The supply of properties coming on to the market for sale in Auckland, Wellington and Christchurch tightened in December, meaning those markets remain in the favour of sellers heading into the new year, property listing site realestate.co.nz says.

There was less tightness in listings in provincial areas, meaning the New Zealand market overall remained balanced between a buyers' and sellers' market.

The comments come in realestate.co.nz's latest monthly property market report for December, which showed a total of 124,748 new listings came onto the market in 2011, compared to 138,789 for calendar year 2010 – a fall of 10%.

The average asking price for homes listed for sale in December was NZ$420,109, which continued a fall from the October peak of NZ$434,161, realestate.co.nz says in the report.

There were 8,732 new listings of property for sale in December, down 35% drop from November’s post-Rugby World Cup surge of 13,369 new listings, CEO Alistair Helm said. Seasonally adjusted figures showed a 6% fall in new listings, he said.

“New listings are one of the clearest indicators of the health of the property market. The more new listings there are, the more fresh choices there are for buyers, which produces a less stagnant market,” Helm said.

"In December, Wellington saw just 571 new listings come onto the market – a drop of 52% from November. Auckland saw a 44% drop in new listings, while Canterbury’s new listings fell 31%," he said.

“December is traditionally a quieter month for new listings, however the demand for good quality homes has continued to be high, with sales remaining strong at the tail end of 2011.

“As we have seen over the past few months, the tightening market is continuing to clearly favour sellers. While Auckland, Wellington and Canterbury are witnessing the greatest extent of this trend, the country overall is still balanced between a buyers' and a sellers’ market with the provincial areas seeing less tightness in new listings and available inventory of property on the market,” Helm said.

See the commentary from the December property report below:

The property market saw a further tightening of supply in December, more especially in the 3 major cities where the market remains very firmly as a sellers’ market.

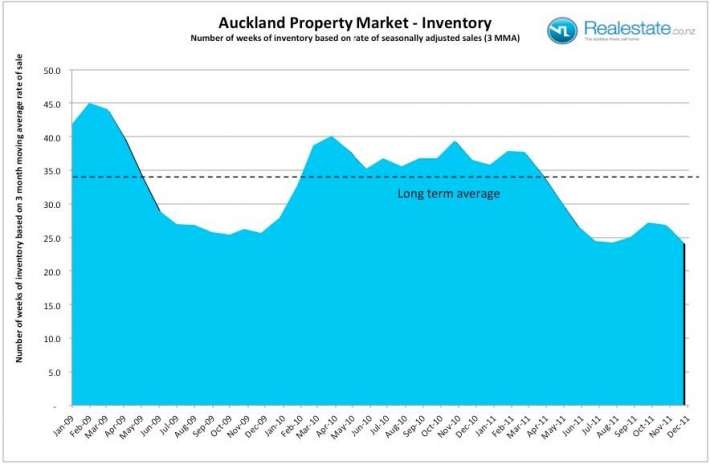

In overall terms the number of new listings coming onto the market in December was considerably lower than expected given the surge in November. This lower level means that inventory levels of property on the market slipped again to remain below the long term average.

In December with 47,557 properties on the market the current rate of sale would see these all sell in just over 36 weeks as against the long term average of 41 weeks. This national level has remained below the average for 6 months in a row and with strong sales in November and early December it is anticipated that this will continue into the new year.

The country overall is still balanced between a buyers and a sellers’ market with the provincial areas seeing less tightness in new listings and available inventory of property on the market.

Asking Price

The truncated mean asking price of $420,109 for all new listings in December eased slightly again from the peak in October of $434,161. On a seasonally adjusted basis the asking price actually rose 0.4%.

The long term trend as seen in the chart has been a steady increase in asking price over the past 3 years – the seasonal trend each year tends to see asking prices rise through from mid winter to October before falling back.

New Listings

The level of new listings coming onto the market in December fell on a seasonally adjusted basis by 2%. A total of 8,732 new listings came onto the market representing a 2% year-on-year fall.

For the calendar year of 2011 a total of 124,748 new listings came onto the market as compared to 138,789 for calendar year 2010 – a fall of 10%. By comparison the prior years, stats were 2007: 177,529; 2008: 163,488; 2009: 135,416. So as compared to the peak of the market on 2007 listings are down 30%.

Inventory

The level of unsold houses on the market at the end of December slipped lower in somewhat of an unexpected trend. At the end of the month there were 47,557 houses, apartments and lifestyle properties on the market down from the 48,647 in November and down significantly from 53,077 a year ago. This current level of inventory represents 36.7 weeks of equivalent sales.

See the press release from realestate.co.nz below:

AUCKLAND, 1 January, 2012 – New Zealand’s major cities are heading towards a shortage of homes for sale in the New Year following a significant drop in the number of new listings that came onto the market in December, says Realestate.co.nz.

According to data released today in the NZ Property Report – a monthly report of housing market activity compiled by Realestate.co.nz – just 8,732 new listings of property for sale came on to the market in December. This represents a 35% drop from the previous month’s post-Rugby World Cup surge of 13,369 new listings, and a 6% decline overall on a seasonally adjusted basis.

Alistair Helm, CEO of Realestate.co.nz, says that the drop in new listings was seen most acutely in the key cities of Auckland, Wellington and Christchurch, which he says will likely face a shortage in early 2012 if the trend continues.

“New listings are one of the clearest indicators of the health of the property market. The more new listings there are, the more fresh choices there are for buyers, which produces a less stagnant market,” says Mr Helm.

In December, Wellington saw just 571 new listings come onto the market – a drop of 52% from November. Auckland saw a 44% drop in new listings, while Canterbury’s new listings fell 31%.

“December is traditionally a quieter month for new listings, however the demand for good quality homes has continued to be high, with sales remaining strong at the tail end of 2011.”

“As we have seen over the past few months, the tightening market is continuing to clearly favour sellers. While Auckland, Wellington and Canterbury are witnessing the greatest extent of this trend, the country overall is still balanced between a buyers and a sellers’ market with the provincial areas seeing less tightness in new listings and available inventory of property on the market.”

Mr Helm says the drop in new listings combined with a higher level of sales has resulted in inventory of unsold houses slipping back down to 36.7 weeks following a slight lift in October and November.

“This remains well under the long term average of 42 weeks, and we can anticipate that this will continue into the New Year” says Mr Helm.

The average asking price for homes remained fairly steady at $420,109 – a 1% drop on the previous month – indicating that while the market is leaning in their favour, sellers are keeping their expectations realistic to the market.

Realestate.co.nz is the country’s most comprehensive property listing website profiling listings of licensed real estate agents with more than 112,000 real estate listings covering residential, commercial, business and farms for sale.

The latest issue of the NZ Property Report, covering December 2011, plus more analysis of the property market can be found on www.unconditional.co.nz, the news and information website for New Zealand real estate.

Housing inventory

Select chart tabs

120 Comments

This is also rather ironic after the Prime Minister said last week that if they introduce a CGT, or more importantly a land tax, then house values would fall and he did not want this to happen:

Prime Minister John Key reiterated later a land tax and broader capital gains tax were still off the cards. Asked whether the implementation of one or the other could allow government to reduce income taxes to give people more income to spend, he replied:

“At the risk of repeating myself from last year, we looked at a land tax, and land taxes, one, reduce the value of land in New Zealand, by definition, and it has an impact on every single homeowner in New Zealand."

“I wouldn’t have thought we’d want to do that on the back of a very weak housing market at the moment,” Key said at his Monday media briefing in the Beehive.

Nothing new here....govt protecting bank balance sheets but telling the public they are protecting property owners...just a big deception.

The fundamental guide the govt is following remains the protection and stability of the property bubbles be they residential or rural....and to that end the RBNZ has been instructed to pork the market with a lower ocr...and the banks are raising the LVR levels and the media are playing the game of misleading peasants into believing the future is smelling of roses.

The truth is kept from the public...that they are forced to borrow massively from banks to own property........ or rent and save but the savings are being debased and any income taxed...while landlords receive a rent subsidy via winz if they own renters needed by low income kiwi.

The low income kiwi would be into their own home far quicker with less debt if the subsidy were not there to distort the rents and property values. Their taxes would drop because the govt would save well over $1 billion a year by cutting out the subsidy scam.

So where to go from here>>>>>>simple to see the piigs euro EU ECB BoE IMF Fed farce falling on its face in 012 as the incredible level of debts and prospect for losses are exposed by the market.....which leads to higher cost for credit....a smack in the face for Kiwi mortgage holders, especially those losing employment...the 170,ooo new jobs sham....not there.

And then down goes the property bubbles...and the weakest bank...which is why Bollard is running on the spot to get his OBR into operation....some poor sods are set to have their assets frozen or go pooof....but not the bank bosses...hell no...they will take the fat salaries and bonuses and trot off to stuff up another corporate.

The low income kiwi would be into their own home far quicker with less debt if the subsidy were not there to distort the rents and property values. Their taxes would drop because the govt would save well over $1 billion a year by cutting out the subsidy scam.

Absolutely, Wolly.

But how would JK and his merry men even let that fact allow entry through their thick skulls to the cavity inside. He may be able to smile his way back into power but with an attitude like he has it is short-termism and the only buyers will soon be with hot money from overseas.

Wolly - stop fretting !

All is well - we only needed the bare $18 billion of new foreign debt to continue the party for the last 90 days.

For the mathematically challenged and politicians this equates to 9% of GDP.

If this is not totally out of control borrowing I do not now what is. Quite unbelievable - yet barely a mention in the press.

This will end in much sadness - the only question is when.

Borrowed money on borrowed time.

I understand why they have this parcel of poop policies...the general peasant population is just too stupid to know what's going on...It matter not whether Labour or National are stuffing themselves in the Beehive...the banks rule the roost.

So they are conspiring to rip us off, eh? And notice all those Jewish names in this banking/financial cartel!

....Muzza - frightening isn’t ?

Yes, seems to be giving some like Wolly sleepless nights. Don't you think it would be good if the old conspiracy theory was rested for a while, even if it is centuries old?

You have the wrong end of the stick Muzza....I couldn't give a ----- what group dominate banking...that is not a factor....the problem is the fact that govts and reserve banks do what they are told by the banks...this comes about because the banks wave the credit in front of the govt liars as well as the peasants...so stupid central govts run fiscal deficits using this credit and hey presto they are under control.

Key and English borrowing $18,000,000,000 so guess what.....the creditors run this ship.

No, have the stick by the right end as what you are saying is a classic, age-old conspiracy theory that the financiers conspire to dictate and control for their own nefarious purposes. The only difference is that you have (fortunately) dropped to claim that the manipulation stems ultimately from the Jewish financiers prominent in those circles. Adolf would be with you on the first part of the conspiracy, even if you aren't with him on the second aspect.

You have to laugh about it Wolly. .Govt thinks high house prices are good, the banks are grinning like smashed cat's, and the masses are in debt up to their eyeballs excited that housing is such a great investment.

Everyone wants to "get ahead" and the banksters and politicians keep directing the flow of traffic to the BOOMING housing market.

No...govt thinks it best to do what the banks demand..protect the bubbles...deep down they know dam well the bubbles mean troubles...but the govt and the banks have an ace to play...the stupidity and greed of Kiwi peasants. Selling Kiwi peasants on the benefits of benefits was all to easy...likewise the benefits of private debt and public debt...piece of cake.

All this housing bubble boosterism from the pollies and talking heads, is exactly like a bunch of doctors telling a patient - "good news, mister - your cancer has grown and is still metastizing....! This is to the good for your life from here on....."

Another interpretation of those statistics could be that sellars have given up on getting a price that is not achievable and withdrawn from the market.

That statistics are really meaningless without average days to sell, or the level of unsold houses that are not actively on the market.

The use of the word acute to discribe it as a shortage is laughable, almost dishonest.

Olly – Olla - be prepared NZimmigration - 2012 with worldwide trouble – will shift “The Rich” to NZ/ AU.

A sellers market is one in which sellers are not selling?

I'm still a bit crook, my logical functions have deserted me.

Had a good read of The Tragedy of The Euro, mildy interesting. Free from Miesis

interest.co.nz has started the New Year with a story about housing .......

... whew , nice to see that there is absolutely no change to our dominant theme .... ......

Houses .... oooooh goody ....

( happy New Year , Alex .... all hunkadory with you ? )

Interesting sustainability reports on US cities here:

http://www.sustainlane.com/us-city-rankings/

The bad guys come up trumps on afforability.

As is usual with such "Reports", it is heavy on subjective rather than objective assessments.

It also ignores economic sustainability. The cities of the UK would score highly by their criteria - Newcastle wins "Green" and "sustainability" awards. But the UK's cities also illustrate the consequences of decades of anti-growth policies - in cross-generational unemployment, lack of opportunity, inequality, reduced quality housing, little discretionary income after housing costs, pathologies of hopelessness among the low income young, etc etc.

A resident of a traditional low density US suburb would completely disagree that a resident of Newcastle lives in a "Greener" or "more sustainable" world. And the Newcastle resident would agree with him. Being greener and more sustainable in the eyes of the people doing most such assessments, means that you win by having small, old, dilapidated and inadequately heated homes; by having no gardens and backyards; by being unemployed; by having no money to spend on your kids; by spending an hour riding a train rather than 20 minutes in a car; by spending your life by yourself in a flat and not being able to own a home or marry and have a family; etc etc.

Patrick Troy, an Australian University Professor, makes pointed observations about "sustainability" in his 1996 book "The Perils of Urban Consolidation":".....Any term which can mean whatever the speaker/writer or listener/reader wants it to mean, provides little guidance or discipline in policy formulation or program administration...." "Modern cities are inherently ecologically unsustainable because they need to import food, energy and raw materials and they produce more waste than they can cope with within their boundaries and because they radically change the ecology of their sites. Moreover, the larger the concentration of population, the more unsustainable the city is. Even if we extend the boundary of the city to include its hinterland we cannot usefully describe it as potentially ecologically sustainable. The more the city becomes part of the international economic order, the less it can be seen as ecologically sustainable in any operational sense. To hold out such a beguiling but unattainable prospect ultimately diminishes legitimate concerns for the environment...... "........The only urban strategy which seems to be environmentally sensible is one which has as its goal the minimisation of environmental stress within and outside the city......."

Troy discusses how increased density and the more intensive coverage of land with tarmac, has already led to drainage and flooding issues; and that higher density results in increased local air pollution.

He discusses the "embodied" energy and emissions involved in higher density structures, which are usually very much higher than those of low density homes - also, that demolishing and replacing existing structures involves much greater additional embodied energy and emissions than continuing to use them.

Troy discusses the relationship between energy use in the home and dwelling type, household size and type, and income; and concludes that it is far from clear that dwelling type is significant. He points out that separate houses have much greater potential for the use of energy other than electricity eg passive solar, solar panels, biomass, air flow for cooling, shade trees, etc.

Troy discusses the use of energy for transport, pointing out that transport only consumes a portion of total energy used, the transport of goods consumes a portion, and private vehicle travel for non-work purposes consumes more than commuting travel. The policy focus on commuting travel is somewhat misguided. Troy estimates that "journeys to work" are responsible for approximately 3.4% of total Australian CO2 emissions....."

The supply of properties coming on to the market for sale in Auckland, Wellington and Christchurch tightened in December, meaning those markets remain in the favour of sellers heading into the new year, property listing site realestate.co.nz says.

A rather unbalanced view. This only holds true if demand is strong. Auckland, yes, but Wellington and Christchurch?????

Inventory was low in early / mid 09 too, yet we didn't see rising prices - because demand was weak. Low inventory can reflect expectations that it is NOT a hot market

Agreed with Matt in Auck. I don't think the market is that hot at the moment. I have witnessed houses sitting in the market for ages and not sold mainly due to unrealistic asking price in my neighbourhood, see:

http://www.trademe.co.nz/Browse/Listing.aspx?id=414694501

This plaster house has been in the market for over 100 days and not sold and now in limbo.

Buyers are definitely more cautious these days especially with known issues such as leaky homes and developers cutting corner. Some are willing to wait and just rent rather than taking a risk.

Not suprising - looks like an absolutely classic leaker. Photo 12 shows a direct stick tile deck almost level with bedroom floor with solid balustrade for starters, then photo 13 shows you can't even get the car out of the garage or open the door into the garage 'cos the cars there.

But wait...the vendor is claiming that it was built in the 90's with a cavity system and full building report is available...

LOL, the internal access opening to the garage is really funny!! Obviously it is a 2-car garage and advertised as 3.

Monolithic cladding for sure. Garage door could be replaced with a roller-door. But having spent 1 month searching property in AKL, given the location, it appears the vendors are recognising all that in the asking price which seems to be no more than land value only.

The land value for a 600+ section in Remuera like this is around 750k. Don't you think the asking price is abit much given that it is monolithic cladding? I think around 800k is fair given that new owner has to reclad at some stage.

And yet you can have all that for only 60k deposit. Just thinking about living in Auckland makes me want to puke. 1.2mil, there is close to an infinite list of things I would spend that money on rather then buying a house in Auckland.

Bt wait, asking has been reduced from 1.25M to 1.19M...let me check the CV...oh, only 1.08M...

In my area, Kohi, CV is ~ 10% over what I consider to be current market value. The house next door started marketing as an auction then went to a set price. I'm offshore so I'm not sure if it actually went to auction, but set price on Trademe is 2% above CV. No leaky home or other issues, I just think it's overpriced. If priced at my view of market it would still be ~ 16% up on values in the six months after the GFC.

All up I take stats with a grain of salt except actual sales and even then want some comparison with that property in the past. Houses like the above inflate the asking price stats and make selling days look bad. Garbage in, Garbage out, but it still seems an active posting topic.

DoubleGZ,

Disgraceful old homes in AKL that would be $40,000 in any market not distorted by an urban land racket. Like most cities in the USA.

A minority of US cities do have the urban growth constraint racket, hence the "US" house price bubble and crash. What we should be thinking, is if the USA can be so damaged by Property Ponzi in less than one third of its property market, what can we expect if 100% of our property market is Ponzi?

Your comment about renters: The recent Productivity Commission Report on Housing Affordability has a very interesting chart of the number of renters in each of 3 categories over time: welfare renters; "intermediate renters" (who cannot afford to buy a house); and "well off renters" who could afford to buy a house but choose not to. The latter class has swelled in numbers since 2006. There are wise people in NZ after all.

Also interesting, is the very low "institutional" involvement in housing "investment" - it seems that "investment property" mania has affected individuals but institutions "due diligence" leads them to conclude that investment property is not so hot after all.

NZ for Sale:

Brownlie needs to release more land immediately on Mt Herbert to accomodate migrant buyers - that will leave Linwood and aranui for the Kiwi working class. Taxpayers can pay for the new harbour bridge, sewage system etc.

Actually that picture reminds me very much of Huston Ta.

Need to click on the top right hand corner button for English translation. Very attractive proposition for the Chinese indeed...they are not just buying the property but buying into the surrounding and beyond.

Interesting how the same press release can be reported in quite different ways ...

Stuff's headline is: "Slump in home listings, asking prices slip" http://www.stuff.co.nz/business/6206713/Slump-in-home-listings-asking-prices-slip

"Despite a dive in new listings and a low level of stock on the market, nationally asking prices are down in the past two months to an average of $420,109.

"The asking price reflects sellers' expectations of what they can get, not what people will pay. There is still a big gap, of about $60,000, between asking and selling prices. During spring that gap widened to $75,000, as listings started to rise.

"Typically, a shortage of supply and good demand would raise prices. But house prices have flattened out in the past year or so, and are down from the 2007 market peak after adjusting for inflation, suggesting the market remains weak. That is despite the lowest floating mortgage rates in more than 40 years, at just 5.65 per cent or so. People are paying down debt rather than borrowing to invest in housing as they did during the mid-2000s boom."

Rent subsidies = HIGHER RENTS

Working for familes tax credit = HIGHER HOUSE PRICES.

JUST WHAT THE ECONOMY WANTS.

It's a competition ngakonui gold...to see which govt in NZ can stay in office with the dumbest economic policies...the bankers just love it.

simple stuff.!

supply and demand= less listings + pentup demand= prices inflate.

people are starting to accept the "new normal" which is that people move,have maitals, get transferred, immigrate etc and buy houses and carry on with their lives.

the side effect of the lack of stock is that the best cat gets picked from the litter...not rocket science or banking conspiricies...just life in motion

It won't suprise you, Rob, that I have a different view!

One for your website Nicholas.

http://www.nytimes.com/2012/01/01/opinion/sunday/unknown-knowns-avoidin…

Thx, Andrew. It's frsutrating trying not to 'interfere' from a distance, and just read from Bernard's top site. But I do still read it religiously; and as another mentioned recently, enjoy reading your links. Today I 'gave in', and posted. That's what happens when the Sydney Test that you though started today, starts tomorrow!

Nicholas, won't surprise you that I have a different view: in reading your blog, you say that supply and demand are not factors in the property market, but price is. It seems that you have forgotten the underlying principals of supply and demand are PRICE and quantity (demand/supply curves), and the price principal includes both willingness and ability to pay for a product (affordability). You state that without the ability to pay for something that demand becomes a “unsatisfied desire” but really if people don’t have the ability to pay for something, demand falls, and will not just be a unsatisfied desire. Therefore if prices set by individual vendors are too high, demand will fall as a result, and eventually prices fall to meet the new demand level. Demand is not falling though, Supply is, and average asking price has remained consistant - these are indicators that demand will increase.

In the housing market supply and demand does matter, in this Article we can see that the quantity of listings are low, however prices are have remained stable (a trend that has existed for the last few months). According to supply/demand this would result in higher demand (more homes sold) as supply is low (less listings & low inventory – 28% down yoy) & price remains stable (and potentially realistic). And in fact this was seen in November where property sales topped 6000 (17% more than prior year). If this tend continues it will result in further eventual increases in both the sales and asking price of properties in NZ.

It will be a interesting year to watch, combine low interest rates, with less properties on the market, and the Govt re-stimulating the ecomony, and we may see a change to the property market - driving house prices in NZ to new highs in 2012.

"When you have an entire economy centered around producing stuff of no real strategic or export value then you are on a road to nowhere and as long as the powers that be continue to protect it due to their own personal interests you will surely head towards a new nation just redefining the term 'third world' "

Goodluck for 2012

Experience is a wonderful thing. It enables you to recognize a mistake when you make it again.

—anonymous—

Had a look at some property for sale in Greece and Portugal, just to compare NZ with other third world countries. Guess what, we are just poor buggers in NZ, house prices over there in NZD are about the same as auckland. Thats my opinion anyway, not that I'd ever live in Auckland.

Yes, and look further afield and same thing. Actually house prices outside of parts of Auckland in NZ are not expensive, but you won't convince die-hards about that on this site, as doesn't fit in with their theories.

Agreed Muzza, a point I have been trying to make. Here me and my partner are, both on average wage with a little one,(ok, subsidised by working in our spare time) getting nicely ahead and looking to be freehold within 12 years of taking out our mortgage(well ahead of that curve at present).

Research what you are buying, biggest purchase most of us will ever make so be smart about it. Start with at least 30% equity and dont borrow more than 3 times your current and projected household income. (which means if you are like us, don't buy in Auckland and factor in losing half of your household income during baby arrivals and period of time that follows)

So many good places to live in NZ. Reskill if necessary to find jobs of relevance in your chosen area. Education/apprenticeships are wonderfully accessible here in NZ. Do this sooner rather than when you have to if redundancy is an possibility.

If we can do it anyone can. Make a plan, stick to it. For us it really has been that simple to get into home ownership successfully and relatively stress free, even over the last turbulent 4-5 odd years.

Still waiting for the interest rate spike. I see we could fix for 2 years at 5.9% right now if certainty required. If interest rates were at large risk of exponential take off why would the banks be offering these cheap fixed rates? 7.3% over 5 years doesn't seem grossly expensive to me either? Our opening rate was higher. As long as people can pay down debt while meeting obligations, all well and good.

I'm all for exposing the realities of a fairly dire financial outlook in the west but we(that is kiwi's) are some of the best placed to do ok regardless.

***Aside - Liam Halligan picked an 8% percent growth trajectory in 2012 for china in the DT a weekish ago. This despite no real movement on tapping their vast potential internal demand, as yet.

"why would the banks be offering these cheap fixed rates?"

You know the answer leadbelly but will you accept it.....the rates are needed to attract new suckers into the ponzi scam to keep the valuations from falling, to save the bank balance sheets...to protect the bloated salaries of the execs plus bonuses of course.

While the game is on you should move like hell to clear the debt. Bollard will work hard to hold the line against the real market turning up to seek revenge...and he will fail...so best you factor in a potential for the worst including the drop in value.

Remember...this is the new normal and the best it will be for a very long time to come...there is no world economic revival likely until the debt burdens are gone...like two decades minimum.

Wolly, we are definitely erring on the safe side paying down our debt as fast as our little incomes can carry. And I'm actively identifying our unknown knowns. (thanks Andrewj)

If only I can talk the missus out of the gold coast theme park holiday planned for this winter. I look forward to that like a pin in my eye and the little fella has just as much fun with a cardboard box on the front lawn, sigh.... Mind you, catch up with the big bro and rub a few occers up the wrong way with the odd reference to Hobart glory, Yes Glory! (gotta enjoy the wins! cause I truly feel the losses, all of them)

Whats your take on the SCF scam?

Bloody save button, too sensitive!

Your only fine IF the NZ/Aussie banks can still find cheap foreign money to continue funding the ponzi scheme. Your only fine in the NZD stays high, your only fine if the cost of living can stay flat, your only fine in Europe and the US find a way out.

None of that is certain, infact its downright unlikely.

Jeez justice...get with the scene man...your and you're...which one to use...or abuse!

LOL, Just editing it as you wrote and then got lock out! go figure

Hey Justice,

At 7.3% for the next 5 years, we would be just fine, debt levels at that stage would be minute. Let alone at the current 5.6% we are currently charged.

Only OK if the NZD stays high? Hedge your bets Justice, get into the export market, make something tangible and sell it. The more of us actively doing this the better the national accounts and future local investment environment. Part of the solution and all that.

Cost of living? Grow our own meat,vege, fish and surf for entertainment and spend the rest of my time with the family. Gas on the other hand?

The financial state of the US and Europe are two seperate incredibly complex topics. I think we both can take a punt on either and offer no illumination to anyone. Fairly well covered.

"....Cost of living? Grow our own meat,vege...."

Great if you're one of those who bought in to the property ladder while a home with a garden was affordable........

What do you think is affordable philwurst?

Need more switched on Kiwis like you leadbelly. Cheap houses, carboard boxes, pegs and sticks FTW. Sadly a lot of people take out the maximum possible loan, and just go to work everyday for the bank and govt.

Thanks skudiv,

We were very skeptical when we went to get a mortgage preapproved the banks tried with all their might to get us to borrow about 40% more than we wanted. They don't want us to be freehold, just eternally interest bearing. Not our plan.

".....They don't want us to be freehold, just eternally interest bearing......:"

EXACTLY.

This is why the banks love low interest rates and high house prices (because supply of urban land is strangled).

On a scale from "low house price, high interest rate" to "high house price, low interest rate", guess which end costs the house buyer the most over his lifetime? This is something that Kiwis have failed to "get" yet.

GLOBAL WARMING AT IT AGAIN - Temperatures are expected to creep up during the next few days after an unseasonably cold start to the year.

WeatherWatch said the weather has felt more like spring than early January, as cooler and cloudier conditions spread across the country today.

NIWA promised us a long hot summer ...... it was 17 'c in Chch today .....

..... meebee they meant you had to emigrate to Victoria or to South Australia for that long hot summer .....

40 'c in Adelaide ...... toasty !

sure was hot....but dry - not as bad as I expected!

Brisbane only got up to 30 during the holiday break. But no doubt it will get into the late 30s in January - March.. I was in Melbourne when it was 40..yuk, something I can look forwards to..

Welcome to 2012 year of the Auckland bull market.

Dont be too sure about that!!!

Once upon a time, in the land of plenty, there was a monster known as the vampire squid, and then, there was a fairy called hank-henry paulson (a love-child of the vampire squid) who wanted to be famous, who one day was attending the lehman bros three-ring circus in a big-tent. In the midst of the main event, with the big-top full of children and other faeries, Hank-Henry shouted "fire, fire, fire", the big top is on fire. All the children and faeries got scared and rushed for the exits. In the following panic, many children and faeries either died or suffered psychological trauma. In fear that the families of the victims of Hank-Henry's prank would sue the circus he threw much money at the circus owners. In the following months the crowds stopped going to all circuses in the land. The owners of the circuses threatened to sue Hank-Henry for their losses. To stop the rot Hank-Henry threw billions of dollars at the circus owners to shut them up.

The moral of the story is .. we will never know if there really was a fire. The only person who shouted fire was Hank. And he kept shouting fire, so much so every one in power believed him including his friends Benjamin and Timothy who to this day still peddle the Fairy Tale there really was a fire and the only way to put it out was to turn on the money-pumps.

In the GFC circus, Hank and Benny and Timmy told everyone that if they didnt bail out the banks the world money supply would seize up. And everyone believed them. Trouble is we will never know.

We went to look at a house we were keen on but it was really no better than a dog kennel and we ran off quite smartly. There was a reason why there were no photos showing the inside, the floors were chipboard soaked with many years of dog piss. It needed the interior gutted completely, all doors and windows replaced (customwood sills) and the garden needed napalm. Otherwise it had potential.

The owner had told the agent he wanted RV for it. Will some mug buy it? Probably. We kiwis have it burned into our psyche that we can just 'do it up' and flick it off for a decent profit and this mindset will prove very hard to change. The chronic bad news from overseas has barely affected us in NZ and I get the feeling that the punters are starting to doubt that it will.

Post the link 69.

ps - you are correct - if there has been no meltdown in the NZ market after everything that has happened globally in the last 4 years - there is no chance of it happening now.

That realisation is evidenced by the increasing sales volumes and prices over 2011.

"there is no chance of it happening now."

On balance I would suggest that Auckland prices OVERALL will hold up OK, and probably even slowly rise (roughly in line with inflation) over the next year or so.

But I'd caution that with some very real risks looming out there. These include the likelihood of rising unemployment, introduction of limited austerity measures from 2013 as the govt's books come under increased pressure (GDP growth much lower than forecast, unemployment much higher than forecast, rising ChCh costs) and thats mid term in the election cycle, not to mention the possible impacts of a significant China / Aus slow down.

So, in my view look for small overall gains in Auckland in 2012, but 2013 / 2014 is where it gets very interesting. I wouldn't expect a meltdown, but I could easily see another 5-10% dip if the govt does what I think it will have to do (ie. pull back on WFF, and other benefits, reduce highway and infrastructure spending with loss of employment in the design and construction areas associated with such projects)

but who really knows?????

What I continually commit to saying, is that the NZ property market will one day return to approximately year 2000 levels. There may be further rallies meanwhile, and the eventual reversion may be a long slow affair like Japan 1988 till now, or it may be precipitous.

The property market's relationship with the wider economy under conditions of land supply racket, is like the relationship of a cancer with the cancer patient. The economy somehow survives and survives in spite of the size of the property cancer, but the size of the cancer is a good indicator of the future prospects of fitness and survival.

NZ property market will return to 2000 yr levels because of your ridiculous cancer metaphor?

You forget the multitude of related industries who do well - with a healthy housing market - and indeed unrelated businesses and industries who trade better while the population enjoy the confidence of a buoyant market in their largest asset.

So rather than being a cancer - it is in fact the biggest natural support for the wider economy.

So rather than being a cancer - it is in fact the biggest natural support for the wider economy.

Yes, and therein lies the huge problem for NZ and its "economy" . Its an "economy" based on shack trading.

dont see your point.

every time someone buys a new house/shack/whatever - many different professionals and businesses get paid.

Then after settlement and move in day - many other professionals and business get hired to alter/upgrade the property - and then they also get paid.

The money moves around and the economy benefits.

Someone has a house with a low LVR in the Auckland market - and has confidence in the market to remain stable/rising - is sick of their job - decides to borrow against the house to start a little business - which becomes a success and hires some people.

The economy benefits.

Need to think bigger picture.

Need to think bigger picture.

With all due respect SK I think you need to think bigger picture.

My point was not that housing and its related industries / services doesn't generate significant and valuable economic benefits. Indeed I have posted regularly on the need for relaxed planning policy and heavily reduced GST on new builds to get the housing sector going again, and help create jobs for builders, plumbers, RE agents, architects, surveyors etc.

My point was that an economy based largely around the extent to which house prices are increasing is one that is very one dimensional and fragile. And subject to disproportionate weakness should house prices fall away.

Matt, "an economy based on shack trading" really? Have you not heard of the Dairy, meat, wool, forestry, aquaculture,horticulture,oil, coal, gold, manufactureing and tourism industries? You underestimate the capability of your former country.

sorry shagger,I should have mentioned our raw produce and tourism industries. Awe inspiring stuff, any third world crackpot country does that stuff. Thats why we are ranking down below some of the ex-communist east european countries now. You mention manufacturing, theres bugger all left. Exporting milk and wool, and tourism, sheep shagger's recipe for an economic powerhouse!

But hey I don't want to knock our rural economy, its the urban economy where the big problems lie. Our second biggest city is down on its knees, our third biggest city is riddled with faultlines and will decline as an unaffordable public service shrinks, and Auckland's economy is one dimensional and truly based on shack trading, thanks to crazy immigration policy and excessive planning controls..

And whats up with all the pious, pompous nationalism mate? You sound like something from 1930s germany or something.

"Any third world crackpot country"...really... is that what you think of us? The fact being in all of those things we operate at the very top end of the market. Thus giving us a decent base too our economy far in excess of"tradeing shacks".

I take exception from the "1930s Germany" comments but make no apologies for a sense of nationalism. Some of us are actually at the coalface working hard to make this place as good as it can be. Its clearly not perfect but where is? At least im here trying to make it better. I have no issue with you emigrateing, my issue is with the cheap shots directed back at us as if we are clueless peasants. Perhaps I sould cut you some slack maybe its the 40+ degree temperatures making you irritable.

Everyone needs food.

Not everyone needs a new Saab.

Yes, everyone needs food, and every country in the world wants to be "self sufficient" in food.

That is why the terms of trade for agricultural commodities has declined by a factor of 4 in the last 60 years. We have to export 4 times as much food to get one Saab back.

Sheep Shagger needs to watch one of Sir Paul Callaghan's presentations - it is a good manufacturing sector that is where all the growth in wealth in any economy in the world is going to come from.

Callaghan points out that if NZ had another 100 manufacturing exporters as good as the current top 40, NZ would be at the top of the OECD instead of the bottom. In contrast, more farming or tourism jobs, merely increases the number of bottom paying jobs in the economy.

Having taken that on board, read "Driving Productivity and Growth in the UK Economy", 1996, by the McKinsey Institute. Take-away point: Britain's urban planning system ensures that there will not be any equivalent of "Silicon Valley" in Britain. It is also responsible for a large proportion of the lower productivity of the British economy compared to its main trading partners.

The inflated cost of urban land alone, causes numerous negative effects on actual productivity, not to mention increased inquality, reduced social mobility, reduced household discretionary spending, and increased workforce cost of living pressures. (While the cost of being in business increases and reduces the ability of employers to increase their staff's wages).

http://www.trademe.co.nz/Browse/Listing.aspx?id=430561493 While the punters seem to be happy to borrow SK the thing to watch might be the banks' ability to lend.

Looks like a great site - thats what you are paying for it looks like - you dont think it's worth 350k? (I have virtually no knowledge at all on the Wellington area)

350K might be an OK price if it were immaculate, but you would need to spend 50 grand and a year's hard weekend and evening labour to get it there. Or get builders in and wave goodbye to 100K. Would suit a young couple who wouldn't mind slumming it for a year while they did it up. Been there and done that, getting a bit too old for it now.

I keep telling people to visit RE agencies sites in ANY US cities where Demographia points out that house price median multiples have stayed at around 3.0 for decades - that happens to be MOST US cities numerically, by the way.

Scungy old "fixer upper" homes are $40,000. And these cities have reasonable employment prospects and low costs of living, period.

In true economic disaster cities like Detroit, you can HAVE a fixer upper home - in fact they might even pay you to take it.

The way we are heading, is like the cities of Northern Britain - unemployment entrenched and cross-generational, AND unaffordable housing. Detroit without the redeeming tree-lined low density suburbs, and with severely unaffordable prices of the slum type housing that there is.

Interesting - you would have to pay high 1millions and up over 2mill to get a view like that anywhere near Auckland.

Its close to employment/Wellington - so on a comparative city to city basis - that would appear to be affordable housing wouldnt it?

There has to be a catch - like a big fat bill for hillside stabilisation, removal and rebuilding of the property...............or something.

350K asking doesn't seem so bad to me based on those pics?? The property looks like it is in the middle of nowhere, the house itself is of modest to cheap construction and design, no landscaping, and is that the Cook straight it's looking out on? What's its exposure to those notorious hurricane force southerlies that strike on a regular basis down in Wellington? Is it weather tight under 10hrs of a 120km gale with driving rain?

In my experience, 1.7M and up for houses/apartments in Auckland with sea views will have more or less uninterrupted and expansive views of the Waitemata harbour, or the Rangitoto channel, will typically be of prestigious construction and design, fully landscaped, high quality chattels throughout and in high end city suburbs 5-15 minutes from the CBD.

It is in Titahi Bay looking north up the coast David. The Northerlies can blow your wig off too. The house has neighbours either side, reserve land at the front. It has leaked in places now supposedly fixedby our old friend, silicone sealant. The area is probably lower- middle class, but not a state housing area.

Cheers, thanks for that. I once had the pleasure of living in a seaside home (in Auckland) that was subjected to regular gale force winds throughout the year. Not for the faint hearted I can tell you when the winds are gusting at 120kms and windows start to bulge! The worst was a weather bomb that had winds gusting up to 150kms. Terrifying. I've never heard a roof howl like that before or since. Thank god we had had the bloody thing bolted to the building when it was replaced 5 years earlier.

The problem with Mr Sealant is that his friendship is strictly temporary! One is much better to go with Mrs Flashing. She knows how to hang around.

Unfortunately Mrs flashing is old fashioned and requires a commitment in time and money. Mr silicone is cheap and easy, one finger usually does the job.

We had a house on a hill overlooking the sea and we used to get belted with some real howlers. Luckily the house was built from concrete and recycled bridge beams - but know what you mean by bulging windows.

SK - Auckland buyers pay millions not just because of the view, but also other factors such as proximity to CBD, grammar school zone, nearby parks, reserves and beaches...and no, they are not just following the Jones but for practical reasons. Refer:

Of course.

In my time in the R.E. "industry" I found a lot of these sorts of buyers are the "look at me" type tosser, un-naturally obsessed on how others perceive them. Not at all unusual in Auckland, folk so desperate for some sort of recognition they're willing to completely impoverish themselves in other aspects of their lives. Sad really.

If you spend your life looking for catches - not suprisingly you will find a lot of catches - and miss a lot of opportunities.

Stunning views

Try these - 40 minutes from AKL CBD, 14 hectares, views left to right Hauraki Gulf to Rangitoto, asking price $400k, agent reckons can be had for $200k

http://www.members.optusnet.com.au/~iconoklast/MH006.JPG

http://www.members.optusnet.com.au/~iconoklast/MH007.JPG

http://www.members.optusnet.com.au/~iconoklast/MH008.JPG

http://www.members.optusnet.com.au/~iconoklast/MH009.JPG

http://www.members.optusnet.com.au/~iconoklast/MH010.JPG

http://www.members.optusnet.com.au/~iconoklast/MH011.JPG

http://www.members.optusnet.com.au/~iconoklast/MH012.JPG

http://www.members.optusnet.com.au/~iconoklast/MH013.JPG

http://www.members.optusnet.com.au/~iconoklast/MH014.JPG

40mins to cbd at 5am on a Sunday morning isnt near Auckland in my book!

Any house on it?

Any services?

Any school?

Seriously, 40 minutes in the middle of a work day. I spent a whole month looking at properties from Auckland north to Whangarei. This was the pick of the bunch (of what was available). But it was originally part of a 20 hectare block, owner subdivided and cut off 6 hectares for own use and the remainder of 14 hectares is covered by a covenant and the building site or platform was about 1/8 th of an acre if you were lucky. Once you got off the building site you couldnt touch the rest of it. Superb for a bush lover. House no. School Yes. Services Yes

Moirs Hill?

Nice view if you want to wear binoculars all day.

it certainly has a lovely view. Probably gets smashed by the wind.

Wellington is an interesting market in coming years. A shrinking public service there won't help its property market. How many people living there, or thinking of living there, would reconsider following Christchuch, knowing that Wellington City is absolutely riddled with faultlines? Do people just shrug their shoulders and say they could be run over by a bus tomorrow? Or when we have options in this world as to where we can live, factor that risk in and maybe choose somewhere else?

Welli is my home town, great little city but a terrible climate! and the quake risk....

Yes it would be exhilarating in a northerly, would miss the southerly though.

The issue of earth quakes is always in the back of your mind in Welly and sooner or later we are going to cop it. When Christchurch got knocked over I couldn't help but feel that bullet was meant for us. Because the risk has always been known in Welly, a lot of the infrastructure has been built to cope and should weather a decent quake. Anything like the quake Japan had will squash us of course.

No city is safe really, take your pick of favourite disasters. Aucklanders are living on top of a volcanically active area that appears to be dormant for now. Don't worry - be happy :o)

69er - not so sure about the security of infrastructure in Wellington. I know a lot of the buildings aren't up to scratch.

I know what you mean about "don't worry, be happy". I just wonder though it probably is putting a few would be immigrants off.

I saw the Parliament Library refurbishment when I was younger and I can say with confidence that the pollies made damn sure that they should be safe in a shake. No shortage of lead isolation bearings and re-inforced concrete.

A mate of mine works in an old double-brick warehouse at the bottom of the Ngaio gorge and whenever I visit him it puts the wind up me to see how little of the structure is held together by anything other than gravity and dead flies. Un-economic to try and strengthen so would need to be bulldozed, unless of course an earthquake bowls it and then the owner should get some insurance money for it.

Personally I wouldn't want to be in any of the buildings along Lambton Quay and lower Willis Street if there was a good shake as the ground is all reclaimed from the harbour. Dig down ten metres and you start to get salt water from the harbour, and they have even dug up the hulls of old ships that were used as floating warehouses.

Titahi Bay - Beautiful Views. But as 69er observed, has particle board flooring and if it has turned to weet-bix - then has to be replaced - next big problem is if the base was done, then flooring installed, then the framing placed on top of the the flooring, huge cost to remediate. How do you replace weet-bix under the framing - with difficulty.

Yes the particle board was under the framing. Could possibly be cut out and patched but there was a lot of it knackered around the bathroom areas, sliding exterior doors and upstairs most of it was black and swollen with dog urine. The smell was so bad that it reminded me of the worst public men's urinal I'd ever been in.

If you look at China. Do we see an urban plan causing the run up in house prices????:

"

Beijing's response to the global financial crisis added jet fuel to the fire. To maintain GDP growth of nearly ten percent during a massive downturn in global demand, China's leaders engineered a lending boom that expanded the country's money supply by roughly two-thirds. Real estate was already the preferred place for the Chinese to stash cash; now, investors had that much more cash to stash. Prices rose accordingly: In many locations, the cost of prime new properties doubled in just two years.

But this run of speculation has bid up the price of housing and left people who actually need a place to live in the lurch. Given the prices prevailing earlier this spring, the average wage earner in Beijing would have had to work 36 years to pay for an average home, compared to 18 years in Singapore, 12 in New York, and five in Frankfurt. The bidding war has further pushed developers to build ever more costly luxury properties that investors crave but few ordinary people can afford."

Yes, the culprit there is "urban planning", or more accurately, the same racket in "planning gain" run by officials using the "planning gain" as revenue - while the millions of slum dwellers cannot afford the asking price of the resulting developments, and "greater sucker" property investors are stuck with empty properties.

If Houston rules applied, the millions of slum dwellers would have been moving en masse into the new apartments at honest prices.

I have been going on about this for years. This will be very very messy yet. I think one of the greatest mass failures of experts in human history, is the failure of late 20th century economists to see the consequences of rackets in "planning gain".

The price of new developments just happens to set the prices of ALL urban property, just as the price of new cars, if inflated by import restrictions, causes 2nd hand cars to be far too expensive too.

Interesting opinion on the role of immigration from Alistair Helm CEO Realestate.co.nz

...................................

Immigration in today’s modern world is not about finding jobs, it is more about creating jobs. It is likely that NZ will benefit from new immigrants and returning kiwi’s who not only bring assets but also networks, capabilities and businesses. These businesses can be managed from NZ as well as they can be from Sydney or London. We do not just rely as a country on manufactured industries.

............

Any empirical evidence of networks, capabilities and businesses that benefit everyone....?

WE see networking amongst the realestate sector.. good for filling developments with foreigners.

Jh, Im a potential immigrant to the USA. If I decide to move there I will do it as someone intending to invest money and create jobs. While I can get in this way Im struggling to see how Im supposed to create jobs and wealth. I could buy houses which some of my kiwi friends are doing but that is not something I feel comfortable with. Im hoping to meet a young enthusiastic man or woman ( being politicaly correct there, will be a bloke) with some great ideas and a need of some capital but lets face it Im not alone, but Ive seen a couple of opportunities. The problem is the risk is soo much higher than buying houses which have already lost %60 of their value. I looked at a house for us to live in, the cost of building it was 600k the section I would guess about 200k. Today I can buy it as a 'turn key' house for 250k as long as im buying with cash. The problem with most of the businesses I look at, its just a case of me having the cash when a local doesn't and without me it would be sold for less to a local. I dont see me enriching the States much everyone employs Mexicans because they are cheap and under the radar. I dont like get rich quick schemes and honestly suspect the west has had its day. The biggest problem is our apalling leadership which is an on going problem as our representatives look form one short term outcome to the next and show poor understanding of whats happening under their very noses and a lot of self interest.

Im looking at buying a boat up at a lake just to muck around with the kids, I think this guy would take $5500

http://redding.craigslist.org/boa/2756461461.html

I trying to say in a long winded way that Im not really going to enrich the States except by paying off someone elses debt,I think the same goes for immigration here, in my favor Im unlikely to cause much trouble and i do have some skills. Lets imagine NZ as a country without special status into Australia and the Uk/ Canada. Be a lot more people and alot of problems with no decent jobs and poor outcomes. Australia acts as our pressure release valve when we run out of decent jobs.

If im a local and cashed up and struggling to find opportunities when I already have a good knowledge of how things work around here,then how is an immigrant meant to do it better? Immigration is more about keeping house prices up and we just divide our wealth between more and more people, its the answer our leaders are looking for.

AndrewJ,

Check out how good the prospects are in all the cities in the USA that have had no house price bubble - use the Demographia Reports.

You can get houses and property for half the price as NZ, AND their GDP per person is way higher than ours while costs of living are lower.

The whole US economy is being dragged down by a few significant property price bubble cities, especially Californian ones - along with some trade-union-destroyed economies like Detroit. Notice that the Nissan, Toyota, and Honda factories in the USA are doing just fine, and so are the regions where they are wisely located.

The good bits of the US economy are simply miles ahead fo anything else anywhere else in the world, especially for future prospects.

There are immense opportunities in enterprise and wealth generation in the US. I have helped eighteen business relocate there in the past year. I would acknowledge you need good introductions and support structure to be successful... like any new market/country.

Social, political problems.... yes however where is that not the case. You have the money so just keep on visiting the girls....

I must add that I wouldnt be considering it if my children were not living there.

Have a read of this

http://hat4uk.wordpress.com/2012/01/03/global-economic-crisis-the-reali…

wow..not just big cities, check this out in Tokoroa - 420,000 smackeroos , I wondered if the owners is moving OUT instead "moving on"

http://www.trademe.co.nz/property/residential/for-sale/auction-434774686.htm

Extremely cheap compared to Auckland. Similar house in Ponsonby on over 1800 sqm land would cost over $2M I'd say.

common ponsonby section is 300sq or even less.

1800 if you could find it, could probably hit 4mill.

If it's 4M I'd rather spend the money on this house in Remmers on 1022 sqm:

http://www.trademe.co.nz/Browse/Listing.aspx?id=422575069

Went to the open home and was stunned by the detailing...asking for over 4M but it has been immaculately renovated, even featured on the Herald:

http://www.nzherald.co.nz/property/news/article.cfm?c_id=8&objectid=107…

What do you think?

I wouldnt call that a 'huge' site for Remuera would you?

Not sure I'm seeing 4mill value in that - for me - 4mill would need an elevated sea view.

Also - you would have to deal with that shortass inbred Boulgaris.

I'd still take the 1800 in pons - could get 5 sections out of that!

Yeah 1022 sqm is not huge in Remuera but not that small either, probably an average 1/4 acre in the area. That's the thing, no sea view on a street called Seaview Road...wrong side of the street for me otherwise it's the right one...am looking for a family home to live in but must be in excellent school zone. Daughter going to college next year so a good state school would compensate the costs of private schools. Definitely not into developing more properties at the moment.

Almost everywhere in NZ is way overpriced - there are million dollar homes in hicks country towns.

This would simply not be the case if even in the hicks country towns, you could convert farmland for housing without having to pay a ton of "planning gain".

This is why a mansion on a lifestyle block is cheaper than one on half an acre of approved urban land.

Come to hamilton if you want good value.A lot of nice quiet streets have been ruined by the influx of renters of houses that were previosly family homes but now investors own them and turned them into somewhere not to live.

Moving to Hamilton would mean funding the local council stupidity Ng.

yeah - we arent all into their $18 million V8 races

Doesnt matter if Hamilton is not fancy enough for some - its affordable - and so are some areas of Auckland - 350k for something decent in Te Atatu - which is only a couple of motor stops from the cbd - and with a few good cafes.

Much cheaper again heading south - no day spas or Gucci though - how sad.

'Lack of affordable' housing is a complete myth.

SK

Rubbish, read the Demographia reports. Hamilton, and every city in NZ, is nowhere near as affordable as the few hundred cities of similar size and much larger, in the USA, that have no "planning gain" racket run by the local council.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.