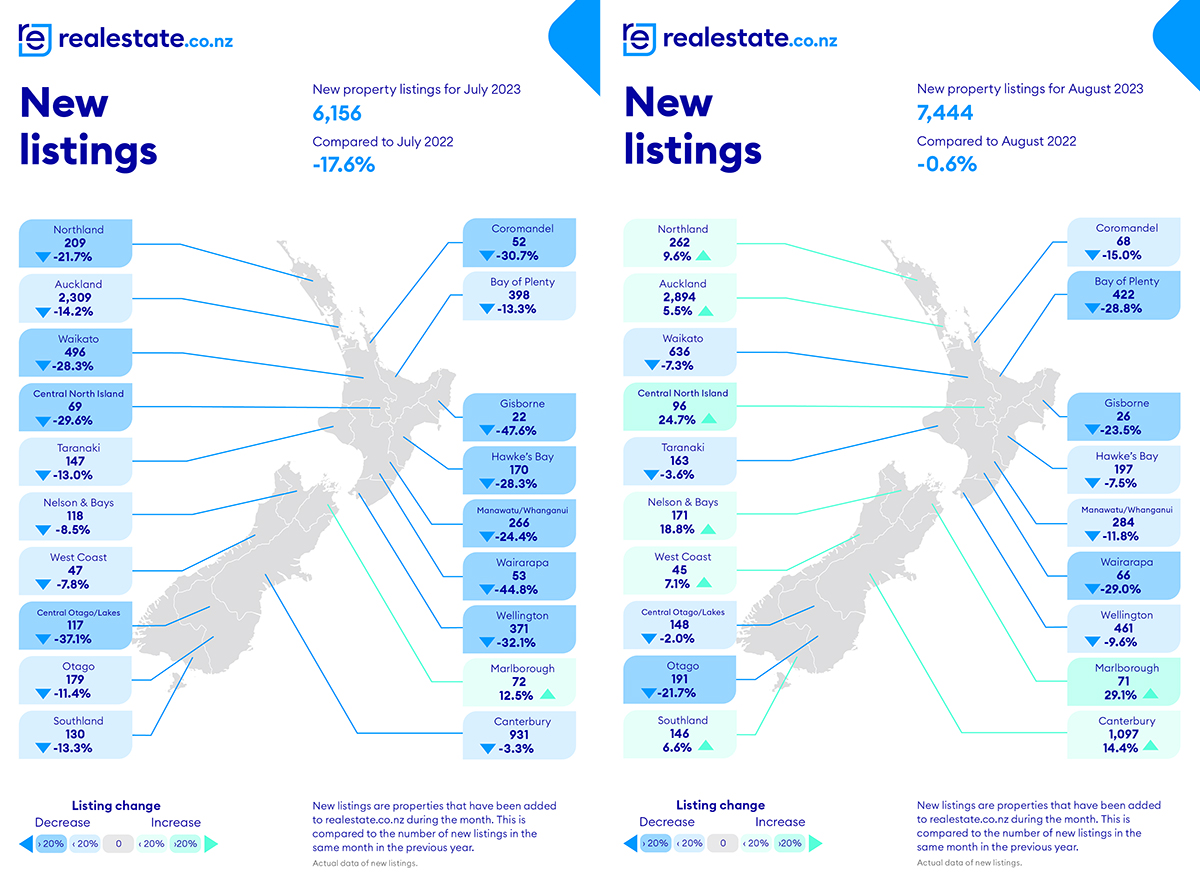

Property website Realestate.co.nz is grasping for "green shoots" in the housing market, noting after 10 months of double-digit, year-on-year falls, new listings nationally fell just 0.6% in August.

"It's a bit early to say whether the tide is turning, but we have some 'green shoots' coming into spring. Vendors are perhaps ready to step out of winter hibernation," Realestate.co.nz spokeswoman Vanessa Williams suggests.

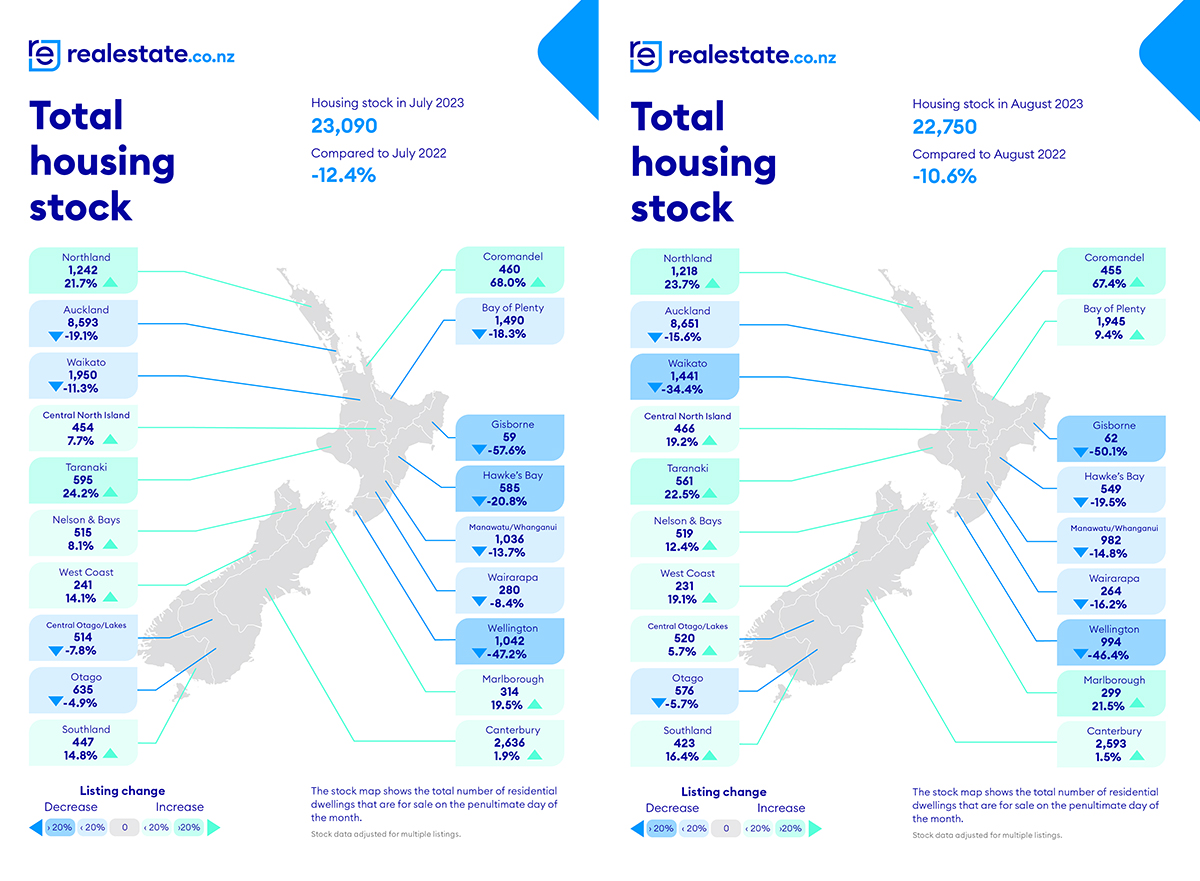

Nationally, eight of 19 regions recorded an increase in new listings during August, compared to just one region - Marlborough - in July. The regions where new listings increased versus August 2022 were Auckland (5.5%), Southland (6.6%), West Coast (7.1%), Northland (9.6%), Canterbury (14.4%), Nelson & Bays (18.8%), Central North Island (24.7%), and Marlborough (29.1%).

Williams notes the lack of new listings over the past 10 months is eating into the total pool of properties available for sale, with the national stock down 10.6% year-on-year during August. The total number of residential properties available for sale on the website dropped to 22,750 in August from 23,090 in July.

Across the country new listings in August totaled 7,444, down 0.6% year-on-year from 7,492. That comes after Realestate.co.nz received just 6156 new residential listings in July, the lowest number of new listings the website has ever received in the month of July.

"At the beginning of this year, we saw high stock levels and low new listing numbers. This is a symptom of a slower market where it takes time for stock to cycle through and reflect the lack of new properties coming onto the market. Month-on-month, stock levels have been trending downwards since March this year," Williams says.

"The total number of homes available for sale nationally has been in decline for almost half a year; over this same period, we have also seen the national average asking price trend upwards."

Realestate.co.nz reported a national average asking price of $872,942 in August, down $59,995, or 6.4%, year-on-year from $932,892, but up 0.7% from July's $866,743. The Auckland average asking price fell $119,744, or 10.1%, year-on-year to $1,064,970 from $1,184,744, and rose 1.3% from July's $1,050,820.

"Kiwis are continuing to slip off their shoes and into open homes. We're seeing more people searching for property on Realestate.co.nz, and the number of homes for sale by auction is on the rise," says Williams.

"Spring is typically a time for new growth and beginnings... Although with the election right around the corner, the growth might be gradual as Kiwis wait to see what happens with the government."

89 Comments

They seem to be saying more new listings = higher house prices....? Or am i misreading that?

Listings are way below average down here, it looks like we are still in a full Covid lockdown. I wouldn't confuse the number of homes for sale with the price. More homes can still mean higher prices. More homes or a sudden huge jump would indicate distressed sellers and obviously we have not yet seen that either.

And what were the lockdowns for?

From which we have not recovered

Yes FE, they're implying more listings = higher house prices, which is ludicrous.

Dead lamb bounce

Auckland, 150 more listings vs Aug last year. Thats not a flood of newbuild listings, or is it.

LOL.

The unemployment is on the way. Chat about good times ahead will need to find a new home on sites frequented by liqidators, repossesors, and receivers.

Auckland up 1.3% strong result for middle of winter. Bodes well for Spring and onwards.

As predicted really. Everything above is what I said weeks ago. The Election is throwing the spanner in the works but as more and more polls indicate a National/ACT government the faster the recovery. 3% to 5% house price gains in 2024 if National get in.

If National get in, then quite possibly. If Labour remains, no green shoots.

So comes down to...

Labour voters will be renters, FHB's, anyone who believes there should be more to our economy than selling property to one another.

National voters, will be RE industry related, property investors & developers, older generation who need to sell large property at top $$ to retire comfortably.

Tug of war of opposing paths and generations.

The housing market is on borrowed time. If this is truly the bottom, then I'd say that the decline has put the shivers in a lot of retirees looking for their god forsaken right to a million dollars. 2026 won't have the same boomer support for the housing market. They will be more concerned about inflation.

Everything is on borrowed time, it's just the duration that's the question mark.

Unless the country enters a permanent downwards economic and demographic trajectory, like your Italy's and Japan's, the current trend will likely continue till that point.

Nothing wrong with Japan. Doesn't work in some peoples theory, but works in practice.

There's a lot wrong with Japan. Low wages, increasing migration.

There's a bunch right with it too. But the barrier to entry is fairly hard, if you're not Japanese.

Italy's pretty buggered though.

I love Japan, and have Japanese family but it is strangely "fetishized" as a country in many respects - perhaps because it is so different to many other countries that it is easy to be caught up on the mystique surrounding the Land of the Rising Sun.

The work culture is whack, all sorts of demographic issues etc.

That being said, lots right with the place too and it somehow all seems to tick over.

The 7/11s, vending machines and Don Quijote variety stores everywhere count for a lot too ... what I'd do to be able to buy a can of coffee for a dollar instead of paying $5.50 for a small flat white these days.

Agree, there is some weird fetishisation. Along with lots of good things, plenty of problems. But in my opinion its strengths way outweigh its issues.

Lack of crime. Respect. Things that are missing in NZ

Japans depopulation is unprecedented. Interesting times ahead

Today's million is worth yesterday's half million.

.

Here’s a thought. FB marketplace has property for sale and there are other sights as well. Are these becoming significant yet and undermining stats such as new listings?

I wouldn't think so, however if you have a camera and half a brain you can likely sell a property yourself and not pay the RE fees. Uneducated RE agents are plentiful and it shows.

I understand that a Nat/Act government would offer a lifeline to the property market, but can an it really counteract the high (and possibly rising) interest rates?

Sentiment is important so perhaps a little bit. But at the end of the day, and critically, the cost and availability of finance isn’t changing, so not much.

Who is paying for that lifeline? Our children.

Not sure, but they've budgeted on about doubling the demand in the 2m+ space so there will no doubt be a trickle-down effect for the squeezed middle and their houses.

Nope. Interest rates are whats causing the giant downwards pressure on the market, and nothing national has planned can change that.

I've just listed a brick and tile house with harbour views for auction in a great spot in Auckland.

One of the websites advertising it has had over 2,000 hits and there were 14 inspections in the first open home.

The agent has described the interest as 'crazy'.

I called it 6 weeks ago, prices up by 5% by end of this calendar year.

Maybe I can be the new prophet?

yup, 5% profit, just like a a TD, it will be deposited in your bank come Christmas :)

November for me, cannot get it to roll over from 5.3% to 6%+ fast enough now.

You would be more optimistic than me, I will pick prices up 5% by Christmas next year.

I would be very happy to have house prices decline a lot - a lot - more. The price explosion of recent years is New Zealand's greatest social disaster, reaching into every corner.

(disclosure. I fully own two houses. Not rented and I use both.)

Agreed. It's not just a social disaster, it is a gross misallocation of capital. It leaches from investment in productivity. It creates a zombified economy, shambling forward by recycling housing equity.

But just think how much rent money we would have if we sold all our housing stock to overseas buyers!

Yeah nah you wouldn't. Nothing stopping you selling them tomorrow for half of what they are worth and that goes for everyone else out there virtue signalling. Form a Facebook group and all get together and crash the market.

Same here. Someone needs to ask Luxon and Hipkins should any new zealander on the average wage be able to buy a home, when they say yes ask what value of lower quartile house they would consider affordable in Auckland for example. Press them to give a number. When (if they don’t it’s not a good look) they do give you a number ask them to tell you what the average wage in NZ is and what the house price to income ratio would be. Then ask how far do house prices need to drop to reach an affordable house price to income ratio.

Adrian Orr is changing his mower engine oil, spark plug and sharpening the blades for those green shoots.

Just a reminder, that the RBNZ is expecting further house price growth, but is going to sit on their hands at the current OCR. "RBNZ has upgraded its expectation for house prices markedly, with RBNZ now forecasting a 9.5% increase in house prices over the two years to the end of 2025, compared to just 0.4% previously." ref https://www.mpamag.com/nz/news/general/more-react-to-rbnzs-rate-pause/4…

Now would be a good time to introduce those DTI limits, but inaction will see affordability decline yet again. I'm seeing most listings go to auction now, and plenty selling over RV (set in 2022) in Canterbury.

So many things wrong with NZ on so many levels but for many as long as house prices are rising it is all good. We really are a twisted bunch.

No more twisted than Australia who are so addicted to negative gearing it is a sacred cow. National are going to turbo charge property so get on board, no more lefty meddling for a few years at least.

Yep, I've spent $1.225m buying 2 acres in an area on the outskirts of Auckland where there's going to be lots of development.

Whereabouts roughly, anymore left?

Outskirts of Auckland?

Probably Paihia.

Riverhead - subdivision sold out.

Great views, elevated, north facing, a stream and pond, can't flood, 2 minutes to Riverhead. 200 meters from the Coatesville boundary, the most expensive suburb in NZ.

Yeah but you have to live in Riverhead

Riverhead's cool, lots going to happen there, I've done the homework. Average house price in Coatesville is over $3.8m.

Realestate.co.nz doesn't really care about prices. They need listings.

No listings, no steak dinners.

Smudge62 go to New York Toronto Vancouver Homg Kong Dubaj London Sydney and its pretty much the same everywhere Honk Kong the most exspensive alot of the angloshere cities and countries prices went crazy when Chinese could move their money overseas like Vancouver family there have be complaining about prices immigration etc for 20 odd years pretty much what is said here in little old NZ it's just not here

I can feel a sense of optimism oozing through the pixels about house prices. I'm not really sure why in light of the carnage happening in China. But anyway. It fits in with my engagement with people at the water cooler. The general 'vibe' is as follows:

Will be a little tough for a while but around 2024 normal transmission will resume - new govt, supply / demand, boatloads arriving from China and India

But maybe their intuition is on the money. Who knows? Another related 'green shoot' is that one of the distressed craft beer brands has found a buyer. Craft beer is a pure 'good times' economy play.

There's only something like 80m empty apartments in China with a falling population. They will be fine. Hang on...

dead cat twitch.

I really hope this is wrong, my wife and I have been waiting and hoping for a pull back for so long and it would be devastating if this it....... Prices have hardly moved in Taranaki.

I hear you, my advice is to vote Labour. (You could almost say National is an offshoot of REINZ).

Go for NZ first. Labour is going to lose by a landslide - that's pretty clear already - but Winnie might squeak in, and he's the one that's likely to cause the most consternation for any government, letalone a National-led caucus. Seymour can handle Winnie, but based on what we've seen of Luxon I reckon he'd be pasted all over the beehive walls.

In terms of house prices, though - certainly a shift from this horrendous Labour government will produce a spike in confidence. Paired with the fact that we haven't really seen any carnage in the (lower case l) labour market there's bound to be a bounce. But with all the bad news coming in from every angle, I can't see how that confidence will last.

Our primary exports are all going out of favour simultaneously. China's 'rebound' appears to be faltering, and they're defaulting on foreign debts already. The banking sector in the US is looking shaky. Commercial mortgage backed securities are looking increasingly like a risky proposition. Europe's a basket case on energy security. The warmongers in the US seem intent on turning the Russia/Ukraine conflict into a multinational war...in fact, is there any good news at all?

A landslide loss for Labour will mean that National will not need NZF. I'm hoping like hell that NZF do not make the 5% anyway.

It might be a bad night for labour but the left block will still do well although won’t win. With Raj and TOP likely to lose Ilam it all comes down to winnie taking enough of the right block to curtail the Nacts plan of selling this country off to the highest bidder.

I really hope this is wrong, my wife and I have been waiting and hoping for a pull back for so long and it would be devastating if this it....... Prices have hardly moved in Taranaki.

Don't worry, some of the soothsayers on here will reimburse you the balance of how much they said your new house would cost you, any day now.

What if the poster actually can't afford a house at current prices and isn't just waiting to get a discount?

Then they were mislead into thinking the price dropping would make them more "affordable", because their income is now worth less also, and the cost to borrow higher.

Looks like New Plymouth prices are heading to 10% below RV in the last two months... slowly softening..

Meanwhile, in the mighty US of A, applications for home purchase mortgages have dropped to their lowest level since April 1995.

https://www.nasdaq.com/articles/mortgage-applications-drop-to-lowest-le…

US mortgage applications may have dropped but house prices most certainly have not. Whereas in NZ Covid created an opportunity for 5 year mortgages at 2.89% in the USA 30 year fixed mortgages were on offer at 2%. Millions refinanced to take advantage. Currently they’re making 2% in real terms on their mortgage. Hence nobody is selling so nobody can buy. The pent up demand is bursting at the seams, but with higher interest rates developers are struggling for financing. Many are bridging at 12-18% praying for rates to start to fall. Meanwhile and this is very tongue in cheek given their recent history, Zillow are predicting 6.5% annual increase as of this week. It doesn’t sound like much but many parts of the country experienced 60% gains over 2020-22. Hence, FHB’s here are far better off than in the USA with little hope of a solution without Uncle’s Sam’s intervention with Fanny & Freddy.

Cheers. biggest takeaway is that existing homeowners in the U.S. cannot afford to move. So without a new buyer cohort, mortgage applications will be low. The millennials are so tapped out with debt, they're hardly going to be able to service mortgages.

Nailed it

I'd like to know how house prices are going to fall when the cost of new builds is always on the way up, with inflation, materials, labour and compliance costs going through the roof.

Same reason a second hand car with miles on it is going to cost a lot less than a brand new model.

Not if you keep it up to speed, carry out regular maintenance and ensure the property has kerb appeal.

There's lots of old houses and villas in Remuera, the price hasn't dropped there, has it?

Well, I'm taking Toyota Starlets and the like, not E-types or 911s.

Those are 2-3x more expensive than they were a couple years ago.

Something to do with diminishing ICE fleet, I forget now.

I know, don’t remind me, I should have bought a 911 I had my eye on, with low kms, 8ish years ago.

I was talking more about the Toyota

Lol.

In saying that, I keep an eye on rarer vehicles, and notice a rather large increase in expensive Kombis for sale.

Which is the sort of unusable vanity vehicle people ditch when things get tighter.

They still want crazy money though.

A dog poop on a nice Remuera section would be worth a few million, and keep it's value quite well. No maintenance required, well maybe mow around it once in a while.

Wait, what were we talking about?

Because the price of houses has an inverse relationship with the actual mortgage cost? It doesn't really matter what they cost to build because new builds make-up a tiny fraction of the market and developers have to sell at the market rate.

How? Land prices that’s how.

Its the land value that is falling. As vacant sites produce no income, but have a holding cost, the cost to hold has increased a lot recently. Some will have to sell their development sites, or subdivide and sell off land, to capitalise on the value increase. In this kind of market, the number of people in the market for land to build on, is pretty small.

The vast majority of a house value is the earth it sits on. Land values are hugely inflated.

With most new houses it's closer to 30-40%.

The values of the land are relative to the amount of competition fighting over them.

It's a great time to trade-up or buy somewhere for the kids, but it is a crap time to trade down... so I'll stay put thanks!

By the way, anyone who thinks that mortgage rates are going higher is not paying attention.

Everything has to trend back towards ZIRP Jfoe. If not, the economic model as we know it is toast. If I'm wrong, kiss goodbye to the 7-10 year theory.

It's year 15, innit?

Mortgage rates have been increased in the last 7-10 days.

Are you saying they are not increasing from 1st Sep onwards?

I don't know what mrs Wiliams is drinking, but an increase in listings does not mean an increase in price.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.