The housing market continued to cool in July, with prices and seasonally adjusted sales volumes all lower compared to June, according to the latest Real Estate Institute of NZ data.

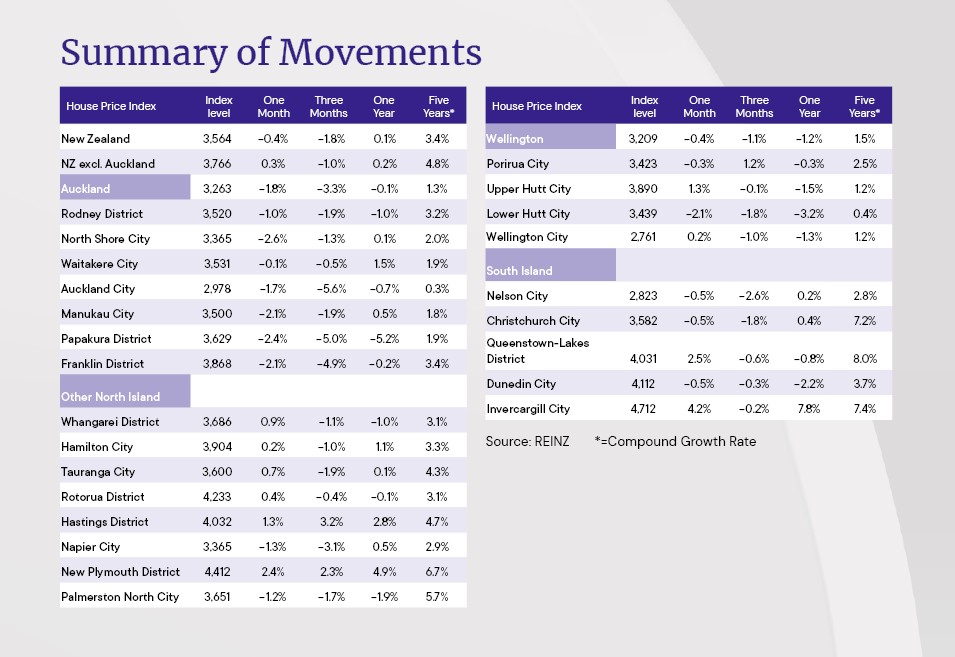

The REINZ House Price Index (HPI), widely considered to be the most reliable measure of house price movements, declined by 0.4% in July compared to June and was down by 1.8% over the three months to July, but almost unchanged (+0.1%) compared to July last year.

Prices were particularly soft in the country's largest real estate market, with the HPI for Auckland declining by 1.8% compared to June and down 3.3% over the three months to July.

All districts within the Auckland region posted monthly declines in July, ranging from -0.1% in Waitakere to -2.6% on the North Shore - see table below for the full figures.

The national median selling price declined slightly from $770,000 in June to $767,250 in July, while Auckland's median price declined from $990,000 in June to $975.000 in July - see the interactive median price graph below for the full regional median price movements.

The number of sales was both up and down for the month, with the REINZ publishing two sets of sales data.

Actual sales numbers were 6319 in July, which was up 5.4% compared to to June, but seasonally adjusted sales were down 1.7% compared to June.

New listings were slightly stronger, with 7737 received in July, up from 7612 in June, which means buyers will still have plenty to choose from.

"While buyers remain active, local salespeople around the country say they're not in a rush to purchase," REINZ Chief executive Lizzy Ryley said.

"With the median days to sell holding steady or improving slightly, it's clear that buyers still feel they have time to assess the market," she said.

The comment stream on this article is now closed.

REINZ House Price Index July 2025

Median price - REINZ

Select chart tabs

Volumes sold - REINZ

Select chart tabs

44 Comments

Auckland continues to deal with the hangover from the 2021 party. The rest of NZ (the South Island in particular) is chugging along OK at this stage.

It's a lost decade situation, worse for those on interest only loans. May be a lost couple of decades.

Many will lose patience

And a lost generation - with transfer of wealth to the baby boomer generation. That (my) boomer generation sold houses at artificially high prices to a younger generation who will not see price increases. I know of 30 year-olds with $1m mortgages - who won't regain equity in their house for another 3 years - and then will be fighting to just repay their mortgage by the time they are 60. Us boomers not only had high property value growth (in the second half of our working life) but also rampant inflation that meant that mortgage payments quickly declined in real value.

The millennials will inherit more wealth than any generation in history.

And the inequality of being born to the wrong parents will become a dominant structure of society....

Not everyone is born equal

It was already the dominant structure of society. The globe actually, for centuries 12% of us got to inherit 90% of the worlds wealth.

But don't worry, us millennials are virtuous and know all the wrongs of the world. We will use that money with full hearts for the betterment of everyone!

Equality is a myth, always has been.

Fixed it for you - a small group of millennials will inherit more wealth than any generation in history

Inheriting wealth sure sounds easy.

That transfer of it is actually fairly wide reaching.

But if your parents were broke or didn't like you, yeah probably not much in the offering directly. Although you could benefit from when a bunch of the wealth gets pissed up against a wall.

Buncha 40 year olds inheriting millions of dollars each, lotta wanton consumer spending inbound.

"Inheriting wealth sure sounds easy".

Make sure you allow your kids to inherit wealth then, since that's your belief.

Which is why a robust tax system should prevent wealth accumulating to just a few.

The game monopoly when played to the end results in a winner takes all. Same thing would occur if tax did not redistribute wealth.

Good points, While the Boomers may not have realised it at the time, when they look back they had an easy ride, compared to the next generations

Yes, Auckland is vulnerable because of continuing supply. I was commenting to someone about Wellington - that Auckland is "over' supply of housing - while Wellington is economic depression. So Wellington will get better in a year but Auckland won't

Why would you choose to live in Auckland? It doesn't have adequate infrastructure and the traffic is absolutely diabolical. The CBD is really poor as well

I'd be living in Omaha, Waiheke, or even Coromandel. Send the kids to private schools in secondary years and they can board. A bit hard if your in the corporate world, but if you can work remotely. It's not as if you are giving up some vibrant urban lifestyle.....

Why would you choose to live in Auckland?

Or literally any city in NZ.

Although most people don't really "choose" where they live. It's mostly what we fall into.

I'm taking a relative value view, you can live in other cities for half the price of Auckland - which changes the value proposition completely when there are no price rises.

Quality of life is not there in Auckland - I'd rather be in Qtown, Coro, Waiheke or Omaha than Auckland if I've got $2m to $5m to spend.

I struggle to make the maths work for most people living in a city. Many things aren't even cheaper as you'd expect from economies of scale.

Queenstown looks nice but I'd never want to live there.

West coast, if it wasn't so wet.

Maybe Golden Bay

Parts of Northland

"Why would you choose to live in Auckland?"

Because it was 11 degrees this morning and not minus 3 degrees.

Because it has direct flight to the world and you don't waste a night if your return flight is late because you miss your connecting flight.

Because you get all the best sports, concerts and events in NZ.

Because you can swim in the sea 6 months pa without freezing to death

Because you can enjoy amazing restaurants from all over the world

Because the Hauraki gulf is magical and there are hundreds of bays you can go to with your boat nearby.

Because it's the most worldly city in NZ, rich with culture and open minded.

You make good points, however many love a crispy hard frost in the morning to wake us up, appreciate the mountains, and get a few cozy layers on, or just throw another log on the fire and bask in the glow.

Winter is warmer in Auckland, but it's also more damp and cloudy.

I'll take this 14 degree cloudless still day over a few degrees warmer and soggy.

You do realise Omaha and Waiheke are 45 minutes from downtown Auckland, with Coro 2 hours? And all 3 are in the Hauraki Gulf last time I checked.

Jesus, lolz.

There's not much point in commuting from Omaha or Waiheke, so if you want to leave Auckland might as well go further out and not compete with the Auckland housing market.

What's your point TK ? Or are you just agreeing ?

My point is your points were ineffective in rebutting mine.

In summary, its flat as a pan cake with month to month reporting deceiving...

And we should also possibly note that we are in rare atmosphere - falling interest rates when house prices are also falling and showing no signs of ending that trend let alone rising. Lower interest rates are not giving the support to the housing market many assumed they would.....

Sadly for some, the truth is unbelievable!

Mortgage rates are lower than they were 2 years ago, but they are quite a bit higher than they were 5 years ago. So its not really surprising.

If mortgage rates go down to 2.5% again, houses will probably go up. Hard to know if this will eventuate, at the moment it is looking more and more likely with the state of the economy.

Down down down in ponzi town.

Hope the interest only specuvestor debt farmers get their long awaited margin call. Find some real equity or be sold up. What would true market discovery be in this market..higher, same or less money. I'm betting on the latter.

Chippy's Capital Gains tax to be announced at some stage will certainly do no favour's for capital gains chasers, and that will be all taxed. So it has to be yield...and that's will a ways off from making sense.

Popcorn.

Does chippy realise that unless he back dated a 'V' date that it might be decades before any cap gain occurs?

Or is he thinking of backdating a V date?

Has anyone asked?

Seems like political suicide for an almost nil tax result.

And what a great incentive for Govt created inflation.

Adds up to a dumb idea to me. have I missed something?

Asset tax would work.

Completely agree. Unless backdated its worthless until they get voted out and would kill realestate sales, as no one would sell to trigger being punished by Chippy's tax. Asset tax the same - who would sell anything until they get voted out. Tax needs to be regular otherwise its worthless. This is 100% why Aussie has introduced the idea of annual assessment on capital gain regardless of sale. Lots of noise over there on that.

Highlights why a land tax is superior. Its unavoidable ....every year.

Chippy's Capital Gains tax to be announced at some stage will certainly do no favour's for capital gains chasers

Chippy might be pulling back any GGT talk until the sheeple have forgotten about the 'nothing to see here' Royal Commission.

"Down down down in ponzi town"

Or you could have a cup of reality and see that:

The REINZ House Price Index (HPI), widely considered to be the most reliable measure of house price... is almost unchanged (+0.1%) compared to July last year.

Yes the HPI is slightly down compared to June, but only a fool would compare 2 different months.

Yes the HPI is slightly down compared to June, but only a fool would compare 2 different months.

Not necessarily Dr Y. While house price indexes are directional only in understanding market value, drilling down, even on monthly changes, can be interesting. Assuming you have access to the full data set.

Five straight months of Auckland MoM declines.

July’s fall represents the biggest drop to the HPI in 16 months.

Call it noise if you like, but it's getting louder

Five straight months of Auckland MoM declines.

July’s fall represents the biggest drop to the HPI in 16 months.

Which is essentially a measure of directional momentum. That 5-month period can be used to make comparisons across other 5-month periods across a total data set.

Wonder if there has ever been a 5-month period of declines.

If you compare last month, with 5 months earlier, you're comparing a winter month (July) with a summer month (February). That's your choice, but I think it serves more to make a pre-conceived point, than comparing like-for-like data.

Yes Dr Y. In a calendar year, there are 8 distinct 5-month periods. Over 20 years there are 236.

Whether those periods start in July or Feb is irrelevant for data analysis purposes.

"In a calendar year, there are 8 distinct 5-month periods"

8, 5-months periods do not fit in a 12 month calendar year, so it's theoretical cherry picking. That's fine, you make your RE investment decisions comparing summer months with winter months, I won't do that.

8, 5-months periods do not fit in a 12 month calendar year

Yes they do.

Still falling in real, inflation adjusted, terms.

The 5 year comfort blanket Auckland speculators have been hugging onto is down to its last thread

At current pace the AKL 5 year is going Negative as I type.

The November 2020 HPI was essentially the same as the July 25 one. So any further declines will mean that the five year HPI increase will be negative later in the year.

ouch, central Auckland district -5.6% in a quarter - thats minus $4,000 a week

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.