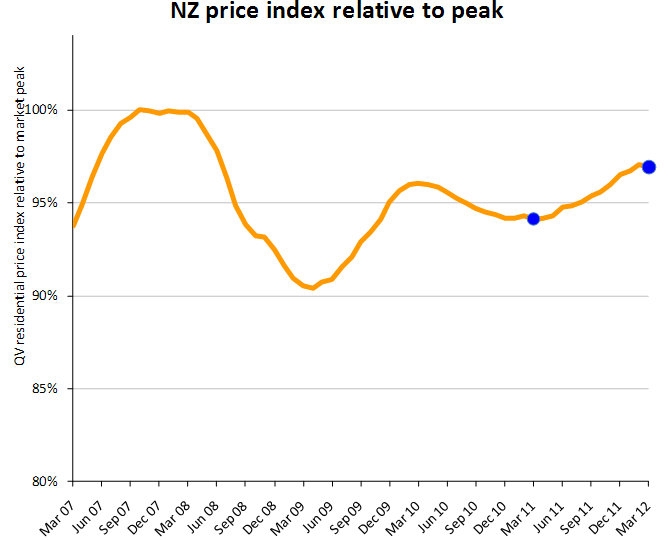

Nationwide residential property values eased slightly in March following a year of slight month-on-month increases, but it is too early to determine whether the fall represents a change in direction in value movements, government-owned valuer Quotable Value says.

Values fell by only 0.1% over the month, which may just be a temporary blip. If values were to fall again next month, then there may be more reason to talk about the movement, QV said.

Despite the slight drop in the last month, values were still up 0.5% over the past three months and 3.0% up over the past year. Values in March were 3.0% below the previous market peak of late 2007.

“The marginal drop in values last month follows a year of slight month on month increases. These increases were driven initially by Auckland and Canterbury but the rest of the main centres have also been increasing over the past few months.

"It is too early to say if the drop in the latest month represents a change in direction for the market," QV.co.nz Research Director Jonno Ingerson said.

"Sales activity remained strong in March, returning to the highest levels since 2009. Activity levels have been bolstered by first home buyers having enough confidence to enter the market, while some existing home owners are now ready to make a move they may have been delaying for several years. The level of sales activity is still being constrained by a lack of supply in some areas, particularly Auckland, Christchurch and parts of Wellington,” Ingerson said.

“The market remains variable across the country, responding to local economic influences. Most of the main centres have been increasing, most of the provincial centres have been more or less stable, and the rural centres have generally been increasing over the past year,” he said.

Below are QV's own regional summaries for residential property values in March:

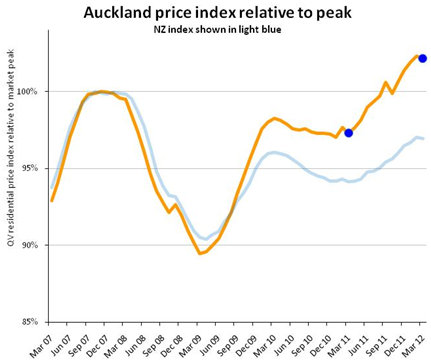

Auckland

Values in the wider Auckland area are up 0.8% over the past quarter, and 5.0% up over the past year. This annual increase is more than any of the other main centres and as a result values are now 2.2% above the previous market peak.

In the most recent month values have either steadied or dropped slightly in Rodney, North Shore, old Auckland City, and Manukau, and as a result the wider Auckland area has eased slightly. It is too soon to say if this is the beginning of a changing trend in the market or just a temporary dip.

In the most recent month values have either steadied or dropped slightly in Rodney, North Shore, old Auckland City, and Manukau, and as a result the wider Auckland area has eased slightly. It is too soon to say if this is the beginning of a changing trend in the market or just a temporary dip.

The old Auckland City remains the fastest growing part of the Auckland Area, up 6.9% over the year and now 4.8% above the 2007 market peak. The Southern part of the old Auckland City within the area from Mt Eden to Waterview to Blockhouse Bay to Penrose has risen 8.8% over the past year and is now 6.1% above the previous market peak.

“Quality properties in good school zones and near the city centre remain in high demand. However there are insufficient properties coming onto the market to meet this demand which is tending to put upward pressure on prices” said QV Valuer Glenda Whitehead.

“In central areas, where zoning will allow, we are starting to see infill housing sites being created, with seemingly good demand for these vacant sections either from spec builders or potential owner/occupiers” said Whitehead.

Across the rest of Auckland values are up 4.4% over the past year in Papakura, 4.2% in Waitakere, 3.8% in North Shore and 3.1% in Manukau. All these areas have risen more in the past year than any of the other main centres apart from Christchurch which has risen 4.1%.

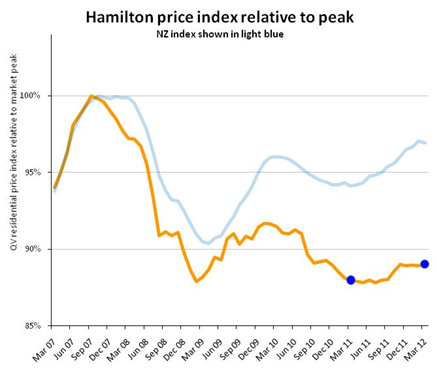

Hamilton

Values in Hamilton have been steady for the past five months, but increases in the months prior to that mean that values are currently 1.2% up over the past year and 11.0% below the previous market peak.

Values in Hamilton have been steady for the past five months, but increases in the months prior to that mean that values are currently 1.2% up over the past year and 11.0% below the previous market peak.

“Anecdotal evidence indicates there has been renewed interest in residential property in Hamilton over the last couple of months. Homes in the middle to upper end of the market appear to be selling best with less demand for homes in the bottom end of the market” said QV Valuer Richard Allen.

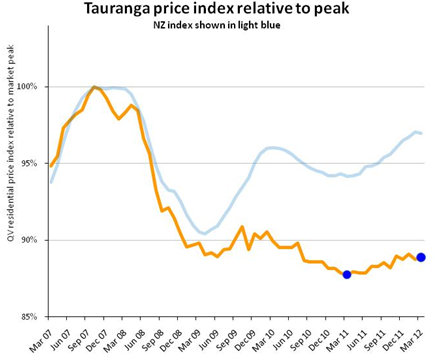

Tauranga

Tauranga values have been relatively steady for the past six months, and are 1.3% above the same time last year and 11.1% below the 2007 market peak.

Tauranga values have been relatively steady for the past six months, and are 1.3% above the same time last year and 11.1% below the 2007 market peak.

“There are some signs appearing in the Tauranga market that a trickle down affect is occurring from the growing Auckland market. Some buyers are starting to perceive they are getting more relative value in comparison. At this stage the market remains generally steady” said QV Valuer Shayne Donovan-Grammer.

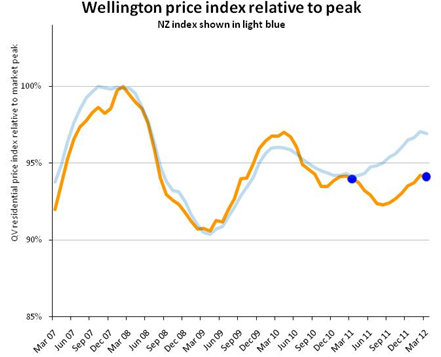

Wellington

Over the past twelve months values first dropped for six months, then rose for the next six months to currently sit 0.1% above the same time last year. Values are currently 5.9% below the previous market peak.

Over the past twelve months values first dropped for six months, then rose for the next six months to currently sit 0.1% above the same time last year. Values are currently 5.9% below the previous market peak.

QV Valuer Kerry Buckeridge said “activity in the market place is anything but static at the moment. Real estate agents continue to report being very busy since the beginning of the year as people returned from holiday with a “let’s get on with it” attitude. However despite a flurry of listings early in the year there are now emerging signs of a stock shortage in some areas. There remain good levels of activity in the first home buyer market, while higher end properties with the “X factor” have been achieving multiple offers at tender”.

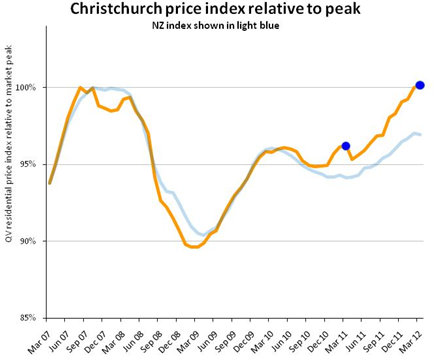

Christchurch

Values in Christchurch have risen 1.1% over the past three months and 4.1% over the past twelve months. Christchurch values are now 0.2% above the 2007 market peak.

Values in Christchurch have risen 1.1% over the past three months and 4.1% over the past twelve months. Christchurch values are now 0.2% above the 2007 market peak.

The areas neighbouring Christchurch are increasing in value faster than anywhere else in the country. Waimakariri District has increased 13.3% over the past year and Selwyn District 10.4%. Both areas are also the most above the previous market peak with Waimakariri 7.9% higher and Selwyn 6.8% higher.

“Demand in towns surrounding Christchurch continues to be high, especially as more contractors and their families start moving into the area to help with the rebuild. Whilst many seem to welcome the opportunity to work in the region, some are worried about another earthquake and want to live away from previously damaged areas. There are reports of some workers who are commuting daily from as far away as Ashburton” said QV Valuer Richard Kolff.

“Feedback from agents also suggests that many people are only selling when they have to, such as if they are a growing family and need more room. This is resulting in low levels of listings and is in turn pushing up prices” said Kolff.

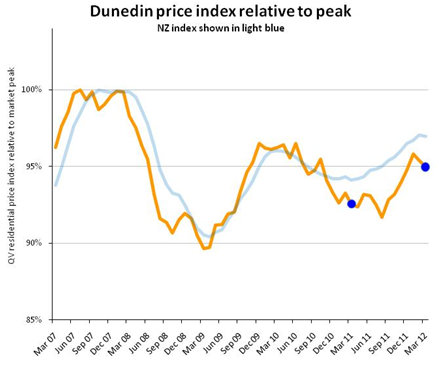

Dunedin

Up until a couple of months ago Dunedin values had been amongst the fastest increasing in the country. Values have dropped slightly in the last two months but are still up 0.2% over the past three months and 2.6% up over the past year.

Up until a couple of months ago Dunedin values had been amongst the fastest increasing in the country. Values have dropped slightly in the last two months but are still up 0.2% over the past three months and 2.6% up over the past year.

“Sales in the lower end of the market are occurring quite quickly with multiple offers evident. This is in contrast to the higher end properties where buyers are remaining hesitant” said QV Valuer Tim Gibson.

Provincial centres

Over the past three months values have increased between 1% and 2% in Rotorua, Palmerston North and Invercargill. Gisborne has dropped 1% with the other main provincial centres staying more or less steady.

Over the past year Whangarei has increased 3.1%, Nelson 1.8% and Palmerston North 1.1%. Wanganui is down 4.3% over the year, Gisborne down 2.0%, Napier down 1.7%, Hasting down 1.3% and Queenstown Lakes down 1.1%. Values in Rotorua, New Plymouth and Invercargill are within 1% of last year.

No chart with that title exists.

72 Comments

Blimey Alex...they had better tell the buyers of Wannabe place Pt.Chev that then ...as it sounds like they got tucked.

But then where the Big B goes....well that's the trend to follow....yes..?

Updated with charts of all the main centres. Check out that Auckland one eh!

Cheers

Alex

What shocking news!

A drop in values of 0.1% is unbelievable.

Shame that nobody bothered to tell the market:

"Barfoot & Thompson said on 4 April it sold 63% more homes in March than it did in February, and 16% more than in March last year. Managing director Peter Thompson said it was the agency’s busiest month for 5 years.

The 1246 sales in March were up from 764 in February and 1070 in March 2011.

The average sale price of $571,076 was up 6.5% on February but down 1.7% on March last year.

Mr Thompson said 99 of the March sales were for more than $1 million, up from 40 in January & 41 in February and the highest $1 million-plus month since March 2007. The 180 $1 million-plus sales for the first quarter were 29.5% ahead of the first quarter of 2011.

He said sub-$500,000 sales were also high, at 628".

10 April 2012

....... if Bernard was here , the banner headline above , would've screamed that the property market had " crashed " in March ......

...... ummm , .... so a 0.1 % fall doesn't spook you out of the market , Big Daddy ?

wider auck up 5% - considering that includes all the bland shopping mall suburbs and crime ridden ghettos - not too bad.

Auckland is red hot right now. Try buying a decent house under $1m in the Central Auckland suburbs! Even $1.5m will struggle to get something decent that isn't plasterboard and potentially leaky.

$750k will really only buy a crosslease in Sandringham or a if you're lucky a do-up on a full site in an outer area.

Grey Lynn/Ponsonby seems up about 20% on 2 years ago. Last week at the auctions 2 villas each broke the $2m mark and a 1970s tear down on 440m2 (land value only) sold for nearly $900k.

That's a bit of an exaggeration... From someone who's currently shopping for property, you're right in that it's red hot, but you're exaggerating more than just a little. You're right if you're looking at high end properties, but the average place in Sandringham on its own title is still well below $750k.

Really?

Try and find something that isn't on a main road or a state house on a full site for much under $750k. A very rough bungalow on a full site in Fowlds Ave Sandringham sold for $736k under the hammer last week. A cross lease villa in Arabi St Sandringham went for $740k last week and also in Arabi St a relocated but renovated bungalow on 487m2 sold for $795k. A total do-up bungalow in Maybeck St Mt Albert went at $907k under the hammer.

Tonight a tidy but certainly not renovated villa in Murdoch St Grey Lynn on 404m2 sold for $1.27m. A renovated one in Norfolk St Ponsonby went at $1.85m. Last week a villa in Rose Rd Grey Lynn sold for $2.12m, and one in Lincoln St for just over $2m.

Anything decent on the market $750k to $1m and I will be buying it in the next few weeks - we still have 4 EQ replacements to buy in that range in Auckland.

Wow there must be heaps of cashed up buyers out there eh!

Which was the 70s teardown?

Ponsonby Terrace

It's mental isn't it? Time will tell if it is sustained, I'm pretty confident it won't be.

Not that I pay them much respect, but the bank economists seem to be pretty unanimous that this mini price spike will soon revert to flatness

You've been confident, certain, definite, positive etc many times over the last few years.

Why should we listen to you now?!

No one has to listen to me, I'm just offering a view point. The winter months are coming up, and there's not going to be a wild spending spree through the budget. Affordability is already stetched. Interest rates are unlikely to go any lower. If you can argue more sustained gains in the next 6 months on the back of that kind of setting then good luck! I'm still expecting 2-3% gains for greater Auckland in 2012

For what its worth, I've been more accurate than most of the "experts", especially with regard to GDP growth, unemployment, and to a lesser extent housing. Where I went wrong (I predicted a fall of 15%, it fell 11% - and I didn't expect prices to pick up THIS much) is that I underestimated Govt's willingness to prop up housing. I genuinely thought Key and co were going to make a real difference in addressing the issue. After all, that's what they promised. They haven't - much to the joy of some landlords, but to the detriment of the economy (apart from some sort of short term effect)

To be fair, you've been pretty good with your predictions. Another bloke here - Murray - has ended up pretty accurate, I think a couple of years ago he was predicting flatness for a few years

Personally I think the Auckland market is about to move up significantly. We've already seen prices of like for like sales in Ponsonby, Grey Lynn, Herne Bay, St Mary's Bay up 20% plus on 2 years ago and still rising.

There is huge pent up demand and no shortage of buyers (especially lots of wealthy cashed up Cantabrians). Prices could easily move to being $1.2m as the starting point for a reasonable stand alone house in the desirable inner suburbs within a matter of months.

Outer areas and North Shore will surely follow in due course.

Take a look at realestate.co.nz search homes $700k-$1m with 3 or more bedrooms in Auckland city - there are 206 listings - doing a rough count at least 36 are plasterboard and have leaky home issues (whether the owners admit it or know about it or not), about 8 are development or investement properties in less desirable outer suburbs, 4 are actually apartments, at least 7 are already sold, 25 are townhouses, about 10 will likely sell over $1m, 15 are on main roads/highways and just 99 are houses that don't have too many problems of which over half are actually larger townhouses or on subdivided sections.

So 99 properties available (compared to 150,000 odd households) in the most popular price segment of the Auckland City market in the entire Isthmus area. Not much supply, especially when you consider 10,000 properties are on the market in the greater Auckland City and 1432 in old Auckland City.

With no new supply prices can rise very sharply very quickly.

agree re your exaggerationChris - most of the trade me ones listed in grey lynn that mention a price seem to be around 1.1 mark - the one below looks decent enough for 1.1, certainly not 1.5.

http://www.trademe.co.nz/property/residential/for-sale/auction-455920356.htm

there is another for 1.1 that is on 600 plus sqm and looks done up http://www.trademe.co.nz/property/residential/for-sale/auction-453517301.htm

its stupid for sure, but not as crazy as melbourne

You're too late if you want either of those, Browning is sold and Crummer is under offer and I think may have already confirmed. Browning has plastic weatherboards and aluminium windows.

The properties I mention at above $2m were higher end but not the top of the market. Rose Road and Lincoln St (both Ray White) sold last Thursday under the hammer for $2,120,000 and just over $2m respectively. Both were high spec renovation/rebuilds on 450m2 each or thereabouts.

Absolute tips in the area are currently $850k ish (16 Wilton St sold last Saturday), or even more in a better location (Ponsonby Terrace for just under $900k last week). Average properties are going at over $1m, like 37 Baildon went for $1,038,000. Or 51 Murdoch at $1.27m.

Any nice character property on a 400m2 or bigger site in Grey Lynn north of Great North Road, or any suburb north of there out to Westmere is worth at least $1m or if it's nice at least $1.2m unless it has a major problem (ie on a main road or down a steep hill etc). That's no exaggeration.

"Auckland is red hot right now. Try buying a decent house under $1m in the Central Auckland suburbs! Even $1.5m will struggle to get something decent that isn't plasterboard and potentially leaky"

"Any nice character property on a 400m2 or bigger site in Grey Lynn north of Great North Road, or any suburb north of there out to Westmere is worth at least $1m or if it's nice at least $1.2m unless it has a major problem (ie on a main road or down a steep hill etc). That's no exagerration"

your first statement is exagerrated relative to the first. From what yoou are saying, 1-1.2 million will get you something "nice" - before you said you woud struggle to get somethig "decent" for 1.5.

Clearly a "decent" house is better than a "nice" house. $1.27m doesn't even get you a nice villa with room for a garage in Grey Lynn (51 Murdoch Rd), $1.5m mightn't either but will get something with perhaps a new kitchen and 2 bathrooms!

Crummer seems like a good price.

No more Grey Lynn, Ponsonby, Pt Chev and Westmere please guys. All houses in these areas are over priced. Come to Orakei, Remuera, Mission Bay and Eastern Suburbs and you will find that with the same price, you will get double the size in land and house, plus it is alot closer to the beaches and more parks and reserves and better school zones. The 1.27M you pay in Grey Lynn will get you a 250sqm house on a 1000sqm land in Remuera GZ.

Unfortuantely most of the modern houses in Remuera etc have leaky building issues. If I could find non leaky houses (no plasterboard) in good order in the double grammar zones on 1000m2 with a 250m2 house I'd pay $1.4m+.

Re your comment about leaky homes, just how well do you know Remuera, Chris-J, because you are describing a Remuera that I don't know? And I have lived in this area for 27 years.

Thanks David B for clarifying. Obviously there are people out there who are not aware of names like Fairholm (1898), Glenholm (1860's), Woodcroft (1870's), Elmstone (1902), Cotter House (1840's), Coolangata (1900's) and the like....oh, and they are far from having leaky building issues. In saying that, I do admit that there are some leaky homes around especially those plaster-claded built in the 90's and early 2000. However, they are everywhere, Northshore is far worse in terms of the number of houses with weather-tightness issues.

One of the best kept secrets in real estate at the moment is the better value buyers get in the eastern suburbs (especially Orakei and Remuera) compared to the likes of Grey Lynn, Pt Chev, Westmere and Ponsonby where house prices are already over-priced and through the roofs! However, how can you put a value on living in an area full of such rich history and graciousness like Remuera? Not to mention double grammar zoning...oops, I have to throw that out :) Only sane people can make a good judgement I'd say.

doublegz there are plenty of well built houses in Remuera, but the fact is most properties on the market in Remuera are suspect - only 52 out of the 144 unique listings on realestate.co.nz have no obvious issues, the rest contain plasterboard built pre 2004/5 and/or internal decks built pre 2004/5, hence the low prices.

Try finding a well built house in Remuera on a full section (quite street, good access and flat usable space) in the double grammar at under $1.4m which isn't either rundown or in the bottom of a gully.

David B

I know Remuera fairly well (have viewed a fair few dozen properties internally since 2001) and have certainly kept an eye on the market their since then despite not living in Auckland.

I do know that probably 80% of homes built between 1990 and 2005 in the area will have significant "leaky" building issues whether the owners know about it, accept it, or not. The lack of cavities, untreated timber and inadequate flashings make almost all buildings built during that period with monolithic claddings or internal deckings virtually worthless as they are impossibly expensive to fix adequately and will eventually fail. Some of these properties are built of quality materials yet one failure such as lack of cavities or flashings still make the building too expensive to fix (ie more economic to build new).

This is not restricted to plasterboard either, I viewed a property last week built in 2003 of weatherboard that was already rotting because the weatherboards were only H1 treated, some timbers were even obviously untreated and flashings were inadequate.

There are five types of properties that are in my view are at risk of being worthless:

1. Buildings built of untreated radiata framing with ANY cladding (including cedar or treated pine weatherboards).

2. Timber framed buildings (ANY treatment level) with monolithic claddings built without cavities.

3. Any buildings with internal balconies or enclosed roofs/gutters with less than H3.1 framing or built prior to 2004/5.

4. Any structural brick building which has no steel strengthening (and no recent EQ strengthening).

5. Any structural concrete or concrete block building of 2 or more levels built pre 1990 or ANY concrete framed highrise.

The reason 4 and 5 are worthless is because when the effects of ChCh are realised, insurance on those buildings will become impossibly expensive and on the worst buildings in that category councils will force evictions (check out Rangiora if you don't believe me where buildings with no damage are under cordon with shipping containers under CERA's orders. Wellington will soon go the same way, as will Auckland - so I suggest if you own a double brick house in Remuera - dump it now!)

But the leaky issue in Remuera is very real, which is why you can buy a fantastic 250m2 1990s executive home on a big site in Remuera (eg 10b Seascape Rd at $690k) for less than the price of a state house south of One Tree Hill.

OMG Chris_J you make it sound like Remuera is a scary place to live and 80% of the buyers should avoid Remuera due to leaking homes. Can I please stress that this issue is not just a Remuera disaster but a national one including Herne Bay, Ponsonby, Westmere, Pt Chev and Grey Lynn.

DG, you and CJ are both right. Buyers beware, well built exist, but form a low proportion of whats for sale now.

Just because the problem is mega doesn't mean we should ignore/accept it as so. CJ is on the right track, the check list of whats a "walk-away" is larger, with the consequences of getting it wrong life changing.

Thanks, doublegz, for some rational and common sense advice. Auckland is so much more than the relatively small area that comprises Grey Lynn, Ponsonby, Pt Chev, et. al. Sensible people would do well to leave those suburbs to the silly fashion victims.

Everyone thinks their little boxes are worth heaps, heres some news, they're not. Smart money is moving well away from property. In fact the smart money is staying right out of it, too much risk.

You are so sure your money is the smart money?

Where is your smart money running away to - now that you have cashed up your property assets?

Hillarious MK. You are a muppet.

If you have any decent standalone Auckland Central houses I can make you an offer if you don't want them...

From this mornings Herald.

"In the next six to 12 months, Tower was likely to be buying more property and shifting out of long-term fixed interest into short term, because of what it saw as an increased inflation risk."

What was that you were saying about smart money ?

Lets just say it ain't in the bank

I think what you guys should probably realise is that by international standards Auckland is not a very good place to live and that New Zealand is a very small country in comparison to many other countries. When I think of the NZ property market I think of Iceland and Ireland. The only reason people can afford to get into houses is because they HAVE TO borrow, I'm telling you now, it's not right.

This is totally wrong small town cultural cringe thinking.

It's only kiwis who take this view.

Internationally NZ is very desirable as evidenced by Auckland always being in the top 5 cities for lifestyle along with the Canadian/Swiss/Australian cities.

Try getting a 500sq section anywhere near Zurich or Sydney for 1million.

You can not - perhaps 8million chf may do it.

Get it?

I find it absolutely laughable that you compare Auckland to cities in Sweden, Canada and Australia. They do not compare one iota.

It's not me comparing - its the world - via a number of international surveys such as this very well regarded one here:

http://en.wikipedia.org/wiki/World%27s_most_livable_cities

ps Swiss - means Switzerland - not Sweden.

SK I think we can agree MK is the sharpest tack in the box.

My is above is missing the n't, which of course spoils the moment.

MK, it's laughable if you think that Auckland is unattractive! As for living environment it is one of the most desirable cities in the world. Certainly up there with Sydney, probably better than Melbourne and Perth. In the US probably only San Francisco and New York could compete, and in the UK only London but for different reasons, I'm not sure if Vancouver gets a foot in, but really there are very few English speaking big cities that compare. Asian cities are not comparable for living environment and many European cities aren't comparable either although many are attractive for other reasons.

You're kidding, right?

An average 120 square meter apartment in Seoul has a value equivalent to a Central Auckland landed property. Many other Asian cities have similar values. If it wasn't for the natural barriers e.g. Jobs and language there would be higher migration as these buyers have no chance of ever having their own backyard in their home countries. House to income ratios have no bearing for these buyers, as they are often paying cash, no mortgage.

i feel for those competing against these buyers but to hope that Auckland is seen as an unattractive destination and prices will drop is not realistic. Interest rate rises are the likely savior, but that will just give another reason to say its expensive.

Some of the comments on this forum are the same types I see on a car forum. There a seller received a diatribe on his 'overpriced' car up for sale. His response was, "why do you care, if you don't want to buy it, move on?" . The same could be said about Auckland as let's face it the rest of NZ is affordable. Move to another city rather than lamenting how much others value properties where you likely don't want to live anyway.

You are taking the piss aren't you? Have you ever even travelled?

What you can get in Auckland is brilliant compared to any city in Europe that has similar or larger populations than Auckland. If you spend equivalent of $1.5 million dollars in a major city in Europe (~800k Euros) you would be looking at an apartment.

I work in Europe every winter and I can assure you that your claims about living standards are completely off - and in fact over there the only way the average person can get into property is by inheriting it when their relatives die.

Anecdotal Hamilton evidence - 1/4 acre section plus 50's state home, 90sqm. GV $325k recently reviewed down from $375k. Purchase price $290k (subj to LIM). Date of contract 12.4.12

I reckon you lot should come over the Bombays...

Akld up 5 % from 5 years ago, nothing to get too excited about, and as Matt said, would be a lot worse if not for govt propping up of market. You have to wonder how much the Christchurch earthquake upset the predictions of the bears. Certainly it has created some additional demand (obviously in Chch but also Akld for displaced residents) but more impact has come from low interest rates (maybe 1% lower becasue of earthquake?) - lets face it, this bubble has always been about cheap and easy credit. If mortgages cost 8% right now we would have seen another 20% of falls.

For my part, I am now looking to buy in melbourne. Its insane, but a bit less insane than previous, and for the house i am looking at its 30% less insane than the ppty was asking a year ago (that said even after the drop the property would only gross 3.8% rental yield), but better than the 2% of the ppty I now rent. Its mad for sure, but so is govt policy that drives rates too low and then taxes you at 46% when you dare to save and earn interest.

Akld up 5 % from 5 years ago, nothing to get too excited about, and as Matt said, would be a lot worse if not for govt propping up of market. You have to wonder how much the Christchurch earthquake upset the predictions of the bears. Certainly it has created some additional demand (obviously in Chch but also Akld for displaced residents) but more impact has come from low interest rates (maybe 1% lower becasue of earthquake?) - lets face it, this bubble has ALWAYS been about cheap and easy credit. If mortgages cost 8-9% right now we would have seen another 20% of falls. So perversely, the GFC and natural disasters have been a boon to the market - surely a sign of how warped Western capitalism is at the moment ie NOTHING seems to be based on fundamentals, its all illusion and ever increasing sugar highs (ie we are a bit like a drug addict welcoming being run over to secure some free and stronger morphine)

For my part, I am now looking to buy in melbourne. Its insane, but a bit less insane than previous, and for the house i am looking at its 30% less insane than the ppty was asking a year ago (that said even after the drop the property would only gross 3.8% rental yield), but better than the 2% of the ppty I now rent. Its mad for sure, but so is govt policy that drives rates too low and then taxes you at 46% when you dare to save and earn interest.

So perversely, the GFC and natural disasters have been a boon to the market - surely a sign of how warped Western capitalism is at the moment ie NOTHING seems to be based on fundamentals, its all illusion and ever increasing sugar highs

Quite right!

Well worth looking at Macrobusiness in terms of how this kind of high-debt madness really comes home to roost when things turn dire.

Sounds like Melbourne is falling away, a bit too much apartment building. All the developers need to come to Adelaide - the Council is liberalising the CBD planning rules (about bloody time!)

Residential property is selling at a substantial discount to replacement value in NZ, and infact more so in other countries such as the US. You would have to say that this is a fundamental valuation metric which suggests housing is not over-valued wouldnt you? When something sells for materially less than the cost of replacing it? Is it fair to call that a sugar high?

if replacement value includes land costs then yes it is a sugar high as land is where the speculation occurs.

Yes I take your point there. So the argument then comes down to whether the land is over-valued or not. I would argue that this is a supply and demand issue, and currently there is not enough surplus land in the right areas to satisfy demand, which is why land prices are so high. Its hard to see this changing in a hurry.

I wouldn't agree with jimmy quite so easily.

In ChCh many insurers have recently found out that replacement cost can be higher than market value even if the land was worth zero (which it obviously isn't). That's how undervalued property is in some parts of NZ.

If an earthquake or fire destroyed my house, then it would cost my insurance co 115,000 more than my Improvements value - either rv or market value.

Strikes me as classic this time its different....so no. For me there is no real competition in materials and building labour so the % markups for new builds are excessive IMHO.

A metric that seems to hold is, our wage earnings say we should be at 3 to 1 and we are at 5.5? to 1 that says property is severly over-valued and at risk of correction.

regards

In a lower price range and different area to the above discussed properties, I notice on Trademe many houses in the $500k plus GV range selling for asking prices many tens of thousands of dollars above their current GVs.

Prices are pushing up in some of the outer areas of Auckland as well.

Here you go Alex. At the end of that video Charles Biderman states that the safe haven status of the commodity currencies (NZD, AUD CAD) are off the table for him because of crumbling house prices.

Yeah, these 'Economic' commentators are the first people we should be believing.....

Just like how a certain Economic commentator from this site predicted a 40% drop overnight in the housing market 4 years ago.......

Don't forget other "experts" predicted a similar 40% drop in 1999 - look at what happened then! Similar to what is about to happen now!

Here is something to throw in the Property v Other Assets debate, which gets quite heated, not sure why. House prices as measured in gold ounces are now the same as in 1992. So what has changed? See here.

Yet if ppl were not worried about inflation and hence buying gold, gold would be significantly lower circa 1000~1200USD...so that has changed....so personally I see no value in using gold as a comparison...

regards

Barton Biggs reckoned that during World War ll gold was useless as a store of value ......

...... the clever folks had gold & silver jewellery , easy to carry , and to hide ..... with which to barter for what they needed .....

Lugging gold bars around just doesn't work well , in a crisis situation ....

...... what's the current ounce of gold to tonnes of tofu ratio , steven ?

So the person who bought gold in 1992 still has enough to buy a house. But the person who bought a house in 1992 has a house plus he has received 20 years rental income. The gold holder received zero income.

Correct. But we shouldn't confuse income earning ability with gold and value.

Your joking, right. Surely income earning ability is the measure of an investment. Gold is not and never has been an "investment'. A curious and prized mineral, but it's never going to pay you a cent in dividends or rent.

Not sure if you have noticed Vera, but irrational is basically the norm here. This seems to have something to do with supply and demand analysis and follow on from there.

http://en.wikipedia.org/wiki/William_Stanley_Jevons

"Jevons was actually very aware of the business cycle - members of his family had been bankrupted by the 'railway boom' crisis of 1847 - and he was one of the first economists to study it in detail. Inspired by his meteorological research, he believed that it was a periodic phenomenon driven by sunspots. Sunspots affect the weather, which affects agriculture, which affects the rest of the economy. Or as he put it: 'If the planets govern the sun, and the sun governs the vintages and harvests, and thus the price of food and raw materials and the state of the money market, it follows that the configurations of the planets may prove to be the remote causes of the greatest commercial disasters.' The fact that the average business cycle, which he put at 10.5 years, didn't match perfectly with the sunspot cycle led him into a long argument with astronomers over the quality of their solar observations."

I assure you he is not joking and its perfectly normal for somebody posting here to have such beliefs. By the way, economics has not progressed that much from this point in many ways.

Agreed. The gold price, for which we primarily use USD to measure value, has reacted to inflation. But not merely as a hedge against inflation by investors. The price has moved considerably in relation to the amount of money being 'printed'. More money units chasing the same asset. I see gold as the best measure of value, not fiat money units. This is why you see property prices rising in fiat currencies, but virtually the same in gold. So I think gold does have credibility in measuring 'real' property value.

Amanda there is also a moral and ethical question over the use of leveraged money. If you read that article in sent you on the quantity theory of money again, you will see that interest on money created from nothing consumes an incrementally greater portion of the money available. That is why houses are becoming increasingly unaffordable, that trend won't stop until the money system fails or debts are forgiven. It is simple maths.

The other problem is the criminal aspect to this. You know the money supply grows each year as new money is introduced to cater for the interest from the previous year. So prices in general are going to go up on average by the increase in the inflated money supply. But when you take money that isn't yours (a loan or mortgage) then you also get an inflationary gain in value in your home on the money that isn't yours. So for simplicity say you start with $100K and were able to buy freehold, at 10% inflation then the chances are your house will be worth $110K the next year If you borrow $900,000 loan and buy a million dollar house with the $100K down, then the next year your house is worth $1.1Million and you have doubled the value of your initial investment. It seems like a smart thing to do but you are getting a capital gain for something you didn't actually earn. Ask yourself where this money for nothing actually comes from. Was this money introduced to match an increase in the production of goods? No it wasn't, it is pure artifice. That is how bubbles form, as real estate is one of the few outlets that permits this crooked money.

It is actually criminal fraud in intent, as you are taking a pecuniary advantage for something you didn't rightfully earn. This is why I level the accusation at property investors that they are behaving in a criminal manner, this still stands unrefuted.

Don't forget that the bank created the money for nothing, and leverged it 9 to 1 before you get your hands on it. So if you leverage at further 9 to 1 then your overall leverage is 81 to 1. All very nice for those morally bankrupt enough to take advantage of it, but think of the consequences of the leverage in reverse.

I will add the the crime of property investment keeps getting perpetuated because there doesn't appear to be a victim, but victims there most certainly are.

Chris J

Its very difficult being scientific about city comparisons, as it is really very subjective. For example, really exciting vibrant cities such as NYC usually rate not so highly in international rankings, presumably because of crime and other factors. Often the highest ranking cities are somewhat in the "lovely, but somewhat bland" category

Sure, Auckland's a nice enough city, but very overrated in my opinion. Let me compare it to Adelaide, which I think is very underrated.

The weather in Auckland is very ordinary compared to the glorious weather in Adelaide.

The cultural scene? Adelaide wins hands down. Great festivals here, and better music acts touring here (Auckland would get more of the bigger name "pop" acts, but as I dislike mainstream pop music, so what). If you are into music and culture - big parts of human life for many - Auckland has its limitations - well behind Adelaide, and massively behind Sydney and Mebourne

Beaches? Pretty much similar. Glenelg is a great beach

Restaurant / bar scene? Restaurants scenes are pretty similar, bar scene in Auckland probably slightly more vibrant.

Traffic? Adelaide is nowhere near as bad as Auckland.

Sports? More variety in Adelaide with an A League team, and as a cricket fan Adelaide Oval is about as good as it gets.

Universities? Much of a muchness

hinterland? Went to the Flinders ranges over Easter, beautiful there. Also the Barossa, Adelaide Hills and Fleurieu Peninsula for beaches. Auckland also has some nice hinterland. The harbour setting of Auckland is lovely

Each to their own, but to me Adelaide offers more than Auckland and at a more affordable price.

That's another reason why we shouldn't celebrate high and rising house prices in Auckland - when there are cities in Aus and beyond offering as good or better lifestyles at cheaper prices, Auckland will struggle to keep and attract the best talent

Adelaide property is less expensive but not significantly so. A typical central area 2 bed terrace seems to be $400k+ if not $550k. Of course less desirable inner areas of Melbourne and Sydney are only around that level and more desirable areas say Richmond in Melbourne or Paddington in Sydney are only around the $800s for the same at present.

Auckland with it's much larger central city properties at say $1m for a 3/4 bed villa on 450m2 seems not too bad value especially if you take currency into account.

Of course ChCh offers far better value where you can still buy a big villa in the central areas for under $200k on a full site (or perhaps around $100k if you buy EQ damaged as is).

Dunedin too, which is actually one of the most attractive cities for Victorian architecture in NZ, is so incredibly cheap still with villas in the central areas still selling at under $100k in some cases and substantial Victorian grandeur for only a few hundred thousand.

These cities all have their pluses and minuses but I'm not leaving the Mainland, just buying property in Auckland because that makes the most sense for us at the moment.

How about somebody overlay the NZ data onto this graph...

That overlay is here »

or

http://www.interest.co.nz/images/market-oracle-house-prices.gif

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.