This is a re-post of an article originally published on pundit.co.nz. It is here with permission.

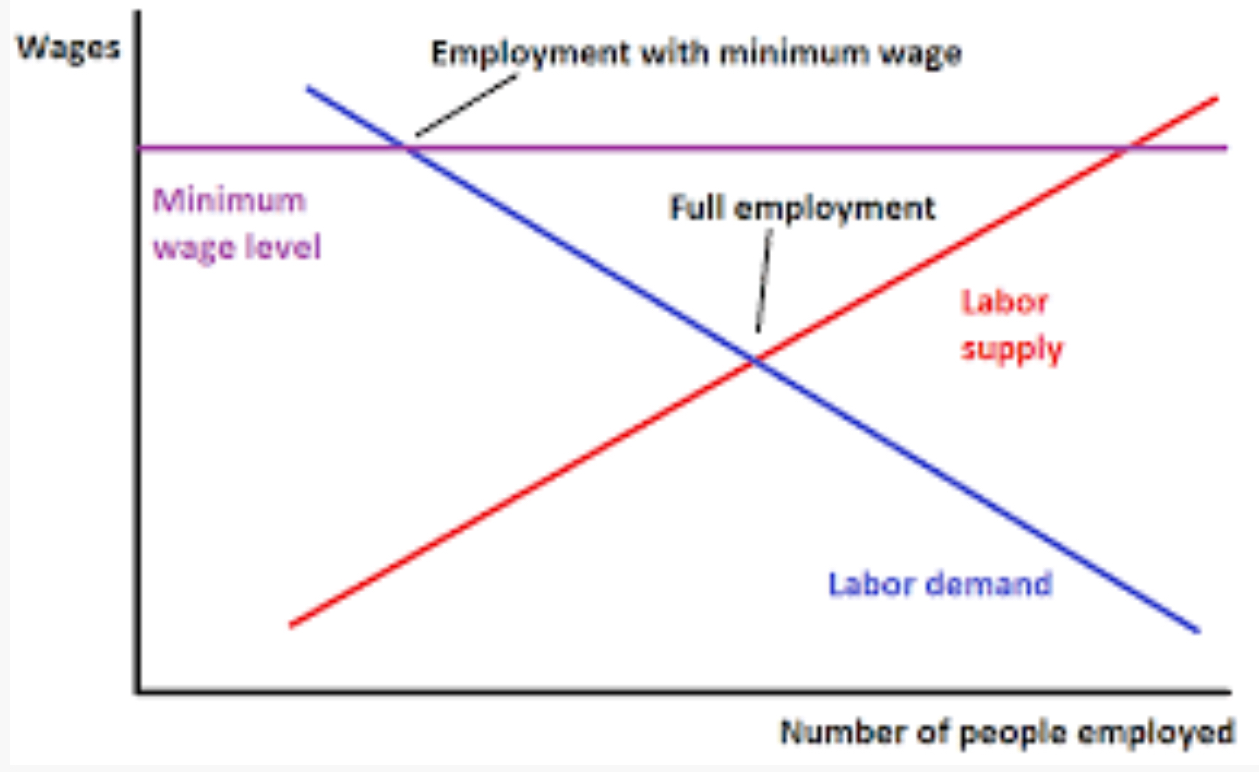

An introductory economics course student is likely to meet the below graph. It shows that if the minimum wage (in purple) is above the point where the labour supply curve (in red) and labour demand curve (in blue) cross there will be less employment. That is what students are taught. But research shows the world does not work that way.

Early in an introductory economics course, a student will meet an example of what happens when there is an intervention in a market. For instance, what will happen if the government introduces a minimum wage and what happens if it is increased? The short answer from the basic model is that there will be unemployment or that unemployment will increase.

A good teacher – many are not, I’m afraid – will warn that there are assumptions on which the model rests, although even he or she will not have time to go through all of them.

Even so, there is a strong lobby for increasing the minimum wage. As a result, economists go about estimating how much additional unemployment an increase will generate. After all, if a 10 percent increase in the minimum wage were to increase unemployment by 100 workers, one might favour a higher wage; on the other hand, if the 10 percent increase doubled unemployment, then one might be reluctant to support an increase.

The size of the estimate is a scientific question, but unlike much of science, economics cannot usually do experiments. The econometrics will be dependent upon those confounded assumptions for which it cannot control.

In 1992, the state of New Jersey increased its minimum wage from $US4.25 to $5.05 per hour, but there was no change in the adjacent state of Pennsylvania. Comparing the two was a ‘natural’ experiment which would enable econometricians to calculate how much extra unemployment was generated by a higher minimum wage.

When David Card and Alan Krueger analysed the data they found that there was ‘no evidence that the rise in New Jersey's minimum wage reduced employment at fast-food restaurants in the state. ... we find that the increase in the minimum wage increased employment’.

They concluded that ‘taken as a whole, these findings are difficult to explain with the standard competitive model’. Bang goes the story in the introductory course.

Yet it continues to be taught, long after the evidence pointed in the opposite way. In that time, Card went on to analyse many more natural and quasi-natural experiments, producing many insights into the economics of immigration, education, job training and inequality. His achievements have been recognised by his sharing the 2021 Nobel Memorial Prize in Economic Sciences ‘for his empirical contributions to labour economics’.

(The other half went to Joshua Angrist and Guido Imbens ‘for their methodological contributions to the analysis of causal relationships’ – best known in the area of the economics of education. Perhaps not incidentally, Angrist’s doctoral supervisor was Card and he supervised Esther Duflo who was a 2019 Nobel Laureate. Krueger was not eligible because he died in 2019.)

Natural and quasi-natural experiments do not often occur, but Card et al. have raised the standard of innovation, sophistication and ingenuity in empirical economics.

Among Card’s other doctoral students was New Zealand economist Dean Hyslop who with his Motu colleague David Maré has just published a paper reviewing what we know about the minimum wage in New Zealand. (Hyslop has also published jointly with Card, including an award-winning paper.) Their findings are considerably more sophisticated than those of introductory economics.

Their main conclusion is that minimum wages over the past two decades have become a de facto teenage wage-setting policy. Some 57 percent of 16-to-17-year-old employees, and 43 percent of 18-to-19-year-old employees are paid at or below the minimum wage. Yes, there are minimum wage earners among older adults but they make up only a small proportion of them – 5 percent of 25-to-64-year-olds. (This suggests that while most of the young start off on, or near, a minimum wage their relative pay rates go up as they get older.)

In the last 20 years, the adult minimum wage has increased 75% in CPI-adjusted real terms and, following the abolition of the youth minimum wage, the real minimum wage for 16 to 19-year-old workers has increased 125%. (Median wages increased 35 percent in the period.) Yet the researchers found ‘no clear evidence that increases in the minimum wage have led to adverse employment effects’, although they wonder whether there have been ‘downside risks for youth and low skilled workers’ employment’.

Where do we go from here? The paper opens with a dedication to Jas McKenzie, who was one of the researchers’ mentors. It goes on, ‘the last time we saw Jas, he expressed the view minimum wages have become New Zealand’s de facto wages policy’. Unfortunately Jas died last year so we will have to work out the implications without his help.

A couple of things struck me about Maré and Hyslop’s findings. While the higher minimum wage pushed up the wages immediately above it, it did not push up the whole wage structure. This is evident from the median wage not rising as fast as the minimum wage. The implicit assumption in the first-year-course illustration is that a rise in the minimum wage is passed on throughout the wage structure. It isn’t.

A second finding was that minimum wage workers are broadly spread across the entire household income distribution which suggests that rises in minimum wages will not be very effective as a redistributive income support policy. That is consistent with my findings when I was exploring these issues many decades ago, although there were some important differences in the labour force. (Mothers were then just sneaking into the paid workforce.)

The second finding will not stop many advocating higher minimum wages because they think it will reduce inequality. Scattered throughout the political spectrum, there are the ideologues impervious to research findings. Some will seize those Card (and Krueger) findings which suit them and ignore others which do not. Drunks use lampposts in a similar manner – to provide support rather than shed light.

To do so, is to lose the richness and nuances in economics that are evolving from new data bases and the technical innovations like those Card have developed. It is to treat a first-year course in economics in a way one would never do if the first-year course was in science, say. It is the beginning of the journey, not the end.

Brian Easton, an independent scholar, is an economist, social statistician, public policy analyst and historian. He was the Listener economic columnist from 1978 to 2014. This is a re-post of an article originally published on pundit.co.nz. It is here with permission.

15 Comments

A good read. Everything is obvious to a Form 1 Economics class, until something is taught to it to distort that obviousness!

Scattered throughout the political spectrum, (NB: And I'll include Central Banking 'professionals') there are the ideologues ...(who will) seize upon findings which suit them and ignore others which do not. Drunks use lampposts in a similar manner

Interesting. I'd like to read a longer version.

Perhaps it'll work if the whole country is a fast food restaurant.

but unlike much of science, economics cannot usually do experiments

To me this is the main reason I don't believe economists. Ever since I did first year economics, it seemed that they made up a theory, made some formula for some calculations to give it air of science, but never proved that those theories are correct. I understand that it is harder to use experiments prove economic theories than say physics, but without that experimental rigor you are not a science.

This is basically why the latest Nobel prize winners won; they figured out novel ways of doing natural experiments to be able to test things like the minimum wage = fewer jobs hypothesis.

Good piece Brian - thank you. I too greatly enjoyed the idealogues paragraph.

Have you read the Rudd take down of inflation expectations paper? It's a peach. https://www.federalreserve.gov/econres/feds/why-do-we-think-that-inflat…

That was good read - but he has no effing idea either, just like all economists.

Whereas I can point to graphs which correlate to 97% or better, over decades.

Liked the quotes - pity they didn't include ones from Albert Bartlett, or Kenneth Boulding.....

We hear from employers about a labour shortage. There is no labour problem, it's a low wage problem.

Counterpoint: remove any form of social welfare or you don’t eat. I guarantee unemployment would fall.

And crime would increase.

A colleague mentioned to me that in the sixties, can't be sure of the decade, there was minimal or very low unemployment because there was essentially no welfare support. I wasn't in NZ at the time so don't have a time scale on when welfare became lets say an optional life style vs being employed at a low wage. There must be some relationship between a minimum wage, unemployment benefits, labour demand and supply and overall unemployment. BE's first conventional economics graph showing minimum wage, labour demand and supply and unemployment is too simplistic.

If there were higher wages across the board, where would the extra staff come from?

From the useless businesses who can't survive without paying low.

I've often thought that to really understand economics you need to understand psychological behavior.

Standard economic models assume rational participants. Many decisions are made by emotion, then justified by selective reasoning, especially in the context of employment.

It would be good to see some humility from economists. Some indication that they finally understand that theirs is not science, but what is termed a social science. You know, the type of subject that would fit neatly in a Humanities degree. Social, but without any actual science.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.