In what ASB economists describe as "an important watershed", for the first time in 18 months, more Kiwis are expecting house prices to rise than fall.

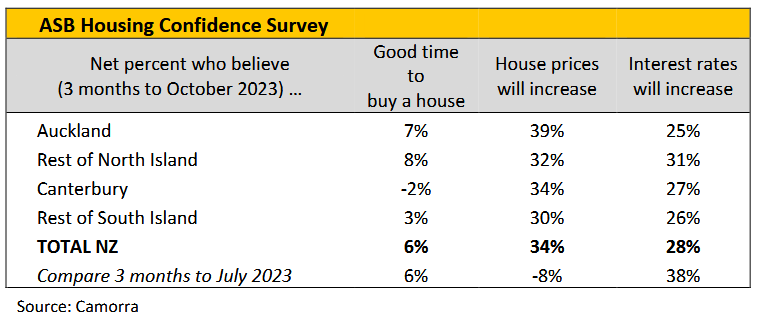

In the ASB's latest quarterly Housing Confidence Survey, ASB economist Nat Keall says a net 34% of New Zealanders expect housing prices to rise from here.

That's up from a net -8% reading in the previous survey and a net -43% reading - IE a net 43% expected falling prices - at the start of the year.

"...This is the first time since April 2022 that those expecting prices to rise has outstripped those expecting them to decrease - an important milestone," Keall said.

"With recent data generally showing prices no longer falling, Kiwis tend to think the housing market has reached a turning point. We agree, though there is plenty of uncertainty in terms of how strong the recovery will be," he said.

"Aucklanders continue to be the most bullish in their house price expectations, in a continuation of the theme we saw last quarter. That remains unsurprising, given housing market activity has recovered a little bit more swiftly than elsewhere in Godzone. That said, this quarter’s shift is very much a national story."

Keall said with net migration proving extremely strong and housing inventory stabilising, the main constraint on the housing market at the moment is the high level of mortgage rates.

"Kiwis don’t seem to anticipate much of a shift on that front just yet. While the net balance of respondents expecting further interest rate increases has shrunk a bit, that looks to have largely been driven by an increase in the number of people expecting rates to stay the same, rather than increase. Just 15% expect much of a fall in interest rates in the near-term. Again, we largely agree."

Keall said Kiwis are still split on whether now is a ‘good’ time to buy.

"Our poll took place at a time of heightened uncertainty, with the election campaign in full swing and the parties setting out their housing market policies. With the tax and regulatory landscape coming into clearer focus, we’ll soon get a better steer on how Kiwis are likely to respond."

ASB economists agree that prices will rise from here, though they expect this house price uptick to be slower than the last one.

"Housing market activity measures appear to be lifting slowly off a fairly low baseline, despite a recent pause over the election campaign. Housing demand has had a big boost from stronger net migration and supply isn’t keeping pace. On the other hand, interest rates are still in deeply restrictive territory, acting as a major constraint on activity," Keall said.

38 Comments

Well I hope not.. Last thing we need is yet another Boom in house prices..

I don't think anyone is talking about a boom. 1-6% in 2024 is the range that most commentators are picking.

"It's only wafer-thin"

“Alright - just one”

Unfortunately, price increases are the most sensible that way we can ration the shortfall of houses in New Zealand......

Unless you favour some heavy-handed form of state intervention.

TTP

Hefty taxes on second+ houses and Airbnbs seems like a more 'rational' response.

Or build more houses….

Taxing people that have more than a week’s worth of food at home as well. Increase supply and prices won’t increase (provided houses can be built at a reasonable price)

Fix why building houses is so expensive. That is why house prices go up so much. Without doing that you are just deciding who to screw over.

The heavy handed state intervention already exists, in the form of restrictions on where and how we build. Take those away and introduce robust DTIs and we are gold.

I've been reading increase in unemployment, interest rates staying the same, more distressed home owners, business's looking at redundancies. Plus houses are so unaffordable its not funny.

Most kiwis think house prices will go up.. luckily most Kiwis are not that bright. See the FB investors page for evidence of my statement.

Yes I just had another scroll through there just now. There's one post where, it appears, the person has their 3.5 investment properties and primary residence under LLC's. I imagine they've done this to claim deductions against their primary residence. Just don't let IRD find out!!!!

They want to buy a $250k piece of land for $200k, but despite having $2m of assets churning $85k p.a. they have $20k to their name, are self employed and have a bad credit rating due to "putting a tenant's power in their own name" so need recommendations on places who will lend to them.

sounds like a crook

The problem is if enough people believe in something like this they will be willing to pay higher prices making house prices go up. Irrelevant of the actual merit of the house prices. See crypto, tulips, beanie babies etc as evidence.

That's why people keep talking up property, because it works, well until other forces finally over power the wishful thinking.

Well they're just that, expectations. Could happen, might not happen. But expecting it to happen?

If I were to guess, 34% of respondents wish for it to be true. Maybe those with low equity in their homes/portfolio. Recent FHB wanting to move off their LEMs.

Interesting. Would be could to see a 10Y time series for Canada to see what it was before.

It takes a lot to make immigrants want to leave once they have established themselves.

Had some Iraqi friends who were granted immigrant status to Canada in 2021. After 18 months, the cost of living was crushing them so they returned to Iraq for a better life balance. Iraq people!

I expect my 2013 Honda Jazz to be worth 25k next week.

But based on the same cohort of people polled in the above survey, it could be closer to $30k

Yes but if you can find someone who is buying that expects that you could probably sell it for 24K no problem.

bottom along for summer, further 10% down next winter .. mortgage rates aren't coming down significantly anytime soon ... IMO

That comment aged really badly

https://www.interest.co.nz/personal-finance/125777/pre-christmas-move-o…

Interest rates back at "normal" levels, more cheap debt rolling off to today's rates, DTI inbound in three months, employment mandate gone =more unemployment, skilled youth exiting in quantity to Straya never to pay a tax dollar here again, and immigration tap set to flood mode - perhaps specuvestor's can have 10-20 deep per house to make the numbers stack...?

Housing to boom...cant see it. That said I also cannot see the cost of construction having a huge decline so who knows.

Edit: All it would take is a couple of tankers to catch fire or blow up as they transit the Red Sea to send oil prices soaring. Almost everything in NZ that moves would be effected. It would underpin mass inflation = HFL.

Can anyone point me at a link to how this survey is conducted?

(I read ASB's infomercial. Doubt it is an infomercial? Read it again and look carefully at the words used. Also read the disclaimer at the end.)

This survey was conducted the same way as the previous ones that showed a net minus -43% and - 8%. So if you want to be neutral, you would have to say that more people are now expecting house prices to rise, whereas before, more people expected them to fall.

I was wondering how the people surveyed could be so prescient. Then I discovered kmart had recently had a sale on crystal balls. A 50% discount I believe.

This was actually a survey of their mortgage lending team.

Insert positive sentiment, because 'like' there has been a change in government, it's Xmas holidays and the sun is shining.

YOLO

So more people expect house prices to rise at the same time as more people have to tighten their belts. Strange.

Expectation appears to be the word of the day.

First mortgage rate drops are actually the word of the day.

https://www.interest.co.nz/personal-finance/125777/pre-christmas-move-o…

I mean....we can all expect to win lotto but many spend their life wasting money on it for no return.

ASB wished.

Have they not herd The NZ first government poor cold water on the restart of their Ponzi.

They CC are on the tail of cartel behaviour ASB.ANZ,WESTPAC,and BNZ better be careful.

If house prices go up I don't know what we will do. Just finished up-skilling/studying, am in my late 20's, landed some work and we are resuming saving for a deposit now. Will have to push having kids a few more years at this rate. Some days I just want to become a hermit screw the houses, screw the banks. Screw it all.

Enjoy your time without the kids as one day you'll think back on how much sleep you used to get and how much time you used to have XD

Have to wonder who they surveyed maybe housing speculators, the next phase of crash happens soon.

Wouldn't think so...huge immigration, more expensive building materials, more red tape, and more restrictions on subdividing land.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.