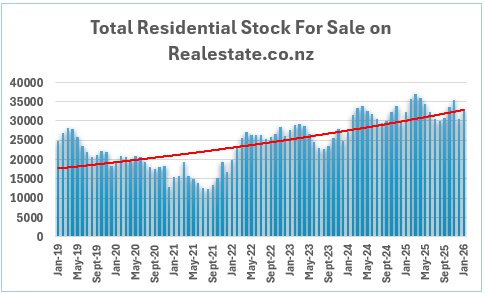

Home buyers will still have plenty to choose from as the housing market heads into the peak selling season, with total stock for sale on property website Realestate.co.nz sitting at a 10-year high for the month of January.

Realestate.co.nz had 33,149 residential properties advertised for sale at the end of January this year, up 2.3% compared to January last year and up 21.6% compared to January 2024.

The website received 9019 new residential listings in January, up 1.3% compared to January last year, however February and March are traditionally the biggest months of the year for new listings, so the really big summer surge is likely just getting started.

The average asking price of the properties available for sale on the website was $869,688, which was down 1.3% compared to January last year.

Overall, these early indications appear to suggest that the market is continuing along at a similar level to last year, with buyers having plenty of choice and prices remaining reasonably flat.

"The market has kicked off at a measured pace, with a slight increase in new listings and a January stock level decade high, but a dip in the average asking price, early signs of momentum that reflect the caution which characterised much of last year," Realestate.co.nz spokesperson Vanessa Williams said.

"We are seeing strong listings and solid sales volumes but buyers are still taking their time," she said.

"There's plenty of stock on the market to choose from which makes the new year a good time to transact," Williams said.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.