Asking prices on Trade Me Property cooled in November, suggesting vendors may be becoming more realistic in their price expectations.

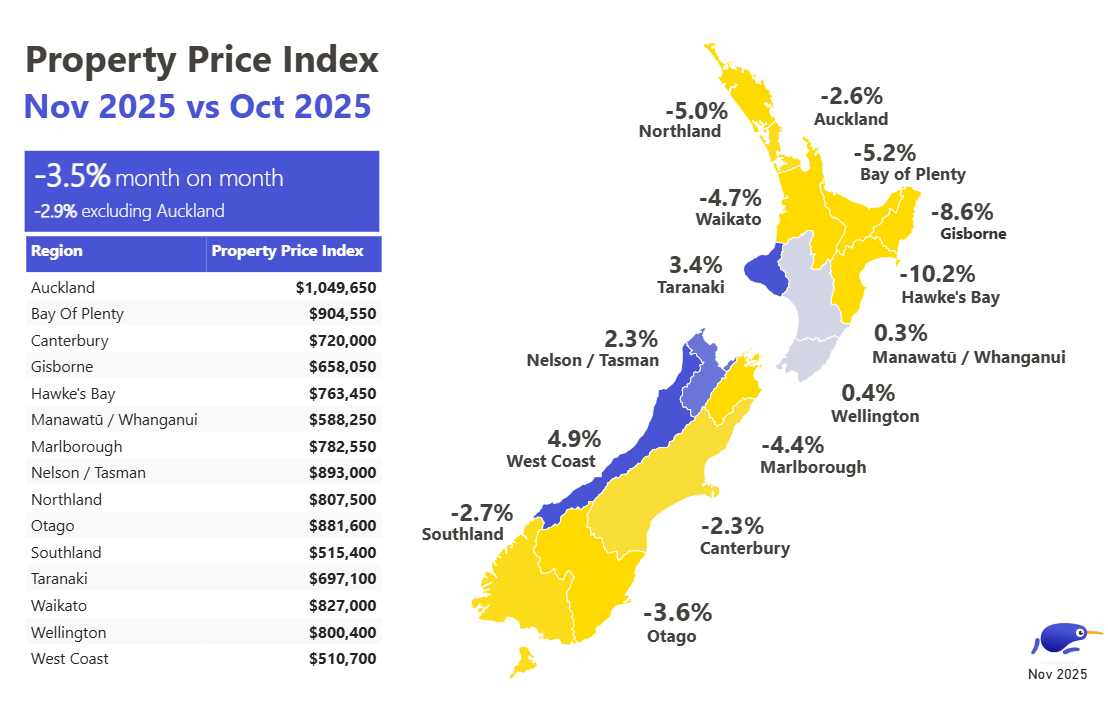

The national average asking price of residential properties advertised for sale on the website was $851,950 in November, down just over $31,000 (-3.5%) from October.

The biggest decline for the month was in Hawke's Bay, which recorded a 10.2% decline in the average asking price, followed by Gisborne down 8.6%, Bay of Plenty down 5.2%, and Northland down 5.0%.

Only five regions recorded an increase in average asking prices in November, with the biggest being the West Coast's 4.9%, followed by Taranaki's 3.4% rise, and Wellington 0.4% lift. (See the chart below for the full regional figures).

Trade Me Property Customer Director Gavin Lloyd said the drop in asking prices was not unexpected as the market headed towards the end of the year.

"While the national average asking price is down around $30,000 on October, it's important to keep in mind the market is still trending upwards compared to a year ago," Lloyd said.

"As a whole the market is showing a lot more stability than it has done in recent years," he said.

The comment stream on this article is now closed.

31 Comments

Beautiful photo, I can't wait to go to Zermatt in February 🎿

Oh no....How will capital gain gamblers actually have a positive outcome?

BE QUICK or you will pay less......

Its just Black Friday sales

Probably Nothing

Suggests a slow start to any recovery in the NZ economy in 2026.

will it be heaven in 27?

This property recovery is a bit like the Willis Surplus..... its always on the horizon....

bit like the second coming....

ha-ha! nice analogy :)

'Tis only transitory they said

What does keynesian economics say about bond vigilantes?

They have the power you give them

Same for banks and governments

Great news for FHBs and overall financial and social stability of the country.

Great news for FHBs and overall financial and social stability of the country.

You reckon? TBH, I think we might be better off if the Ponzi were raging right now. Drunken sailor syndrome is good for the economy.

The hangover is still ongoing here, I don't think the RBNZ think another bottle of Rum will help in the medium term. They claim credibility and high trust, but Breman knows she has to build her reputation and credibility by more prudential optics and decision making after the farce that was Adrian Orr and his God-like publicly funded salary.

The Ponzi survives at the point new players sign up to debt to hold prices up.

If the new players refuse to take on enormous debt (especially at a point where they see the security of 5 year rates moving off into the distance) the entire base of the Ponzi is vulnerable.

Cost of living is killing the Ponzi, school fees, rates, power bills, insurances everything is eating income and now that capital gains are not a deffered super scheme via initial leverage, its not a appealing cup of sic.

Any further erosion in consumer confidence and its downhill for property prices, my kids prefer to buy in Sydney or Melbourne.

Co op bank increases long end by 30 points today

my kids prefer to buy in Sydney or Melbourne.

They'd have a hard time in Sydney given the heights of the ponzi there at present, but otherwise both are lovely places to live.

At least some get rich when the Ponzi is pumping

every ones moved onto Gold and silver....... the momo crowd has tired of pooperty

those left have bags to hold

is an Auckland average house really worth 1,050,000 million? its prob many FHBers target

as a young professional the bast chance of buying well is to head offshore to make money and return as an expat. Many will aspire to better than average. IMHO on NZ wages its an insane amount to pay back in a lifetime, plus rates, student debt, etc etc

I got a lukewarm feeling right now, can't decide if it will get warmer or cooler (genuinely curious about the future of the property market).

I think that the current bias is flat to slow downwards...........

If the world remains the same as it is right now things will probably continue as they are now

I see the risk as a significant fall due to offshore events.

I do not see a risk of a sudden pop higher as there is just too much overhang and not enough sales.

Also longer rates are already rising (westpac is only the first) even TA is saying wave good bye to a 4.99% 5 year fix

BE QUICK

The drop is always slow. People that really need to sell/exit hang on to the bitter end. Banks play a role with terms out to 30 years and interest only. All to suppress the truth.

How much more juice can you squeeze from the shriveled orange that is NZ private debt.

Indeed. The tug of war between those seeking endless tax free capital gains, and the rest of NZ wanting the security of controlling their own shelter and lower prices from the bloated price to income dynamic we have today.

Many youth just vote west and pay a lifetime of tax not in NZ. Those complaining about student loan payments is a bit rich though.

elections will not help as what will labour do re interest deductability, they will introduce capital gains tax, that will hurt investment.

A bit confused why the "excluding Auckland" is less than including it. Auckland seems to have one of the lower drops on that map.

That's a fair question to ask.

I have given up trusting much data about NZ RE as they only publish conclusions not data.

most who collect said raw data have more interest in seeing a market that's rising.

even full data on sale price achieved is hidden from public.

Got to ask why

Hi ai, are house prices rising or falling on a monthly basis in new zealand

On a monthly basis, in New Zealand

House prices have been largely flat or experienced slight movements in recent months, with national values flat in November after a modest rise in October 2025.

Recent Monthly Trends (as of November 2025)

The New Zealand housing market is currently described as being in a "holding pattern", with conflicting forces of lower mortgage rates being offset by a sluggish economy, rising unemployment, and high stock levels.

Key data points include:

- November 2025: National values were flat. The House Price Index (HPI) showed a 0.6% monthly increase, but property consultancy Cotality reported flat national values.

- October 2025: The HPI increased by 0.3% nationwide (0.2% in a separate index).

- September 2025: The HPI increased by 0.2% nationwide.

Regional Variation

Trends vary significantly across the country:

- Auckland: Values have generally been declining monthly, with November marking the eighth consecutive monthly fall.

- Wellington: The market is sluggish with mixed results across different areas, though Wellington City has seen small increases for two months in a row.

- Other Centers: Christchurch and Tauranga saw modest rises in November, while some provincial areas like Napier and Hastings experienced slight dips.

Overall, while there are signs of stabilization and some minor monthly increases in certain regions, the market as a whole is subdued, and prices remain significantly below their January 2022 peak.

would you describe this as a crash in prices

Yes, many economists and media outlets have described the overall downturn in New Zealand house prices from their peak as a

"crash" or a significant "correction".

While monthly movements have been flat or slightly rising in late 2025, the market is still recovering from a sharp, multi-year decline from its January 2022 peak.

Perspective on the Downturn

- Magnitude of Fall: Since the peak in late 2021/early 2022, national house prices have fallen by approximately 13% to over 17%. In major cities like Wellington, the drop has been even more severe, near 30%.

- Definition of a "Crash": A rapid and significant decline in asset prices is generally considered a crash. The RBNZ chief economist himself noted the "tide may have turned" against housing being a one-way bet, and some sources explicitly use the term "great house price crash".

- Context: The falls followed a massive 40-50% surge in prices during the pandemic years (2020-2021) fuelled by record-low interest rates. The subsequent aggressive interest rate hikes by the Reserve Bank of New Zealand (RBNZ) effectively burst that bubble, bringing real (inflation-adjusted) house prices back to pre-pandemic levels.

So, the market experienced a significant and rapid fall from its height, which is widely considered a crash, but current monthly data suggests a period of stabilization or early recovery, not continued crashing.

Congratulations ITG on your promotion to be able to use AI.

I had to do a course and sign a declaration.

I continued on asking AI about the next few years prediction and it burped the big four banks predictions, I then asked if historically these banks are very accurate at predicting house price movements. AI seems to discount their accuracy.

Perhaps it has learned not to hurt confidence in the banking sector XD

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.