Hopeful vendors surged into the housing market in September, with the number of new listings on Trade Me Property up a whopping 24% compared to August, and up 5.9% compared to September last year.

That should ensure prospective buyers will still have plenty of choice as the spring selling season gets underway. Trade Me Property's figures suggest they are already looking, with property searches on the site also up 24% in September year-on-year.

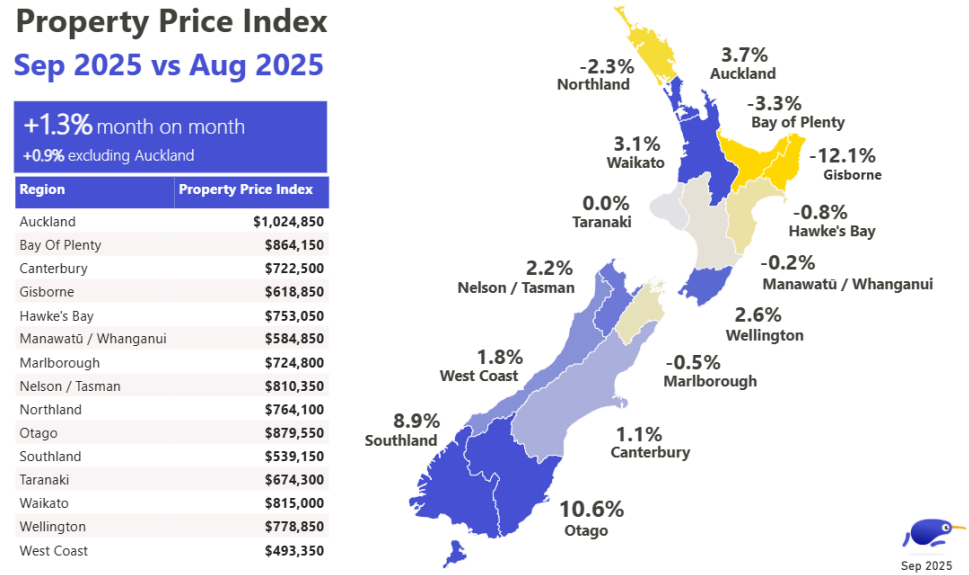

However, there was also a lift in advertised asking prices. The average asking price of $835,350 in September was up 1.3% compared to August, although it was still 1.6% lower than September last year.

Around the country, eight regions posted higher asking prices in September compared to August, while five posted lower asking prices and one was unchanged. See the chart below for the full regional figures.

The biggest increase was in Auckland where the average asking price in September was $1,024,850, up 3.7% compared to August. The biggest decrease was in Gisborne, where the average asking price was $618,850, down 12.1% compared to August.

The comment stream on this article is now closed.

18 Comments

Making Rates are cheap again thanks to the letters RBN and Z. Its pump and dump time!!!

I can't understand your angle, usually all grump and slump, and people making off like bandits not paying tax on gains. While at the same time you're either heavily invested in property or were previously

Any Boomer selling this summer is doing exactly that - selling before any talk of getting taxed at the next election starts to take place. Debasement of interest rates allows another pump window for them to dump out, tax free.

This talk on tax ppty is nothing new. Been going on for years.

I doubt if many are selling for this reason - more likely they have to or are eyeing the mouth watering some are getting from the financial markets.

There will be a lot of sales too. Cost of borrowing probably went down 5-10% (not immediately but once they are done edging down over a few weeks). Good time to purchase at slump prices and lock in recovery rates.

So it's a fake RBNZ pump and dump into the continued slump.

The NZ housing ponzi is broken and no amount of RBNZ resuscitate rates will liven the horrendously high priced housing market.

The slump may end come 2027 / 2028.

BOOMERS come back out of the seĺĺing closet, to dump their crappy old rentals and 1970s family homes.........dump into the slump.

Some will jump at the opportunity to stump out in the middle of the slump after the RB's dump and pump.

I am always nervous about the extrapolation of the asking price into an indicator. I suspect the price is far more determined by the pool of properties listed rather than the price levels of what is listed.

Yet it's very much needed. Imagine going to a car yard and there are no prices on any cars.

What? people pay what's listed on the car?

I suspect the opaque proprietary algorithms provided by vested interests to 'help' guide buyers and sellers by giving an estimated price are more of a nudge than they let on. Could see there being baked in growth in line with web traffic, akin to airline pricing maybe.

The so-called free appraisal service just feels off and should make you wonder right

Trade Me Property listings up 24% in September from August

Sorry Greg, but that's a daft comparison, it's like saying "September temperatures up 24% from August". The real comparison is:

The number of new listings on Trade Me Property up 5.9% compared to September last year.

That's the metric which matters, and it should be the only headline. And yes, it's up quite a lot !

I'd also like the same comparative figures for Jan-25 through to Aug-25, in a pretty graph, so we can observe trends easily

Looks like the already spoilt for choice buyers have 23% more choice this month then last.

Suddenly there are 5 houses on your watchlist instead of 4...

he didn't make a comparison, so it's perfectly valid - as is your temperature quote.

Sorry but saying "Trade Me Property listings up 24% in September from August" is absolutely making a comparison, it's comparing August's data with September's data.

But you saying above, the more important comparison is Sep-24 to Sep-25 is still just two data points. You need to look at trends to see what is really happening over time.

The issue is not so much the new listings, or what many are, are old withdrawn listing being relisted, but what price they sell at.

If there is a price increase because of newly built housing, or they are bigger, or they have extra amenity value compared etc. with past average comparibles, that is OK.

But if the price increases include any specularive monopoly gain caused by demand suddenly exceeding supply, then that is not good.

We have plenty of non value added supply (ie over priced housing due to historical restrictions that caused housing to be more expensive than it needs to be).

But we don't have any new stock being developed free of these restrictions.

Hence housing is still over priced even with this excess of supply relative to demand.

There is at least a further 15% that house prices could reduce in nominal terms, but of course if any further reduction in house prices is to occur, then the Govt would sooner achieve that in real terms.

And if house speculative can be removed, and thus from causing excess inflation, then low, and even lower interest rates can stay without causing house prices to speculatively rise.

House prices are then not only more affordable price wise, but smaller mortgages at lower rates are also possible

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.