Average national residential property values rose in the December quarter, with Christchurch leading the way among major cities, but a glut of homes for sale means buyers start 2026 with the upper hand, Quotable Value (QV) says.

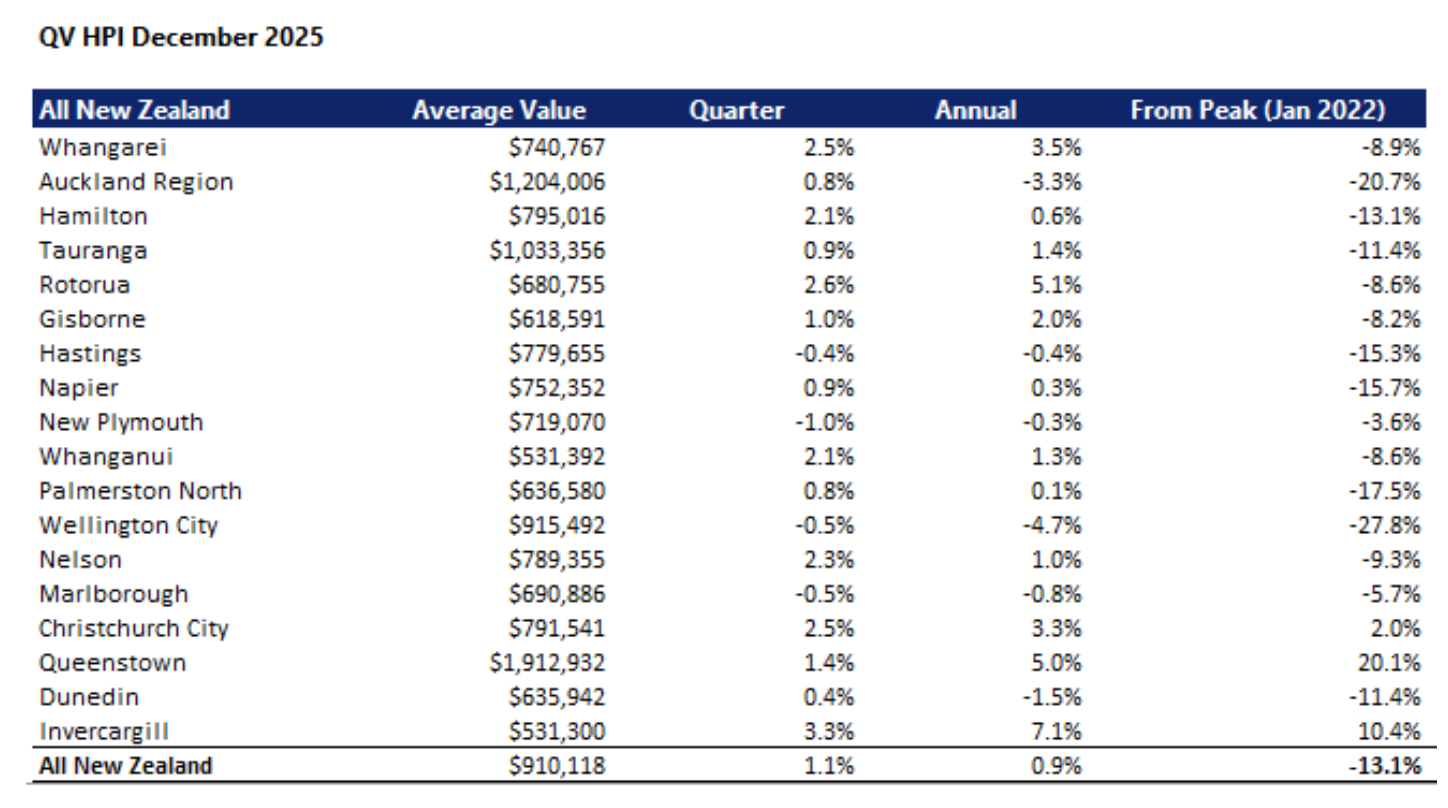

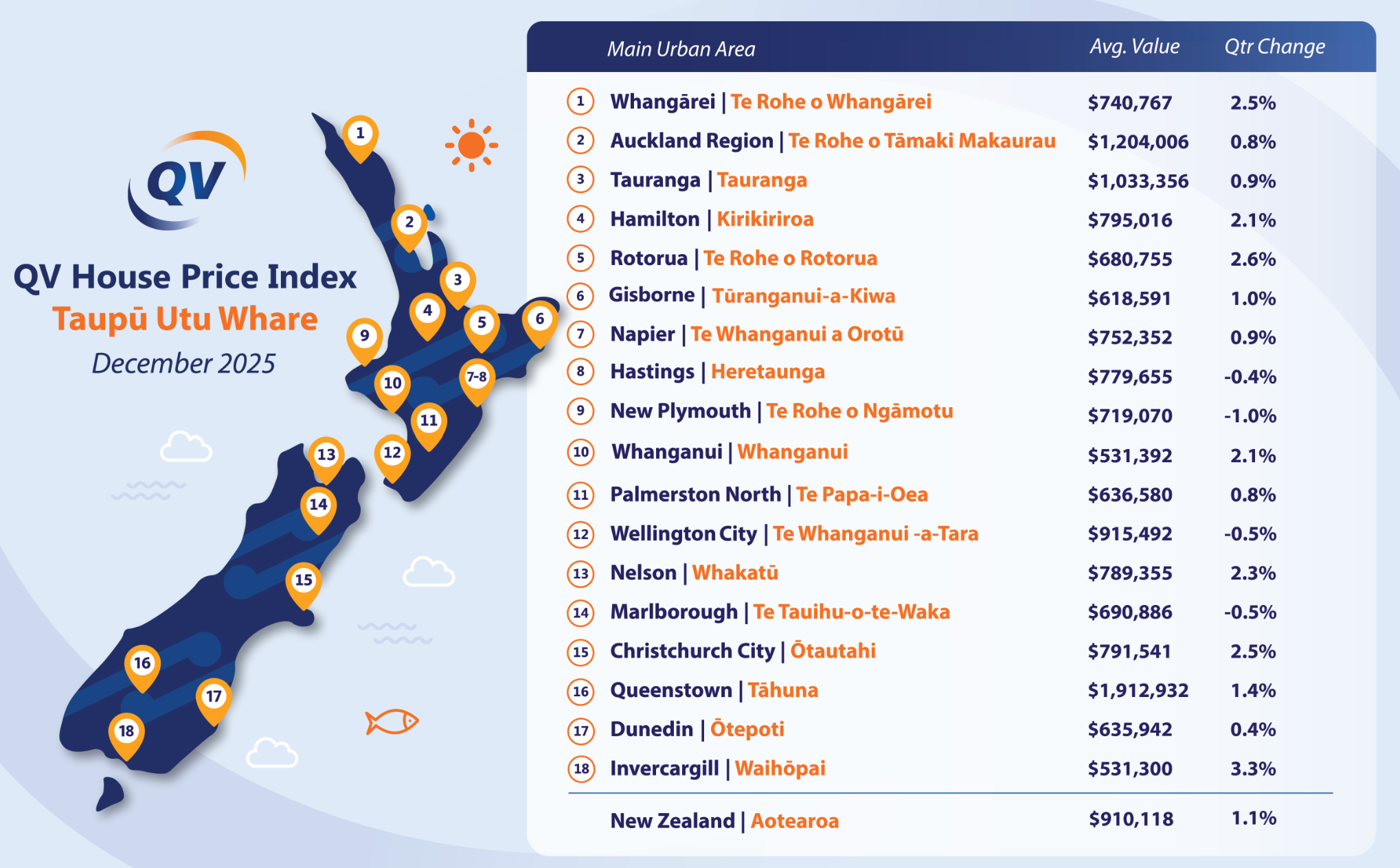

QV's House Price Index shows average residential property values across New Zealand rose 1.1% in the December quarter from the prior September quarter, lifting the national average to $910,118. Although that's 0.9% higher year-on-year, it's 13.1% below the national peak in January 2022.

The QV HPI uses a rolling three month collection of sales data, based on sales agreement date.

QV National Spokesperson Andrea Rush says the December quarter rise follows a prolonged period of flat or falling values during much of 2025. Rush says value increases are becoming more widespread across NZ, albeit the pace of change remains modest in many places.

"A clear majority of the areas we measure recorded quarterly growth, indicating that value movements are now occurring across a broader range of regions," says Rush.

However, big numbers of property listings remains a key housing market driver. The three big property portals ended 2025 with huge volumes of properties for sale. Realestate.co.nz had more than 30,000 for sale listings, TradeMe Property had more than 41,000, and OneRoof had over 38,000.

"With the number of homes for sale nationwide at the highest level in a decade, buyers continue to have the upper hand, with more choice and the ability to negotiate. This is keeping value movements in check, even as activity improves in some areas. That dynamic is also contributing to improved affordability in relative terms, particularly for first home buyers, who remain active across many parts of the country," Rush says.

Of the main cities, Christchurch recorded the strongest quarterly growth at 2.5%. Next was Hamilton at 2.1%. The Auckland Region recorded a 0.8% increase, with Dunedin up 0.4%. Wellington City was the only major centre where values dropped, down 0.5%.

In the regions Invercargill recorded the strongest growth of 3.3%, followed by Rotorua's 2.6%, Whangārei's 2.5%, Nelson at 2.3%, Whanganui with 2.1%, Queenstown's 1.4%, and Gisborne at 1.0%. Tauranga and Napier were up 0.9%, and Palmerston North 0.8%.

New Plymouth was down 1.0%, Marlborough down 0.5%, and Hastings down 0.4%.

Development land value reset lower in some places

Rush says in the likes of Auckland and Christchurch, apartments and townhouses face pricing pressure because of ample supply, higher building and servicing costs, and because values for stand-alone homes have fallen.

"In many cases, buyers are choosing houses on their own sections offering more storage, privacy, living space and carparking over townhouses or apartments that lack these amenities and are often not significantly cheaper to purchase. Agents also report that buyers are favouring developments that do offer these features, particularly those in popular locations, over those that lack parking, storage, privacy and outdoor space," Rush says.

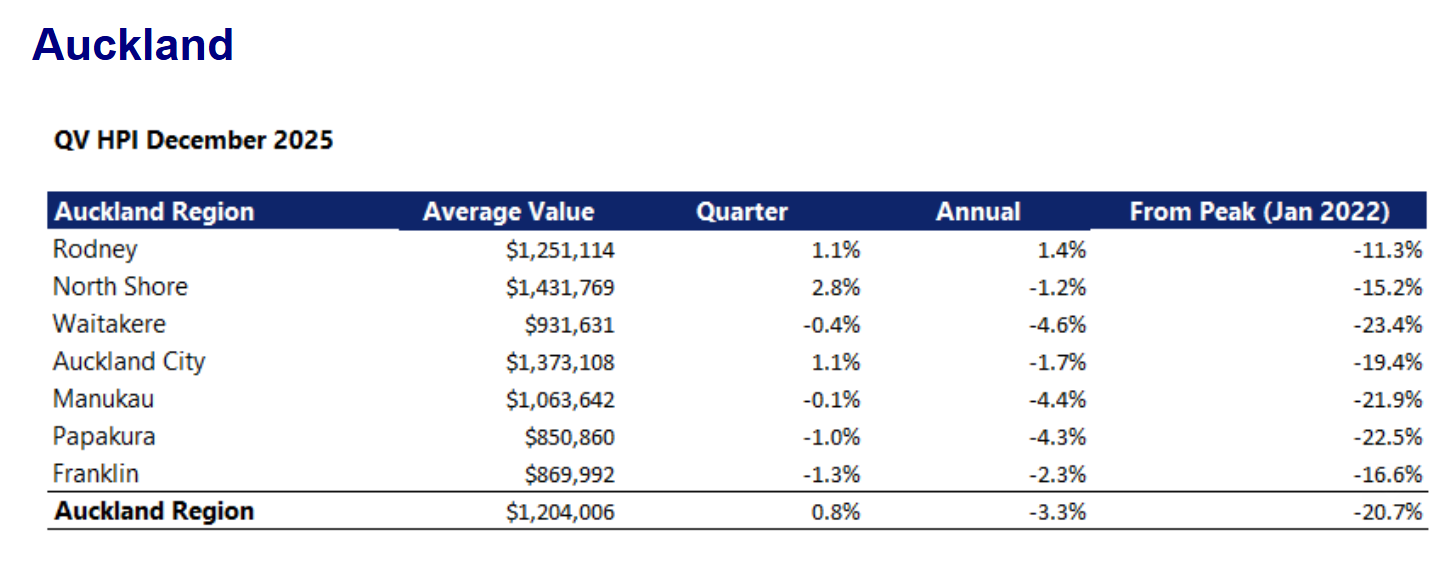

"We’re also seeing the effects of a reset in development land values in some locations, following elevated prices paid during the previous peak such as in Auckland’s Waitākere, Manukau and Papakura, where values have dipped more sharply. With QV CostBuilder data showing building costs remain elevated compared to pre-peak levels, alongside higher interest rates, some developers who paid a premium for land during the peak can no longer afford to develop or hold it, resulting in land being resold in some cases at significantly lower prices than originally paid."

Election looms

Rush says some uncertainty remains for the housing market this year, especially with an election looming.

"An election year can create a degree of caution, which may restrain activity at times as buyers and sellers take a more wait-and-see approach. As a result, any change in values is expected to be gradual rather than rapid."

Auckland high end prices rise, Wellington prices down almost 30% from peak

In Auckland QV Registered Valuer Hugh Robson says the biggest gain came at the higher end of the price spectrum, especially for homes priced between $2 million and $3.5 million, where sales volumes have risen.

“That segment has clearly regained momentum, and it’s helping to support overall values across the region," Robson says.

The average home value across Auckland is now $1,204,006, with values 3.3% below where they were at the same time last year, and 20.6% below the nationwide peak of January 2022.

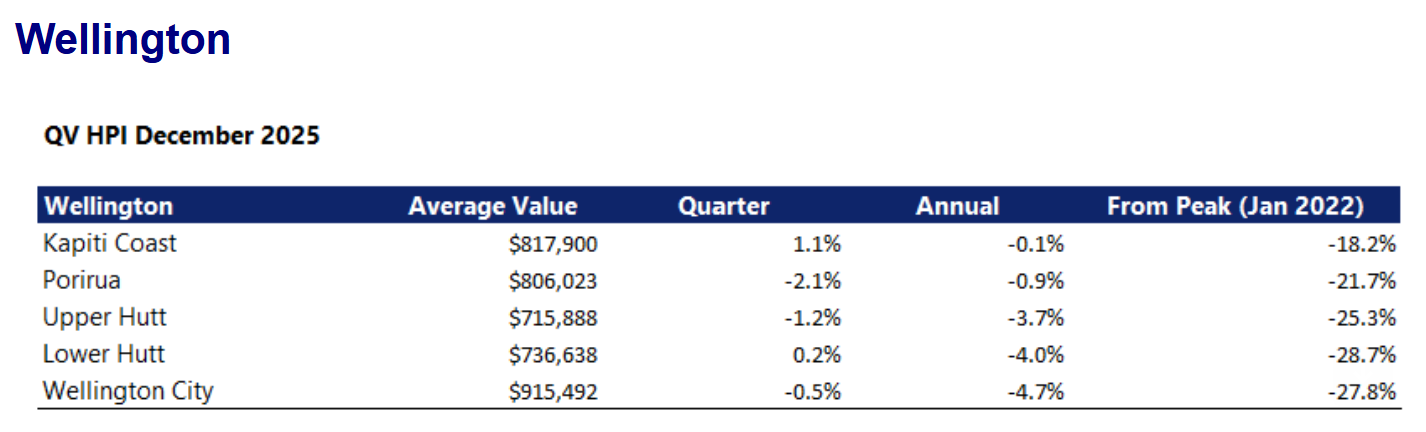

QV Wellington Registered Valuer David Cornford says many parts of the Wellington region remain close to 30% below previous peak values, which is helping first home buyers enter the housing market.

"Lower prices have improved affordability for some buyers. However, interest rates remain much higher than during the peak which means servicing debt is still a barrier to many potential buyers," says Cornford.

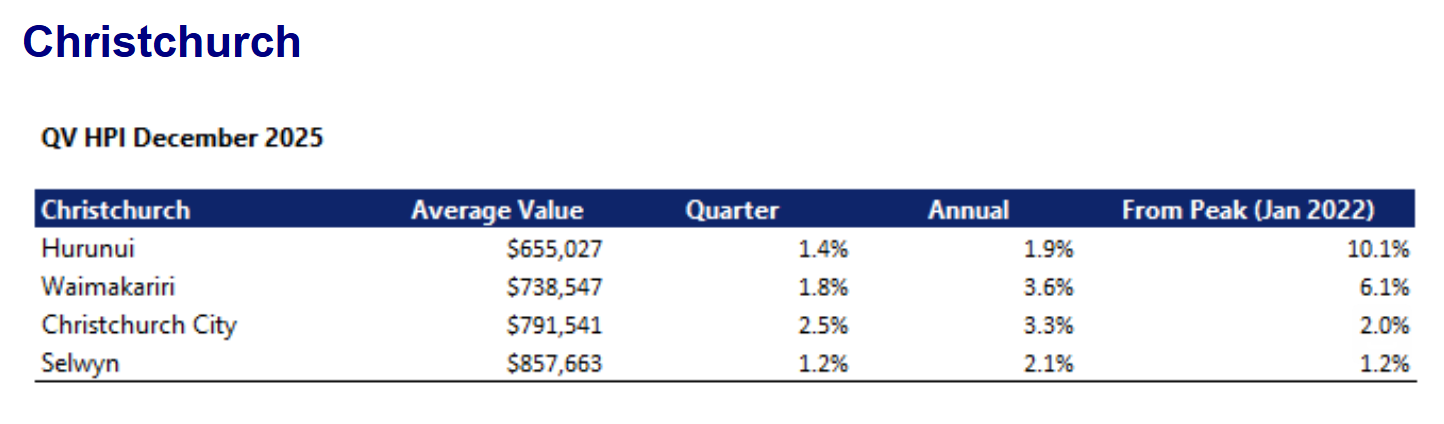

In Christchurch QV Registered Valuer Michael Tohill says property listings are still high, while selling times have continued shortening, reflecting a well functioning market.

"Demand remains particularly strong in the $1 million to $2 million price range, with competitive bidding and solid sale prices being achieved," says Tohill.

He says building activity across Christchurch, Selwyn and Waimakariri remains steady, with builders reporting healthy forward work programmes well into 2026.

The comment stream on this story is now closed.

21 Comments

Twelve months shows red ink for specu town, unless you are in parts of the South Island. Perhaps the drop has leveled out last quarter as the tightness of the debt noose was reduced. Time will surely tell.

HNY all.

Looks like the 'ponzi' is finding its feet.

These price increases would be at least doubled if townhouses noone wants were stripped out.

🥂

Noise suggests there is more "yet to be listed" townhouses to sell that have yet to hit the market. Banks still supporting but if margins close for them perhaps they will have to force the shadow listings into the sunlight.

Narrated by David Attenborough:

In the concealed realm of human ambition we find the Ponzi.. battered by years of mounting losses. Yet in its final struggle for survival, strange foot like deformities appear.. Broad, grotesque structures, evolved to bear the crushing weight of a supply glut. An adaptation born of desperation, in perhaps it's final stages.

Sales mix is accounted for in the HPI, isn't it? Shouldn't make any difference to this series, would only affect the cruder measures like average and median prices.

That's true ...for the REINZ HPI, which is an index, with values around 3,500 for each city

This one is stated to be an average value (values around $1M), so it looks like they're just using a fancy name for this report. I don't see any mention of methodology on their report page, so I can only assume it's a plain mathematical average

Happy to stand corrected, even better if a source is linked

They'll become more desirable with time as we get used to the idea, and the 60+ yr drafty home with dodgy renovation history and prized lawn to groom, less so.

Wow, Wellington confirmed as currently down -43%, Auckland down -36% and the NZ average down -28% in REAL value.

Spectacular losses for any speculating investor over the last 4 to 7 years.

With mortgage rates only hitting lows of around 4.5% during the now ending down cycle (little to mild respite for the high debt junkies).......this is not the required 2.5% to 3.5% mortgages many need, to be able to pass the debt parcel (with profits) to new gumby debt holders.

Mortgages are now on the rise again and are the next sucker punch is about to hit the NZ Housing market.

No end to this epic property crash, until 2028.

Real Residential Property Prices for New Zealand (QNZR628BIS) | FRED | St. Louis Fed

The tail of that Fed graph looks unsurprisingly similar to the phases of an asset bubble. Looking at these graphs next to each other, we look like we are in the "fear" phase after a small "bear trap" last year. What happens next?

If rates go back up, or there are more Orange swan events (Greenland etc), ...anything could happen. Meanwhile stagflation continues.

Popcorn

You people are hilarious please keep it up!

Especially love the specutown ponzi bits.

Meanwhile learn about nominal vs real in the context of assets purchased using debt.

🥂

Glad you are entertained and have a portfolio strong enough to pay .27c a day to participate. Sadly many of the housing to the moon commentators of previous years appear to have not.

Yeah, sure, righto, yeah, sure.........your speculand lot, talked endlessly that "property was the best inflation hedge"....hahahahahha.

So the loss of monetary value of -15% from early 2022 to late 2025, does not matter if you borrowed oooodlles to fund the buy, that then went on to lose BOTH Nominal value and Real value.......

Sounds vet much like lalalaland economics, that you have cooking in your Ponzinomics kitchen, CoteyYourSelfInDebtAZur

If only we had the possibility to 'heart' a comment!

I'll do it here instead ❤️

Glut of homes for sale restraining property value increases

Strange headline, given that the data shows that house prices have increased in almost all regions in the last quarter.

You missed a bit; Glut of homes for sale restraining property value increases, QV says

OK then,

Glut of homes for sale restraining property value increases, QV says

Strange headline, given that the data shows that house prices have increased in almost all regions in the last quarter.

It implies is that prices would have gone up more if unsold stock had not acted as drag on stats.

Headlines are simplified.

RE is rather illiquid on the way down. May go some way to explaining the low sales turnover.

NZ 10year bond about to punch back through 4.5%.

More mortgage hikes during Jan 2026 now expected!

Specucrowd, does a group pearl clutching!

❤️😂

🥂

Happy new year to you, Cote DZure!!!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.