Residential asking prices on Trade Me Property ended last year on a decidedly soft note, with the website's national average asking price dropping 6% in December to its lowest level in 12 months.

Trade Me Property's national average asking price fell by more than $50,000 in December, to $800,700 from $851,950 in November, the lowest it has been since December 2024.

The sharp drop in December followed a $31,250 drop in November from October, meaning the average asking price of properties advertised for sale on the website dropped $82,500 over the pre-Christmas summer selling season.

The biggest fall in the average asking price between October and December was in one of the country's smallest housing markets - Gisborne - where it plummeted to $463,100 in December from $722,400 in October. That's a slide of $259,300 in the last two months of the year.

Asking price declines were also substantial in most other parts of the country over the same two month period, led by Auckland -$126,400, Hawke's Bay -$109,350, Marlborough -$93,300, Wellington Region -$69,300, Waikato -$59,500, Northland -$50,000, Nelson/Tasman -$41,650, Otago -$36,600, Canterbury -$23,050, Southland -$19,900, West Coast -$18,450, Manawatu/Whanganui -$15,250 and Taranaki -$9250.

The only region where average asking prices went against the trend and posted an increase over the last two months of last year was Bay of Plenty, with a $9,900 increase to $963,000, giving the region the most expensive average asking price in the country.

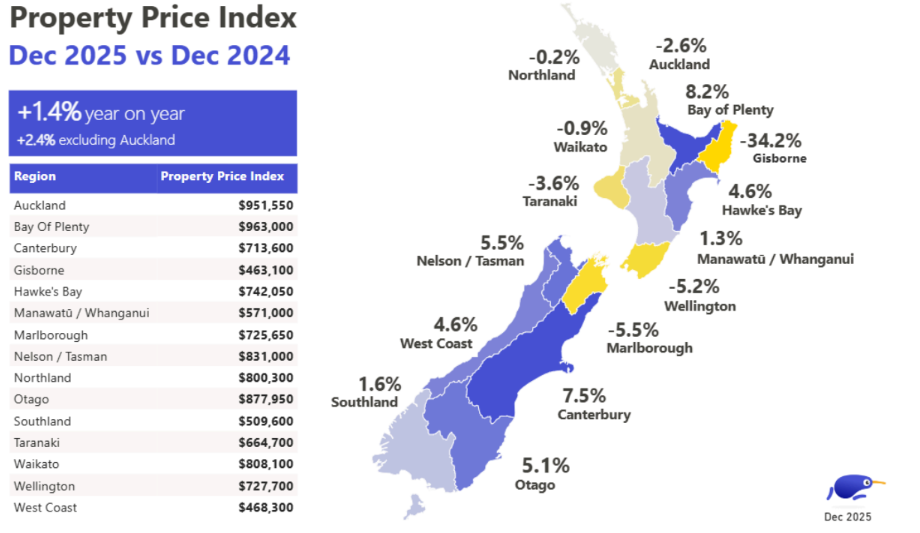

The chart below shows the average asking prices on Trade Me Property for all regions in December 2025 and their percentage change since December 2024.

- The comment stream on this story is now closed.

14 Comments

REINZ report for December is delayed.... suspiciously, as it's usually out 15th or 16th of the following month. Clearly wanting to add a few sales through before the numbers come out that paint a downwards trending picture resulting in lower offers and sale prices.

It's not unusual for the REINZ December report to be published later than usual in January. Last year the December market report was published on Jan 22. That's because most agencies are more less closed up over Xmas/New Year, so it takes longer than normal for them to send their sales data for December through to the REINZ as they open up again. It would also make sense for REINZ staff to take a break over Xmas/new year when the market is dead.

Thanks for clarification Greg. Keep up the good work.

Talk about ruining the narrative with facts.

.

Not surprised that asking prices are falling. I am seeing it locally, sprikervestortown is bailing out.

The fast/smarter investors are getting out before the next round of Big mortgage rate hikes, scare the bejeses out of the already skittish buying horses.......

Hope you fixed, well past 26 !!!

Bubble talk. We are past peak (2021) and bull trap (q3 and 4 last year), which leads us to the capitulation phase. The next phase is despair and then return to mean.

Is very interesting to see how this phasing matches reality, and the yoyo of the cost of debt created by central banks. Almost like they make this happen. Anyone over invested (negative yields) should stock up on pepto pills, or find a way to inject come capital to cover falling valuations. Ideally before the bank calls.

Question. Will open banking allow different banks to swap data on how strung out various speculators are as a whole?

Not arguing house prices are way too high, or rather sucking out too much money from houselholds incomes leaving too few for other parts of the economy to flourish (discretionary spending at its minimum). But the bull trap then capitulation narrative is only theory, I'd like to see a real world example where real estate actually followed it. Examples I found show there either wasn't any bull trap or capitulation phase. People's behaviour has to be taken into account, they're not going to let their biggest "investment" sink unless forced to, and surprisingly the level of resilience is very high.

Agree owners seem willing to eat expire dogfood rather than accept a loss.

That said if rates go up a lot, the banks have two options. Shoot the over leveraged like the 1987, or wait untlll they banks are Nationalised by the Govt at at cents in the doller.

🍿

How will trumps takeover of Greenland impact NZ House prices?

Trump wants to tackle living costs, with housing at the center. Those with TDS will believe this is just rat cunning for some ulterior motive.

When Jacinda promised affordable housing while not wanting house prices to fall, we thought she was Mother Theresa.

What can we take away from this?

Cult of personality is alive and well. And people think irrationally and emotively.

[Trump doesn't sound much different to Ardern to me]

not wanting to spook the electorate rather

Trump taking over Greenland, whether either by force or financially, now seems increasing likely as he is now going to have to save face with his continued rhetoric. To take it over by force will be supported by many of his MAGA base in the all-important mid-terms . . . the morality of any such action will mean nothing.

So yes, a good chance we need to prepare for the economic and political consequences, but any effect on New Zealand housing will be only a very small part of it.

As an aside, a couple things I have learnt about Greenland in recent weeks. Despite its large area, the island’s population is only 57,000 so there is likely to be only 15,000 to 20,000 houses there . . . smaller than Napier city. As to housing; there is no private ownership of land as all land is communally owned; a house is owned the land is not.

Another thing; don't get misled by the size of Greenland as on a standard map. Most maps are the Mercator projection which distorts Greenland's size to appear even larger relative to countries close to the equator - Mexico for example is 90% the sie of Greenland while the Democratic Republic of Congo is about 9% larger.

Man ordered to pay $1.1m - and counting - after pulling out of house purchase | Stuff

What happens when you believe house prices can only go up.

Judge went hard. Clearly thought Singh was a liar.

Doubt he will ever pay up.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.