The NZ Super Fund is signalling that the days of "extraordinarily high returns" may be over.

Turbulent global financial markets saw the NZ Super Fund take a $3.3 billion hit to its value in the financial year to June 30, 2022.

The fund, set up to help out with the country's future pension requirements, stood at $55.7 billion, down from approximately $59 billion at the end of the previous financial year.

The performance in the latest financial year contrasts hugely, with the bumper 30% rise in value the fund enjoyed in that previous financial year as it rode then super-buoyant global markets.

Fund chief executive Matt Whineray said that despite the tough global conditions in the latest financial yer, the fund's active investment strategies cushioned the overall impact - delivering record value-added returns.

"It might sound counter-intuitive to say we had a strong year with the drop in value of the fund," Whineray said.

"However, our active investment strategies have performed extremely well and are a reflection of the excellent work and skill of the team over many years."

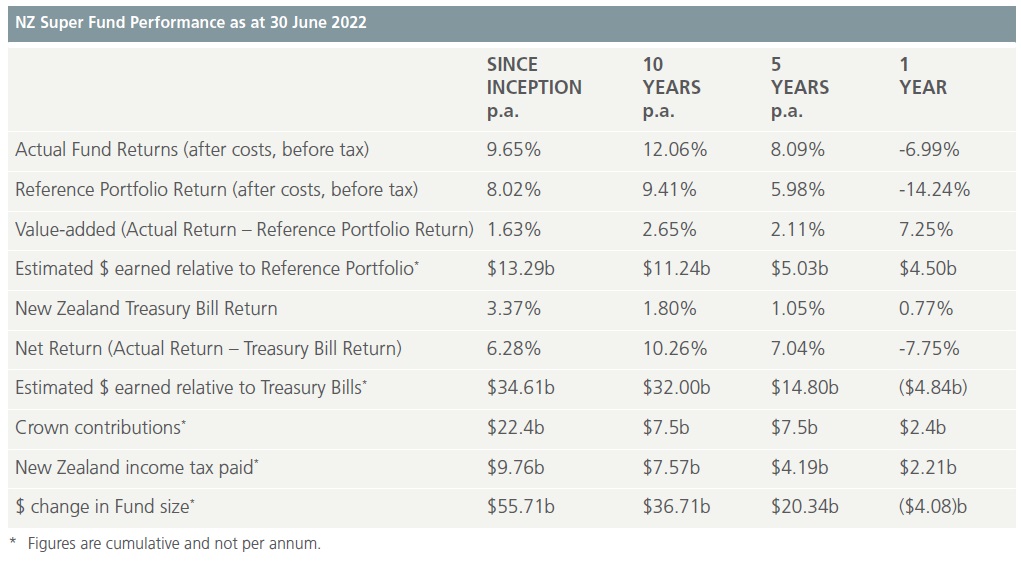

Whineray said the passively-invested Reference Portfolio, which sets the overall portfolio risk target and makes up approximately 60% of the fund, returned -14.24% in the 2021/22 financial year. This is an index made up of 80% equities and 20% fixed income.

The 'active management' saw the fund significantly out-perform this passive Reference Portfolio benchmark by 7.25%, earning a record $4.5 billion in value add, which Whineray said represented "significant real value to New Zealand".

NZ Super said all figures presented are after costs and before New Zealand tax and are provided on a provisional, unaudited basis. The Guardians of New Zealand Superannuation 2021-2022 annual report and audited financial statements will be released in late October.

"While there is no hiding that market conditions are challenging – the first six months of 2022 have seen the worst global equity market performance since 1970 - the fund showed resilience and is performing well." Whineray said.

In the two months since the end of the 2022 financial year the size of the fund has recovered by approximately $2 billion to $57.3 billion.

Whineray believed, however, that the periods of "extraordinarily high returns", like 2020-2021 "are behind us".

"In effect we were bringing forward future returns in an environment which combined both monetary and fiscal stimulus."

Whineray said higher interest rates such as are now being seen both weigh on market performance and increase the fund's "internal hurdles" for making direct investments in companies.

"The external economic environment continues to present challenges to investors. Heightened inflation, and the associated response by central banks to push up interest rates to suppress demand, places considerable pressure on investment returns for both bonds and equities."

The market volatility is expected to continue, Whineray said.

"Stakeholders should expect to see further ups and downs going forward. As a long-term investor the fund is well-positioned for this sort of market.

"...We believe we’re entering a lower return period, but remain confident our long-term approach will continue to deliver value to New Zealand."

Government contributions (net of NZ tax) since inception of the fund have been $12.6 billion.

In the last 10 years, the fund has generated returns of more than 12% a year.

The Government is projected to start making withdrawals from the fund to help pay for superannuation from the mid-2030s.

Since investing began in 2003 the fund has returned 9.65% per annum, equating to $34.6 billion more than the cost of Treasury Bills (what the Government would have saved if it simply paid down debt). The value added by active investment since inception represents $13.3 billion.

In terms of highlights in the past financial year, Whineray picked out the fund's "strategic tilting", timber, global macro, tactical credit and equity factors mandates with contributing to the strong value-add performance.

"Our Strategic Tilting strategy continues to perform above expectations and deliver strong value, with returns in 2021/22 largely driven by higher bond yields as central banks hiked interest rates in response to inflation.

"Timber also continues to outperform, headlined by our investment in Kaingaroa Timberlands, a radiata pine forest in the central North Island of New Zealand.”

"Our global macro opportunity, a hedge fund strategy that bases its holdings primarily on the overall economic and political views of various countries or their macroeconomic principles, and our internally managed tactical credit mandate, also delivered strong returns. Tactical credit investments provide debt funding while using downside protection to mitigate or prevent a decrease in the value of an investment.

"Equity factors investments in developed markets had a very strong year, reversing prior under-performance. Factor-based investing is a long-term strategy that uses a range of criteria – such as value, quality, momentum and low risk factors – in an effort to out-perform traditional equity benchmarks, while taking lower levels of risk. An allocation to the 'value' factor, which had historically weighed negatively on performance, started to reverse in late 2021, after global equity markets began to pull back after reaching all-time highs."

21 Comments

NZ is waiting for a ruling party that will put up some attractive economic clay pigeons for investors to shoot at in addition to KS. Property cannot be re-ignited after this cycle and until world banks start up the presses shares will be quiet unless a listed company actually performs above expectations. ISA's etc would be a welcome addition.

Clay pigeons is probably the wrong term. Once targeted, they get smashed to smithereens and are worthless. We want boars or other meaty beasts!

Market capitalization isn’t “wealth.” It’s the latest price, times shares outstanding. Blotches of ink on paper. Flashing pixels on a screen. If a dentist in Poughkeepsie buys a single share of Apple at a price that’s 10 cents higher than the previous trade, $1.6 billion in market capitalization emerges from thin air. If a single share trades 10 cents lower, $1.6 billion evaporates just as quickly. Whatever happens, every security in existence has to be held by someone until it is retired. Ultimately, the wealth inherent in a security is the future stream of cash flows it will deliver to its holder(s) over time. Price fluctuations don’t change those underlying cash flows. They just provide opportunities for the transfer of savings between investors. High valuations favor the sellers. Low valuations favor the buyers. Investors have never paid higher prices for those future cash flows, or accepted prospective returns so low.

Put simply, the bubble hasn’t changed the wealth, and a collapse won’t change the wealth. What will change is the market cap. I suspect that the erasure of market cap in the coming years, and possibly the coming quarters, may be brutal. Still, no forecasts are required, and our own attention will remain on observable valuations, market internals, and other factors. Meanwhile, even if an investor sells at these extremes, the only thing that will change is who holds the bag. Link

yeah..excuse me im a dummy

so for the 55B invested how much was returned as dividends?

For context, the NZSE50 is +8.1% (annual compounding) for the same 2003 to 2022 as NZ Super and those firms certainly did not have the tail wind of funding at the T-Bill rate..

Yes, NZ Super are too large for the NZ bourse, but choose some blend of S&P and Nasdaq and you are well >10% currency adjusted. Factor in that NZ Super have roughly 33% of assets marked as Level 2 or 3 (so not marked to market and illiquid), I would say these results are mediocre at best. Maybe that's too harsh, but it's certainly not a high Z score result.

Indeed:

“The first half of 2022 was a discount rate shock,” he said. “From here, as short rates march higher, investors will allocate away from risky and into risk-free assets.” Outflows expose the liquidity mismatch between the liquidity terms offered to the investor and the actual liquidity of the underlying investments. “The authorities and markets implicitly assume liquidity is plentiful and market behavior will remain orderly. We have been questioning that assumption and examining what might cause a disorderly liquidation?”

“I think we see the answer,” said the CIO in response to his own question. “The liquidity available to financial markets is being pincered between the forces of:

- the Federal Reserve’s Reverse Repo Facility (RRP) facility, its interaction with central bank reserves and the level of interest rates,

- the inflating nominal economy’s need for more of the commercial banks’ aggregate balance sheet, and

- the reticence of commercial banks to expand their balance sheets because of regulatory pressure on them to be crisis proof in the face of an oncoming hurricane.”

“And these liquidity pressures are weaponized by poor trailing 6-month portfolio performance and rising real rates, creating a genuine threat that we may be on the brink of The Great Liquidation,” explained the CIO. Link

With things getting tougher, putting more money into this fund right now should be reassessed.

Disagree, eventually things will turn, we just don't know when. Essentially huge dollar cost averaging, over the long term it's not a terrible strategy.

That depends, we have a large infrastructure shortfall that needs to be addressed or else we'll run into the same issues we had pre-Covid. No good having our wealth riding on the markets when we're being made actively poorer in the medium term by our own crappy planning.

Agree that much more of it could be used for large NZ infrastructure projects, but they are only ones that are supposed to return a profit eventually (like energy expansion projects, looking at you lake Onslow). Nothing wrong with kiwisaver investing in long term infrastructure in NZ, but it has to get it's mix right to balance all of it's priorities. A small part of the fund should also be going into the early stage startup stuff in NZ too, high risk, but potentially high reward both for the fund and the country. They have the Elevate fund for this purpose actually, but I haven't heard of much going on with it.

I'm curious as to why NZ Super are the vehicle, or potential vehicle, to invest in infrastructure. If I'm the Crown minister for that infrastructure I want it under my remit. What particular skills do NZ Super posess? They are either stock pickers (active and passive) or outsource funds to professional investors (private equity and hedge funds). They are not subject matter experts, engineers etc. Maybe if we need a state investment bank to arrange debt/equity syndication, but otherwise hand it over to the Crown subject matter experts.

No reason I can see for the infrastructure ministry to be able to present business cases and be the subject matter experts for NZ Super fund, who can then assess them as long term investments (though this would need to be a high trust environment, so unlikely). Alternatively the Super Fund may need to employ some experts themselves if they were to take on some level of infrastructure funding. Neither of those are show stoppers IMO, they just need the political push to say divert say 10-20% of the fund into long term infrastructure funding for NZ, that will return long term dividends.

Really anything that would remove the short term focus of almost every government to only fund what they can get through in their term, with a few exceptions. Would take some of the politics out of how "the government is wasting money".

You are trying to solve two different problems. The Politicians are a good example of how not to interfere

In a language that we all understand, the US will not print excessive amount of green back in near future.

so it was pretty much luck then!

wind it up and pay off Crown debt

What is government debt but the money which the government has spent into the economy but has not taxed back and cancelled. Money which the government then holds in the form of bonds to maintain the OCR and money which remains in the private sector and represents our savings of government currency.

Why would anybody choose to work with this particular NZ govt. They don't know which way is up. They may learn which way is out next year. With any luck.

Kiwisaver has 'generated' funds?

Bollocks it has. Stop stealing words from physics - where they actually mean something.

So-called 'investment' is just being a rentier on someone else doing something else somewhere else.

It 'generates' nothing; it commandeers, at best.

Get it right please...

Do you have any savings or Kiwisaver etc? Did you put aside anything for the future and then invest it and expect a little return on funds invested. If not you are a complete numpty.

Generated is a word in the english language, stolen from latin, not from physics.

generate (v.)

c. 1500, "to beget" (offspring), a back-formation from generation or else from Latin generatus, past participle of generare "to beget, produce," from genus "race, kind" (from PIE root *gene- "give birth, beget," with derivatives referring to procreation and familial and tribal groups).

Sir M Cullen, I salute you.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.