Residential dwelling values declined by 0.8% over the three months to the end of October, according to the QV House Price Index.

New Zealand's average dwelling value was $902,020 at the end of October, unchanged from a year earlier. That was, however, down 13.9% compared to the market peak in January 2022.

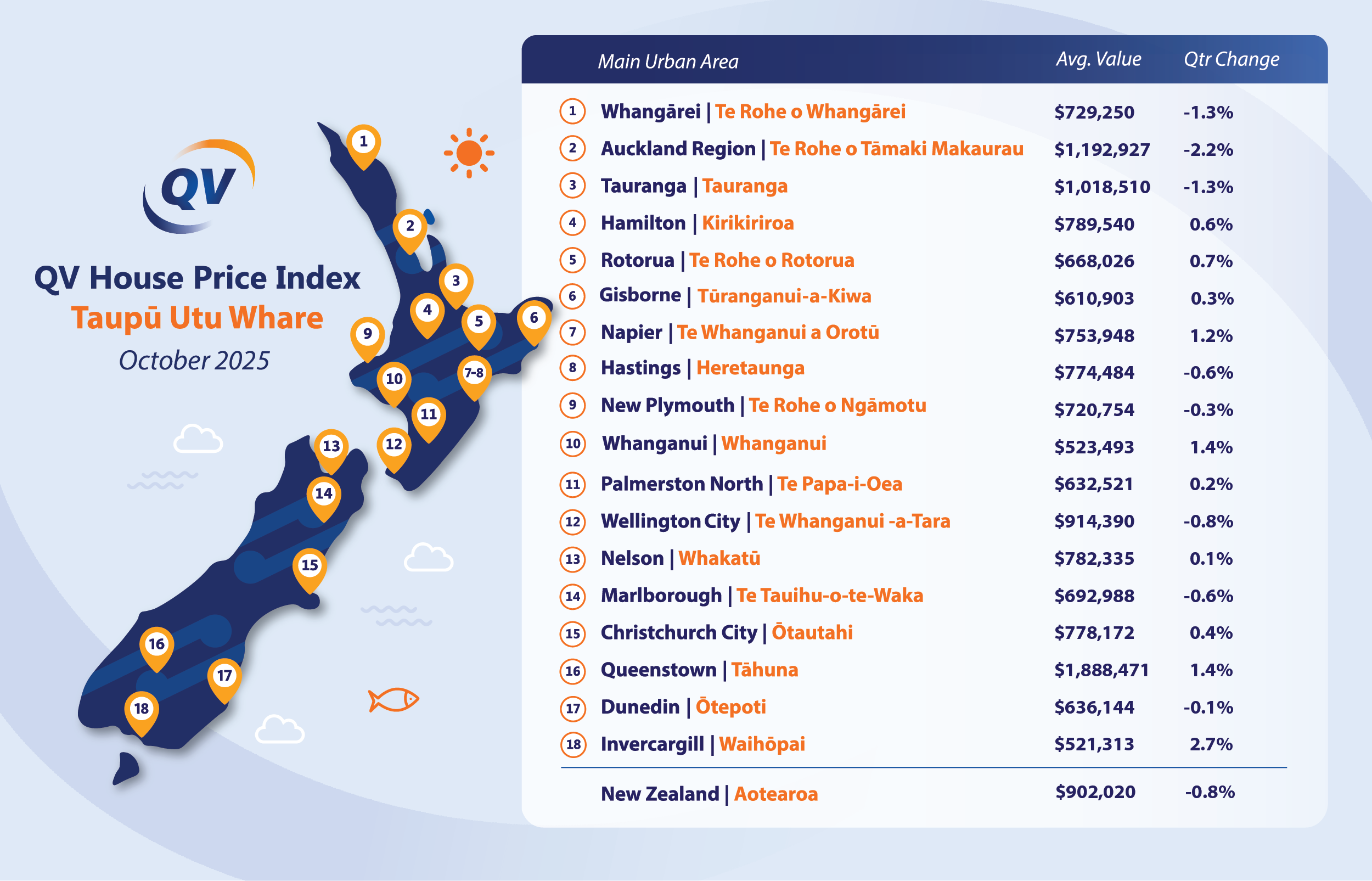

The biggest decline in value over the three months to the end of October was -2.2% in the Auckland Region, followed by Tauranga and Whangarei both -1.2%.

Within the Auckland region, value declines were greatest in Papakura -3.5%, Manukau -3.4%, central Auckland -2.8%, Waitakere -2.5%, Franklin -1.8%, Rodney -0.1% and unchanged on the North Shore.

However, several centres around the country went against the trend and posted value gains over the quarter, led by Invercargill, up 2.7%, followed by Whanganui and Queenstown, both up 1.2%. (See the chart below for the full regional figures).

QV spokesperson Andrea Rush said the housing market remained broadly flat, with small declines in most main centres offset by modest gains in parts of the South Island and regional Aotearoa.

"Listings and buyer activity have lifted this spring, but it hasn't yet translated into sustained value growth," Rush said.

"The market is still finding its footing after a long period of economic uncertainty, with confidence slowly returning as interest rates ease," she said.

The comment stream on this article is now closed.

20 Comments

AKL and TGA the biggest losers. Also the biggest bloaters on 2% interest rates. Gravity...

But but but......Spruikertown told us all here, that the "Bottom was in" in mid 2023.........

Aged well didnt it?

Spruikertown will be feeling the burn well into 2027, as the flacid NZ housing market deflates much further,.

But but but……NZGecko guaranteed us 60% decline for the peak !

Aged well didn't it?

New Zealand's average dwelling value was $902,020 at the end of October, unchanged from a year earlier. That was, however, down 13.9% compared to the market peak in January 2022

Is it your assumption that all price falls are over?

Its possible that house prices fall 60% in real terms.

https://fred.stlouisfed.org/series/QNZR628BIS

If anyone follows technical analysis, looking at the above chart, its quite possible that further significant falls in real terms are ahead of us. Perhaps with a bottom around 2012/2013 levels (in real terms, not nominal). ie we may now be at the second shoulder of a head/shoulders pattern. Another phase of significant falls could be ahead of us (either in nominal terms or via another round of inflation/higher interest rates) that would undo the significant rise in house prices 2012-2016 significantly above the general rate of inflation (ie speculative, unsustainable capital gains that fundamentals could never sustain over the long term eg prices vs incomes/rents/national productivity - despite all of the euphoria and 'be quick' encouragement from the vested interests).

(or for the most extreme, one could argue that 2008 was the initial shoulder of the head and shoulders pattern! and not 2016-2019 - which would return real house prices to the initial trend line that existed for about 100 years up to 1990 when we decided to financialise the housing market - but then you're talking about 80% drops in real terms)

Is it possible that NZ Gecko and I are the same person ? Unlikely but it's possible.

Gecko isn't as skilled as you at timing the top of the housing market, making millions, and forecasting central bank interest rate policy so you can't possibly be the same person!

Thank you.

I/O how would it be possible for house prices to fall 60% when land and building costs are so high.

Just start with the actual 13.9% down, add inflation, multiply by the NZD exchange rate, divide by the price of Gold and subtract your grandma's age "et voilà", 60% down.

You forgot to pay tax owing.

The better question is why did they become so high? (compared to any fundamental analysis?) Not why couldn't they possibly fall...but how the hell did they become so insanely expensive?

Why should a section cost $300 - 500K for 400sqm? We have plenty of land and on a daily basis I see old people dying, no longer utilising the land they are living on. We had a supply/demand imbalanced coupled to banks willing to lend any man women or teenager hundreds of thousands of dollars to bet up the price of land beyond any logical valuation.

When demand for land collapses and everyone wants to get out at the same time, and banks get twitchy and stop lending or start recalling loans, then you get a 60% fall. Globally, this has happened many times over and people have always said things similar to your question above....'how could it possibly happen when x, y , z are existent?' And yet it happens anyway - see Ireland, see Spain, see Japan.

As I mention above, I think we are only about halfway through the current unravelling of the NZ housing market - with more supply become available with little demand due to aging/dying boomer cohort coupled with weak immigration, coupled with weak general economy, poor GDP growth.

Yes, few seem to question , how is it possible for prices to rise by 24% in one year, or why we are 2 to 3x more expensive on a median income to house price ratio than some other jurisdictions.

If you look at the data, inspite of the fall in prices, almost none if it has happened in land prices, especially landbanked raw land, yet that is the very product that has the most speculative captured increase in non value added costs. Ie the price of this land could easily be reduced in value by a factor of 10 if policies were introduced to stop speculative land banking.

The three pricing mechanisms for prices becoming more affordable are nominal and real comparing houses against houses. And then real/relative pricing comparing house against incomes ie the median income multiple.

Interest rates slashed by >50% from peak, interest deductibility re-instated, capital gains tax removed. Yet still house prices continue to fall in Auckland.

This is a complete economic re-rating of NZ lower, there is no other explanation. Parts of NZ now remind me of Guatemala, I was asked for food by a guy while filling up at a gas station on Monday. Extraordinary.

Animal spirits TK - as I was warning in the 2016-2021 period that generally the euphoria in the boom is equally matched by the opposite polarity in the bust. I think we're about a halfway through the bust (why I was warning people to calm down because of the long term consequences of the euphoria but in return being laughed at as a 'doom gloom merchant'). Wouldn't be surprised if the malaise lasts until 2027-2028 which makes sense as we tried to bring forward years or a decades worth of cash flows in to present prices by playing silly buggers with interest rates/discount rates on assets.

I personally don't see things getting noticeably better next year - much the same as this year. Could even be worse when we can't drop rates any further and people are still struggling to cover the losses on their rentals then we may see another round of sell offs/price drops - that coupled with low immigration and the number of boomers I've been watching dying of cancer the last few years (every few months someone in that age group I know has died - leaving their partner living in an oversized 3-4 bedroom family sized home), then I don't see any shortage of housing the next decade or two. Supply of housing for sale could continue to saturate the market with limited demand.

The most devasting change is that we no longer see NZ as somewhere where you can get ahead, that's Australia.

I have come to the realisation that Christchurch through to Queenstown is our jewel and growth corridor. Auckland is finished, in fact the NI is - and I'm NI through and through. The alps shield the East Coast from the procession of fronts that march through every other day, incredible lifestyle. Everything you could want,

If I was 25, it would either be CH, QT or Oz.

I saw the writing on the wall in Auckland in 2019 (house price to income ratio insane, traffic bad, violent crime rising significantly, homelessness, large amounts of mental health problems (perhaps due to the unhealthy lifestyle of big mortgages/work stress/stuck in traffic etc etc), lack of social cohesion/community feeling completely gone, absurd levels of immigration and lost cultural identity) - all pointed to me to a future that was highly undesirable...so left before COVID hit and located myself in the areas you suggest above. The fly fishing and hiking are world class and if you avoid Queenstown the problems identified in Auckland are more or less non existent.

South island in general has such geographical diversity and lifestyle freedoms. It feels less exploited with more native forest, lower population, and the mountains always give an awe-inspiring sense that your problems are fickle and small in relation to the big wide world around you.

It's really hard if you are unemployed right now, even young and a few years experience with a good degree.

It's hard sending out 10 job applications a day, getting 5 responses a week 2 interviews a month (with no feedback about your interview). I am watching friends go through this. Its really hard and even worse if you have a mortgage, banks are being nice for now.

NZ is SHIT right now with a capital S.

And we have to listen to green shoot bullshit from NAct and Yvil on here.

There are no green shoots, only weeds popping up due to rain. A global equity crash on the back of AI overvaluation staring at us.

Its S H I T

Houses in NZ are still so overvalued, investors do not even want them, and if prices rise more investors will ty to get out FLAT

NZ was shit post 87 crash. Shit post Dot Com and shit post GFC. Agree AI is looking more like Teahupoʻo on a bad day.

All resulting from debt laden asset being exposed as grossly over valued without income. A lesson we need to keep learning while banks cream it literally. After a decade of low interest rate fueled pink fluffy unicorns and jellybeans, the truth is again unfolding.

Yes a -60% REAL crash in property in the big NZ cites is looking likely by the bottom in 2027 or 2028.

We are already down a REAL -35 to -45% in Auck and Wellingtank.

Wait till the bottom falls out of the AiHyped USA - DotAi market and the downslope will steepen

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.