The past week saw a big jump in auction room activity, along with a slight improvement in the sales rate.

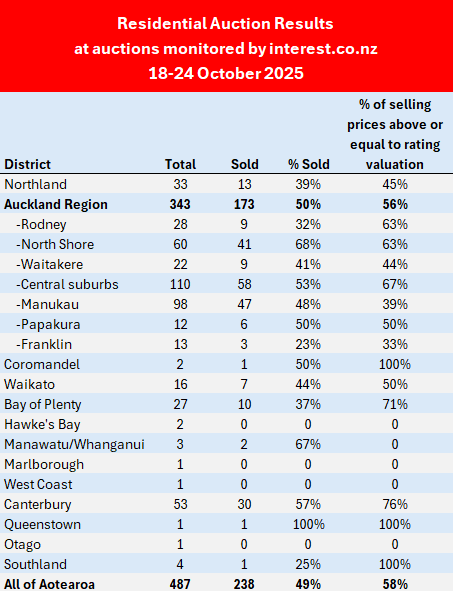

Interest.co.nz monitored the auctions of 487 residential properties around the country over the week of 18-24 October. That's up sharply from 344 the previous week, and is the most in any week since early April.

It seems that spring sales activity is now well underway.

The sales rate was also up, with 238 properties selling under the hammer, giving an overall sales rate of 49%, up from 43% the previous week.

That's the highest sales rate recorded by interest.co.nz since mid-August.

However, buyers appear to be remaining cautious on price, with 58% of the properties that sold achieving prices above or equal to their rating valuation, down from 62% the previous week and 69% the week before that.

It appears the lower mortgage rates on offer aren't flowing through to higher selling prices, at least not yet, although of course they may be helping some buyers to get across the line to make a purchase.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the selling prices of those that sold, are available on our Residential Auction Results page.

The comment stream on this article is now closed.

6 Comments

Big increase in listings this week too

They own three houses, they’re approaching retirement, and they’re terrified of losing everything

https://www.stuff.co.nz/money/360864322/they-own-three-houses-theyre-ap…

The derailed plan

They saved carefully, sacrificed holidays, avoided unnecessary luxuries like fancy cars and invested in a plan they thought would secure a healthy retirement.

But this carefully woven strategy has started to fray at the edges. And they now find themselves asset rich, saddled with debt and deeply concerned about a market that shows no guarantee of a swift recovery.

This is the story of a couple of self-confessed “boomer babies”, born in 1963, who now, two and a half years away from retirement, worry that all their careful planning and sacrifices was for nothing.

“We are of the generation that grew up believing that the best investment for retirement was property,” the couple wrote to Stuff.

“We've both worked very hard and saved enough money to purchase three houses.”

Once the first two houses were mortgage-free, they took on debt to purchase a third home that would serve as their dedicated retirement home. The plan was to clear the mortgage on the third home by selling the first, while the second would serve as their retirement fund.

Everything was moving in the right direction, until the Wellington property market fell from its previous highs, almost immediately wiping $500,000 off the value of the third property.

The weight of bricks and debt

The heavy burden of a mortgage on a five-year fixed term (signed when interest rates were higher) weighs on them daily.

The family feels defeated. They still drive old cars, haven’t been on an overseas holiday in 25 years and don’t even own a smart TV. They feel they’ve bought into a promise that never materialised.

“Every time our house values drop, it’s hundreds of thousands off our planned retirement,” they say.

“We are fearful we will lose just about everything.”

Living in the shadow of a crisis

This couple are part of a cohort of New Zealanders who have long seen property and term deposits as the best way to build family wealth – an approach further accentuated in the early 2000s.

Mark Lister, from Craigs Investment Partners, told me this week the psychological wounds of the collapse of the Finance companies still linger for many New Zealanders and continue to influence investment decisions.

A total of 67 finance companies collapsed between 2006 and 2012, wiping an estimated $3 billion from the portfolios of up to 200,000 New Zealanders.

The collapse of these companies cast a long shadow and cemented the belief that property should be the cornerstone of a family’s wealth.

But this hasn’t come without consequences. We were reminded of those this week when Stats NZ data showed it takes an average New Zealand household 14.6 times its annual income to afford a median-priced home outright.

Regardless of what else you own, servicing a mortgage that large can put significant strain on your household income and has led directly to the widespread trend of asset-rich Kiwis, who are often left wondering how they’re barely making ends meet.

Being rich on paper

Katie Wesney, a financial adviser, empathises with the couple, saying they’ve simply done what so many in their generation were encouraged to do: put everything into property.

Katie Wesney is a qualified Financial Adviser and Head Strategic Coach at Enable Me. Supplied

The problem is these assets are no longer working for them because prices aren’t rising like they once did. This leaves them trapped.

Wesney says New Zealanders constantly need to question what type of retirement they want and then find ways to ensure their investments are working to get them to that point. If your investments aren’t serving your objectives and they’re creating unnecessary emotional stress, then it’s time for change.

The pitfalls of concentration

James Paterson, the chief client officer at Pie Funds, says the case of the couple is a textbook example of the pitfalls of concentration.

“This is why diversification across different assets and investments is something that should be considered when constructing investment portfolios,” Paterson told me.

Relying too much on property investment will make your entire retirement plan vulnerable to “the whims of the government of the day, future housing sentiment and interest rates.”

While property has historically performed well, Paterson adds that the market conditions have changed.

“With migration trends changing and interest rates influencing values, the demand side is not as strong as it once was,” he says, pointing out that the market won’t necessarily return to the way it was in the past.

Relying on government policy also adds an additional element of risk, says Paterson.

Successive governments will always have differing views on what should happen in the property market, and not every politician will agree with the sentiment that up is the only direction prices should go.

Looking at the couple’s situation, Paterson says an immediate question they should be asking is whether the rental income on the third house comfortably covers expenses.

“If not, and it’s creating ongoing emotional pressure, selling now to lock in what they can might be the only way to free themselves from uncertainty.”

Results not guaranteed

The agonising choice facing the couple is whether they should sell and suck up the losses, or hold on in the hope of the housing market picking up again.

History will show that the housing market hasn’t always been a certain bet.

“It’s always been cyclical with periods of up and down,” says Rupert Carlyon, the chief executive of Kōura Wealth.

Rupert Carlyon, the chief executive at Kōura Wealth.

“From the period 2007 through to 2013, house prices were largely flat with a big downturn during the GFC. During the early 90s, they were also pretty flat. We are currently three years into a downturn, and it’s impossible to know when the recovery will happen.”

The key to successful property investment, says Carlyon, lies in understanding it as a long-term asset, best held for 10 to 15 years.

“[You need] to make sure that the rent covers the costs,” he says. “This means you are never forced to sell and you will have time to hold the asset through a downturn.”

The story of this couple offers a timely reminder that wealth isn’t measured in the number of assets you have on paper.

Financial planner Zara Malcolm, the owner of consultancy Foundher, says this couple’s situation requires both a financial and psychological reset.

“When the market shifts, it doesn’t just hit the numbers,” she tells me.

“It hits confidence, security, and self-worth. It’s natural to want to hold on and wait it out, but hope isn’t a financial strategy.”

If all your money is wrapped up in paper value, this can reduce flexibility and make you feel the pressure of meeting daily costs more acutely.

The top priority in this case, says Malcolm, is restoring cash flow.

“Sometimes that means selling one property, even at a loss, to relieve pressure and reduce debt. This isn’t failure. It’s a strategic reset.”

With some of that stress relieved and cash on hand, you can then assess your objectives and invest that money in a more diverse portfolio.

It's Wellington, a place no one would have gone to had it not been for the NZ Company and the "enterprising" Wakefields. The Wellington is sluggish compared to elsewhere every recession.

Anyway these people should have realised that prices are headed toward 2015 prices according to some interest commentators ... wait a minute

Noise about a few US regional banks falling over. Stupido debt and leverage is far from just a NZ thing.

Give it a bit more time and see what happens.

https://youtu.be/H4Ql91nb6kg?si=DNlrVbgkCIrAfFoX

A song in their honour.

I couldn't see the problem. They're still rich AF. They just need to get over have lost a bit.

2 of those properties were mortgage free prior to the purchase of the 3rd....so they are servicing the equivalent of one mortgage, whats their problem?

If they have taken on too much debt they have assets to sell.

Youve saved 10k and 'someone in the know' gives you a hot tip for the races so you place that 10k on the nose and it comes home, so you take that 100k and place on another 10 to 1 shot and that also romps home, so thinking you can really pick them you take that cool mil and try to place it on another 10 to 1 shot but the TAB says, nah we will only accept 700k on the nose so you have an each way7/3 and it runs third.

Should have quit while you were ahead.

Gawd, the emotive language in the stuff article. Poor suffering millionaires! Why did Stuff devote space to this "story"?

Gawd, the emotive language in the stuff article. Poor suffering millionaires! Why did Stuff devote space to this "story"?

Gawd, the emotive language in the stuff article. Poor suffering millionaires! Why did Stuff devote space to this "story"?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.