This could be a difficult summer for the real estate industry, particularly in Auckland, with the number of homes being listed for sale well down on this time last year.

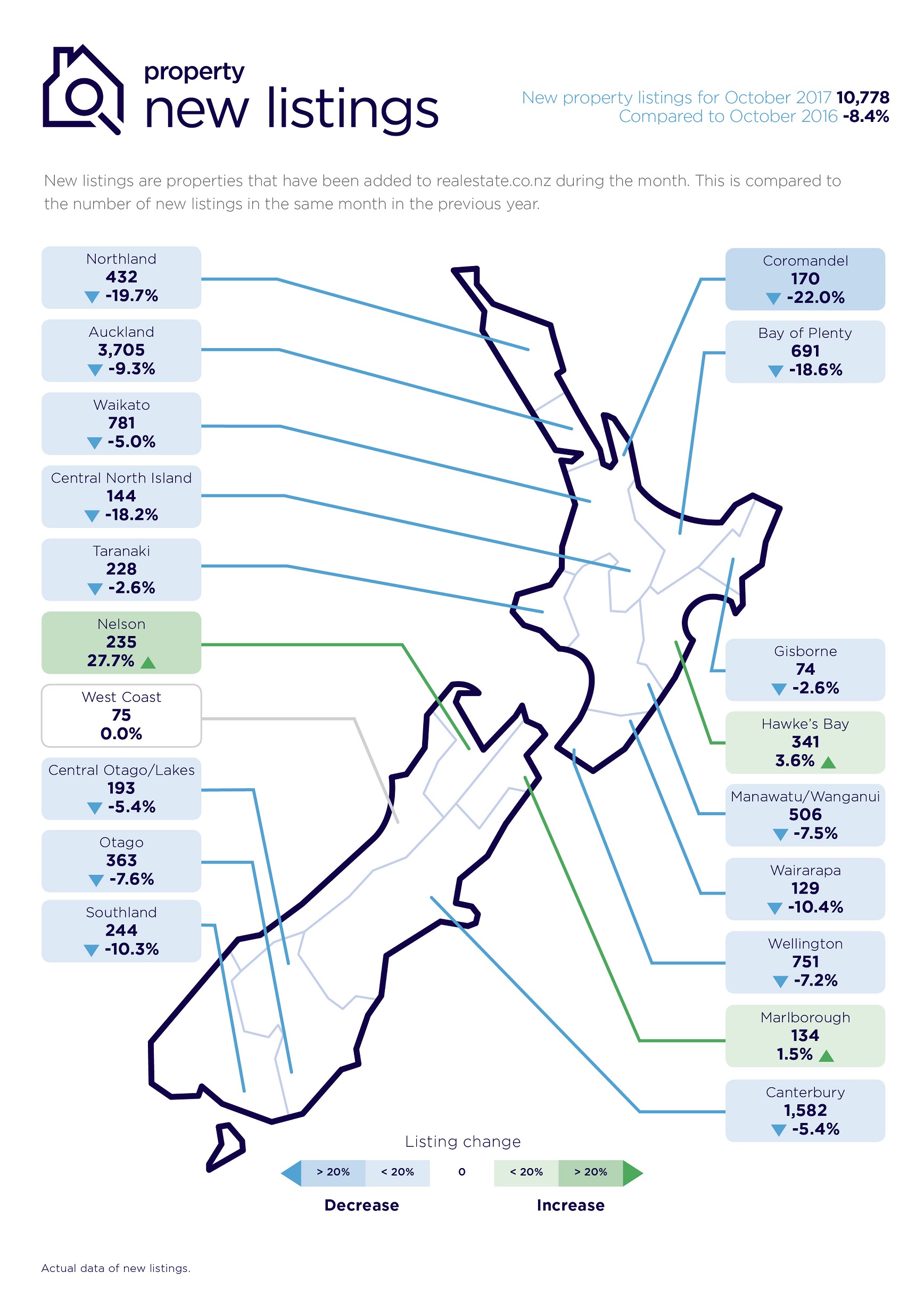

Property website Realestate.co.nz received 10,778 new residential property listings in October, which was down 8.4% compared to October last year.

More importantly, it was the lowest number of new listings the website has received in the month of October since its records began in 2007.

Compared to last year new listings were down in most parts of the country, the exceptions being Hawke's Bay, Manawatu/Whanganui, Nelson & Bays, Marlborough and West Coast, where new listing numbers were unchanged or rose slightly compared to October last year.

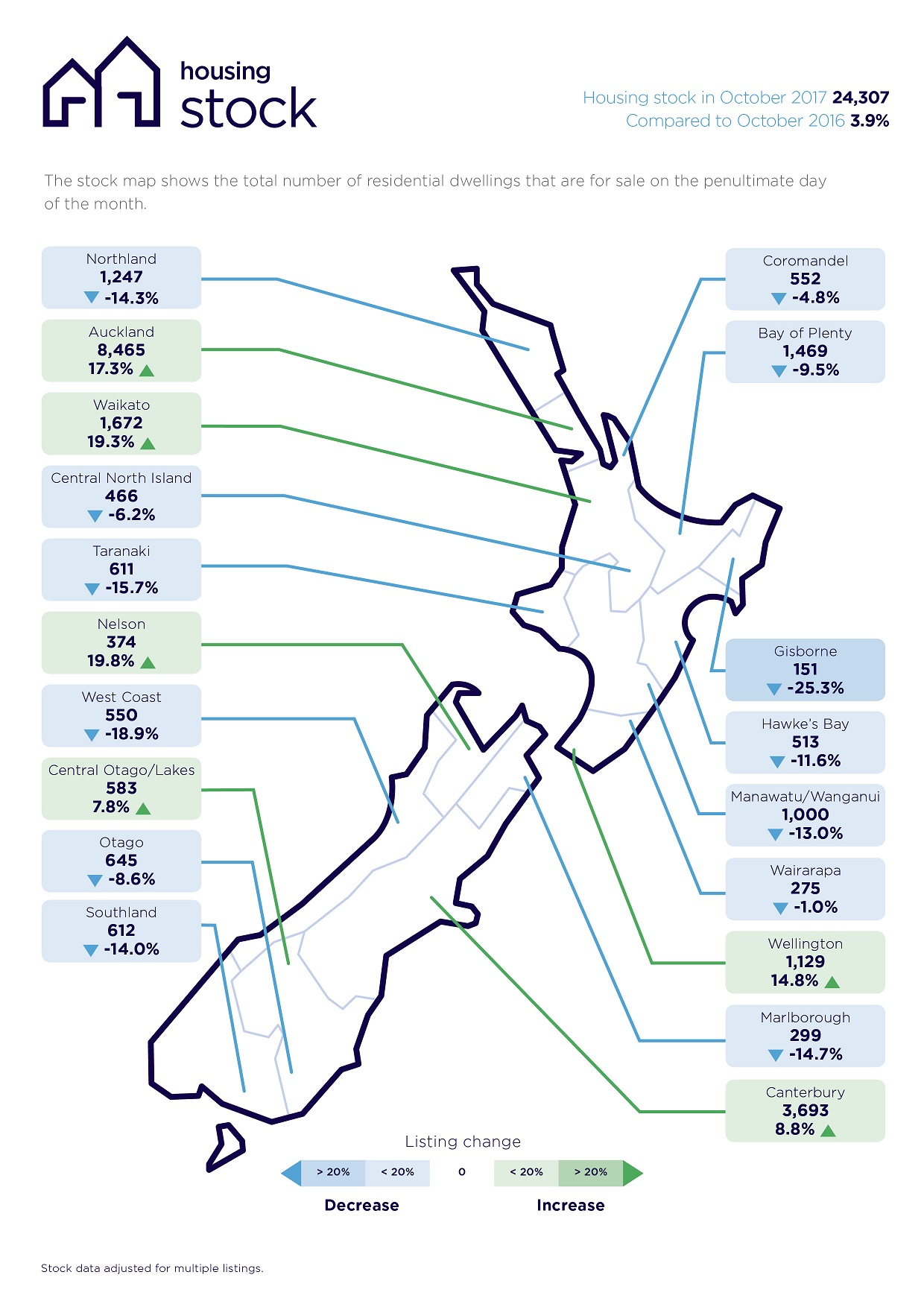

In most places that has led to a reduction in inventory levels (the total amount of stock listed as available for sale).

That means there was less total stock available for sale on Realestate.co.nz at the end of October this year than there was at the end of October last year in Northland, Coromandel, Bay of Plenty, Central North Island, Gisborne, Hawke's Bay, Wairarapa, Taranaki, Manawatu/Whanganui, Marlborough, Otago, West Coast and Southland.

If those conditions persist through the summer months, the supply of properties for sale in those districts could be on the tight side, and unless there is a unexpected drop in demand or increase in interest rates or some other financial shock, prices in those districts should remain firm.

However compared to October last year, inventory levels were up in Auckland, Waikato, Nelson, Canterbury and Central Otago, which means potential buyers in those areas now have a greater choice of properties than they did at this time last year.

That trend is particularly pronounced in Auckland, where there were 8465 residential properties available for sale on Realestate.co.nz at the end of October, up 17.4% compared to the same time last year.

That is the most Auckland properties that have been available for sale on the website in the month of October since 2012.

With the Auckland market already in a sales slump, the growing mountain of properties for sale in the region is likely to put further downward pressure on the market.

And the increase in inventory levels in Waikato, Wellington and Canterbury could turn the heat down a notch or two in those markets as well.

So in one way or another, this could be a difficult summer for the residential property market.

121 Comments

Well, the situation is entirely logical/predictable: a standard market response.

As myself (and others here) have noted for some time now, house owners are less inclined to list their properties in a soft market.

This summer might well be financially tight for many real estate agents, because sales volumes look set to remain at relatively low levels.

Prudent agents would have squirrelled away surpluses during the buoyant 2014/16 period. Not so sure about the others...... Maybe a few more German cars will find their way onto the auction floors and TradeMe.

TTP

TTP, potential sellers can't hold off forever. This soft market being the new normal will cause many to regret not meeting the market sooner.

X2. Some will have to sell setting new price expectations, downwards.

Hi Retired-Poppy,

A few people may go to the wall.

But plenty are long-term owners/investors who don't need to sell. They're savvy enough - and in for the long haul.

That's always been the case with property.

TTP

Hi TTP, I disagree. There are plenty of overleveraged players out there just hanging on. This is a symptom of herd like belief in housing being a one way bet. It's good lending on the way up, bad on the way down.

Hi Retired-Poppy,

They've always been plenty of "over-leveraged players out there" - and that's why we have mortgagee sales etc. Speculators/developers etc go under not infrequently - even in buoyant times.

But if you're yearning for a crash, you're in for a disappointment.

Hi TTP, right now, a crash appears unlikely next week, next month - in a year maybe. A new normal of market weakness would be the best outcome given how over extended things are. The next global shock will however render our overvalued market completely exposed - market will then crash. Many forces such as the Fed unwinding etc are beyond our control. It's not our money.

Hi Retired-Poppy,

In the "next global shock" I'd much rather have my money invested in well-located real estate, than in financial institutions, shares, bonds, managed funds etc etc.

Even in a mega-shock, property is likely to come through ok. Best long-term bet in my view. Demographic factors add to the appeal.

TTP

Must be great being able to tell the future with such certainty. I have my money diversified to reduce risk, about 50% property at the moment. No asset class should be considered immune from risks.

It's called diversification.

Putting all your eggs in one basket is just asking for it.

Brock Landers

Diversification in theory is fine. But becomes an impossibility when every asset class is overvalued.

You can still be diversified even when markets are overavalued. Diversification is the only free lunch in investing - you can reduce volatility/risk without reducing return. Anyone not diversifying is either gambling or stupid.

Agree with the above.

Diversification is an excellent strategy - right through to holding a reasonable amount of cash (and bottled water!!) for emergencies.

But I know plenty of people who regretted their diversification into shares prior to the 1987 stockmarket crash - and finance companies prior to the 2008 GFC.

In diversifying, property is a good bet - because it's generally much less volatile than many other asset categories. I would favour weighting an asset portfolio towards (well-located) property.

But everyone to their own. It's what any given individual feels comfortable/relaxed about that matters.

Property (especially leveraged) is only a hedge against increasing inflation and rising GDP expectations. You need to diversify to give yourself protection against falling inflation an falling GDP expectations. This means diversifying across several asset classes with periodic rebalancing.

That is not true, in a big shock property is screwed.

Perhaps you as apparently NZ's most astute investor will be ok,but everyone I know has been it it for capital gains and the tax advantages...both will soon be gone....then see how you 55 yo mum& dad investor feels about topping up the mortgage for the next 5 years for NO gain...eating baked beans 3 days a week is delicious when you think your making $100k a year capital gain,but they taste like shite when you realise all that interest only money is just going to the banks.

As for shares,as long as your invested in a good company,they will always come back too...except they won't be costing you money in the mean time...and they won't ring you up at 3am to tell you your 2 bed cross lease rot box in Clendon has a leaky hot water cylinder...

So much rubbish posted by people who have never owned a rental...

Yvil, don't you mean smart enough not to own rentals - especially now?

Thanks for exemplifying

"Perhaps you as apparently NZ's most astute investor will be ok"

Made my day, yes I am boring now.

Money "invested in property" is not treated differently if you are reliant on a bank (financial institution) by the way of a bank loan. If your bank hits hard times, they can and will alter your mortgage agreement/contract to meet their new lending criteria. It is in the fine print on your loan docs. Rarely used, unless there is a banking crisis and has happened right throughout history in a downturn. Just make sure you are paying off any debt and building equity during the good times which will help you hold during the downtimes.

The situation isn’t going to get better. Previously it was - wait until the shock of LVRs wears off, wait until after Christmas, wait until after Chinese New Year, wait until after winter, wait until after the election. Now it is wait until after election 2020. That is a long time to wait and there are no guarantees. If I was advising someone considering selling I would suggest they get their house on the market now to catch any flurry of people buying before the rules change. Property investors need to reduce their exposure and debt because Winter is coming.

Tothepoint Tut tut old chap to the point then shall we ?

Interest rate increases will squeeze the life out of leveraged properties

They’ll be a good selection of ex leased top line Euro cars available too once the new arrivals experience the downturn and must work instead of speculate

Interesting article in the Herald:

New Zealand's number of homes for sale has halved in 10 years

I didn't realize there were so many houses for sale ten years ago. It certainly accords with what I am seeing around me. Pretty much nothing for sale in Greenlane-Epsom - mind you it is a small area.

Was there a particularly high number of listings around the GFC in 2007? I wasn't here then, but seems like a possibility. Would be great to see the full raw data since then.

Also interesting to see listings in Auckland have fallen by 9% yet the available stock has risen by 17% over the last year.

It might have been a spike of listings when the leaky home fiasco was made public and people wanted to bail fast. So a good chunk of the houses for sale then might have been the lemons.

So hours after the 5.00pm close to the month, the REINZ , has collated all the listings data for the month, throws in a few graphics ,puts a powder puff piece in the herald, and Greg has it posted at 1.00am. Monthly sales must be a shocker.

Property is doom. Just focus on something else if you can.

Good to .see Zach & DubleD keeping up the laughs

I had a R E agent called calling (knocking on my door) yesterday asking if we were interested in selling our house because he was short on listings (Ponsonby)

Sure he wasn't just scoping the place out to burgle?

Funny

:) I suggest that its Nationwide that agents can never get enough cheap listings - Ponsonby is no exception. Once they have captured a listing they take it upon themselves to carefully GRIND DOWN seller price expectations to meet today's timid buyers. The more listings the more chances = more commission $$!

Hi Yvil,

Indeed, in that whole exclusive area - Ponsonby, St Mary's Bay, Freemans Bay, Herne Bay - house listings are few and far between. As scarce as rocking horse sh _ t.

I can't see that's going to change.

TTP

Read the realestate.co.nz article:

"In October 2007, some 47,958 homes were available for sale in New Zealand on realestate.co.nz, the country’s largest property listing site.

Ten years on, the total numbers of homes listed has slumped to 24,307 (October 2017)."

There's a nice graph too

October 2007? I recall toddling into the BNZ around that time and the store officer telling me he'd happily lend me $X for property, as long as I had 5% deposit money..... As you note....times and financial imperatives, change.

haha Yep we bought in Auckland in 2008 just before the GFC hit, with an easy 5% deposit and half a million debt. Crazy times! House prices tanked shortly after, job losses and hubby went offshore to work in a fly in fly out scheme for the next few years. Thankfully it was the offshore income that kept us afloat nicely.

Interesting that it is the lowest number of new listings since 2007.

People are too scared to list because nobody can guage what the new price point is. So if you are selling to move, how do you work out if you are paying to much for the new property, only to find out that you are forced to sell for alot less than you expected? How do you recover from that hit? The property market is trying to find the new average and until then, prices will keep falling until people are comfortable enough that they won't be left cashed up with nowhere to go.

All existing stock, unless rezoned for increased density, has not just stopped its rocket boosters (capital controls), its about to jetison them. Well done.

New builds, international targeted appartment builds not so much. Hopefully will fund intensification and train lots of new tradies.

No doubt more changes to come for those who will leak around the new change, but thankfully Govt has a will to actually protect the average tax payer, unlike Nat who had its head up its own dark place on this issue.

Picking more sellers trying private sale, agents offering better deals, mass agent reduction, and perhaps even a new low fee option surfacing.

In my experience, I know that lots of RE agents own multiple properties. As their livelihoods erode, I suspect that many will be desperate to offload properties.

Baby boomers also. I don't believe that all those who bought multiple properties were in it for the long haul, many were just after quick capital gains and if that erodes there will be some nervous people out there.

Yes. There might also be those who have bought in the last 2-3 years who are worried about the outlook and the fact that govt will extend the bright line test to 5 years. Could be a fair bit of 'get out now'.

Inner city apartment market will be one to watch, as the govt slashes low quality student visas.

Will take a couple of years to have an effect on actual students in Auckland. And it assumes Labour don't cave in under pressure from begging owners of PTEs.

I don't think they can cave in. Winston would have set some non-negotiables around immigration

I think Labour would do well to employ more inspectors of PTEs and more labour inspectors. Simply rooting out fraudulent practice will have a significant - and entirely good - effect.

These three previous comments are spot on.

You could add to these comments those homes owned by builders who desperately need cashflow to keep up the payments on the new ute.

Fewer students would make inner city apartments more desirable in my opinion.

Apartments are the first to climb and first to fall So watch that market

I’m sure they’ll be plenty of apartments for you Zach

Auckland city apartments predominantly filled with migrants so any change to migrant status will hurt the apartment market

One thing you can be sure of is there are less Baby Boomers today than there were one year ago

Which generation will inherit the Baby Boomer's portfolios?

If there isn't an income stream, there can be no "portfolio" to inherit.

This is the inheritance

https://populationspeakout.org/uncategorized/download-pdf/

The ‘lucky’ generation who ever they are, as there will be valuable properties shared amongst fewer siblings. Life changing sums of money.

yes, although with life expectancy increasing many may have to wait a while...

Correct, the oldest baby boomers have a further life expectancy of another 10 or so years, whereas the youngest have another 30 years or so to annoy the Millenials.

Much baby boomers wealth will & is being eaten up with Alzheimer’s care

Anyone who has paid for secure rest home care knows it is extremely expensive over years.

Commercial property investment didn’t cut it but the sharemarket worked very nicely

Aged care is intensive and expensive

A generation of Prince Charles's.

If a boomer gave you "life changing sums" of Monopoly money, would it change your life?

It has to be exchangeable to be worth anything. Picture inheriting a castle, for which there are no buyers or viable tenants. Not so life changing.

Um, we're talking about here and now really, not the coming Mad Max dystopian future.

two other guys wrote:

..less Baby Boomers today than there were one year ago

today highlighted

fair enough - but i tire of the line that the boomers will pass on lots of "wealth".

Unknowingly, the reality is they've already burnt the wealth.

..it will be asset and income tested away.

All experts in the media are talking that ban on foreign / non resident buyer will be minimmum as data provided under national government suggests that foreign buyers is just 3% but they forget that national manipulated the defination of foreign buyer and did not include Non Resident (Short term visa / Student visa /work visa).

FOREIGN BUYER AS PER NATIONAL WILL BE 3% BUT WHAT ABOUT NON RESIDENT BUYERS.

Correct National conveniently fudged the numbers, and the bulk of the media lapped it up without even questioning it.

The impact has already occurred with China's crack down on money leaving the country. This new policy just ensures it doesn't happen again.

Ha ha Hosking has called the foreign buyer ban 'xenophobic bollocks'

The man is angry

I'm sure he does the National party more harm than good, as I know many more moderate Nats / potential swing voters who also can't stand him

And increasingly irrational and irrelevant.

Even though I can't stand the man, some of what he says is correct, Labour has not gone far enough, they should of banned all land not just existing houses, that would of truly upset him, I would have enjoyed that immensely.

To be fair they are only allowing the purchase of land, if non residents build and sell soon after. I accept there could be loopholes with this though.

My anticipation for that blow up wasn't wasted.

I struggle to understand why any kiwi would not want to ban the foreign ownership of existing houses.

Except maybe those who are sitting on a debt fueled portfolio.

I have a number of aquaintances who have investments in Auckland property over and above their own home. A number of these are either putting some of their properties on the market or now talking about putting them on the market.

This is the first time any of them have talked in this way. The change in sentiment is very pronounced and I've been surprised how quickly the mantra of "property always goes up" has dissipated.

Fear appears to be rapidly replacing greed. I believe the Auckland market, in particular, is becoming somewhat fragile. At this point its looking very vunerable to any external shock.

Yes and by historic standards we are overdue for an external shock.

I think you will find that most investors around the country are not worried at all!

Reality is that if they hold numerous properties then their rental income level is fine or the Banks would not have lent to them.

The ones that will have trouble are the ones that have negatively geared Property and need to prop them up big time.

Auckland and Tauranga markets will drop by a bit but then they have done exceptionally well over the past few years so they shouldn’t be too worried.

The opportunities will still be there for the more successful investors!

Sorry, remind me of this. I always forget...

What happens to rental prices when house values drop?

Do they also drop?

End of day its just monthly debt payments. If you can keep making the payments banks probably all good. Refinancing is the speed bump, but only if goal posts move radically.

Real issue is not investors, its speculators. I suggest that to many of the investor crowd on here get over excited about the posts debating speculation, and take them almost personally. It just makes them look like speculators....thou doth protest to much

Hi nymad,

Suggest you enrol for an introductory microeconomics course and learn about the Marshallian Cross.

Then you'd be better skilled to work such things out for yourself.

You should talk to Andrew King, NZ Property Investors Federation executive officer, he seems to think negative gearing is quite common.

"Negative gearing essentially allows rental property owners to deduct a third of their expenses. Without that many rental property owners simply won’t be able to cover the necessary costs"

My feeling is that in Auckland you would be very hard pressed to be covering your costs with rent, if you bought in the last 3 years.

Negative gearing is definitely a thing for this very reason.

Agree. Negatively geared investors are often accidental landlords with only a single investment property. Many are interest only, have no strategy and no real experience. A typical investment: Purchase $550,00 with $475 per week in rent, ~4% gross yield. If the property is 100% mortgaged, it costs $10,600 before tax refunds! Thats at 4.5% interest. If that goes up to 6.5% then the loss is $21,500. This makes it $5000 in a tax refund assuming highest tax bracket and some depreciation or $100 per week. If the interest rate goes up another 1% then that's another $100 per week. Can your average mum and dad investor handle/stomach and extra $200 week ? And add to that no capital gain and other compliance issues....

TM2, you say "I think you will find that most investors around the country are not worried at all!"

Strangely many commentators who have never owned a rental are very worried for investors, how caring of them

Falling house prices are good for income yield. I'm not sure why people have been buying rentals with yields in the 2% region as that seems like a really poor choice (speculation).

If people really want to feel sorry for someone then feel sorry for property speculators.

@ Dictator. Every night I cry myself to sleep over the coming plight of property speculators.

Won't someone think of the property speculators!

Capital losses instead of gains! Low or negative income! Clearly the banks tricked them into an interest only loan and now they have to sell their Audi with broken sensors (costing $3000 to repair) even though they still have 7 years of monthly payments to make.

There are many valuation metrics to use when assessing the purchase price of a residential real estate. The most common is to compare look at comparable recent sales prices of houses in the area to arrive at a valuation for the property being purchased (this is pretty much what valuers do). Other valuation metrics commonly used are purchase price relative to council valuations, purchase price premiums to council valuations relative to other recent transaction price premiums to council valuations in the area. If the purchase price is below comparable recent sales on these valuation metrics then the buyer believes they are getting a bargain. A more complete analysis would include looking at rental yields but very few look at that valuation metric. Another metric that is useful is the house price to income ratio. I was telling a friend about how low rental yields were in Auckland and regardless he chose to buy. He was an owner occupier and believed he was wasting money paying rent for his accommodation, hence his decision to buy. Many property investors believe that prices will continue to grow by extrapolating historical property price growth for the last 50 years. As they haven't seen property prices fall dramatically in NZ, they continue maintain these price expectations about property prices in the future. If future property price expectations were to change then property investor behaviour might also change. Typically in markets, most participants extrapolate recent price action, so if there were a price fall, this might start to impact investor confidence about future price expectations. Those that are negatively geared and those that are highly leveraged might reconsider their property investment in the absence of capital gains. I've heard some stories of property traders in Auckland residential real estate making losses - they purchased a property to renovate, then the current resale price would mean a loss and the rental yield is too low to hold onto the property to rent out to service the debt. A useful guide might be to look at what happened in the US in 2008 - 2010, or Ireland during 2008 - 2010 or Spain during 2009 - 2010 - some will say it is entirely different, however they will fail to learn precious lessons that property prices can fall.

"Typically in markets, most participants extrapolate recent price action, so if there were a price fall, this might start to impact investor confidence about future price expectations. "

I thought a requote here was appropriate.

I dont care about speculators or investors. I care about my children and FHB. If investors dont lose money because they are smart thats great. If speculators lose money because they made a bad investment, I have some empathy.

But my priority are my children. I have my money invested in a business and if this gos tits up, I need the property market to be attainable for an average income. If they earn more then average then life will be easier for them.

I do not understand these so called successful people that get the hump because people are worried about a property bubble which was predominantly created by overseas money. Surely if they average person; that is as many as possible kiwis owning their own home this has to be good for NZ.

Its not gloom that the market could drop, its actually excitement.

How many leaky homes are current rentals? Presumably they will not pass warranty so renters can get their payments back.

In which case the logical landlord reaction would be to terminate the tenancy when the WOF rules make the property unfit for tenancy.

But they are insulated. A mass of soggy insulation, but insulation nevertheless!

Well Labour's next target will be the landbankers to free up empty homes. Once they established how many vacant properties are out there most of which will be in Auckland. I think you'll find that we don't have much of a housing crisis any more.

Far better to free up existing homes rather than needlessly building.

CJ099. And how do you propose the coalition will ‘target land bankers to free up empty houses’? Forced acquisitions, collectivisation of housing perhaps? Public executions of those vile Kulaks?

Overseas observers and investors are already noting the changed attitude to investment in this country. People with Chinese sounding names wanting to buy houses now face intense scrutiny, O’Connor has signalled farmland will be virtually unavailable to overseas buyers and Peters is directing Ardern to put power companies under the blowtorch.

NZ is highly dependent on the fickle whims of offshore investors. People on this leftie site might feel good advocating action against the ‘foreign devils’ but just a hint of the ghost of Hugo Chavez stalking the beehive will be enough to spook investors and do us serious harm. The ex world socialist youth comrade leader should be treading very carefully.

National should never have brought housing into all this in the first place. Fix housing first. Nz in doing no different than any other country. Things will be fine

I’m not sure it’s accurate to call it a ‘leftie’ site, albeit it has a predominantly left leaning group of posters at this point in time and is in danger of becoming an echo chamber.

Fair challenge. But not convinced the distinction you make materially alters the proposition. We posters create the culture of the site.

In fairness, we don't seem to have many truly right-leaning folk in NZ, at least compared to overseas. Voting for National was a vote for increasing socialism via WFF, the Accommodation Supplement, the First Home Buyers grant, subsidies for farming etc. And no one seems to want to go full free-market and personal responbility and forgo the pension in their retirement. Heck, even ACT doesn't want to go free-market in old age, as far as I'm aware.

I actually voted against National (but not for Labour) because they failed to address the underlying causes that resulted in them eventually needing to increase the above redistribution to paper over the gaps...I was less keen on their mix of socialism overall. National was even happy to socialise the cost of transporting fuel in the case of the recent pipeline break.

Let's not deceive ourselves that National is not socialist. Both our major parties sit well to the left of the Democrats.

NZ's a social democracy.

Good reading Rick as always

Agreed NatNil has long moved to the centre My late father voted Muldoon over Bill Rowling in the mid 70s because Nationals Muldoon was keeping the pension at 60 and wasn’t creating a super fund like Labour wanted.

Then lately jK kept Helens WFF intact moving further left to match Labour

Indeed it made Labour’s job difficult providing a point of difference to vote for over NatNil but National arrogantly believed { and nearly got away with } they could gain a 4th term based on doing nothing as usual.

I commend NZ1st for making the right decision come what may It was time for change

Yeah, agree National has moved significantly further left than they used to be, eh. The last few years have seen more than a few lamentations on this over in the comments on NBR.co.nz.

If there hadn't been a housing crisis to differentiate the two parties significantly one wonders how the two major have differentiated themselves significantly. Funding of charter schools and irrigation subsidies vs. health and education?

It's simple middleman, you just tax them it's not that difficult. Lots of countries have tackled this problem you can even tailor it to individual cities. Take a look at Canada: http://vancouver.ca/home-property-development/empty-homes-tax.aspx

They either rent out the empty properties or pay a hefty tax on them to keep them empty.

IMO still a good time to buy that rental.

Some never learn!

Not in Auckland with most of them returning gross yields under 5%. Buy after the slump/collapse/stagnation whichever it turns out to be.

It doesn’t matter what happened years ago . Or listings are here or there . Some sales here , some their, what matters is the trend and listings are trending up and sales down here today . It’s all about that difference. There simply isn’t anywhere enough buyers and even if trademe is at 10000 or 15000 it’s about the 2 numbers widened. That’s why prices are falling. The new government isn’t going to save the day and nor is the RB. There’ll be a lot of people regret not selling now why’ll price are still highesh , in a year they’ll regret that . But remember one very important thing there’s no save ya. And the very very low volume of buyers are here to stay and don’t need the sellers that payed to much, that number is TINNY. Also people on here go on about the word crash. To me a crash is down 20%. You speak to anyone with only 20% deposit in there house and there’s many. They’d say the same. We’re half way there already and some houses are. RE agents are probably treating buyers like gods now because be clear here. RE agents look after themselves. A market going up or down they sell something. Very soon I’m picking RE agents will get lots of work for about a year

Q4Normal with due respect you must refrain from using common sense

Using logic upsets the stomachs of spruikers

Haha yeah it’s a bit unusual like supplying facts. I’ll try and get with the dreamers haha . I can’t believe how I spelled save ya. Looked good to me

Save ya?

Saviour.

Haha.

It actually kind of works.

Friends f mine have a family home for sale in Hamilton.

Originally 410k was accepted in Nov 16 but due to a family issue was withdrawn from market.

Put on again in June 17 at 450k no takers

Dropped to 435k 6 weeks ago no takers.

Now by negotiation.

Two things potential buyers have said are...Don't like shared driveway or cross lease section.

How can you pull out of a contract due to a family issue?

Agree with the cross lease comment.

50% of house owned by 8 family members.1 family member refused to sign for the sale and i wouldn't be surprised if the samething doesn't happen this time round.

just guessing but is the one that wont sign a property bull and wants a higher price ?

Friends f mine have a family home for sale in Hamilton.

Originally 410k was accepted in Nov 16 but due to a family issue was withdrawn from market.

Put on again in June 17 at 450k no takers

Dropped to 435k 6 weeks ago no takers.

Now by negotiation.

Two things potential buyers have said are...Don't like shared driveway or cross lease section.

Gee unsold stock in Auckland a ?

To the spruikers here that means the portfolio isn’t going down !

Keep dreaming

NL why do you always talk about other people's business? Would it not be more beneficial for you to look after your own business?

Its called "freedom of expression"... just the same way you consistently do on this site!!!

The RealEstate.co.nz report is really very good. Here's the link for those of you interested.

http://www.realestate.co.nz/blog/news/property-market-october-property-…

One thing that could be improved IMO is to separate Christchurch from the rest of Canterbury (like Wellington-Wairarapa, Queenstown-Otago) because Chch is quite unique following the EQ rebuild and it clouds whats happening in the rest of the region

Could we have TradeMe figures? Anecdotal or not, I have noticed that more new listings in the area I am interested in are being advertised on TradeMe and not Realestate.co.nz.

Hamilton.

Trade me For Sale / Rent

7/11/16 -- 580 / 557

31/10/17 -- 655 / 445

The for sale high was 660 just last week, the low was 518 in Jan....but note i only randomly check a few times a month.

We are also at the end of semester for students, so rental numbers will mean more in another month.

I agree, potentially less people are looking at realestate.co.nz hence the drop is agents wanting to list properties there? I for one don’t bother and do all of my research on TradeMe.

At the time of writing Auckland TradeMe listings at 10,750. Likely to cross 11,000 by the end of the week? I’m off to an auction tonight and am interested to see what the mood is like

......a song to play at the B&T, Harcourts, LJHooker et al upcoming Christmas functions ... https://www.youtube.com/watch?v=9ePIZugahFc

Have had 7 rentals since 2005/6. Rents have gone up and continue to go up, Prices gone up, debt has stayed the same and low interest rates now. Property cycle is into negative/flat part of cycle. Will rise again in 2020. Whats not to like??

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.