By Alex Tarrant

The Reserve Bank of New Zealand says households will not increase spending as much as bank economists expect as households seek to reduce high levels of debt.

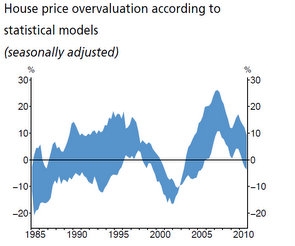

Meanwhile the RBNZ said house prices still appeared to be overvalued by up to 10%, and that house price increases were likely to be at or below inflation over the next couple of years.

Subdued consumption growth and weak housing demand could mean funds flowing into New Zealand may be directed more to investment rather than consumption, meaning a current account deficit over 5% could be sustainable, if borrowed capital from the rest of the world was invested for future New Zealand economic growth, Bollard said.

The RBNZ made the comments in its June Quarter Monetary Policy Statement, where it left the Official Cash Rate on hold at 2.5%. See more on the OCR here in Bernard Hickey’s article.

Households learn their lesson

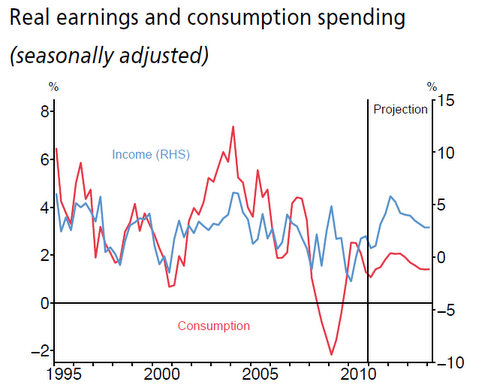

Over coming years households were not expected to increase spending at a rapid pace, the RBNZ said.

“Households have accumulated a significant amount of debt over past decades, and are expected to undertake a period of consolidation. This implies that consumption growth is likely to be modest, both relative to recent history and when compared to the projected increase in real labour incomes,” the RBNZ said.

The judgement around household spending was a key difference between the Bank’s projections and that of many external forecasters, it said.

Real consumption was expected by the RBNZ to return to the share of the economy seen prior to the years of strong consumption growth in the mid-2000s. As a share of the economy this would mean consumer spending returning to about 60% of GDP, rather than the 63-64% levels seen in the mid-2000s.

“Such an adjustment in household behaviour is needed to see household debt stabilise, but whether it eventuates remains uncertain. The Bank will be monitoring this closely,” the RBNZ said.

“Recent fiscal policy changes may increase the likelihood of conservative household spending. In addition, projected rate increases will tend to reduce consumption,” it said.

“Consistent with subdued consumption, house prices are likely to increase only modestly over coming years. A number of in-house statistical models suggest that house prices continue to be overvalued when compared to metrics such as nominal GDP or rental yields. As a result, house price increases are expected to be at or below the rate of inflation over the projection.”

Current account deficit sustainable if capital invested for growth

Asked whethere the Reserve Bank's track for a current account deficit rising over 5% would be sustainable for the New Zealand economy, Bollard replied it would depend on where incoming funds were allocated.

"If, as Australia has increasingly been doing, we are borrowing in order to invest in future growth, then absolutely it’s sustainable and you could see that continuing for a very long time," Bollard said.

“If, on the other hand, it’s borrowing for consumption, then more question marks get raised and you’d have to say, ‘will the market support that sort of borrowing,’ and that really depends on how benign those international markets are going to be in the future,” he said.

Currently, borrowing was for a mixture of consumption and investment.

“But we are expecting to see investment pick up this year and next year as the business sector regains confidence and starts to recover," Bollard said.

"We’re not expecting to see consumption pick up in a very marked way over the next couple of years. Now we might be wrong about that – that is a particular forecasting stance we are taking. We’re judging that New Zealanders have learnt from the global crisis, have been surprised and in some cases concerned by it, they have decided their debt is too high and they want to get that debt down," he said.

"Consequently they’re prepared to go through a rebalancing where they don’t increase their consumption to levels we might have seen in the past, and in addition [we would see] that house prices remain reasonably muted through that period as well.

“But that’s something we’re going to have to test. If we’re right on that, then yes you might see more going into investment and relatively less going into consumption,” Bollard said.

The Reserve Bank was keeping in close contact with the banks over their lending policies at the moment, with some banks again offering 95% home loans as they sought to reignite lending growth while households were cautious about taking on more debt.

“Net growth in lending into the household sector is very, very low. So we don’t have broad concerns from a financial stability point of view, or from the point of view of households overloading their own balance sheets with debt," Bollard said.

The Reserve Bank would not be slow in telling the banks about its concerns if it thought households had resumed overloading their balance sheets with debt, he said.

(Updated with comments on current account deficit, with charts)

25 Comments

In the previous MPS, the RB commented on renewed activity in the housing market, but they were proved to be wrong and have now adjusted their view.

Year-to-date sales and loan approvals are tracking at or below the feeble 2010 levels, there is little if any upward pressure on actual prices, and asking prices seem to be coming off the top.

Rather than BUY, BUY, BUY, as Olly N would adivse, all this points to RENT, RENT, RENT and SAVE, SAVE, SAVE. Anyone not already owning a house will be significantly better off by deferring any purchase decision for a year or two.

So you are saying I am better off paying rent rather than paying off a mortgage?

Yes, unless your circumstances are unusual

If you are not already owning, the interest on a mortgage (i.e. the "rent" you pay to the mortgagee) will be the bulk of what you would pay monthly. In all probability, this "rent" will be greater than the rent you pay to a landlord for an equivalent property.

You could save the difference between the mortgagee "rent" and the landlord rent, accumulate a bit of interest on the saving, and then have more money to put down in a year or two on a property whose price is unlikely to increase, and could well decrease, in the meantime.

The bonus is that you will have free weekends too.

"A number of in-house statistical models suggest that house prices continue to be overvalued when compared to metrics such as nominal GDP or rental yields"

Do they have a model where they compare it to incomes? If you want to look at long term sustainability then that's the measure you need to use. And I'll bet that indicates they are more than 10% overpriced.

When they FINALLY start to increase interest rates watch house prices fall more than 10%.

NZ is becoming the last cab on the rank to have falling house prices. The longer the rates stay lower the harder our eventual property fall is going to be.

The RBNZ statements and predictions lack drama, don't they? House prices going up slightly only, tracking inflation... - boring! This site likes dramatic statements like 10% drops, 20% drops or more! :-)

OK so I have $400K in the bank and am looking to buy a brand new 4 beddy for $450K I could rent a similar property for $450 pw. Rates would be around $2,000 pa. I calculate a net cashflow benefit of $8,000 by owing (assuming 6% interest on 50K and 4% less tax on $400K on TD).

If you have $400k in the bank, it's unlikely you'll be after a $450k house for your residence! More probably a $1.2m and have equity of a comfortable 30%. How do those calcs look? NB: My point being I'd want far more than a miserly $8k to tie my $400k cash up in any illiquid asset, whatever it is. That's a risk weighted return of only 2%. Even a true property investor looks to get 7%

Doesn't it depend on what reason he is looking for a house? If he is wanting a home of his own then the returns are irrelevant. I'd suggest buying a cheaper property, have cash left over and 100% equity. If he is like most other NZ speculators/PI's the return is also irrelevant - how many actually purchased their rental property based on yields and not the tax advantages/capital gains?

What people do with their own money,meh, their savings, is up to them. I would say, though, that those who do better than most, financially, step outside the emotion of doing anything, and make it a numbers game. That's not for most people when it comes to their home. But to gamble your, and your families, future on capital gains in the New Zealand property market is a risk doomed to failure when the market is at an historical high. That was last decades game, and the one before that. It's not knowing 'what happened last time' that makes for success, but figuring out 'what happens next time', and the two are not necessarily the same. 5% odd off from peak is not anywhere near the correction that will come, in my opinion, with a 'rebalancing' of our economy. But we shall see :)

I think you have missed the point completely. I am buying a house for my family to live in. We are on one income as my wife is a stay at home mum. The $8K represent the how much less it will cost me (in annual cashflow) to own versus renting.

You're right shorts...buy something but be dam sure you aint paying above 05 prices and avoid the rotting ones...leaving it in the bank is not worth it otherwise.

Go for one with veg garden potential and room for the chooks and kids.

Give the better half some packs of seed to start her off. Buy the sprogs some chickens for their birthdays.

Then go fishing.

Are you sure you have the calculations right?

You have the cost of rates in there but have you included insurance, maintenance and Interest on the remaining $50k debt that would be required? These are all costs you don't have to foot as a tennant. A rough calc on those adds up to $165 per week.

7% is a little light isnt it? - even for central auck.

Could be ok in a real bluechip area I suppose.

So is now a good time to lock in a low interest rate for a new home loan? Or better to stick with the variable rate?

http://www.stuff.co.nz/national/5132335/Proof-of-life-in-property-sales

house prices moving up... a house was sold in hamilton last week... 5k above asking! Means its boom boom BOOM time again!

"Some are saying buyers now can't afford to wait and think about making an offer or they will find themselves in a bidding war.

In Hamilton last weekend a house that had been on the market for just three days attracted seven offers and sold for about $5000 over the asking price. "

"Queenstown...had...... "massive adjustments" in section prices.." I wonder which way the 'massive adjustments' were!

It depended on location NA and on winter sun...the best stuff went up.

We had a bubble and now prices need to adjust. Once the interest rates start rising, house prices will drop down faster than the titanic .

I am in the market looking for a home and I know what people are buying and NOT buying. There is pent up demand but buyers like me will NOT overpay and will sit and wait. There are multiple offers on "ONE" good priced listing and the rest are just sitting there waiting for some idiot to overpay, real estate is still overpriced.

Interest rates may not rise much, in fact I expect the OCR to drop because I expect deflation...but its the same result, house prices drop....only worse 50% maybe more sitting and waiting isnt insnae in my book YMMV....If we see a technical default by the US then its possible over a very short period interest rates might rocket, but thats only for some months...after taht I expect the US to keel over....if the GOP are that stupid that is...and frankly they are...fanatics the lot....

regards

do you see whats happening in australia???? the economy is still very strong... and yet whats happening to their house prices????

even they were claming Shortage of Houses, yet with all that, prices are dropping!!! WHY??? interest rates are bitting...

China??? same thing, the latest moves by the govt are now kicking in and their prices are falling...

Why should NZ be any different????

Come on 'Houses Overpriced', wishing prices drop is one thing, but comparing NZ house prices to the rest of the world's house prices is just silly...

So let me explain this slowly...

We live in NNNNNUUUUUUU ZZZZUUUULLLAAAANNN'....

Prices only go UUUUUUUPPPPPPPPPP here....

even when prices go down they go UUUPPPPP... ask Olly and ask anyone in the property industry...

SIgh....

Now if the exchanges rate finally gets a kick in the guts at the whim of the overseas speculators, the price of fuel and most other things we buy will rise. Less available for mortgages.

The banks will still have a lot of cash to spew out and we note here that all of them are now into getting extra cash other than borrowing on the market. More available for mortgages

It is an intriging conundrum on which way these forces will affect the price of houses.

The one certainty is that the present National led (?) government will not want any price fall before November.

2012?

Can anyone else see the RBNZ dropping the OCR even further? Excuses could range from rebuilding Christchurch to propping up the housing market...

Spot on, deanbo! But it's more than the property market that wants to be propped up with a lower OCR ( it won't be ~ the property market's fate is all but sealed); it's our struggling economy....silly me! The property market IS our economy :)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.