour the brave. But the more wins you have the closer to a loss you get.

Like many here we have brought and sold many houses. Timing is everything and now is bad bad timing.

Build prices will fall!

Suppliers will lower their prices to get work.

Like post GFC SqM rates will drop by nearly half.

Builde I my area are doing nothing but asking for work now.

Land prices are just starting to drop in my target area where supply is huge and demand is zero.

I'm excited about what will happen next. It's like being back in the GFC zone.

And that's not a vibe but 6 months of waiting and analysis

Barefoot and Thomson say May sales up strong from the month before

What a crock of sh1t as one month doesn't count for anything.

#skewedbythespruikers

Marketing 101, sales 101 - accentuate the positive, eliminate the negative.

Who out there has heard of Thomas Piketty who is regarded as today's "Einstein" of Economics? Nobody seems to mention him. I guess the banks' economists would be sacked on the spot if they dared mention him; the likes of Tony Alexander would be in the dole queue; the real estate industry would be on its knees.

He is the leading economist on the subject of inequality. Here is the review of one reviewer on his most recent book "Capitalism in the Twenty-First Century":

'There are some books, I am thinking of Gibbon's "Decline and Fall.." or Darwin's "Origin of Species..", that give a quantum leap in our insight into how the World works. Picketty's "Capital.." is one of those books. His forensic analysis of the vast trove of economic data accumulated over several hundred years provides the scientific basis for his analysis. His convincing conclusion is that inequality of wealth and of income fell greatly by the end of the second world war from its extreme levels at the end of the nineteenth century. This provided capital for the generation of a large and financially comfortable middle class in the post-war period. Unfortunately, with the advent of neoliberal economics promoted by Reagan and Thatcher inequality has increased to where it was at the end of the nineteenth century with consequent shrinking of the middle class and a growing underclass of financially vulnerable people.'

In a nutshell, Piketty's thesis is that capitalism possesses a central contradiction in that when the rate of return on capital exceeds the rate of economic growth, then inequality tends to rise.

I can distinctly remember that in the post-war era particularly in the 1950s, our society was definitely more equal (and egalitarian) than it is today. Our agricultural production (i.e. rate of growth) easily matched any rate of return on capital. A few people did own an extra house or a small block of flats but the rents were not considered onerous. Most newly-married couples comfortably rented while they saved the deposit on their first home.

David Parker is a big fan of Picketty, hence his recent mischievous/malignant cherrypicking of apples & oranges income comparison data for his IRD HNWI report.

Both Parker & Picketty assume an a priori prejudice position that inequality is a very bad thing.

However I myself found this review helpful a while ago

https://www.bostonreview.net/articles/marshall-steinbaum-beyond-piketty/

I'm not implying that there shouldn't be any inequality per se. I'm just wanting to start a conversation about how much inequality there shoud be.

At this very moment there is a petition going around among the uber-rich in new Zealand pleading for the Government to tax them more; the other day 97 had signed.

You can't just slam Parker. Neither Labour or National will tax the uber-rich .......both these centrist parties are wanting to be all things to all people except the underclass which never existed last before the onset of neoliberalism.

If these 97 multi-millionaires won't be taxed more, then I would suggest that they put their hands in their pockets and give $2,000,000 each to make up for the $190,000,000 set aside for the mental health but was instead given willy-nilly to businesses during Covid, much of which was obtained fraudulently as the IRD has now found out. $2,000,000 is mere pocket money for the uber-rich.

Why don't we tax everybody at 40% like the successful Scandanavian countries where there exists inequality but not to the extent it is in New Zealand.....everybody has a comfortable standard of living.

Treasury have a public bank account where the 97 can donate more money to the Govt, apparently they haven't so their stance is simply virtue signalling.

"...the underclass which never existed last before the onset of neoliberalism."

You lost me there. A rudimentary historical knowledge will develop your understanding.

"Why don't we tax everybody at 40% like the successful Scandanavian countries..."

https://www.theguardian.com/world/2023/apr/10/super-rich-abandoning-nor…

Because the wealthy and successful would leave the country.

What wealthy and successful are you referring to? Are you talking about big business people? They won't be going anywhere. Even if they did, do you think someone like Bruce Plested, founder of Mainfreight, would just wind up his business leaving NZ stranded?

They would sell it, wealthy people are very mobile, businesses can be shifted offshore.

In the 1980's there were extortionate taxes imposed on NZer's, thousands left for QLD, where then Premier Joh Bjelke-Petersen promised them a much better deal.

Hi Greg, there is another distortionary effect in these 'unsold' numbers.

These are the new-builds that are listed while being nothing more than slick architectural renders that don't get completed (if they even do) until 18 months to 2/3 years later. They often just sit with optimistic pricing until they're near completion. And of course, some are pre-sold, but re-appear just as quickly, as the pre-buyer becomes the re-seller. It's a weird market alright.

The size of these developments have expanded exponentially as well, developers have gone from building 2-3 townhouses per project, to building 6-8 per project, to building 15-20, and the latest ones in my area that are currently under construction are now 30+ townhouses. Good luck trying to sell them all at completion. The cashflow drain of 30% unsold stock in big developments (combined with pre sale buyers being unable to settle due to higher interest rates and restriced lending) is going to be astronomical. Amusingly, I notice the one that is 60+ townhouses has not yet started, and I don't think it ever will.

FYI, in Auckland, approximately 28% of properties for sale on Trademe are new builds.

CARNAGE IS COMING

Maybe you're a goldbug, they're always predicting financial Armageddon.

I have done well in my life betting against the crowd at the peaks and the lows

It's like you've got in the lifeboat and now you are shouting at those in the water, "YOU"RE ALL GOING TO DROWN!"

So...is this different to specuvestors farming debt saying"YOU"RE GONNA PAY MY RENT FOR MY TAX FREE GAIN"

Crickets...

I can't see how this is even remotely similar. However, if you think your example is bad and it is similar to my example then I must assume you agree with me that it is "a bit off".

That's right...betting against the doomsayers and economic 'experts' generally pays off. That's why those that take calculated risks in the property market are rich.

You are right wingman but capitulation has not happened the only vendors selling at market are forced, great buys are coming but not hee yet

It’s not a slump. House prices are just regressing back towards where they should be.

The number of comments on a housing article is really depressing

You'd almost think that the majority of average NZdrs wealth creation & lifetime savings was inextricably linked to housing...oh, wait...

It's not just the number, it's the "You're wrong, I'm right" nature of them as well. Sad.

Yep - it was as if our central bank made decisions for the economy to keep house price inflation going...

August 2019:

The outlook for household spending was discussed with regard to the assumed dampening impact of soft house price inflation. Some members noted lower mortgage rates could contribute to a stronger pick-up in house price inflation, which could support consumption. Other members noted that house price inflation could remain weak, for example if net immigration continued to decline relative to the number of new houses being constructed.

https://www.rbnz.govt.nz/hub/news/2019/08/official-cash-rate-reduced-to…

They had the chance a soft landing for the housing bubble in August 2019 and they blew it

Of course, the 'RE industrial complex' played their part at the time to discredit any reports of an unsustainable market and bubble

https://www.oneroof.co.nz/news/why-the-new-zealand-housing-market-isnt-…

If it wasn't so tragic for the innocent sheeple that believed the myth of a bulletproof NZ property market, it would be a comedy

Vendors need to bite the bullet or take properties off the market as they are wasting everyones time, the RE complex is now desperate, they are not being feed commissions..... They are collapsing under the weight of their expenses, meanwhile Pete Thompson spruiks green shoots

Here are a couple more from other high profile people in the mainstream media:

1) Bernard Hickey - https://www.stuff.co.nz/national/114321627/new-zealands-armourplated-ho…

2) Mike Hosking - https://www.nzherald.co.nz/nz/mike-hosking-time-to-get-real-on-housing-…

3) Tony Alexander in Dec 2021 (i.e right at the peak of house prices) - 19 reasons why there's no crash

https://ndhadeliver.natlib.govt.nz/delivery/DeliveryManagerServlet?dps_…

The other point to note is that this article has now been removed from Tony's own web site.

The extreme house price risks were preventable back in 2016 when the then Finance Minister did not give the RBNZ the tools they requested to address macroprudential risks.

RBNZ's DTI plans hit by Government changes | interest.co.nz

If a debt to income ratio of 5 was imposed back in 2017, then a significant amount of lending would not have been made (and house prices would have been less likely to have reached their record levels).

Based on RBNZ data, the lending commitments made by banks in 2021, that were on a debt to income of 5 or above were NZ$58.8bn (about 59% of total lending commitments made in 2021). For the period of 2019-2022, total loan commitments on a debt to income of 5 or above totalled NZ$99.8bn (about 32% of the total loan commitments for that period)

https://www.rbnz.govt.nz/.../residential-mortgage-lending...

The higher the debt to income ratio for a borrower, then the higher the probability of default.

Now how many of these borrowers will experience significant cashflow stress, or default?

"it was as if our central bank made decisions for the economy to keep house price inflation going"

The RBNZ has inflation and employment remits as well as financial stability responsibilities. As a result of meeting those targets, there are unintended consequences - one of which is rising house prices.

"Our job, ultimately, is financial stability, so it's the resilience of the banking sector. "

"That's not our job; we don't have a consumer protection role. We have a role which says we want to reduce the risk of a big blow up, not the fact that a few people are going to get burnt.

"A few people are going to get burnt, probably. That's what happens when you buy at the top of the market. Somebody will find it will not keep going up in the way they expected."

https://www.stuff.co.nz/business/99408539/reserve-bank-warns-its-not-ou…

Exciting to see these comments as it is very positive and means opportunity.

Read about the " 50,000 soldiers ( or Frenchman) can't be wrong" saying

market dropped 2.9% then 4% shite 6.9% in 60 days,,,, shite is getting serious now, and still vendors wasting everyones time, shite is going to get interesting to say the least... I see CV 2017 offers everywhere. By the time vendors start accepting them will will have 2015 offers or lower... this is a full on crash

You have just antoganized 100cents, ZS, Divil, FH, BHS, DD

A friend mentioned last night that it looks like I'd been lucky in suggesting property prices would fall. "So. When will we know when we've hit the bottom of this cycle, and prices start to go back up?" he asked.

"When you're frightened" was my reply, in a friendly sort of way of course. Because he's not. He still thinks it's all going back to 'normal'. And it is. Just not his normal of the last couple of decades.

Not me bro. I'm looking at a big crash... bring it!

Sorry mate, meant WM :)

Buy when interest rates are high, and that's right now. I often see comments from property critics lamenting the amount of money people make on property. If it's so easy, why aren't they doing it and getting rich? Oh, that's right, they've got a social conscience and don't want to be rich. Err, yeah right!!!

The volume of comments on this article indicate just how screwed NZ is.

There is only 1 industry in this country - property property property.

What should we be doing with our money? Give us a clue.

"Follow the money"

NZ is a low productivity country and is a basket case without capital gains and wealth taxes.

Property simply ends up being the easiest and nearest tax-free hole to dump capital.

What we have done is simply bid up land prices (not house prices).

Its one of the most wasteful and unproductive uses of capital possible.

(I'm ignoring the stupidly excessive immigration, the 40-year plunge in worldwide interest rates to historic lows and screwed up govt policy of not building enough social housing, but they are all factors as well.)

We need to get rid of the tax subsidies for property (add capital gains and wealth taxes) + add environmental taxes & relatively lower taxes on labour and companies, which actually do something productive with capital.

We also need to break up the monopolies and oligopolies which are lazy fat users of capital, so they actually have to compete and use their capital productively.

So more socialism is the answer?

Property is a legitimate business enterprise and it does pay taxes. For some very strange reason the current socialists have disallowed tax deductions on rental mortgages, and made it more difficult for landlords, and that'll be just a couple of the reasons there's 40,000 empty houses in Auckland.

What's "using your capital more productively"? Putting it into the NZ stock market which has taken a turn for the worse, or maybe "invest" at 3% return?

And lastly, if property's so lucrative, why aren't you doing it?

The tax working group showed how distorted the NZ tax system is and significantly favours property investment over other investment, although the government has wound some of it back.

https://taxworkinggroup.govt.nz/resources/future-tax-final-report.html

Socialism? - that's another argument and not relevant.

My comments were about putting capital to productive use, not bidding up land prices, which is totally unproductive and a complete waste of useful capital.

"Putting capital to productive use?" Like what, the stock market?

Haven't you seen what happens when the stock market gets overheated? I've witnessed it several times, the 1987 implosion was a classic. I went to the Stock Exchange in Queen St. in 1987, and after witnessing the excitement, yelling and overenthusiastic punters went home and sold my shares. The NZ Oct '87 crash was the worst on the planet.

It's worth noting that the Treasury was against the Government revoking the tax deductibility of mortgage interest on rentals, but the government in its infinite wisdom went ahead and did it anyway, because the Government despises anyone who takes risks and thinks for themselves. A National Government has promised to reverse it. 70% of adults in NZ receive some form of government handout. Hardly surprising is it?

BTW there is a capital gains tax.

"Haven't you seen what happens when the stock market gets overheated? I've witnessed it several times, the 1987 implosion was a classic. I went to the Stock Exchange in Queen St. in 1987, and after witnessing the excitement, yelling and overenthusiastic punters went home and sold my shares. The Oct '87 crash was the worst on the planet. "

There is an entire generation of investors who were traumatised by the stock market in 1987. Several friends lost a lot of their net worth in high flying shares such as JudgeCorp, EquitiCorp, etc As a result of their experience, and the higher volatility of share prices, many of these people have chosen to invest in real estate and stay away from the stock market.

For many investors, real estate seems a safer investment due to the lower volatility of house prices and given that prior to 2022, house prices really hadn't fallen by much and long term (e.g 50 year) house price trends were rising.

Correct, a lot of people lost the lot. It was very traumatic for many. The number of punters spending up big was huge. New cars, partying downtown, many mortgaged their houses to buy shares, they thought it would never end. Where I worked all they could talk about was which shares they'd bought and how much money they were worth. You could buy a new car, and months later sell it for than you paid for it, I did it myself. And then the chickens came home to roost. Who remembers Ray Smith's Goldcorp?

Houses don't suddenly evaporate and become worthless, like many of the shonky, overvalued shares touted in those days. Even in the bad times there's pockets of real estate that have lots of potential. Real estate is something you can manage yourself, not rely on a faceless bureaucrat on a company website.

"a lot of people lost the lot. It was very traumatic for many."

Going to be the same result for many who bought residential real estate in NZ in the 2020-2021 period. This will cause mental stress. Some of these buyers will never recover financially, and unfortunately, some will resort to self harm (similar to those who experienced large losses in the stock market crash in 1987).

TD in Argentina gives 53% return last time I looked.

Marry a argentinan and 💥💥💥💥👌🎯

Mate it is getting very hard to make a buck in this country. Looked at re entering the workforce a few months back and the pay that was disclosed at the second interview was terrible so I took a pass. I have noticed that in the last few months things have really got tight, which I anticipated to a degree due to election but the vibe out there is not good. Property has been a winner, the house earns more than you do in most cases. Even with the recent falls its been a fantastic long term investment.

You can probably blame that on Comrade Ardern and her red fed mates, the almost total destruction of the NZ economy.

Labour have totally screwed the pooch but there is a chance they will get back in so what does that tell you about the average Kiwi voter? Yep pretty stupid which is where we are where we are now.

Correct. Them and the Greens!

it aint over yet next will be

1} the fed will have to raise rates as the us economy is strong and corporate lead inflation is strong

2) this coming northern hemisphere fire season will be bad but as el nino kicks in the aussie fire season will be disasterous

3) because of ) nz rates will rise4

4) house prices are unaffordable now!

"Stop wasting everyone's time"?!!!

Do they actually mean stop making RE's have to work for their pay?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.