The latest sales data from the Real Estate Institute of New Zealand (REINZ) delivers mixed messages, with sales volumes declining further in June but prices rising slightly.

The REINZ recorded 5629 residential property sales nationally in June, down 4.1% compared to May, suggesting market activity remains at a low ebb.

Sales volumes usually decline from May to June, so in that respect the June decline was not unusual. Although June's sales were up 14.6% compared to June last year, they were still down 9.0% compared to pre-pandemic levels in June 2019.

The national median selling price was $780,000 in June, unchanged from May, but down 8.2% compared to June last year.

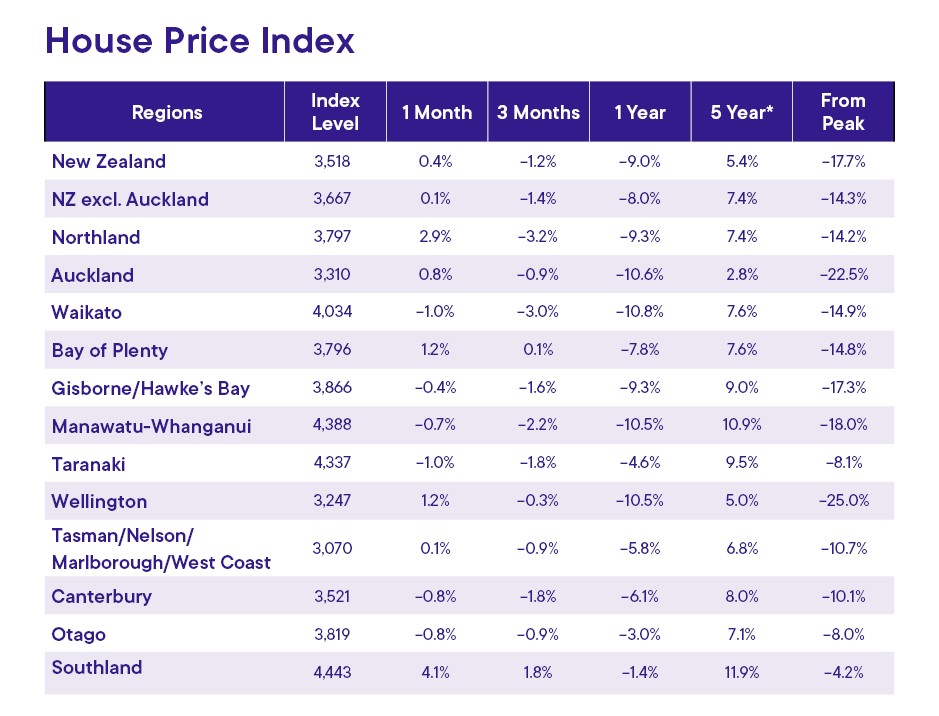

However the REINZ House Price Index (HPI), which adjusts for differences in the mix of properties sold each month, was up 0.4% nationally in June compared to May.

The regional HPI figures were evenly split. Six regions (Northland, Auckland, Bay of Plenty, Wellington, Tasman/Nelson/Marlborough/West Coast and Southland) posted rises in June compared to May, and six regions (Waikato, Gisborne/Hawke's Bay, Manawatu/Whanganui, Taranaki, Canterbury and Otago) recorded declines. (See the table below for the full regional figures).

There was also less stock on the market, with a total of 24,676 residential properties available for sale at the end of June. That's down 7.5% compared to May, and down 6.1% compared to June last year.

New listings were also down, with 6218 received in June. That's down 15.5% compared to May, and down 21.2% compared to June last year, suggesting vendors remain hesitant about selling.

"Salespeople across the country are reporting increased first home buyer activity at open homes with the easing of LVR [loan-to-value ratio] restrictions that came into effect on June 1, bringing more people out looking," REINZ Chief Executive Jen Baird said.

"Although activity has increased, caution remains as interest rates, a pending election and further strain caused by the cost of living tempers putting pen to paper.

"In the three months ending June 2023, 15,934 sales have occurred, a 1.2% increase year-on-year.

"A lack of listings and the challenge of navigating the current economic climate are putting pressure on the market.

"Commentators say there are harder times ahead, but sales are still happening, people are still making choices about where and how they live and these choices necessitate a property transaction," she said.

The comment stream on this story is now closed.

Volumes sold - REINZ

Select chart tabs

Median price - REINZ

Select chart tabs

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

172 Comments

Lump trading conditions but overall HPI up slightly. Wow.

Lest not forget all the spruiking that took place after the last MPC, with calls that the ocr will drop by the end of the year.. all that talk was put to rest yesterday..

Nothing was put to rest yesterday. Yesterday was exactly as signalled previously. You and I must read different information.

Isn't that obvious...

What makes you think talk of easing by the end of the year was put to rest yesterday? RBNZ are not going to come waving a big white flag at this stage. Kind of like when they all said rates would remain low for several years. You have to look through the posturing.

Maybe the article just released regarding the fruit and vegetable prices will make you rethink..

I doubt it, the RBNZ would have already known that fruit and vege prices would be high this quarter.

Personally I think the next CPI will be a shocker (maybe even over 7%) but once we get some normal growing seasons food inflation could actually go negative. The fuel tax is also a one off. So the CPI after the next one could be much lower. But that is a long time away...

Not at all. Only data that materially differ from what I expect make me rethink. USD will continue to depreciate from here. Employers have already tightened up on CPI pass-through, so shocks like fuel excise reinstatement and fruit and vege will have a negligible effect on wages. We are well-and-truely in contractionary territory and all RBNZ need to do is give the perception that they'll stay the course from here. The job is essentially done.

I thought you promised to drop the "spruicking" talk, dgm?

Does the cap suit you?

Property Brokers Realty Still Frantically Advertising on the Radio here in Hawkes Bay for Salespeople to Join.

Thats all I need to follow where things are going.

Timmy is getting desperate, might be just a ploy..

Play a game with their jingle at the end of the ad: try to change station before the word "country" is finished.

https://seekingalpha.com/article/4574170-what-goes-up-comes-down-bubble…

It's always sticky on the downside

There's a well-worn psychological path in the collapse of bubbles. This path more or less tracks the Kubler-Ross phases of denial, anger, bargaining, depression and acceptance, though the momentum of speculative frenzy demands extended displays of hubris and over-confidence, i.e., the first wobble "must be the bottom."

There's also repeated spikes of false hope that "the bottom is in" and the bubble is starting to reflate.

This pattern repeats until the speculative fever finally breaks and all those betting on a resumption of the bubble mania finally give up.

So I guess the debate will soon become whether we are retracing covid bubble or previous

The thing to note is less stock on the market as greedy vendors are waiting and watching in hope that they might get a better price if they wait

But interest rates on the up and cost of living eating into the savings of the people, the more they wait, the less they will get.

If vendors sell now or sold 3 months ago they earn more interest on that money than waiting and will sell for less at a later stage.

Wait for a glut of properties to come into the market this spring. Buyers will be able to cherry pick at a price they want.

Not necessarily “greedy” vendors. Nobody wants to sell for a loss.

Or they could wait for 10 years and likely get a much higher price with the mortgage much reduced.

To me it makes no sense to sell in a depressed market.

It’s not depressed, it is being reset.

Depressed suggests it will bounce back. It won’t.

Oh look, the media manufactured dead cat bounce.

Oh look, a dgm valiantly ignoring figures that don't suit his narrative.

Because all crashes are straight down with no little recoveries in-between, right?

Mega mortgage cliff coming later this year, prices will keep falling.

Not seeing it, we are at or very near the top of the mortgage rate increases, the market isn't being flooded with houses for sale, the only thing that is slightly supporting your narriative is the increase in mortgage arrears, but its not at a significant level historically.

There’s a huge portion of low interest mortgages still in circulation, also factor in a the people that have refinanced their mortgages are in the early days of meeting their payment obligations. You can only sell so many toys.

There’s a huge portion of low interest mortgages still in circulation

There may be, but what's the value of these mortgages?

And that's the issue, some of y'all see this 'mega mortgage cliff, as if most mortgages are based on purchasing in the last 2-3 years. When the reality is there's a spectrum of debt on property, with a few that'll be costing owners a lot more, but most with far less exposure.

So probably less 'mega mortgage cliff's, or some sort of metaphor involving a tsunami, and instead probably more of a paddling pool.

Meanwhile there are wage rises rampant, inflation is waning, and we are most likely entering a recession.

Have noticed at work that we are starting to see reps from companies we haven't dealt with in a while drop in looking for work again, and existing suppliers following up on quotes a lot more.

Pragmatist, interest.co membership consists of a random cross section of society. One only has to look at where the upvotes are leaning to get an idea of how little confidence there is in house ownership at the current price point.

Que Pa1nter with the narrative interest.co is saturated with Doomers - LOL!

Random? lol, not even close to random. If the commentors on here were truely a fair random representation of the general NZ populace then the amount of mentions TOP gets on here would put paid to all the wasted vote comments, they'd be a shoo in with a double digit party vote percentage.

Pa1nter is not wrong.

I think you're overstating not only your presence but the numbers that share your belief.

and Vice versa.

If it helps, keep telling yourself that :)

Thisd be a random cross section of society if it were 1860s migrants.

Its rigged goddammit - its rigged!

Its high time you just admit that all you're armed with is hearsay.

Whatever it is it seems to have you fairly aroused.

LOL! - You can talk!

Hearsay it is then.....#fullofcrap

It's unfortunate that many commentators on housing issues behave just like low class soccer fans, shouting in favour of their team, being house prices up/down with hardly any regards to what is actually happening on the field. It's really unhelpful in being able to assess neutrally what is actually happening.

Yvil, are things really this boring for you in Bali? Honestly, this is more robust back and forth debate than anything else. Like others here have already commented - practice what you preach.

Totally agree - the fact this guy bailed for 2 years in shame only to show back up when the wind blew his direction. i lean bearish on property - but seriously the nerve.

Fergus, your comment is factually wrong. Other than heavy COVID related work commitments, there was no shame involved in my absence whatsoever. It was a particularly difficult time and I guess sometimes there is simply bigger priorities (like saving lives) than posting here on the interest.co forum. I hope this helps put your mind at ease.

I've been labeled a coward, gutless you name it but your "but seriously the nerve" - priceless :)

Jesus - you work for the government dont you. Double shame.

Why would you expect Int.co to be a fair random representation of the general NZ populace?

TOP has only featured in more recent times. Their policies are smart and smart people read Int.co.

Those that attack TOP policies are do so from a me me me perspective, not from the wider good approach.

That is why I support TOP. Personally their polices would hurt me. But it's not all about me.

For all members of the public there is no selection process involved in obtaining a username here. None of you has come up with any proof membership is heavily biased - beyond hearsay.

Sorry if this fact fails to tickle your narrative.

The selection process is 'are you interested in economic news stories'. This is quite a stringent test.

There is absolutely no way that Interest readers or commenters are representative of the population of NZ.

Yep, it's like saying a Yoga class is a random cross section of society.

Interest.nz users seem to be mostly middle class white males. That's not random.

And that is the selection process for the readers, there yet another selection process for the commentors and upvoters. People with far too much time on their hands might be one factor. :)

Agree.

Anyone who's does uni stats knows how in limportant (and hard) it is to get a sample representative of the whole.

I don't, and it isn't

re ... "Pragmatist, interest.co membership consists of a random cross section of society."

A random cross section of society? Seriously?

Best statistical laugh-out-loud moment this week and there's been some absolute howlers this week.

Whos opinion is prevented from being heard on this public forum? Can your opinion step beyond the realms of hearsay?

Open access is not sufficient to get a representative population. Anyone is free to go and climb Mount Cook, but if you look at those who actually do it you will find they are not representative of the population as a whole.

More generally - the onus is on those who claim to have a representative sample to convince everyone else this is the case. In my world there is never an assumption that a sample is fair - you have to work hard to acquire such a sample or to prove that you have one.

mfd, yours is the best unbiased response thus far. I think those who argue this forum is saturated with Doomers seem do do so out of desperation. Its like they're overwhelmed in the face of what they interpret as being "negative" opinion of a select few. These negative opinions could easily present positive life changing opportunities and experiences to others.

Glad to have a fellow commentator here that's savy with at least stats 101

The arrears seem to be trending upwards. Also note that not only the percentage of mortgages in arrears grew, but a group of borrowers whose nominal values are significantly higher, historically, are also the ones who are more affected by the increasing interest rates.

Who are a very small number of households, compared to the rest.

Yes, a small group compared to the 2 million or so dwellings in NZ. However, is a big group when you compare them to those who will be willing and able to purchase.

Perhaps there is a middle ground to consider. The OCR stays over 5% for the medium term and over that period we get a change in government. Outside social reasons (schools, death, marriage, divorce, job) those are likely to be the two largest factors which influence a decision to enter their property market. I see a 12 month period when we see an improvement in confidence on the back drop of expensive credit. More people will buy and sell as there will be a small amount of pent up demand. Sale volumes will rise a little but prices will stagnate in keeping with the cost of borrowing.

Are we then, got a source? Because for some that have done their research, the first cliff is Sep - Dec this year and shocks will be going through to the end of 2024. We are just getting started. https://aucklandpropertyrealitycheck.substack.com/p/auckland-wellington…

Good news for hard working multiple property owners - back on an upward trend!

I'm a hard working property owner, why is this good news for me? At best I think it's irrelevant.

Did you mean to say 'multiple property owners'? They are the main cohort that benefit from rising house prices.

nothing like holding a basic human right over those in a lower wealth position than yourself, kudos to your hard work!

Up 0.4%. That's margin of error stuff, like $3k on the median of $780k.

But I suppose when the monthly falls have been 1 - 2% it's a huge swing in the other direction, and a ray of hope in dark times.

Yo ho ho and up she rises....

Harvey, UM - NO.

It's now. Prices have bottomed. Buy now. Be one of the smart ones that bought in 2023.

Like I've said here before, we are firmly in a down trend and it would be foolish to expect that every month would show a decline from the previous. Is this trumped up price floor sustainable - highly unlikely. I already own my home free of debt, I see no need for owning multiple properties so falling prices won't keep me awake. Saving FHB's should start making lowball offers from early 2024. Those who followed your advice and bought in 2019 - 2021 are likely suffering increased mortgage stress along with increased insurance, rates, you name it. Not a nice trap to find oneself in. The fallout from this episode of greed is only just beginning.

Nope. The problem is house replacement cost. Successive govt have made it very expensive to provide both land and dwellings. There will have to be an equilibrium between cost to build and selling prices, and it means prices will rise, starting this year.

Perhaps the land value just goes down to compensate? Especially in places like Auckland where land has typically made up a greater % of the cost of an average house.

It would be interesting to see what's happening with the value of bare sections. I haven't seen this data reported anywhere though.

Land value won’t come under the same pressure as it is often help by those with little debt and/or has income potential without being redeveloped (existing buildings).

Also, land value can only drop so far. Most feasibilities with a zero land value still don’t stack up.

Building costs need to come down or there are going to be lost of people sitting around next year.

Is the GFC was anything to go by the tradie's workforce will either retire to their bach, or relocate to building work in Aussie. None will be sitting around, its not in their nature.

Those poor sops, who get spruiked by the discredited Oneroof squawkers like Tone the Comb, etc and buy into the "this return to normal" phase of this still unfolding crash, will lose all of their cash in the next year or two.

After this RETURN TO NORMAL..... she is a long way down.....

Boom / Bust Chart...Where do you think we are on the curve... (activerain.com)

Don't buy until we see DTI of 3 to 6x. Pay Higher and you are: The Greater Fool.

Simple.

Don't buy until we see DTI of 3 to 6x.

Easiest way to get there, is get a real job that pays well. :)

LOL

Isn't it quicker and more effective to have the economy provide me a more productive job and much cheaper houses automatically?

How would "the economy" do that exactly?

Don't sully the dream by getting specific.

:)

so true. that's how I did it

But that graph you link is way too old to be relevant today. It's from 2007 and......ah...now I see.......

Yes good spotting, are on the edge of another 2007........but worse this time, with a much bigger bubble (only hist out a little air, still a slobby bubble) and MUCH MUCH MORE Dangerous, incendiary Debt.

Long term real house price trend puts the 2007/8 crash into perspective. Note also that no 'real' change in house prices between 1975 and 2002.

DON'T FORGET TO ALLOW FOR INFLATION!

The "2007" chart linked above shows a bubble scenario with inflation removed. The NZ dollar graph will look way different. If the graphs in this article were corrected for inflation they would not look the same.

The real reason the NZ government is printing money and giving it away like there's no tomorrow is because they know the only way out of this mess is to devalue the NZ dollar. By devaluing the NZ dollar, house prices can come down without the house price in NZD actually changing. MORTGAGES GET DEVALUED TOO at the same rate as house prices, people don't get into negative equity and have the illusion that their houses are still worth the same. Interest rates could get crazy though. Hyperinflation is a risk.

I don't see NZ house prices in NZ dollars actually changing much from here. BUT the graph of NZ house prices PRICED IN GOLD will look exactly like the "2007" bubble graph linked above. What we are going to see is an NZ dollar price crash so the house price crash will be mostly invisible to most people due to pricing houses in NZ dollars.

Even the NZ dollar price crash will be partly hidden because NZ dollar is priced in other currencies which (to some extent) will all be devalued too.

If you want to see what's really going on then you need to correct all the graphs above for the true rate of inflation. The easiest way to do that is to price everything in gold. A graph of house prices (or anything) in NZ dollars is completely meaningless because the value of the NZ dollar is changing more than the value of the house.

One poster noted a few days back that "If you think it's dead, shoot it one last time to make sure" and that, is what the RBNZ failed to do in May. Perhaps we are about to see what a mistake that was, as the Property Market resumes its Devine right to always go up and with that continue the decline of the debt-soaked New Zealand standard of living.

I agree. Aussie, US and UK are spending large out of their public purse to reindustrialise their economies, while NZ reaffirms bipartisan support to preserve the housing Ponzi at all costs.

I see the brain drain out of NZ picking up pace in the years to come. Don't let the government fool you into believing the net positive migration is a good news story for our economy.

Chefs, deck hands, builder's labourers, cafe managers, retail supervisors and farm workers took the top spots in the 12 months to June 23 on number of work visas by occupation.

I have a very smart friend who works for the government in economic development. He works very hard but is always broke because he doesn't get paid much contrary to the rhetoric by the National party. He's just been on a trip to Sydney where all the Kiwis he met were asking him why he is still in NZ when he could earn double over there (yes in a similar government job). I've lived in Sydney and am encouraging him to go and I am in favour of all young Kiwis to got to Australia. NZ doesn't deserve them.

This country doesn't care one bit for young people. We have lower incomes and houses prices should be lower too but they aren't. The most important thing in NZ is to ensure Mum and Dad investors "get ahead" and stuff everyone else. National will only make this situation worse.

Absolutely right. Every time we come close to a market correction event that could readjust house prices and living costs to the average Kiwi's purchasing power, authorities intervene with mass migration and stimulus (both fiscal and monetary).

This pivot away from exports and investments towards household and government consumption is not going to end well. The writing is on the wall with cost of essentials still rising fast. Politicians choosing to ignore it completely won't stop until they turn NZ into the next South Africa and jump ship.

Average kiwi can afford to buy in the provinces. All over the world, houses in major cities are beyond the reach of the average punter.

I have a very smart friend who works for the government in economic development. He works very hard but is always broke

Perhaps he's not that smart after all?

Please do explain why you think that in further detail Yvil. I don't see how anything I've said could suggest he isn't smart so please enlighten me.

If he's smart why hasn't he figured out how to either earn more, or live within his means and build a reserve fund?

You don't always move to Australia as soon as you graduate, most people gain some experience in NZ first and student loan interest gets expensive while overseas. He does live within him means but with his NZ govt income and cost of living here there isn't much left. He's very frugal actually and does save some but nothing like he would if he was in Australia.

Again nothing here to suggest he isn't smart.

We must have different interpretatiosn of "he's constantly broke". What you said above does not marry up with what you said earlier.

Ok some people may hear 'constantly broke' and think they have to go begging on the street of something. I'm not talking anything close to that.

Jesse, your friend works in the field dealing with money, yet you say he's always broke. So he may not be so "smart" dealing with money after all. Can you now see the correlation?

Working in economic development for the government isn't dealing with money. It's not banking and finance. Maybe you're the not so smart one.

Sorry if I hurt your feelings Jesse.

Still: "Economics: the branch of knowledge concerned with production, consumption and the transfer of wealth"

"Wealth: an abundance of possession or money"

Haha no hurt feelings here Yvil. You've completely missed my point and gone into a silly tangent so this is a waste of time.

For Yvil, smart = financially successful.

For Yvil, anyone who works in a job (or have a business) that doesn’t pay top top $ isn’t ‘smart’. So we can count out a large chunk of the population, including all the people who contribute to the public good (teachers, nurses, doctors, police, academics etc etc). Oh, I guess we can also count out many highly talented artists, musician etc.

He has a very narrow and materialistic view of what ‘smart’ and ‘success’ means.

Some commentators on this site (usu dwelling in the same industry) equate smarts with making lots of moneys

Also, it's important to note that smart people have it all figured out and are successful in all areas of life because, you know, Michael Jordan never missed a shot and all those analogies

The fact that you can't see your friend isn't smart but some random guy on the Internet has figured it out also says a lot about you and nothing about them. We all need a little more certainty and a tad more judgement in our lives, that's what real progress is made of. Curiosity and understanding are for silly people like your friend, may he stay forever broke as a token to the greatness of the smart people around us. Because, if no-one's stupid like your friend, whom would they have to compare favourably to?

I have a friend. Works for the government. Lives frugally. After basic living costs and student loan payments there isn't much left. And this makes him stupid? Then you are implying that I'm stupid for not seeing that my friend is stupid? WTF? No wonder this site ends up with just the same people commentating everyday.

The only country more obsessed with property than NZ is Australia (and maybe Canada). Over in Australia investors still have the benefit of interest tax deductibility, depreciation, a 50% discount on capital gains taxes and a 6 year CGT exemption for renting out your family home, and .... get this. ... you can still offset rental property losses against your personal income.

And despite all this, Australia still manages to offer a better standard of living to its citizens. So maybe property investors aren't the problem and demonising them is not the solution?

Well let’s see how well it works out for them

https://www.facebook.com/reel/321492716870685?fs=e&s=TIeQ9V&mibextid=nL…

There was a news report of a leveraged owner occupier in Brisbane, Australia who came under cashflow stress and chose to self harm and damage the property at the same time. Unfortunately more leveraged owners under cashflow stress will choose to self harm.

Property prices ain't gonna 'return to the good ol days' for 20-30 years - possibly longer.

Why? MDRS, NPS-UD and I expect even more intensification as people get real hot as the planet continues to warm.

Think I'm wrong? Prove me wrong. No one has yet.

Think I'm wrong? Prove me wrong. No one has yet.

You keep asking people to disprove a prediction, which is an impossible thing to do without the passage of time defined by the prediction itself.

Leave the line out, and your point still remains.

I have already proved my "prediction" by referencing the flatline in the REINZ graphs of medium prices between 2016 when the new Unitary Plan came out and 2020 when RBNZ inspired madness caused one of the biggest property bubbles the world has ever seen.

It is not a prediction. It is most likely a fact. I will not leave the line out. Facts matter.

But people still believe property prices will return to the good old days and post comments that are likely to mislead?

Are they stupid? Or are they charlatans?

Maybe I'm reading your posts wrong (it happens, I'm fallible), but it seems to me what you're showing is the effect of the rules on the past few years, and extending that into the future, making the assumption this effect will hold true.

Which is what property spruikers did with price predictions, and they were right for so long, until they so demonstrably weren't.

I don't think anyone is going to seriously try and challenge an unknown by offering another unknown.

MDRS is gone-burger if a Nat / Act government is formed, which is more likely than not.

Take a breath before next downward tumble

Auckland is up 2.8 percent over 5 YEARS. WOW! Less than half percent every year is not worth the risk.

The 5 year column is CAGR - average return per year rather than total over the 5 years.

Still very anaemic for an asset that barely supports itself through rents (or at current mortgage rates, likely bleeds cash).

You are kidding!

Those are rock solid returns for everywhere else

Some are over 10 percent pa. Southland up 75 percent over that time

Yes, it's crazy - you can check the graphs in here, and the table shows the * in the 5 year column signifies 'compound growth rate'.

https://www.reinz.co.nz/libraryviewer?ResourceID=581

Southland index value from ~2200 in 2017 up to ~4400 now.

Some will look at that and think 'let the good times roll', others will think 'what goes up dramatically can also come down dramatically'. I wonder who will be right.

Compared to wages house prices are still way over valued. The people who did manage to get a mortgage over the last 3 years and now see that purchase drop around 20% will now be on the hunt for for another emergency level mortgage rate when refinancing but most will be looking at a 50% rise on monthly payments, this will create huge financial problems and finally sink housing market.

Don't forget the impact of debt leverage with DTi flagged for April 24. Oh the humanity.. spec crowd will actually have to have some equity.

by Flying high | 13th Jul 23, 10:16am 1689200203

Auckland is up 2.8 percent over 5 YEARS. WOW! Less than half percent every year

FH and all the people who upvoted his comment, stop embarrassing yourself with ignorant comments like these. Read and learn first! 2.8% is a yearly rise over the last 5 years, so including the steep fall of the last 18 months. To help you see clearly, 2.8% compound over 5 years is a 14.8% increase.

Yvil can't you see what you are doing.

You are giving fuel to all the f'ing spruikers, by just emphasising the better returns on property. If I had realised that it is compound rate I probably would not have mentioned it, as people like Housemouse will be having kittens (apology for the analogy)

Sssshhhh please.

Lets not consider further declines at an end.

Elsewhere in NZ mortgage cliff approaching, more new housing stock completing construction, inflation still on fire, 13400 existing tax generators to Australia, a number of some significant job losses announced - we received some back no doubt including more 501s aka tax leaches. Elsewhere in the World US and UK central banks indicating further interest rate rises, Chinese banking system requiring yet again a massive CCP money injection to stay afloat.

Your bias is showing.

There is absolutely no biais. I simply corrected a mistake with the correct number. Simple, factual, no biais!

A question for all ...did I hear correctly that the amount of money in bank savings accounts and term deposits was almost equal to the total mortgage book in NZ ?

If so, what will happen, is there will be further reductions in price, until such time these saved funds come out and put a deposit down for a purchase of a property BUT only IF and WHEN the numbers stack up and a gross rental on the purchase price of at least 7% to cover ALL the costs

So for the Auckland market, your $1,000,000 damp, cold sh*tbox would have to rent out at $70,000 pa or $1,345 per week .....totally ridiculous ! ..and how much of that would come from the taxpayers pocket. !

This market has been totally overblown and even though prices are dropping, they are still totally stupid

Anyway, where's TTP et al ? I'm sure they could "spin" my figures above, and bring out something positive - because this market needs it !

Maybe I'm thinking about this incorrectly, but shouldn't it be basically an identity that mortgage book equals savings accounts? If I took my savings and took out a mortgage and bought a house, that money would go into some other guys savings account. Both sides of this equation should be equal, right?

A question for all ...did I hear correctly that the amount of money in bank savings accounts and term deposits was almost equal to the total mortgage book in NZ ?

The sheeple are led to believe that banks lend out deposits like an intermediary. But no. In fact, no. When banks make loans, a fictitious customer deposit is created. The bank 'pretends' the borrower has deposited the money.

Judging by the number of posts on various NZers in Australia Facebook pages, the mass migration is about to start.

Aust Govt's new policy of making easier for kiwis to obtain Aust citizenship is another turbo charging factor!

Agreed. path to being a legal Aussie is the big draw card for those thinking about it. I expect to see a very good chunk of our best and brightest youth to pack their bags and relocate their future tax paying effort to the Aussie tax jurisdiction.

Kiwis in Australia that don't have an Australian resident spouse aren't required to pay tax on capital gains on shares and overseas properties. Once they get permanent residency this benefit goes away so it's actually best for some to not apply for residency and citizenship.

That is not 100% correct, there is time limit and after that you will be considered fully fledged taxpayers. I've been through this with my Tax specialist when we sold our family home in Auckland.

Why just young people? Now citizenship is available, there is nothing stopping older people with families from leaving as well. Get your kids into a school where they dont spend all day doing Maori singing and dancing, learn to speak proper English, study actual Science, and are citizens by the time they graduate so they enrol in a real University and not an indigenous apology for one. If you cared at all about the education of your kids, you'd be on the next flight out.

Then there are the retirees who also now qualify for citizenship. Why would you risk getting sick in this country when its basically a death sentence, especially if you are European or Asian.

Also oldies with kids / grandkids in Aus.

Extremely sceptical of this data.

I've noticed a very deceptive tactic being used by Real Estate agents of delaying the release of the sales price for a property if it sells below value, but immediately releasing the sales price for a property that sells for a higher price or relatively high price relative to CV. I suspect this is intentional data manipulation by the Real Estate agents to limit/weaken the data influencing pricing decisions.

Any metric which is used to inform public sentiment in a market is always bound to be manipulated. Goodhart's Law in effect.

Price Punishments will continue for Housing Spruikers until the lesson is learned.

I've been noticing that too.

I'm with you, VM.

You could try the following interesting exercise: Search Homes.co.nz for houses that sold for less than $150 in the past year. You'll see that Barfoot & Thomson made hundreds and hundreds of sales for the spectacular price of $0. Is that perhaps because the house sold for a 'weak' price and they realised that the algorithms ignore sales where the price is entered as $0 (with the algorithm probably assuming this was a typo)? Am I a cynic for thinking they're doing their unscrupulous utmost to try and keep the 'value' (lol) of houses as high as possible?

Desperate times call for desperate measures, I guess. Best to remember that before relying on any data provided by those with vested interests in the property market.

When its this Baaaad. "THEY JUST HAVE TO LIE"

Com'on, stop being ridiculous guys. In short you're saying "if the data tells what I want (being prices to drop) I believe the data", "if the data says the opposite of what I want (prices going up) the data must be wrong". How narrow minded is that?

It is more that you can delay release of bad data till 3 months after the sale where it blends into the wider trend rather than the month by month trend. You can sort of infer this by the significance of the drops in the 3 to 6 month range vs the month by month.

If say some sales were delayed to make a month look better, it just means that the following month will look worse by the same amount. Just think about it.

Except what matters in the minds of the people looking for a win is the month on month. Human beings do not understand geometric or compounding numbers intuitively.

Sure, you're right, when the numbers say what you don't believe, the stats are wrong. Good luck to you, making decisions based upon these one eyed assumptions.

It is the same logic that influences massaging jobs data with 'seasonal adjustments' where the month by month data is often out of sync with the wider trends. Same reason that people don't believe Chinese GDP data and use Rail Volume, Electricity generation volume and so on.

In short you're saying "if the data tells what I want (being prices to drop) I believe the data", "if the data says the opposite of what I want (prices going up) the data must be wrong". How narrow minded is that?

I'm saying there's an excellent reason why researchers are supposed to declare any conflict of interest when publishing research. Also, only a fool would lap up research published by those with vested interests.

For example, if Kelogg's funds and publishes mountains of research articles 'proving' that 'breakfast is the most important meal of the day', then you should believe it at your own risk. Duh. (See https://www.theguardian.com/lifeandstyle/2016/nov/28/breakfast-health-a… for more info.)

I work with relatively large datasets every day and can assure you that having a vested interest in something changes the way you think about the data and probably how you analyze it, if perhaps only subconsciously. You might not intend to lie about the results, yet fail to see something pretty obvious due to your biased view and end up publishing rubbish.

People see what they want to see. It's human nature. And marketers will try to show you what they want you to see. That is the nature of marketing.

When I search for $150k and below I get no results?

Are you searching for Sold houses? Try to zoom into on an area over Auckland, as B&T sells more houses there than in the wop-wops.

Try this to see many: https://homes.co.nz/map?lat=-36.84759&lng=174.77632&zoom=11.41&filter=t… (Although I find this to load very slowly and you might even have to refresh if it times out - probably because there are so many houses to draw on the map.)

"You'll see that Barfoot & Thomson made hundreds and hundreds of sales for the spectacular price of $0."

Interesting. Here are a few such examples that I just stumbled upon.

i) March 2023 - https://homes.co.nz/address/auckland/mount-roskill/6-marshall-laing-ave…

ii) April 2023 - https://homes.co.nz/address/auckland/new-windsor/24-trevola-street/yyXNQ

iii) May 2023 - https://homes.co.nz/address/auckland/sandringham/30-halesowen-avenue/BE…

iv) May 2023 - https://homes.co.nz/address/auckland/mount-eden/4-35-esplanade-road/DX5…

v) June 2023 - https://homes.co.nz/address/auckland/wesley/295-mount-albert-road/9kWb

Anyone got any other examples?

1) Why are they recorded at zero? are these not yet settled? are these conditional sales? long term settlement period? other contract terms not yet met such as subject to financing, subject to their existing house being sold?

2) How does that impact the REINZ house price index?

Probably because of this

30 Halesowen Avenue

5 Bed | 2 Bath

CV: $1,875,000

Sale Date: May 2023

Sale Price: $1,050,000

https://www.facebook.com/photo?fbid=675108931300088&set=a.4533751801401…

Here are some more:

1) April 2023: https://homes.co.nz/address/auckland/hillsborough/18-stephen-lysnar-pla…

2) April 2023 - https://homes.co.nz/address/auckland/blockhouse-bay/36-endeavour-street…

3) May 2023 - https://homes.co.nz/address/auckland/blockhouse-bay/85-lynbrooke-avenue…

4) May 2023 - https://homes.co.nz/address/auckland/te-atatu-south/122-tiroroa-avenue/…

5) May 2023 - https://homes.co.nz/address/auckland/massey/25-triangle-road/DgrZv

6) June 2023 - https://homes.co.nz/address/auckland/blockhouse-bay/75-lynbrooke-avenue…

7) July 2023 - https://homes.co.nz/address/auckland/mount-roskill/5-battersby-avenue/8…

This place sold in Dec 2022. Publicly disclosed sale price is TBC. Long settlement? Change of policy by B&T of reporting numbers?

https://homes.co.nz/address/auckland/mount-eden/2-1-rahiri-road/E19x

Who knows. I can deal better with 'TBC' than with '$0', though, as there might at least be valid reasons for the 'TBC'.

How long could they delay it for? It would only cause a really bad month later on.

Three months by law. So a sale made today below par won't show in the data till October.

Three months by law - can you tell me what website a sale price has to be listed on by law? Thanks.

It gets recorded at Linz, who record all title transfers.

Thanks for a balanced article. It seems the various sources who claimed the market is bottoming out were right, for now anyway. I still think there is further weakness to come in price.

Agreed. It does look like it is bottoming. (But bottoms often look like that.) And yes - the pain has just started. Lots more to come.

New listings were also down, with 6218 received in June. That's down 15.5% compared to May, and down 21.2% compared to June last year, suggesting vendors remain hesitant about selling.

What low number of listings really suggests, is that vendors are not (yet perhaps) in a tough situation where they have to sell.

Also likely vendors holding on for brightline tax free sales window. Mortgage cliff coming so lets see how the new twelve months travels as those two realities fight to meet in the new middle.

That Brightline expiry is an interesting one. In IRD eyes, are such examples automatically absolved from paying CGT? If people are waiting for say their 5-year Brightline period to expire to dispose of property, and do so, I would have thought that still presented a case under the "intention" criteria for IRD to assess for CGT.

https://www.ird.govt.nz/property/buying-and-selling-residential-propert…

Just putting it out there.....

Intention is only relevant at time of purchase.

Yes correct. There is a wealth of information in the above link that many are blissfully unaware. IRD are no doubt expecting many flippers will try selling just outside their relevant Brightline period. Even outside the Brightline, IRD can still assess the vendor for CGT.

so what was that nonsense above about then?

It might seem like nonsense to you and its telling you didn't even check the information from the link before commenting. Have you considered the many ways that IRD investigators can utilize technology to establish intention?

"Nonsense" - LOL!

Wow, look at those timestamps.. typical RP retrospective editting. :)

Are you still blissfully unaware? :)

I was talking to someone this week about house price falls and they seemed blissfully unaware even though they owned a rental property. Suddenly they looked pale when I told them about the 300k drop in 18 months. I wonder if most people are like this and it is only us here, we few, we unhappy few, who are aware of the awful truth.

by Zachary Smith | 13th Jul 23, 3:20pm - "we unhappy few" - don't be so hard on yourself.

When comparing to 2019-2021 pricing, FHB's will be on a much sounder financial footing by waiting for the desperation to set in before purchasing next year. This as a positive development.

We've all witnessed the greed. The many naive who purchased in 2019 -2021 at stupid prices with dirt cheap money are discovering home ownership is becoming unsustainable. Lets witness the fear run its course and provide the next (hopefully more educated) generation a decent chance at sustainable home ownership within a more stable market.

'it is only us here, we few, we unhappy few, who are aware of the awful truth'

Aeschylus comes to mind;

He who learns must suffer. And even in our sleep pain that cannot forget falls drop by drop upon the heart, and in our own despair, against our will, comes wisdom to us by the awful grace of God.

It's only just sinking in for many in my water cooler conversations.

First mortgage refix cliff coming up in September:

https://aucklandpropertyrealitycheck.substack.com/p/auckland-wellington…

This is a bump not a trend. Price falls will continue.

The increased interest costs do have offset interest income.

The bigger hits are losses in value.

It still feels like winter at our place. No sign yet of the warmer weather. Keep your thermals close.

Strange, there's no mention of Tony Alexander in today's threads, I wonder why that is ?

There was, NZ Gecko mentioned 'Tone the Comb'.

Perhaps because TA has become less and less relevant to anyone as his predictions continues to fail?

NZ had a net migration gain in the year to March 2023 of 65,000. That to me means that house prices are about to stabilise or even increase....in some areas...not all.

Building firms are going to the wall and the number of consented houses is down.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.