The housing market slump deepened in August with a dip in the median selling price and a substantial slide in sales numbers, according to the latest figures from the Real Estate Institute of New Zealand.

The REINZ recorded 5866 residential property sales throughout the country in August. That was down 11.1% compared to July and -3.7% compared to August last year.

In Auckland, the country's largest property market, sales were -10.9% compared to July and -8.6% compared to August last year.

The national median selling price was also softer at $761,000 in August, down 1.2% compared to July and down 0.5% compared to August last year.

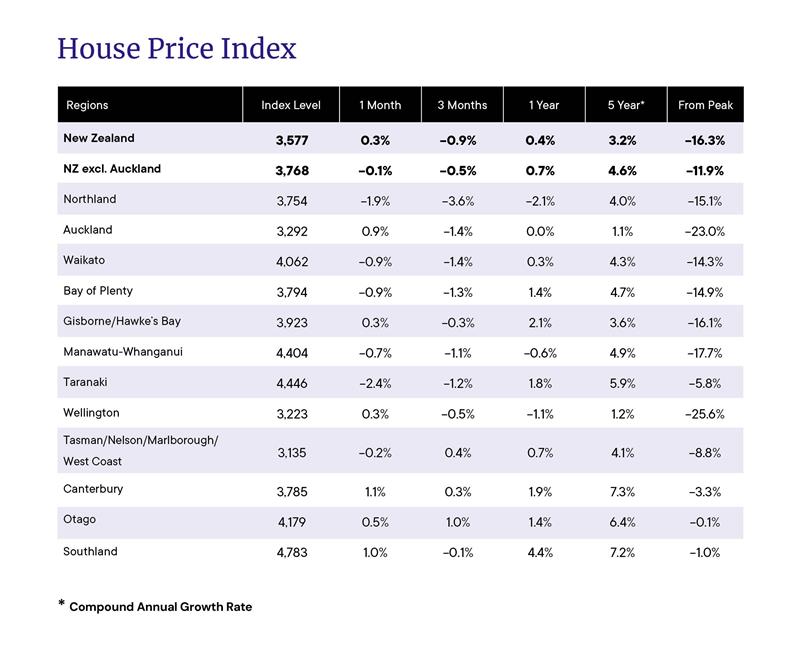

However the REINZ's House Price Index, which adjusts for differences in the mix of properties sold each month, was up 0.3% compared to July and up 0.4% compared to August last year.

That could suggest sales of lower to mid-priced properties held up better than higher priced properties in August.

"Across New Zealand, confidence in the property market is tempered with caution," REINZ Chief Executive Lizzy Ryley said.

"While many expected the recent OCR change to encourage more activity... at this stage, both buyers and sellers appear to be taking a measured approach, as they watch how the market unfolds, particularly as we near spring," she said.

However, Ryley was optimistic spring would bring an improvement in sales.

"The history of REINZ data suggests that we may be cautiously optimistic that we will see an increase in activity in the market in the coming months," she said.

The interactive graphs below show the monthly trends for median prices and sales volumes.in all regions.

The comment stream on this article is now closed.

Volumes sold - REINZ

Select chart tabs

Median price - REINZ

Select chart tabs

25 Comments

Stagger...flation.

Selling like cold turds...

Meadowbank down 120k in 3 months, and 20 other suburbs down 5% in three months, going to get worse yet, people refusing to pay current prices. On the table above it says Auckland is -0.6% in medium price mom, but on the HPI table it says +0.9%... got to love this data set.

Meanwhile OneRoof is at least being honest about on the ground falls.

Meadowbank down 120k in 3 months, and 20 other suburbs down 5% in three months, going to get worse yet, people refusing to pay current prices. On the table above it says Auckland is -0.6% in medium price mom, but on the HPI table it says +0.9%... got to love this data set.

Where it gets really interesting is when the fancy pants models don't work - the central bankers reduce rates 0.25-0.5 basis points and expect house prices to resume climbing. But they don't. There is a time lag before the model has to adjust to represent the new reality. I'm not claiming that the models don't work. I'm saying that there is a probability that the models don't work when the facts change. "The facts" are changes in the collective behavior and attitudes of the sheeple and their purchase behavior (remember, this is not the RBNZ's forte or expertise - not enough budget for behavioral economics / research).

And remember, this is a massive paradigm shift. Up to not so long ago, a house purchase didn't just meant shelter, the Ponzi threw in saving and capital gains for free (well they're not actually free because there are trade offs like socio-economic disruption and monetary debasement). Where we go from here is unclear. Wheels are possibly starting to fall off.

Wheels are possibly starting to fall off.

Starting to see more and more liquidation auctions https://www.number8.bid/

IRD owed 3.6 billion, lots more to come

IT Guy is that all from liquidations? That's a lot of peoples small biz dreams broken, makes you want to weep really.

Its only one small house All about auctions are much bigger

Liquidation is normally forced by IRD and then the liquidators go personal via overdrawn current acc, and bankrupt the directors to recover what they can. An overdrawn current acc is an asset of the company. Bigger guys with heavy machinery use others, diggers are cheap ATM

Many have had 30-50k from covid turn into 100-250k. If the IRD went hard NZ small biz would collapse, many on 1-2k a month repayment arrangements.

Hearing tradies considering going this path then heading to Aussie

You are about to see some "Urgent" property sales go low.

I wonder if the impact of new, lower council CVs is kicking in...

Maybe but I do not think Vendor expectations are moving lower as fast as the market is, many worry if they drop their price, the one they want to buy will not drop their price so the upgrade becomes unaffordable, its somewhat freezing the market $1.7-$3mil range.

We decent clearance people will be more aware where the value sits. Many are using conditional chains to overcome this issue.

The delayed Auckland release no doubt helped a few vendors finally give up their 2021 value delusions, some after already turning down better offers and thinking the market would turn frothy again in the space of a few months.

Next CV updates aren't far off..

Warren Buffett's most famous mantra is to "Be fearful when others are greedy, and be greedy when others are fearful". Right now is a great time to be greedy IMO.

He also says

Rule number 1 - Never lose money

Rule number 2 - Never forget rule number 1

He does not seem to like real estate

My favorite is

“After all, you only find out who is swimming naked when the tide goes out.”

Most hi profile are Evergrande and other Chinese property companies and Duval locally. There are many more. I guess greed is good...untill it isn't.

CAN-terbury is looking gooooood, I don't think that this is all farmers buying second homes

Christchurch has stubbornly refused to join the price falls so far, maybe because we also failed to join in with earlier price spikes (until the COVID-craziness got to us).

Still heaps of units springing up around me, and new houses on the outskirts, so I do wonder how much longer prices can hold out. Is there enough internal migration to fill up the new space?

Canterbury is bigger than Christchurch.

Yes it is, but Chch is the bulk of it and the city I am familiar with.

Rachael Hunter knows.

Knows that blonds have more fun?

Christchurch refused to participate in the 2% specu ponzi of stupidity in 2021. Lots of unsold rebuilt supply to boot. Accordingly what didn't specuvest up, has little to settle back from.

Its popular because its cheap, opposite applies to Auckland

If the Chch wizard was still around he could have worked his magic

So I think what you are saying is that if Auckland was to IMMEDIATELY take the hit, after that it's Game On?

It's been 14 years since CHCH took a big hit, it takes time...

Note CHCH has never really been game on, its slow and steady climb.

The Fed is about to cut and property continues to go nowhere. Sounds like a recipe for a 2.00% OCR to me.

possible but inflation is coming into band very slowly, why not stop at 2.5-2.75

will the last 50 help vs hinder? at 25 lift will not brake a runaway inflation outlook

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.