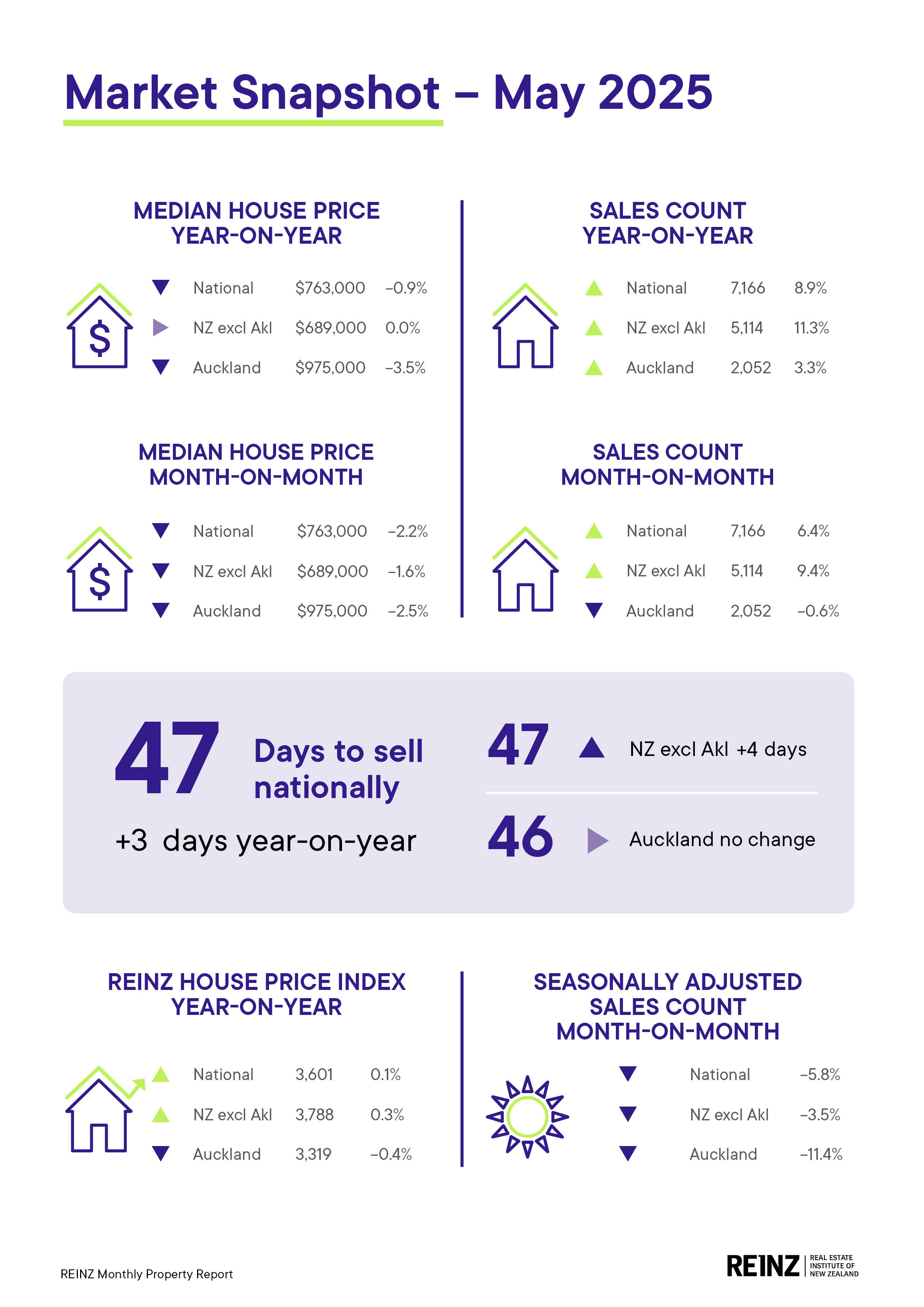

The housing market suffered mixed fortunes in May with sales numbers rising compared to April while prices headed in the opposite direction, according to the Real Estate Institute of NZ (REINZ).

The REINZ recorded 7166 sales nationally in May, up 6.4% compared to April and up 8.9% compared to May last year.

However sales remained weak in Auckland, with just 2052 residential properties sold in May, down 0.6% compared to April,

That's a poor result for Auckland because April was a short month, with fewer sales due to the Easter and King's Birthday long weekends.

The national median selling price was $763,000, down 2.2% compared to May and down 0.9% compared to May last year.

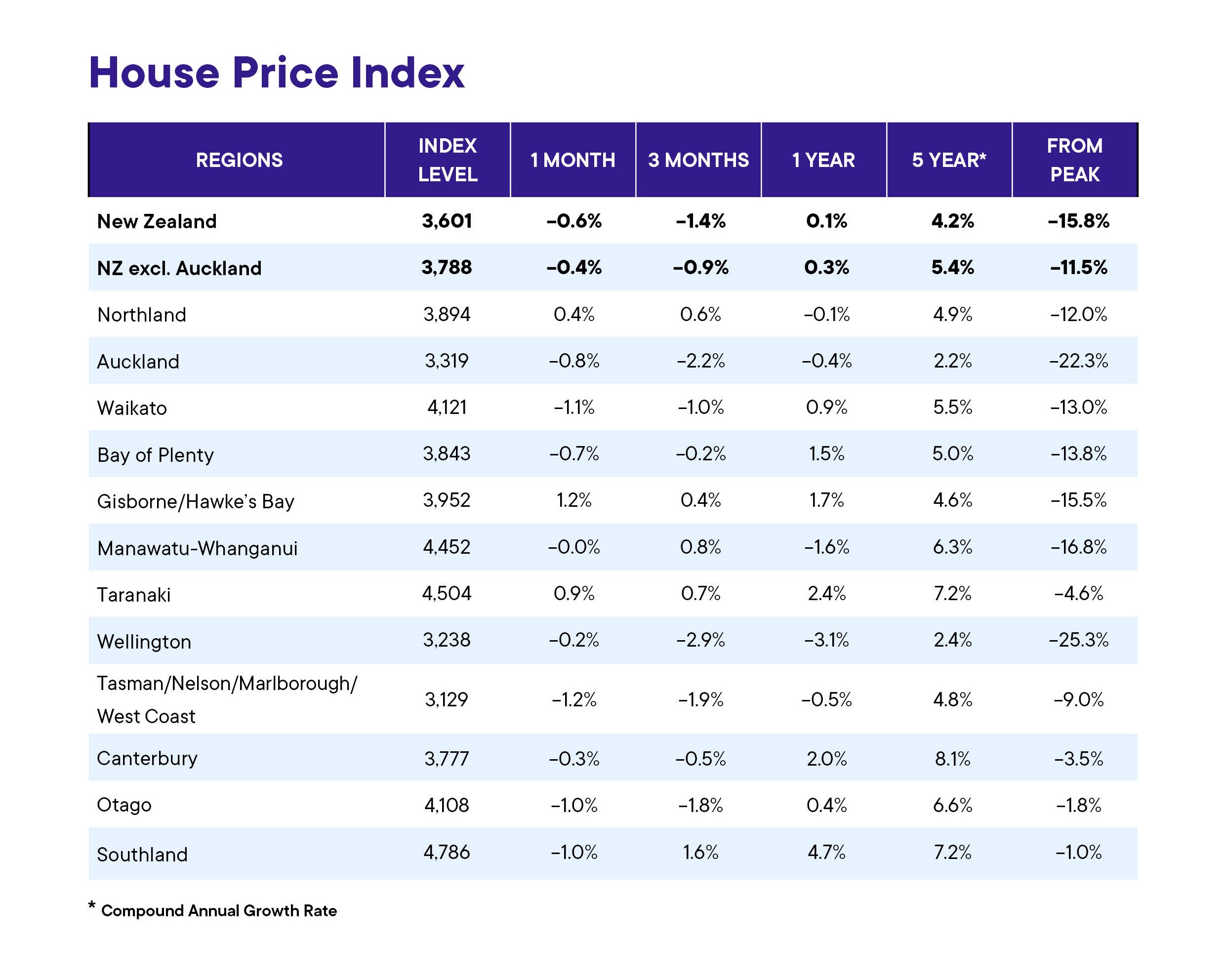

The REINZ House Price Index (HPI) , which adjusts for differences in the mix of properties sold each month, declined by 0.6% nationally in may compared to April but was up 0.1% compared to May last year.

Around the country, eight of the REINZ's 12 sales regions recorded HPI declines in May compared to April, three recorded increases and one was unchanged - see the table below for the regional figures.

Properties are also taking longer to sell, with the median days to achieve a sale increasing by three days, up from 44 in May last year to 47 in May this year.

"The increase in the median days to sell reflects a market that, while more active in terms of transactions, is also characterised by greater buyer caution," REINZ said in its May report.

"Purchasers are taking longer to commit, which local agents suggest could be due to a lack of buyer urgency and the fact that buyers have time to find a property that best suits them," the report said.

See the first two interactive graphs below which track the REINZ's monthly median price and volumes sold - both nationally and by region.

The comment stream on this article is now closed.

Median price - REINZ

Select chart tabs

Volumes sold - REINZ

Select chart tabs

20 Comments

New Zealand's massive housing market crash, has still got the Aussies looking aghast at the major year on year declines in NZ, that seem to be going on and on and about to leg down still further....

New Zealand's house price crash won't end - MacroBusiness

Housing Ponzi Pop Much!

Still, Mike Hosking sees green shoots at every turn, on his radio show, every day ......HE NEEDS the green shoots, as Katie is not happy at Mikes masterfully terrible move, to load up on the housing rentals, over the last 5 years.......

NZGecko,

I have just read and printed out that article. I think he gives our politicians rather too much credit, but for my grandchildren's sake, I hope to see this trend continue. A median multiple of 7.70 is still much too high. It needs to get back to around 5 and that will take years of stagnating prices.

Yes lets have policies that help lower the DTIs back to between 3 and 5x again.

While I don't like much of what they do, the new Labour party tax policies, will put landlords back in and cash strapping, higher taxing and profit sucking headlock.

It does seem a drift downwards - I was picking 2% declines for Auckland this year. But the real issue is the extent to which it is failing to keep up with inflation - so a potentially five more years of drift along

Capitulation starting....?

Edit. Hearing that Banks are having "sell yourself or we will" chats. Aka if you see an "urgent" sale then very possible they are being pushed.

A relative recently went unconditional on their house. Took almost two years and 12% drop on the original (ridiculously high) asking price. Buyers saw it one week and unconditional offer the next, was actually expecting a low-ball offer at least another 10% lower. Interesting part was when they built it they made the hallway and doors wider and put in wet floor bathrooms. Most people said it was a waste of money, turns out accessibility was it's main selling point something most NZ houses lack badly.

April was a short month, with fewer sales due to the Easter and King's Birthday long weekends.

King Charles keeping us on our toes

Hard to blame a 2nd June holiday for low April / May. results

Only >20% drop in value since the peak in our two biggest cities. Hardly a collapse at all.

/sarc.

Christchurch is bigger than Wellington (appreciate that may have been part of the /sarc)

Christchurch seems to be doing its own thing. Prices are static, but not declining, since the peak. That's a remarkable thing, given the large number of medium density developments that have popped up in the last couple of years.

Yes, it's a little surprising. I think we've been out of sync since the quakes - price rises because of post-earthquake shortages, then a long period of flat prices while other regions boomed because we (and surrounding councils) actually zoned enough for new supply. Last 5 years has been a period of catch-up.

We've obviously got some geographical benefits when it comes to building houses in places people want to be, but despite the big falls in Auckland and Wellington houses are still cheaper in Christchurch.

Christchurch has been working the way property markets are meant to work - when demand increases they build more houses. So prices only go up with inflation.

Unfortunately the market still caught COVID like everyone else and went crazy when interest rates fell to near zero. Even Chch couldn't escape that insanity.

Imagine the alternative world where reasonable DTIs had been implemented before the horse bolted.

The board game graphic needs an update with more snakes, less ladders, and maybe a pit at the bottom labelled '2015 valuations'

The 5-year growth rates for Auckland will be interesting in October 2025. As median price in Auckland in 2020 was $1m - so no effective increase for five years.

The 5 year HPI published by REINZ today is +4.2% compound, that's 22.8% higher than 5 years ago. It would have to go down hell of a lot to have zero growth over the last 5 years by October.

Edit: Oops, that was for NZ, and you did sat Auckland, sorry. For Auckland the 5 year HPI is +2.2% compound = 11.5% higher than 5 years ago.

Well Yvil, 4.2% is REAL zero growth NZ wide over the last 5 years!!

Inflation has been 22% cumulative, since 2020.

So Nada growth, zero.

Lost decade of property losses, just midway in.

Won't happen by October, but we'd need some serious rises in the next 9 months or so to keep a reasonably position 5 year return. We'll be rolling over those big late 2020, early 2021 rises soon.

Auckland median house price in October 2020 was $1m. If Auckland prices don't go up between now and October then 2.5% decline over a five year period. New Zealand median house price in Oct 2020 $725,000 - if that doesn't go up by October it will be 5% increase over five years. 1% per annum.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.