Earlier this year, Inland Revenue ran a consultation on the not-for-profit sector. In the course of that consultation it raised the treatment of the taxation of mutual associations, including clubs and societies. Inland Revenue indicated that mutual transactions between clubs and members, such as subscriptions, which were previously thought to be exempt from tax, were in fact taxable. It transpired Inland Revenue had actually been sitting on a draft operational statement on this matter for some time.

Inland Revenue has now released a draft operational statement (“OS”) on the taxation of mutual transactions of associations, clubs and societies.

This OS takes into account submissions Inland Revenue received on the not for profits consultation. One of the issues this draft OS considers is whether the principle of mutuality applies. As the draft OS notes, under the common law principle of mutuality, an association of people such as a club or society, cannot derive taxable income from transactions within the circle of membership of the association. Mutual transactions do not generate profits for the association, because the amounts received by the association come from members transacting with themselves.

This primarily refers to subscriptions, but as the draft OS also notes, the principle does not apply where legislation provides otherwise. And what Inland Revenue has highlighted in this consultation is that it wants to give greater clarification about the scope of these potentially mutual transactions.

The basic position is supplying stock or services to members is taxable. That's not a new position, but as the draft OS comments

“…this has not been communicated clearly or consistently, and Inland Revenue is aware affected customers take different approaches. We are hoping to increase awareness of the correct treatment and achieve certainty and consistency by finalising a statement on this aspect following consultation.”

A change of tack

The key point the draft OS proposes is that member subscriptions may be subject to tax, which does represent a change in practice. Therefore, “an object of this consultation is to test whether the reasoning for that conclusion is sound.”

To be frank, this has caused a bit of a stir amongst the potentially affected clubs and societies. There are exemptions given for specific charities and sports clubs, but a large number of organisations would previously have thought and filed tax returns on the basis that transactions involving member subscriptions were exempt. This does work both ways. If the subscription is treated as exempt, then costs relating to subscriptions are not deductible.

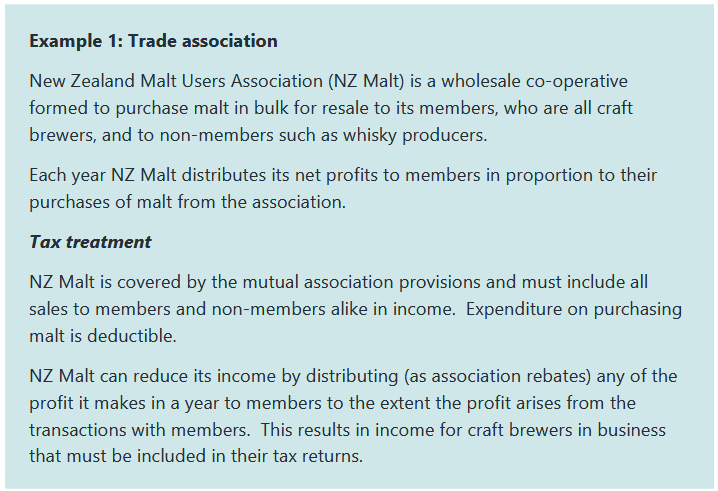

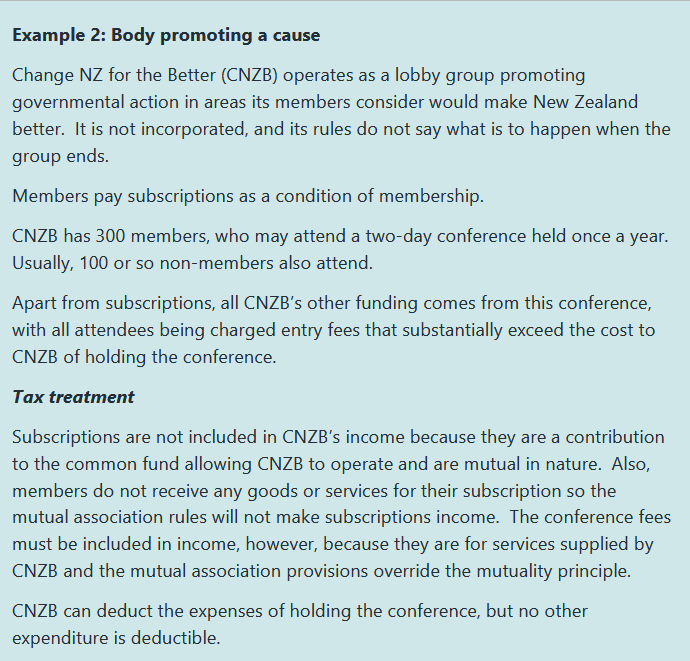

The paper contains 7 examples setting out various scenarios and how transactions might be treated. As noted, Inland Revenue’s position is that in some cases membership fees and levies are not mutual in nature but represent income and are taxable. A key point in this approach is if the associations constitution allows distributions to be made to members. If distributions are prohibited, then membership fees and levies are income. The following examples taken from the draft OS illustrate the issues under consideration.

One for legislative reform?

The sector has been taken a bit by surprise by this consultation. In my view it represents such a change of interpretation it should be legislated if Inland Revenue wants to achieve that clarity. To be fair Inland Revenue is saying that any changes made after consultation is finalised would be prospective and it would not generally seek to reopen prior years. I recommend all potentially affected groups to submit on this draft OS, consultation on which is open until 25th of June.

Inland Revenue gets tough on student loan debts

Moving on, Inland Revenue has been regularly providing updates on the progress of its debt collection and general enforcement in the wake of the additional funding of $116 million over 4 years it got in last year's Budget for this purpose. Last week, we discussed the extra $153 million Inland Revenue has recovered in the year to date from the property sector alone.

Its latest update this week is about its progress on recovering student loan debt and included the news that "One person was arrested at the border last month and they have since paid off their debt.” According to Inland Revenue at the end of April, there were 113,733 people with student loans believed to be based overseas. More than 70% of those people were in default of their loans and in total they owe $2.3 billion. This includes 150 overseas based borrowers with a combined default debt of $15 million. It is therefore understandable why Inland Revenue is a tougher line on student loan debt.

Information sharing with New Zealand Customs…and airlines

Inland Revenue gets notified by New Zealand Customs about any border crossings into New Zealand by overseas based borrowers. According to the RNZ report apparently airlines are also providing similar information to Inland Revenue. This is an interesting, and previously unknown, detail.

Once notified Inland Revenue will then apply to the District Court and the police can make an actual arrest, which, as noted, happened last month. Since 1st January 2024, 89 people have been advised they could be arrested at the border. This has prompted 11 of them to take action, either by making acceptable repayments or entering into repayment plans and applying for hardship. So far during the current financial year to 30th June, this programme has collected $207 million in repayments from overseas borrowers. This is up 43% on the same period in the previous year. So yes, it's making progress.

Progress, but…

On the other hand, some of the reported numbers are quite concerning to me, and I consider also highlight why student loan debt has become such a problem. As noted above those 113,733 overseas based borrowers owe over $2.3 billion, but more than a billion dollars represents penalties and interest. What happens is that as the interest and penalties pile up, many debtors get to a point where they feel it can’t be repaid, and they simply freeze hoping the issue will somehow go away. This phenomenon is well understood by Inland Revenue because it happens with other tax debt.

Therefore, the question arises about the efficacy of the current penalty and interest rate regime. Interest and penalties accumulate swamping repayments, so little progress in repaying debt is made even where repayments are being made. The overall amount of debt on Inland Revenue’s books then just blows out.

Debt more than 15 years old? How did that happen?

One particular point really concerns me about Inland Revenue’s latest update. Apparently for over 24,000 of the overseas based borrowers, the debt is more than 15 years old. In many cases, it's highly likely that people in that category are not going to return to the country, so the threats of arrest at the border are probably not going to be effective.

But then the question also arises is it really very realistic to expect people to repay debt which has been allowed to accumulate for 15 years? And a really big question here is what was Inland Revenue doing during that time?

It's all well and good to say Inland Revenue is clamping down now. But it seems to me to be against natural justice that it can target debtors where the debt has been allowed to accumulate, and insufficient action was taken early enough to control the debt and prompt earlier repayment.

Inland Revenue, as we repeatedly mention on this podcast, has enormous information sharing and gathering powers. The question really arises as to whether sufficient resources were made available in the first instance to keep control of the student loan debt. And now we've reached a situation where, to borrow an old saying, “You owe the bank $100,000, it's your problem. You owe the bank $1 million; it becomes their problem.” It seems to me that's where we've reached with overdue student loan debt.

Are the rules fit for purpose?

It should also be noted that looking into the legislation applying to student loan debt it appears it's quite difficult for Inland Revenue to write off debt and interest as part of reaching a settlement. The rules are very prescriptive in such instances, apparently deliberately so.

As a consequence, I wonder if this holds people back about making attempts to settle outstanding debt. There’s also the question of debt over 15 years old and what records are available to prove outstanding amounts. Inland Revenue has the luxury of having the upper hand here where the age of the debt means debtors may not be able to provide any contradictory evidence about lost payments or incorrect adjustments. Although it’s good to see Inland Revenue is making progress on the overall collection, I don't think that means that it should avoid scrutiny for how the debt book has been handled in the past.

Pre-Budget teasers

The Budget is next Thursday and ahead of it, there's always plenty of speculation as to its contents. Things have got spicier because of the pay equity issue: depending on who you want to believe this has either “saved the Budget” or just happens to be a coincidence.

As usual there's been a steady stream of announcements from the Government about particular items which will be in the Budget. A very interesting and quite significant one relates to future drawdowns from the New Zealand Superannuation Fund (“the NZSF”), established by the late Sir Michael Cullen in 2002.

The country’s biggest taxpayer

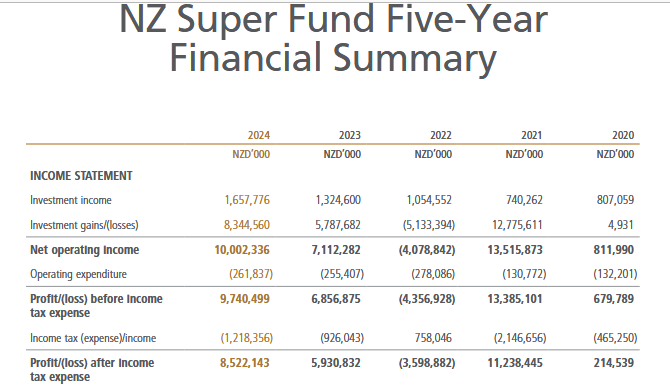

Ahead of the Budget the Finance Minister announced that the Government will start drawing down on the NZSF with effect from 2028, five years ahead of first forecast. It is just worth keeping in mind that since inception the NZSF has been paying tax. In fact, it is the only sovereign wealth fund in the world which is taxed. For the year ended 30th June 2024, its tax bill was $1.2 billion. It’s usually the largest single taxpayer in the country, meaning it’s already contributing to the funding of New Zealand Superannuation.

Changes ahead for KiwiSaver? National’s record would indicate so

Elsewhere there's been speculation about what's going to happen with KiwiSaver. The Finance Minister has alluded to some changes leading to speculation that the Government's contribution could be increased for lower income earners or might be means tested for higher income earners.

It's worth noting that previous National-led governments have a pattern of playing around with KiwiSaver. The maximum Government contribution each year used to be $1,043 a year until that was halved by Sir Bill English with effect from 1 July 2012. He also scrapped in 2009 a $40 annual fee subsidy. English also removed the $1,000 kick start payment from 21st May 2015.

The biggest KiwiSaver change English made was introducing employer superannuation contribution tax (“ESCT”) on employer contributions to KiwiSaver funds from 1 April 2012. To illustrate how important that change was, the amount of ESCT collected annually was $1.982 billion for the year to 30th June 2024 or about 1.7% of the Government's total tax take for the year. Consequently, ESCT is too big for it to be changed in any way. But I do think we might see some tweaking of the Government’s KiwiSaver contribution settings.

A potential corporate tax cut or accelerated depreciation?

There's also been talk about a potential corporate income tax cut, but I'm with Robin Oliver who said that if they're going to do it, they'd have to go big. In other words, from probably 28% down to 18%, and that's simply not going to happen because it would be unaffordable. On the other hand I do think we might see some more targeted investments around increased or accelerated depreciation allowances, which I, and the business sector, would certainly welcome.

The Green alternative

The Greens took the opportunity also to publish their alternative budget on Wednesday. Looking past the predictable scoffing from opponents a few initiatives stand out. They're proposing a higher top rate of 45%, which is the same top rate as Australia and the UK just for reference, it should kick in at income over $180,000 with the 39% rate starting at $120,000. The trade-off is that every person will get $10,000 a year tax free exemption. The 45% top rate is comparable to other jurisdictions, notably Australia and the UK. I'm not so sure about the thresholds though as the level they kick in seem on the low side.

Think 45% is high? Try Austria

As an aside and about high tax rates I was very surprised to find out this week that Austrian Government, which is a centre right coalition, has kept in place for the next four years a top income tax rate of 55% applicable to income above €1,000,000. Food for thought therefore claiming the Greens’ suggestions are excessive. (As a sidebar and follow on from my comments last week about mandatory indexation of thresholds, Austria is actually reducing part of the inflation adjustment for the tax rate thresholds. In Austria income tax thresholds are automatically adjusted annually by 2/3 of the inflation rate unless the government legislates otherwise).

A Capital Acquisitions Tax?

The Greens are also proposing a 2.5% wealth tax on net assets over an individual’s threshold of $2,000,000 with a 1.5% tax applying to net assets held in “private trusts,” The press has talked about the Greens introducing an inheritance tax, but that's not actually correct. In fact, and I think this is probably the most interesting revenue raising idea from the Greens, what they are actually proposing is a variation of the Irish Capital Acquisitions Tax. Why this is interesting is Capital Acquisitions Tax is a donee based tax. In other words, it is the person who receives the gift who is taxed. By contrast a typical inheritance tax or estate duty work on the principle of any taxes being paid by the donor (the person, or their estate making the gift.

Under the Greens proposal a 33% wealth transfer tax will apply to significant gifts and inheritances received, over an accumulated lifetime threshold of $1,000,000. The 33% rate is the same as the Irish Capital Acquisitions Tax. This is an interesting proposal and it’s the first time I’ve seen a New Zealand party raise it as an option.

Elsewhere the Greens want to increase the corporate tax rate to 33% and also restore a 10-year bright-line test, as well as reintroducing interest deductibility restrictions. All of the tax increases are to pay for a huge social. Investment programme, including free dental care. It would also include a major increase in the threshold for Working for Families from the current $42,700, which has not changed since June 2018, to $61,000. The current 27% abatement rate would also be reduced.

Wealth taxes and capital flight

On wealth taxes, a reason why tax practitioners including myself are sceptical about the revenue projections for a wealth tax are the issues of valuation and capital flight. Valuation issues are always a key objection to wealth taxes, but I think the question of capital flight is one that we perhaps have to think hard about when considering the impact of a wealth tax. That’s because I think we are very vulnerable to capital flight to Australia.

Australia has always been a huge land of opportunity for many Kiwis but it’s also very attractive for those Kiwis moving there who qualify for the Australian Temporary Resident exemption. This exempts non Australian sourced income and capital gains from Australian tax. It’s similar to our Transitional Resident exemption, but unlike that which is generally only available for 48 months, the Australian Temporary Resident exemption, is more or less indefinite or until the point you either become an Australian citizen or marry or cohabit with an Australian citizen.

A bewildering brouhaha

In the run up to the Budget, there's been a quite bewildering to me brouhaha over who can or cannot attend the Budget Lockup. It's really surprising that Treasury would get itself dragged into such a controversy with its unpleasant tones of attempting to silence critics. I do think as a result of that, together with the pay equity issue, Thursday’s Budget Lockup could get a little fractious. I certainly think the Parliamentary ‘debate’ will be particularly rowdy.

What does happen in the Budget Lockup?

Thursday should be my 15th Budget Lockiup. I've attended every single one since 2010 other than the COVID affected 2020 Budget. The routine is that we get access to the Budget documents at 10:30 and then we have about 90 minutes to analyse them before the Minister of Finance (and several colleagues) comes in to give a speech and answer questions. After that Q&A session Treasury provides lunch, and everyone finalises their analysis for release at 2 o’clock when the Finance Minister starts delivering the Budget to Parliament.

To be honest, I don't know why the Finance Minister bothers with a speech to analysts. We've all read the material and frankly it's much more interesting to ask questions about particular details. Obviously, finance ministers all want to sell the big picture, but for most in the Lockup, including myself, we're very much more interested in the detail.

This is why the Lockup matters; it's one of those few opportunities where experts can directly ask questions of the Minister of Finance and other attending ministers. The first few questions will go to the Press Gallery after which economists and other experts chime in.

It's quite interesting to see who attends the Lockup. I’ve sat next to next to overseas economists, analysts from the British Embassy as well as plenty of other colleagues from the Big Four and other various accounting and advisory firms. But the best part of the Lockup is the question and answer with the Finance Minister which I'm looking forward to as I think it could be a bit spicy this year.

Budget predictions?

I don't actually think that we'll see a lot of tax measures in the Budget other than possible accelerated depreciation changes. We might get more details about those changes previously announced in relation to the Foreign Investment Fund regime. As I said, I think the Lockup could be a little bit more entertaining this year and I do expect the Parliamentary debate to be more raucous than usual.

Tax Freedom Day

16th May was Tax Freedom Day according to business accounting firm Baker Tilly Staples Rodway. From this day onwards, workers will have paid their tax bill for the year and are now working for themselves for the rest of the year. Interestingly, according to Bake Tilly Staples Rodway the overall tax paid has increased by 4.66% on last year. That's despite the tax cuts announced in last year’s budget.

Happy Anniversary…to me 😊

May 16th was also the 32nd anniversary of my arrival in New Zealand, and for those who don't know my back story, I arrived on this day in 1993 as a backpacker, to follow that year's Lions tour. The All Blacks finished up winning that series 2-1. Despite that result, I had a great time, and I decided I rather liked New Zealand so I explored opportunities about how I could stay. The rest, as they say, is history. One of the key changes is these days I'm very much an All Blacks fan. Anyway, happy anniversary to me and many thanks to many, many people not least of all my wife Tina for what's been a fantastic 32 years.

And on that note, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā.

3 Comments

Terry Baucher is much more understanding of what the Greens aspire to accomplish with their alternative Budget than Jack Tame on Q&A (like a terrier snapping at ankles), the sneering Herald editorial 'A delusional alternative Budget from Greens is what we’ve come to expect', and, of course, comments from government MPs.

Thanks, Terry.

Im sure Terry understands that the Greens are self serving entitled communist leeches on working people, he's just too nice to say so.

Marama Davidson: Tomorrow, the Prime Minister will deliver a Budget built on rolling back pay equity, a Budget that takes money from our most vulnerable and places it in the palms of a wealthy few. I want everyone to know that it does not have to be this way, change is possible.Our plan sets out exactly what this change could look like and we are so excited to share this vision with communities across the motu [nation] as we take our Green Budget on tour.

https://www.nzherald.co.nz/nz/budget-2025-govt-spending-needs-to-fund-c…

https://archive.ph/63GqL

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.