This Top 5 comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

Cartoon by Chris Riddell, The Guardian.

1) The end of socialism for the rich?

One of the most interesting aspects in the fallout from the infamous British government's mini-budget, I thought, was the criticism it attracted from the International Monetary Fund (IMF). Especially because the IMF said the nature of the UK measures, featuring well publicised tax cuts, "will likely increase inequality."

This comment caught the eye of Yanis Varoufakis, a former Greek finance minister, too. Varoufakis, who has experience negotiating with the IMF, has written a very interesting article for The Atlantic about it.

He suggests that the IMF criticising the government of a major Western economy "was a little like the janitor scolding the landlord for putting the building’s assessed value at risk."

Varoufakis explores three theories as to what was behind the IMF's inequality comment and brings in some fascinating insight from his own interactions with the IMF. Ultimately, he argues, the IMF panicked.

Along with other smart people in the U.S. government and at the Federal Reserve, its officials feared that the U.K. was about to do to the United States and the rest of the G7 what Greece had done to the euro zone in 2010: trigger an uncontrollable financial domino effect.

In the days preceding the Truss government’s mini–budget statement, the $24 trillion U.S. Treasuries market, whose health decides whether global capitalism breathes or chokes, had already entered what one financial analyst called a “vortex of volatility” not seen since the crash of 2008 or the first days of the pandemic. The yield on the U.S. government’s benchmark 10-year bond has risen sharply from 3.2 percent to more than 4 percent. Worse, a large number of investors had recently stayed away from an auction of new U.S. debt. Nothing scares those in authority more than the specter of a buyers’ strike in the U.S. bond markets.

To steady the investors’ nerves, officials came out in strength with reassuring messages. Neel Kashkari, the Minneapolis Federal Reserve president, summed up the spirit thus: “We are all united in our job to get inflation back down to 2 percent, and we are committed to doing what we need to do in order to make that happen.” This was the moment when the U.K. government chose to announce Britain’s most expansionary fiscal policy since 1972.

Not convinced the IMF is really worried about inequality per se, Varoufakis suggests the IMF is really viewing inequality as a proxy for systemic instability.

After the 2008 financial collapse, the U.S. and the EU adopted a policy of socialism for bankers and austerity for the working and middle classes. This ended up sabotaging the dynamism of North Atlantic capitalism. Austerity shrank public expenditure precisely when private expenditure was collapsing; this sped up the decline of both private and public spending—in other words, aggregate demand in the economy. At the same time, quantitative easing by the central banks channeled rivers of money to Big Finance, which passed it on to Big Business, which, faced with that low aggregate demand, used it to buy back their own shares and other unproductive assets.

The personal wealth of a few skyrocketed, the wages of the majority stagnated, investment crumbled, interest rates tanked, and states and corporations became addicted to free money. Then, as the pandemic lockdowns stifled supply and furlough schemes boosted demand, inflation returned. This forced central banks to choose between acquiescing to rising prices and blowing up the corporate and state zombies they had nurtured for more than a decade. They chose the former.

All of a sudden, though, the IMF saw the liberal establishment’s lost capacity to stabilize capitalism reflected in rising economic inequality. So the last thing the markets needed, the fund’s technocrats realized, was more socialism for the wealthy. But it would take a feat of wishful thinking to interpret the IMF’s panic-driven reaction as a sincere conversion to economic redistribution and social democracy. A warning against an act of elite self-harm was the extent of it.

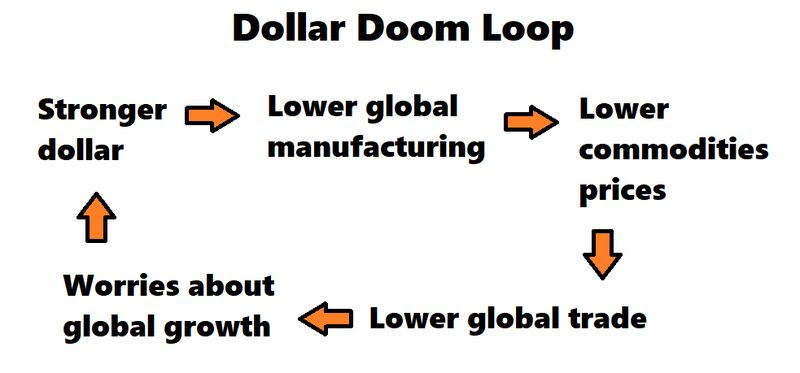

In a recent interview with Bloomberg, Jon Turek the founder and CEO of hedge fund advisory firm JST Advisors, talked about what he refers to as the US dollar doom loop. (His diagram of this appears below).

Amid aggressive interest rate hiking from the Federal Reserve as it battles high inflation, a global push into US dollars as a safe haven and the world's reserve currency is underway. Given the way monetary policy is designed in the US as in NZ, Turek argues the world is effectively waiting for US unemployment to rise

In terms of where we are. I think we’re in the ‘things break’ stage. Now, typically when we enter the ‘things break’ stage the Fed is able to get dovish and arrest the move. However, inflation is at 8% and the Fed won’t have confidence it is sustainably falling until the unemployment rate rises a bit. So this the problem now, and why this rendition of the doom loop is more severe, the Fed doesn't have its usual off ramp because they are in panic mode over US inflation. The whole global economy is basically waiting for the US unemployment rate to tick up to 4%.

The most recent official US unemployment rate was 3.7%.

The way things seem to work via Fed pass through is: global financial conditions (FCIs) => global growth => US financial conditions => US growth. We are probably in stage three where US financial conditions have been really hit and now it’s a waiting game for it to show up in the labor market.

Turek acknowledges it could be a long wait as following the Covid-19 pandemic labour markets may not be behaving quite like they used to.

Ironically this is really the risk to asset prices at the moment. We are all waiting on the labor market, and what if it doesn’t give for X,Y,Z reason. Maybe it is changed, post-Covid, I don’t know. But to me a big risk for markets, ironically, is that claims are still printing 200,000 come the February 2023 FOMC. There is a chance that a too strong US labor market will cause a financial accident via this rate shock.

There's more from Turek here.

Dozens of sailings on the world’s busiest freight routes are being cancelled during what's typically peak season, The Wall Street Journal reports, with economic whiplash hitting companies as inflation hits global trade and consumer spending.

It certainly seems like the great Covid-19 global supply chain disruption, with massive price increases, is over. Albeit freight rates on key shipping routes reportedly remain above pre-pandemic levels.

Trans-Pacific shipping rates have plummeted roughly 75% from year-ago levels. The transportation industry is grappling with weaker demand as big retailers cancel orders with vendors and step up efforts to cut inventories. FedEx Corp. recently said it would cancel flights and park cargo planes because of a sharp drop in shipping volumes. On Thursday, Nike Inc. said it was sitting on 65% more inventory in North America than a year earlier and would resort to markdowns.

For the two weeks starting Oct. 3, a total of about 40 scheduled sailings to the U.S. West Coast from Asia and 21 sailings to the East Coast from Asia have been scrapped, according to the data companies as well as customer advisories viewed by The Wall Street Journal. Typically at this time of year, an average of two to four sailings a week are blanked, the industry’s term for canceled sailings.

Citing the Freightos Baltic Index, the WSJ says daily freight rates now average US$3,900 to move a single container across the Pacific, compared with US$14,500 at the start of 2022, and more than US$19,000 in 2021.

The WSJ article goes on to suggest new container ships will add capacity over the next two years, meaning that freight rates could come under more pressure as more ship space becomes available, even raising the prospect of over capacity.

“The global economy has thrown a few curveballs this year, and our outlook on future demand is uncertain and tepid,” said Jonathan Roach, a container analyst at Braemar. “Overcapacity will likely become an issue from the middle of 2023 through to 2024 and potentially beyond.”

Overcapacity pushes operators to undercut each other, putting pressure on freight rates. Boxship operators fought deep losses for nearly a decade starting in 2008, which prompted consolidation in the industry. The top six ocean-freight carriers move more than 70% of all containers worldwide.

In a separate story The Wall Street Journal reports that despite lower shipping and commodities prices, Costco, which recently opened its first NZ store, isn't ready to cut prices.

Pricing at the retailer’s 839 global warehouse stores hasn’t decreased, according to Chief Financial Officer Richard Galanti, despite the lower prices for shipping goods and for things like gasoline and steel. Costco in some cases locked in prices it pays to suppliers months ago and inflationary pressures from rising labor costs persist, which means the drops in shipping and commodities prices aren’t necessarily benefiting the company’s balance sheet yet.

“It takes time for changes to come through,” Mr. Galanti said.

A company’s freight costs vary depending on whether they are fixed by contract for a period of time or based on spot-market rates that can change more quickly. Issaquah, Wash.-based Costco, which is known for selling discounted bulk goods to paying members, uses contract rates for more than 80% of its total freight, Mr. Galanti estimated to analysts in December. The length of contracts as well as the company’s ability to renegotiate the terms of its agreements also affect the retailer’s freight costs, he said. Mr. Galanti declined to comment Tuesday on whether Costco is working to renegotiate its freight contracts.

The WSJ notes that margins have been falling.

Costco’s margin on its core business, which excludes its gas sales, was down 26 basis points in the most recent quarter, compared with margins that were lower by 39 basis points in the prior quarter and 40 basis points a year ago. The retailer’s margin has been falling in recent quarters due to inflationary pressures and as margin gains realized during the first year of Covid-19 have stabilized, said Mr. Parikh [Rupesh Parikh, a senior analyst at investment banking firm Oppenheimer & Co].

4) Rethinking monetary sovereignty.

This academic paper, for those interested in the concept on monetary sovereignty, rejects the Westphalian understanding of monetary sovereignty. What's the Westphalian understanding of monetary sovereignty you ask? It focuses on what states can do without interference from other states. For example, states are thought of as sovereign as long as they can regulate financial institutions domiciled within their territory.

Earlier this year I discussed the concept of monetary sovereignty in an episode of the Of Interest podcast, looking at central bank digital currencies, with Reserve Bank Director of Money and Cash, Ian Woolford.

This paper, authored by Jens van 't Klooster, Assistant Professor in Political Economy at the University of Amsterdam, and Steffen Murau, a Postdoctoral Fellow at Boston University and a Research Fellow at the Bank for International Settlements, notes that monetary sovereignty has repeatedly been declared dead.

Here's an overview.

We propose a new conception of monetary sovereignty that acknowledges the reality of today’s global credit money system. Today, the concept is predominantly used to denote states that issue and regulate their own currency. We reject that Westphalian understanding of monetary sovereignty. Instead, we propose a conception of effective monetary sovereignty that focuses on what states are actually able to do in the era of financial globalization. The conception fits the hybridity of the modern credit money system by acknowledging the crucial role not only of central bank money but also of money issued by regulated banks and unregulated shadow banks. These institutions often operate “offshore”, outside of a state’s legal jurisdiction, which makes monetary governance more difficult. Monetary sovereignty consists in the ability of states to effectively govern these different segments of the monetary system and thereby achieve their economic policy objectives.

For something a bit lighter, here's an NPR article about Fat Bear Week. This is where people vote on Alaskan bears preparing to hibernate.

Fat Bear Week has officially started, celebrating the hard work bears do to survive, and giving all the rest of us a reason to gawk at massive animals and spawning salmon in their home in Katmai National Park in Alaska.

The 12 brown bears are placed into a bracket, where voters decide who should advance from each matchup.

The contest highlights the amazing transformation bears must make after they emerge from hibernation, emaciated and hungry. From the middle of summer to the fall, an average male adult can go from weighing 600-900 pounds to well over 1,000 pounds, according to the Katmai website.

Contestants are tracked by their numbers, but veteran animals are known by names like the large male Chunk, or the blond-eared female Holly. Then there's 747 — who doesn't need a nickname because his number and size both echo the famous jumbo jet.

It's a great survival story and certainly something worth celebrating.

33 Comments

Gareth : this fat bear reminds you all that today is International Beer & Pizza Day ... get some into ya !

... dieting is for losers ...

And , a hearty congratulations to all the new unLabour mayors around the nation : may we not hate your guts in 3 years time as we do of the numpties we just voted out : Beeeeeeeeeer !!!!!

Despite the glee over the TLA elections, in large part, tossing out the lefties, it's worth recalling that Councils have only one employee, the CEO, who then employs the power behind the throne: the hordes of unelected and unfireable Staff. Who, with one eye on their own cozy prospects, and both hands on policy and munny, are fairly much free to follow the latest fads. And who regard Councillors, of whatever stripe, as show ponies around a very distant table.

Re Beer and Pizza day, I started yesterday. Am I disqualified? And no beer yet, as I have a lotta purlins to get on my roof and need the tattered remnants of my brain function to be - er - Functioning.

Good point waymad… I’m hoping the powers of Mayor extend to appointment of the chief executive roles?

Probably but to get rid of the encumbent on contract will take a golden handshake and whose to say the new one is any better. There seems to be a round robin of CEOs with the smaller council CEOs progressing up the ladder.

Boomers will fix Auckland.....more Roads cars and expand the port.

Expand the port? Browns policy is to massively increase the rent it pays to force it to downsize. He still seems pretty keen to move most of the shipping to North Port, which will be a gift to Ports of Tauranga

What an interesting strategy if true. What better way for Aucklanders to reclaim access to their foreshore? Its quite silly to my mind to see it as a competitive boost to other ports - if so, great. It's a shame to my mind that central government didn't take ownership/control of all ports when LG was restructured. We're a bit too small for this kind of internal/inter-regional competition for that infrastructure.

How will we 'reclaim' it? We can't sustain our current eateries so another food district is out. And more million dollar apartments aren't exactly handing it back to the people. As for Brown's plan for an in-land port in West Auckland: Where? That's where all the housing he thinks should be happening on the fringes is being built, and there's no North Western Busyway (despite what he keeps saying) to enable rapid transit - so more trucks stuck in congestion and lost productivity. But I'm sure he wouldn't be the kind of person to sloganeer past reality. I'm sure all these problems can be solved by ranting about road cones or pissing on journalists.

It's funny, when the government was in opposition, they got their knickers in a twist over selling down stakes in power companies. Then they were quite happy to strip a publicly owned asset from Aucklanders to try to buy a seat for NZ Fist in Northland. And now we have the clown who was party to that charade in charge.

Hopefully he fixes all the 150k+ staff. Someone came up with the number and it seemed excessive to me

How is he going to "fix" staff? He's not in any way in charge of operational matters. Seems like a lot of people bought into angry boomer talkback ranting and don't actually know what the mayor does. With any luck Wayne Brown is in that camp as well.

I am an economic bear so count me in. I also like beer.

RE: 1) The end of socialism for the rich? & 2) The dollar doom loop.

One could consider money supply as a contributing factor to the noted observations.

In Latest Recession Signal, Money-Supply Growth Plummeted To Three-Year Low In August

Dollar-denominated bank liabilities are being destroyed (dollar shortage). Link

The NZ equivalent to US Treasury's General Account is Crown Settlement Account.

Audaxes

You may find this of interest.

Centre for Central Banking Studies

Understanding the central bank balance sheet.

https://www.bankofengland.co.uk/-/media/boe/files/ccbs/resources/unders…

Good that shipping is back to normal. Importers and exporters can focus on their own businesses again.

There must be a lot of uncertainty bed in now re demand.. business must be cautious not to overstock.

there’s going to be a lot of liquidations coming in construction with risk being factored in and residential market all but dead.

No looking good for the Fed unemployment dropped to 3.5% in September

Don’t you love it… it’s like watching kids yanking away of 747 controls aiming to fly straight, but always overcompensating

And it's only going to get 'better' (statistically lower)?

The US 65+ million Baby Boom generation has continued working far longer than previous generations, but as they inevitably have to leave the workforce, the replacement workforce isn't of the same size or as qualified.

Sure. There's immigration. But everyone will want to tap that pool - rapidly ageing One Child China paramount amongst them. And the same likely applies here.

More Workers Find Their Wages Falling Even Further Behind Inflation

A rising real wage allows workers to improve their standard of living. However, the Wall Street Journal recently reported that “… vast numbers of Americans find their cost of living is rising faster than the income they’re bringing home.”

Seen some really weak understanding of inflation in general and wage inflation. There seems a misguided belief in a positive correlation between wage growth and inflation growth. It is not the 1970s and technology has a deflationary impact, particularly with the price of labour.

A great Top 5 - Yanis Varoufakis is right on the mark.

Foreign institutions cannot create another country's money. All NZ Dollars must originate from within NZ for example. A sovereign currency is one which doesn't operate on a fixed exchange rate or is pegged to another currency and doesn't borrow in foreign currencies.

Government bond issuing is an archaic procedure which dates back to the gold standard days when set exchange rates had to be maintained and this is now no longer necessary and it is now just a rort for the financial markets. If a central bank wishes to maintain a certain interest rate then it can just pay interest on its reserves without issuing bonds.

It's not my sort of TV show but I'll be watching the Block auction tonight. Will be interesting to see.

Just saw the result, don’t like the programme. Result reflective of the market!

Good article GV. A timely selection of current affairs. And am really looking forward to CT's reaction to this weekend's results in the morning.

Me too , but I expect CT to be more forthright & honest about the thrashing Labour candidates received than Jacinda & Robbo will be ... they'll be putting a brave face on it in public ...

... but , panicking unreservedly behind closed doors

Two words , guys ... 2 little words which are whispering death to your hopes to win the general election in 2023 ... " Three Waters ! "...

Labour candidates

It always annoys me that LG candidates usually don't specify who they are affiliated with. Cue people saying "keep party politics out of LG" - naive IMO, it's already there but hidden.

Yeah, this one just ran for Mayor in Kāpiti as an Independent;

And she's been provisionally elected.

May be an article on how much our RBNZ printed NZD out of thin air like the Canadian Reserve Bank would be good to know. The houses which had prices of 800k in 2019 went to 1.5 million in Q1 2022. Any responsibility of this government?

https://torontosun.com/opinion/columnists/gunter-bank-of-canada-governo…

What do you expect the IMF to do? They do their over paid, self serving job, which is to preserve the existing power structure (including their own tax free pay) based on US hegemony. The UN, NATO, IMF and World Bank were all set up by Eisenhower to form a basis for US global power in the Cold War.

Sad thing is, they say politicians only speak the truth in their resignation speech. Eisenhower plainly says, "Oh, bugger, I have created a monster. You will not be able to control it. Sorry about that, eh."

https://www.youtube.com/watch?v=OyBNmecVtdU

The FED trying to edge up unemployment will really have to work hard. Intrinsically the US working age population is declining: https://data.oecd.org/chart/6Q4a

As labour becomes increasingly scarce it's value will correspondingly increase. The revenge of the Millennials and Gen-Z isn't low interest rates but much higher wages, assuming they can stop governments diluting that with low wage immigration.

This is true, however we also need to consider the need to fund the increasing public health expenditure for the baby boomer generation as time goes on, then add those of that generation coming back to NZ to retire from overseas and adding to the cost. Millennials may get higher wages, but whether this corresponds to greater financial opportunity is yet to be seen

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.