The rental housing pendulum continues to swing firmly in tenants' favour, according to the latest rental data from Trade Me Property.

The national median asking rent for rental properties advertised on Trade Me Property was $610 in October, the lowest it has been since May 2023.

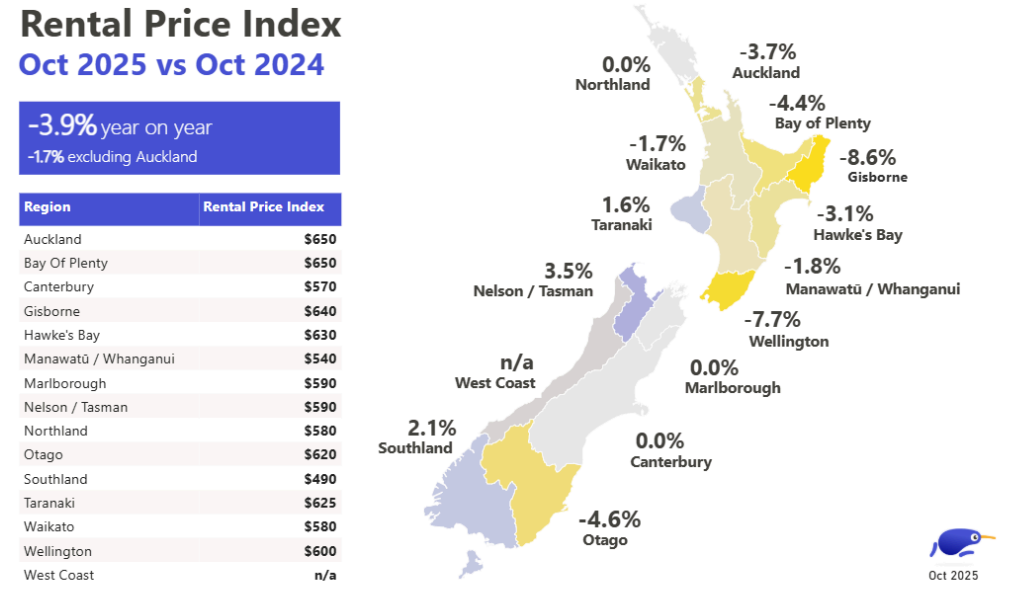

The decline in advertised rents is affecting most of the country, with the biggest fall over the last 12 months occurring in Gisborne, where the median advertised rent in October was 8.6% lower than in October last year.

That was followed by the Wellington Region -7.7%, Otago -4.6%, Bay of Plenty -4.4%, and Auckland -3.7%.

The only regions to show an increase were Taranaki 1.6%, Nelson/Tasman 3.5% and Southland 2.1%. (Refer to the chart below for the full regional figures).

The decline in advertised rents may be part of a structural change taking place in the rental market, with the number of rental properties being advertised on Trade Me Property rising, while enquiries from prospective tenants are declining.

Total rental listings on Trade Me Property in October were 2% higher than October last year, while searches for rental properties on the website were down 6%.

"This suggests we've either got fewer people in the rental market overall, or that tenants are choosing to stay put in their current flats," Trade Me Property spokesperson Casey Wylde said.

She described the latest drop in rents as "significant."

"We haven't seen the national median this low since early on in 2023, which is good news for renters who are looking at moving ahead of the summer months," she said.

The comment stream on this article is now closed.

13 Comments

ouchy ouch

How long can asset prices hold up if cashflow does not support

Judging by comments on such as Reddit threads, forever.

Some people will smile through their teeth as their house gets repo'd, as you know.... can't lose with housing they said, you'll get rich they said....honey do we still have a car?

If the asset is only an investment, not long. If the asset also provides actual benefits other than financial, like a roof over your head, then its price can hold up.

As long as there is a sniff of tax free gain....oh wait.

Tough time for property investors, house values stagnant, rents down and expenses up (apart from interest rates).

The housing stock is our lifeblood Dr Y. When we create credit out of thin air, we can either use it to consume, speculate on asset prices, or use it to produce goods and services. Aotearoa chose the former - consumption and bidding up house prices, instead of building houses and the infrastructure to support communities. And much like Japan in the 80s and Aussie in 2025, the aggregate value of residential land to GDP is high. The high cost of land makes makes us a high-cost economy across sectors such as logistics, manufacturing, professional services, etc.

But look on the bright side. Things are pretty dire globally but that 's potentially a good thing for the the Ponzi, even if you don't understand why. The US preparing stimmy checks; Japan and China preparing stimulus packages; the Fed dumping QT and the US is issuing $1.9 trillion in treasures per year; etc. Global M2 money supply is at a record $137 trillion - indirectly this is all good for Aotearoa Ponzinomics.

supportive, but the piper must be paid.

M3 money supply in Oz is well up thanks to their ponzi, and they wonder why inflation is ticking up. They're still in the rockstar economy period, but it'll be interesting to see what happens when they, like us, hit their limits and their great property sell off comes o a head as their asset prices drop.

Negative leverage coming to a house near you. Sprinkle in some stagflation and let the staggering begin.

Anyone catching fire financially...did it to themselves.

🍿

Always worth pointing out that changes in rent levels follow changes in gross earnings (total wages earned). As gross earnings pick up again, so will rents. Why? Because rents rise to whatever level renters can afford to pay. And, they always will unless someone decides to quickly build 50,000 dwellings across the country without caring whether they make a decent return.

Only when renters are e sorted thru supply restrictions. The supply term being used is "overhang"...

Govt has demanded councils plan 30 years of property growth. How confident are we they will follow through on this, or will it simply go by the wayside after the election?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.