Housing Minister Megan Woods recently made a surprise announcement that blocks of at least 20 new and existing build to rent flats will be exempt from the interest deductibility limitation rules in perpetuity if they offer 10-year tenancies. Currently, build to rent flats would only qualify for the exemption from interest deductibility rules if they are new builds and then only for 20 years.

This is quite a significant change clearly aimed at the developing build to rent market, which after the announcement of interest deductibility limitation was made last year was quite concerned that the sector would be very hard hit by the proposals. During the group discussions and consultation that went on with Inland Revenue in the run up to the release of the relevant legislation, these concerns came across very strongly from the build to rent sector.

Obviously, they've continued lobbying in the background and have won this concession. This is a big win for the sector as it will probably greatly shake up the rental market over the long term. It gives it security of supply and therefore for financing. But it’s also a win for tenancy advocates who have been pushing there should be longer tenancies available to renters similar to what we see in continental Europe.

It's also worth noting that this new exemption will apply to existing properties. Therefore, if you take an existing property and convert them into 20 apartments or flats, then you qualify for this permanent exemption. Again, last year there was quite a bit of discussion over what constituted a “new build” and conversions were high in the list of matters under consideration.

On the other hand, the move does further sideline the mum and dad type investors who are currently a large part of the rental market. And at the moment they will definitely be left hoping for a change of government next year. Overall, this change seems a smart policy to boost the growing rent to build sector, but also give greater protection to tenants.

The reasons for very high house price inflation

Moving on, exactly why house price inflation in New Zealand has been so high has long been a matter of debate. The Multi-Agency Housing Technical Working Group, which consists of members from the Ministry of Housing and Urban Development, the Reserve Bank of New Zealand and the Treasury has been studying this issue in some detail.

And on Thursday the Housing Technical Working Group released a report on the housing system based on a close look at the housing development system in Hamilton, Waikato area.

Now the group's key conclusion was:

“…a combination of a global decline in interest rates, the tax system, and restrictions on the supply of land for urban use have led to a large change in the ratio of prices to rents and are the main cause of higher house prices in Hamilton-Waikato, as well as other parts of Aotearoa New Zealand, over the past 20 years."

The report has some interesting insights on the road tax matter. The report starts from the pretty standard theory that a neutral tax system is one that treats different economic activities equally. However, the report notes that “New Zealand's tax system is not neutral” and there are a range of tax distortions that affect house prices, land prices, rents and construction costs.

According to the report, the most important distortions in the tax system are firstly imputed rent, that is the rent owner occupiers effectively pay themselves is not taxed, whereas other forms of income from investments are taxed. This is a very controversial point and conceptually counter-intuitive for owner-occupiers. But it is an approach that the Netherlands has adopted to tax housing on an imputed rental basis.

Secondly, capital gains are often not taxed, whereas other forms of income are. Well, this podcast is a broken record about the distortions the lack of a comprehensive capital gains tax produces.

Then thirdly, the GST is charged as a lump sum when a house is built and is charged on maintenance costs and rates but is not charged on rents. This is a very interesting point and not one that I'd actually considered in much depth.

The consequences of these distortions is the first increases the incentive for people to live in bigger or better houses than otherwise. We see that in New Zealand, new builds are the second or third highest in the world in terms of area.

The report expands on the matter of the first and second distortions, that the lack of capital gains and imputed rent also increases the investment value of housing relative to other investments. This is a well understood point which means those resources devoted to owner occupied housing “yield untaxed shelter in perpetuity as well as untaxed capital gain”. If on the other hand, you put money in the bank or in shares you will be taxed on the income. Finally, as is well known and is one of the reasons for the interest deductibility limitation rules, investing in rental housing yields tax free capital gains for those who hold property long enough.

The report concludes these tax distortions have caused a higher price to rent ratio in New Zealand than under a more neutral tax system. The group also reaches the interesting conclusion that New Zealand is “closer to restricted land supply than abundant and therefore we conclude that these income tax distortions are likely to have driven house prices higher rather than increasing supply and reducing rents.”

The commentary on the impact of GST is interesting because as I said, not many of us have actually thought about that and how it might play out. What it says is that the overall role of GST extends well beyond the “…direct impact on construction costs and includes a complex array of interactions stemming from the fact that GST is not charged on rents but is charged in other goods and that GST is charged only on some land transactions. The report notes “Assessing the overall impact of New Zealand's GST on house prices is a possible area for future research.”

The report includes an interesting table estimating the impacts of tax distortions on house values for each type of buyer. The report notes the tax distortions were relatively small in 2002 when interest rates were much higher but by 2021, the impact of these tax distortions “had grown significantly”. The report further noted that in a low interest rate environment, the tax distortions were significantly amplified.

Table 2 Impacts of tax distortions on house values for each buyer type

|

Estimates with current tax settings |

||||

|

Date Inflation rate Interest rate* |

Q2 2002 π = 1.8% i= 5.6% |

Q2 2011 π = 2.5% i= 5.4% |

Q2 2016 π = 2.1% i= 4.1% |

Q2 2021 π = 2.0% i= 3.5% |

|

Landlord Equity financed |

$169,031 ($114,495) |

$289,709 ($185,365) |

$438,582 ($261,808) |

$680,901 ($379,377) |

|

Landlord 60% debt** |

$164,869 ($112,175) |

$276,188 ($179,021) |

$435,601 ($261,950) |

$431,979 ($400,966) |

|

Owner-occupier Equity financed |

$189,161 ($89,753) |

$278,309 ($141,369) |

$367,980 ($185,213) |

$516,949 ($255,797) |

This is a very interesting report which feeds into the ongoing debate about housing. I think it underlines a constant theme of this podcast that we need to change our tax settings, settings around the taxation of capital and in particular, housing. Of course, Professor Susan St John and I would be pointing to the fair economic return methodology as one option for starting to take some of these tax distortions out of the market.

GST and private schools

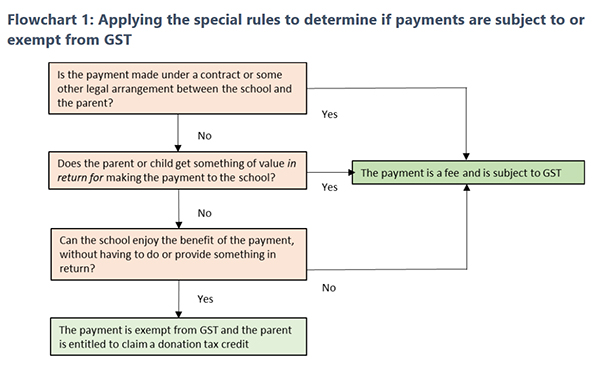

And finally, private schools have been in the news recently, largely because of the revelations about the behaviour of the newly elected MP for Tauranga. Quite by coincidence, this week Inland Revenue has released a draft Question we've been asked on the GST and income tax treatment of payments made by parents to private schools. This also comes with a handy flow fact sheet as well which has a useful flowchart which explains how the rules apply.

Something else to keep in mind are the special rules for calculating GST on school boarding fees. Where students have arranged to board at the school for more than four weeks, the school charges GST at a lower rate (9% or 60% of the standard rate) to the extent the boarding fee is for the supply of domestic goods and services.

Well, that's all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

*Terry Baucher is an Auckland-based tax specialist with 25 years experience. He works with individuals and entities who have complex tax issues. Prior to starting his own business, he spent six years with one of the "Big Four' accountancy firms including a period advising Australian businesses how to do business in New Zealand. You can contact him here.

73 Comments

I have the impression that this working group went into this with some firmly imprinted paradigms they are not prepared to let go. No mention is made of the impact and influence of foreign investors buying residential properties in NZ. This statement is scary; "the most important distortions in the tax system are firstly imputed rent, that is the rent owner occupiers effectively pay themselves is not taxed, whereas other forms of income from investments are taxed" No understanding expressed that owner occupiers are taxed on their properties. That tax is called rates and is levied by the local bodies. Nor do they express an understanding that there are other costs involved in owning properties. And not one mention of the banks pumping the property market at all!?

When I had rental properties over twenty years ago, it was explained to me that capital gains on a property's value was a taxable income if the property was sold. What I learnt, was that IRD did not pursue the tax. This report reads to me more like Government propaganda than a well balanced and thought out report.

I think you are conflating issues here Murray. The ownership is irrelevant, the tax implications are the same. And rates are not an income tax - rates are levied on all properties regardless of ownership. And banks are only responding to market demand - demand which is created by tax benefits.

Creating a level playing field with other investments is the goal. For example, if you were to start a new job you would be taxed through PAYE. This is completely expected by all involved. But the same is not true for housing - why not?

Imputed rent is basically an excise with literally no social harm to justify it. People owning and living in a single house (and bearing all risk for debt used to buy it) are in no way comparable to renters, who can simply end a tenancy and go somewhere else, but home owners should be taxed for... not renting?

There is no justification or perverse outcome from owning and living in a single house that would warrant a ticket-clipping tax, and the amount of deductions you would need to open up to regular home owners to make this a coherent policy would stupidly complicate our tax system.

I doubt imputed rents will ever happen. But if they did then why wouldn’t you do the same for all other items.

A car for example. If you own a car you are getting a tax advantage compared to someone who leases one. Imputed taxes should apply to car ownership.

If it was possible to rent toothbrushes, then the same should apply for tooth brush ownership.

Houses are just another consumer product. The only difference is the price of hiring or renting them.

I can see the pure mathematical idea behind imputed rents. But what government would ever do this? Madness!

Of course rates are tax. Who would ever say otherwise? CGT is not income tax. GST is not income tax. Fuel levies are not income tax. They are all taxes to fund government spending. Local, regional, and national. Nothing more or less. The question is; how much tax does our government need to run itself? Roger and Dave said that GST would see income tax lowered by the same amount to keep total taxes collected the same as before GST was introduced. So government tax income would stay the same, pre and post GST introduction. What a lie that was.

Creating a level playing field with other investments is the goal. For example, if you were to start a new job you would be taxed through PAYE. This is completely expected by all involved. But the same is not true for housing - why not?

First income from work is not an investment so and PAYE is not charged on an investment. So lets compare investments if you buy shares and they go up and you are not considered a trader, you do not have to pay tax on that gain. If you buy a classic car or a painting and you are not considered a trader then you are not taxed on that either. The problem is too many people took advantage saying they where not a trader of houses (i.e. in it for mainly capital gain) when they actually where. If house prices where not ridiculous this would not be a problem. I have a concern with capital tax since once the government starts making income from it they will be discouraged from letting house prices fall. https://edition.cnn.com/2022/08/18/asia/japan-tax-alcohol-competition-i…

From my own experience, gains in value in property or shares do not attract tax. Realising those gains has attracted much tax from myself to the government. Beause the government is tougher than me, I am forced to pay this tax. End of story. To repeat Ad Nauseam, we don't pay tax because it is fair or equitable, we pay it to fund government spending. The only reason governments tinker with these things is to see if they can extract more tax than they already do. It is most certainly not in any way an attempt to be either fair or equitable.

I don't understand the concept of Imputed Rent, where is the tax leakage here?

Also, what is the relevance of larger dwelling sizes? These will come down in the long-run as zoning law changes will deliver more medium density dwellings. In the meantime, we are a country the size of the UK with <10% of the population. Bigger houses mean's more GST, more work for trades people.

My understanding of imputed rent is as follows: if you were a renter, you would earn money from a job, pay income tax and then use your post-tax (i.e. net) earnings to pay your rent. For this payment you get the benefit of shelter.

As an owner-occupier you receive the benefit of shelter however most of this benefit is not taxed. The only portion that is taxed is the interest component of the mortgage repayments (the principal payment being a transfer of value between you and the bank i.e. you give the bank money and in return get to own more of your home).

So once again, there is a distortion between the tax treatment of a renter and an owner-occupier.

And re the larger dwelling sizes/GST, the tax incentive creates a distortion to build bigger houses. This means there is less housing stock available for FHB/smaller families/single people, and ensures the value of the 3BR/2BA remains high as this is where the demand as. I would also say that current council/zoning/lending rules contribute to this.

So once again, there is a distortion between the tax treatment of a renter and an owner-occupier.

...except there isn't, really, is there? The renter benefits from the landlord being able to access deductions for their expenses in maintaining the home and therefore pays lower rent, while the home owner bears 100% of the maintenance, insurance and financing costs, as well as liability for the debt used to pay for the underlying home.

The tax advantage only exists if you deliberately measure things in a way that suggests it might exist, but the reality is that it probably doesn't if you were approaching it with all of the considerations you'd have to take into account when designing such a tax.

The UK used to have this system called schedule A and imputed rent had expenses deductible (just like Landlords) it collected little tax and was abolished, but Terry and other clowns think its different in NZ - well its isn't. Instead of constantly trying to manufacture new taxes try looking at wasteful Govt expenditure of which there are Oceans of and then try providing incentives for citizens to achieve and watch the economy grow. An old tax saying - load the Donkey (Taxpayer) with just enough baggage and he walks, too much and he sits down which is what is already happening in NZ and Globally - open your eyes.

Laffer Curve

Te Kooti,

The laffer Curve is utter nonsense based on no empirical evidence whatsoever and apparently 'discovered' over dinner and drawn on a table napkin. That's where it should have stayed.

Say I have a million dollars to invest.

I could buy shares, and the company I buy into will be paying 28% tax on any profits. If they pay dividends to me I'll top that up to, say, 33%.

If I put my money into term deposits I pay 33% on the income.

If I buy a rental property, I pay 33% on any profits.

If I buy a house to live in, I pay no tax (rates is mentioned above, I'd see that more as paying for the services associated with the property rather than general taxation).

One of these is not like the others, meaning there is a clear incentive to invest more money in my own house rather than other investments. This probably helps to drive up house prices.

I'm pretty ambivalent about this argument personally, and I know it upsets a lot of people who don't want to sign up to ongoing taxation just to live in their home.

In which case it is an academic/theoretical construct that has no place in a functioning society. We have cities and neighbourhoods because we have encouraged families to buy homes and settle down. Rent is paid out of net income no different to a mortgage.

Yeah, I can see how it would be a tool to bring down house prices but I'm not sure I like the logic. Should I be paying imputed groceries tax on the veggies I grow in the garden? If I have solar panels should I be paying tax on the power bills I am avoiding?

Not to mention my daily run - should be taxed as it is likely to save considerable medical expenses over my lifetime.

According to Terry yes and as a principle it applies to many more items until eventually you pay tax on everything you do that could have been done by someone else on which tax would be paid so you end up effectively being allowed pocket money and become a slave - tax slave - slaves revolt eventually!

So because prostitution is legal in NZ, then when my wife and I...

...

...um...

GC, that is one of the better comments since I've been coming here.... I would say top 5.

We need the old comment of the day back.

Dead right and in addition capital is repaid out of net income, rent is effectively only the interest portion so the renter has more disposable income to spend and pay more taxes - Fuel/Goods/services on which there is Gst - perhaps Terry is a IRD mole propagandist.

MFD what is the cost of ownership in shares? $0. If I own a house to live in I have multiple costs associated with that ownership. Rates is just the beginning. There is also insurance and maintenance, all of which are tax deductible for the landlord but not for the owner occupier.

I would go so far as to say the whole principle is flawed. This response is the result of the Government failing to properly regulate the market and those who influenced and manipulated it. Further this principle could be applied to any asset. Take for example a motor vehicle. Should people who don't own their own vehicle be considered disadvantaged because they have to pay for taxis or public transport, and therefore vehicle owners have to pay an additional tax to compensate for this? But this is worse, the cost of ownership is such that should such a tax be imposed there would be some home owners who would literally be forced to sell because they could not afford the tax. Such a tax is what I would suggest is draconian and anti-democratic.

Murray - and the best way to remove the anti democratics is by the ballots box (you know who they are) the alternative as history shows is violent and more effective due to the fear effect. Check out 1795, Marie Antoinette - let them eat cake - fame!

Well, I could say when I buy shares in a company I am buying a small part of the company so the cost of ownership is my share of the company's expenses. This is paid from the company's income and if I'm lucky there's some excess which will be taxed then perhaps passed on to me. I'm just outsourcing a lot of those considerations.

I do also claim my Sharesight subscription against my dividend income, and I am sure others claim accountant fees, other subscriptions and perhaps loan interest against their share income.

You're stretching now and it is just rubbish. Plenty of the other commenters in this stream apply a lot of examples why it is wrong.

If you look closely, I haven't argued for it, just explained the logic behind it.

However, I don't think what I've said above is crazy. A shareholder is a part owner of the business. You could just as well put a bunch of your rental companies into a company and claim they have zero costs associated with them, because the company pays for it out of rental income.

Mfd, if my shares go up in value, I pay no tax on that gain, only on any divvie provided to me. If my renter goes up in value, I pay no tax on that gain, only on the rent minus expenses. If my own home goes up in value, I pay no tax on that gain, just like the previous two.. But we all knew that anyway, didn't we? So why all the rubbish being talked about imputed value, blah, blah, blah? Can anyone here please explain why our government actually needs, not wants, the extra tax money?

They can't make money off a Brightline or CGT in a falling market. Imputed rents mean they can have their cake (economic mismanagement) and eat it too. And even better, there's still no obligation to actually give those houses access to the services that the whole exercise of government supposedly exists to serve anyway; like a functional education, health, transport or other such trifling matters.

You just get the money either way. Hence the pivot to this kind of taxation, removed from a market that the government now realises it can't influence or control for its own benefit.

Except I think high rates of home ownership are beneficial to society and should be encouraged. It's the accumulators that need to be discouraged with tax policy, and what's been put in place should do a good job of that going forward. The other significant factor is not letting more people into the country than we can provide with housing.

Yes, I largely agree. I think I would prefer to see a land tax, or a deemed return tax on any house that isn't your primary resident. Could be similar to the FiF scheme on foreign shares where you pay tax as if you have made a 5% income from the value of your second home and any rental properties. A ~2% holding cost on holiday homes or second homes seems an appropriate way to discourage excessive use of a scarce resource.

Perhaps this deemed rate of return could be reverse applied to windfall profits, say petroleum co profits should have a fair rate of return of 10%, more risk higher fair rate and anything over that is progressively subject to a windfall tax starting at and additional 10% and increasing by a further 10% for each extra 1% profit above fair rate with a cap of 100% of course and perhaps a similar scheme on bonus payments?

mfd, when you invest in shares, term deposits or a rental property, you will only pay tax on the INCOME you receive. If you spend the same money to own a house, you get NO income, hence no tax. Looks the same to me.

I guess the argument is similar to that use to justify the FiF tax regime. If I spend 100k on US shares which produce no income, I still have to pay tax on them as if I had earned a 5% income from them.

The idea (which as I said, I don't feel strongly about either way) is that this is trying to address the imbalance which means money is put into assets that don't produce income in order to avoid tax. Buy a $2 million house to live in rather than a $1 million house and $1 million invested into income producing assets.

Personally, I would rather make money and give part of it to the government...

Capital gain does not make money. Only realising capital gain makes money. Regardless of the investment.

Wrong - interest and dividends taxed at source.

#1. In jurisdictions with better land use policies, the rate of house price increases is generally in line with inflation, so there is no, if any, capital gain to tax. Thus there is no non-value-added increase just by 'sitting' and speculating on a property. Rental return is based mainly on yield. The house prices to income are a lot lower than in NZ. As a relative %, the rents are higher, but in absolute terms, the rent is lower than in NZ. The net result is low capital growth, lower house prices, lower rents, and higher yields.

Value is added by taxable entities by improving the amenity value, ie land is developed plus a house is built = a habitable dwelling, which should give a profit that is taxable.

#2. House size is a red herring. NZ has more freestanding houses in which the attached garage is included in the m2 size. Other countries have more housing without garaging or without attached garaging, ie basement garaging in apartments which are not included in the house m2 size. Further, neither is the off-site storage facilities many townhouse/apartment owners have to store their excess. The growth of such facilities parallels the increase in apartment living.

I don't buy this Dale. In the countries you refer to the dwelling are high density - like apartments. Apartments underperfrom houses because there is nothing scarce about an apartment. You can buy an apartment in downtown Auckland or Gold Coast for a fraction of a house.

Show me an 800 sq/m section in Amsterdam price inflation vs cpi inflation.

I'm not sure what point you don't buy.

On a like-for-like basis, anywhere in the world, apts. are generally cheaper than houses because they are smaller, but apt. are dearer on a per $m2 basis. That's just maths.

And density and apartments have never been a proxy for true affordability anywhere in the world. If it was Hong Kong would have the world's cheapest housing relative to income, not the dearest.

Not sure what your Amsterdam interest is as that is not an example of what I was talking about as it is more akin to Auckland, but still it is cheaper on a median income multiple than Auckland

Yield and capital growth are almost always an inverse of each other. And the most stable housing markets have low capital growth and high yield, and the most unstable have high capital growth and low yield.

Your point that dwelling prices in some markets abroad closer track CPI. Those markets are generally comprised of high density where the marginal cost to build is highly correlated to CPI. CBD land has never really been correlated to CPI.

Nope, 100% incorrect. Texas is an example, or say Houston, and it operates from the fringe to the heart of the CBD. Some parts of Houston are very high density, far more than Auckland CBD, but in general medium to low density.

And you have misunderstood the CPI reference. When land use policies are less restrictive, then land prices are more closely aligned to CPI, as is income increases, so the median house price to income median multiple does not change.

These less land restrictive policy jurisdictions all have median income multiples around 3 to 4.5x.

#2 I'm currently in Oz/GC for a few weeks visiting family. Looked at a new 4brm 2 bathroom 2 living room 200+ m2 house & double garage yesterday in a new subdivision in a good handy location. $675k house + land package. House was approx $300k for the luxury option package. So, $1500/m2 building cost including driveway etc.

I built a new house in Wgtn in 2019 which cost more than double that /m2. Probably 3x today.

Section prices in ChCh average $500k - why - council land policies/council fees/ Duopoly in materials/obstructionist bureacrats/to much spent on nice to have rather than must have to live. Spot the common factors?

“New Zealand's tax system is not neutral”

I wonder which tax regimes are rated "neutral". The Dutch pay high rents, no?

The way Terry holds up Netherlands as an example of taxing imputed rents is highly misleading.

Dutch system is pretty complex , interacts with mortgage interest deductions that still exist and has a number of other wrinkles.

The net result of all of it is that few Dutch people pay tax on their first home , by design more or less .

The Netherlands is considered the most unequal developed economy in the world. So it’s maybe not one to inspire to be like.

People have gone all in with housing market and now realise the game is fixed, price’s will continue to fall and big losses are coming, banks will be fine as they have your 20% deposit and won’t worry when you go into negative equity.

The bank doesn't have the deposit, the seller does.

Actually I think the Real Estate agent does, but in the end when it all crashes the bank will have the property. It is all fixed.

Check out negative equity affair in the UK 1990 - Banks with unsaleable property paying rates/security/insurance etc is not a happy place.

Are you saying you don't understand the point DTHR is making about the banks' exposure being in part, or in full, covered by the amount of deposit the owner has put down?

He said the bank has the deposit, they don't - the seller of the house has it. The bank have lent at an LVR which is totally unrelated to the deposit unless the transaction happened recently. Someone who bought a house 10 years ago at 80% LVR is probably now 33% LVR (or whatever).

You're being pedantic. Everyone else reading that comment knew what was meant by it, And since banks lend you the money at the time of settlement then the deposit you put down is directly related to the 'transaction that happened recently,' ie contemporaneously with the settlement.

And your LVR is based on present value, and conditions, ie not based on what you borrowed 10 years ago in the example you give, so the 33% you quote is irrelevant.

How far do you think the medium price across the country will fall peak to trough during this cycle.

my pick is 14% as I don’t see the financial strain eventuating the way others are picking.

anyone else care to make a prediction?

DTRH thinks house prices in NZ will fall 7542%...

Just fact’s Yvil, price’s are falling just like them tree’s you cut down. Why can’t you understand that housing price’s are way to high compared to average income, and the majority of people would like price’s to drop, this is now happening and the correction could be far bigger than you think. You really need to stop throwing tantrums and embrace to crash.

We're already down 12% (REINZ median price nationwide) with no sign of bottoming so your estimate looks pretty optimistic to my eyes.

Honestly I have no idea, but I think it's quite likely to be more than 20% and could quite conceivably grind down to 30-40% over a year or two if conditions didn't improve. Lets pick a number out the air and say 25% peak-trough.

To disclose my position, I own my home with plenty of equity and am not particularly looking to buy more. My equity is worth quite a bit more than my share portfolio so I think I'm overweight property already.

https://www.interest.co.nz/charts/real-estate/median-price-reinz

Jamin - try 40% - NZ 2nd highest property to income cost globally - but of course its different in NZ until it isnt, Japan commercial property fell 60% 30 years ago, still not recovered - so keep believing this time its different until you find it isn't or like China with Tanks outside Banks in Henan province and rapidly spreading as depositer's fear their money is not safe.

At least they are beginning to catch on. The fundamental distortion they omit is the current account balance. We import more than we export. The shortfall is met by capital flowing in. As a nation we are running down our savings. The capital flows in via the banks extending more and more and more loans for housing, and the rest goes into hoovering up our listed and private businesses and government overspending debt. This flows from a conscious decision to favour consumers over producers.

The consequence is you will be renting from an overseas corporation, probably American. Keep dumping more regulation on producers and you get poorer. This change in regulation appear sensible, but they are merely Useful Idiots serving our colonial masters.

Exactly. Klaus Schwab is trying to set up his World Government which will be Crony Capitalism at it's finest.

Imputed rent. So if I own a car, I should pay imputed hire fees? In my profession, I buy equipment and software, which I could pay a subscription, or rent, for. Should I pay imputed hire fees on these? Good luck to any government which tries to tax home owners on this basis. Some might dispute my analogy, but the imputed rent would be imposed whether or not the house was producing capital gain. Mr Orr and Mr Robertson might as well say ‘let them eat cake’.

And the most valid point is this: the unfortunate souls in emergency accommodation would be unable to afford housing at any price that reflected cost. It isn’t the housing model that’s broken, nor the tax system. It’s a deeper societal Ill which cannot be fixed with money.

My final point regards Mr Baucher’s statement that the ‘distortion’ has lessened as interest rates have risen. But interest rates were not cut to benefit home owners, but to protect businesses and jobs. Unintended consequences…

I agree. Imputed rents will never happen.

just try and imagine a minister of finance going on tv and explaining to the public their long winded mathematical explanation as why the government is now taxing them for the rent they are not paying by owning their homes.

They would first have to confiscate every pitch fork in country.

Well, its not as if you would be able to protest about it. We've all seen what the Govt/media/big tech does to people who protest Govt policy.

We are all the same "tax them, not me".

Single house owners and renters love landlords to be more taxed.

But when a tax is proposed on the single house, the single house owners find a million reasons why it's a bad idea.

Renters on the other hand cheer on for a rent freeze, one that could go down but never up...

Yes, correct.

But taxes are not just a way for the govt to take money, they are also a very efficient lever to encourage/discourage behaviours.

So I think the current tax system (almost everywhere) is discouraging production, work and research... while encouraging accumulation and speculation.

That doesn't sound smart to me.

If NZ taxes people the same as other countries, what is the incentive to continue living here? We put up with an inferior lifestyle in return for favourable tax treatment on housing and investments, otherwise we might as well all be living in Australia and paying stamp duty and CGT but having a far higher quality of life in return. NZ might find that slapping everyone with more taxes simply results in less of a taxpayer base to squeeze.

You haven't lived abroad have you?

He's right, the level to which the middle (formerly comfortable) can now live without someone being on an executive $200K+ salary in the household is now rapidly declining, our parks and beaches are over-subscribed, our food and rents are through the roof and we have more and more congestion from adding more people than we are capable of building things like transport to support.

The debasement of the middle in NZ in my short life (basically split into those who bought property and played the stupid game and those who did not) is one of the most incredible things I have ever seen or come to understand. We used to be a sleepy backwater, but when you compare what we have normalised now (mega commutes, low wages, high migration, zero infrastructure building), we are heading downhill fast.

We won't be like everywhere else soon. We'll be worse. A little Los Angeles on the other side of the world.

Here in Spain, non-residents are taxed on their holiday homes for imputed foregone rental. It is not that unusual a concept even in NZ; you may remember intra-familial loans being made interest free, repayable on demand? The reason the loans were repayable on demand was so the revenue had no fixed term over which to assess income foregone and therefore taxable. This also why a properly run family trust will charge something close to a market rental for the right to live in the trust property. The principle can easily be extended to all residential property, and if in addition capital gains taxes were to be imposed on all assets without the exception of the family home, the housing market would level out. Additionally in Spain there is a 10% sales tax on the purchase price of any home and capital gains on the sale are taxed at around 20%. Result? Plenty of cheap property, very little speculation, and hardly any market for doing up and flicking on.

Remind me again, what is the unemployment rate in Spain? It is a basket case country, reliant on the kindness of strangers.

Unemployment rate in Spain 2020 15.5 some areas much higher - 22.36% doubt current rate is lower. But in NZ 90,000 unemployed + 3.2% but 180,000 on jobseeker allowance aren't unemployed so if they are not unemployed what are they - Scotch Mist - I think they are unemployed so the real figure is 9%+. please prove me wrong?

Haha love it, Terry’s articles hardly attract any comments, but when it’s about housing….BOOM!!!!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.