Things were a lot quieter at the latest auctions as the market winds down for the Christmas break.

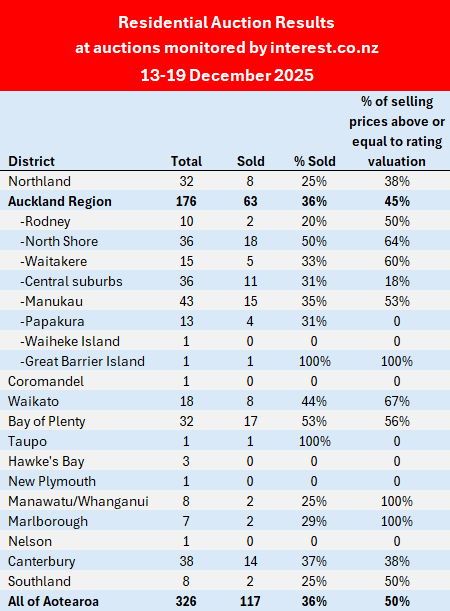

Interest.co.nz monitored the auctions of 326 residential properties around the country over the week of 13-19 December, well down from 517 the previous week.

Sales were also weaker with 117 of the properties on offer selling under the hammer, giving an overall sales rate of 36% for the week.

That was the lowest auction sales rate recorded by interest.co.nz since mid-June.

Prices were also weaker, with exactly 50% of the properties that sold achieving prices equal to or better than their corresponding rating valuation, down from 62% the previous week.

That was the weakest price to valuation ratio at the auctions monitored by interest.co.nz since late July.

Although auction activity is finishing the year on a soft note, over the course of this year the sales rate has perked up compared to 2024.

Annual figures

Over the course of 2025 interest.co.nz monitored the auctions of 16,613 residential properties, down slightly from 16,897 in 2024.

However, the number of properties that sold under the hammer increased from 5938 in 2024 to 6550 in 2025.

That pushed the annual sales rate up to 39% in 2025 from 35% in 2024, almost back to the 40% sales rate achieved in 2023.

As always the latest district results are displayed in the table below.

This is our last auction report for 2025 and they will recommence as auction activity starts to pick up again next year, probably in early February.

We wish all of our regular auction readers a safe and enjoyable Christmas break.

The comment stream on this story is now closed.

4 Comments

Does this result form the basis of a sustainable high sales volume floor then price recovery throughout 2026? Even for the pro BSer, it's hard sell.

Auckland Central figures are appalling...

Houses going backwards relative inflation

Merry Xmas all Interest Staff and DGMers and Spruikers alike.

None sold by Auction in Wellington region? Is this correct?

It is indeed down down down, in ponzi town. Down in price. Down in sales turnover. Down in future buyers.

No surprise, we continue the slide from Orrfuls peak bubble. No surprise sellers still think they deserve that peak, and hold on waiting. Waiting for capital gains tax.

The next election will likely be fought over capital gains. A tax we in all likelihood need, as the greed of price expectation drives our future tax payers west. Construction cost countines to stay high, so waiting for the appartment zoning may not yield as much as some think. Zoning that all spec owner will have to pay rates on prior to sale. Zoning that require multiple properties to actually build.

Perhaps the best spec play in the next twn years is owning multiple adjoining properties...just like monopoly.

Activity is lackluster right now, but I'm seeing the very beginnings of another round of property euphoria. It goes like this:

1. Immigration numbers begin to increase (we're in this phase now).

2. Queues begin to form at rental property open days.

3. Specuvestors start getting back into the game, as they prepare to snort lines of 20% capital gains.

4. Owner occupier buyers see material rises in prices and begin to develop severe cases of FOMO.

5. Property owners start feeling "rich" again as prices are bid up ever higher by specuvestors and FOMO owner occupiers.

6. Banks pour hundreds of billions more of poorly allocated capital into the property market.

7. The government of the day claims the credit for "fixing the economy" and voters believe it, eagerly returning them to power.

8. Meanwhile, NZs per capita output takes yet another hit as capital ends up in all the wrong places. But hey, who cares. Our houses have just doubled in value...again.

https://www.stuff.co.nz/home-property/360911885/how-choose-home-pool-an…

fill your boots, not sure many NZers will be able to afford double current...

https://www.stuff.co.nz/home-property/360911885/how-choose-home-pool-an…

fill your boots, not sure many NZers will be able to afford double current...

Can you share your source for the immigration numbers please? I see no increases other than the usual seasonal agri workers...

Profit circle for banks. Stupidity circle for non speculators kiwis.

Govt may see this as a relection strategy but is will just pour fuel on inflation making being retire, unemployed, and a government employee e en less survivable.

Would add mass immigration still has no electoral mandate. Aka anti democratic.

Politicians whether in govt or opposition consider reelection priority above all else. They do not care beyond the next 3yr term.

Politicians whether in govt or opposition consider reelection priority above all else. They do not care beyond the next 3yr term.

.

.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.