The Green Party wants to reform fiscal responsibility laws to encourage governments to focus on building economic capacity, rather than obsessively maintaining low debt levels.

A discussion document published on Tuesday said the fiscal tools of the 1980s had not equipped the country to meet 21st century challenges.

The Public Finance Act and fiscal advice provided by the Treasury was overly fixated on the risk of debt, while ignoring the costs of underinvestment and long-term considerations.

“For decision makers and policy advisers, this creates a bias toward lower debt levels and higher operating balances than may be economically optimal, while understating the risks and costs of underinvestment,” the document said.

Chlöe Swarbrick, the Green Party co-leader, put it more bluntly: The Coalition Government was currently “borrowing for tax cuts, while actively contracting the productive real world capacity of our economy.”

A lot of the blame for this perceived problem was directed at the Public Finance Act and the neoliberal governments of the 1980s and 1990s who wrote the bulk of it.

The Act, which is considered to be a world-leading fiscal framework, was first introduced by Labour after the 1984 currency crisis and was expanded by Richardson in 1994.

Swarbrick said the Act was more about ideology and risk aversion than economics. Fears of repeating the debt crisis and the personal politics of Ruth Richardson’s reforms were now baked into Treasury's fiscal management system.

The Green Fiscal Plan discussion document argued Treasury had calculated an overly cautious debt ceiling, and that its fiscal models failed to recognise benefits of spending.

Raise the roof

Treasury’s current advice suggests the government should keep net core Crown debt below 50% of gross domestic product, in order to retain a 40% buffer for responding to economic or natural shocks.

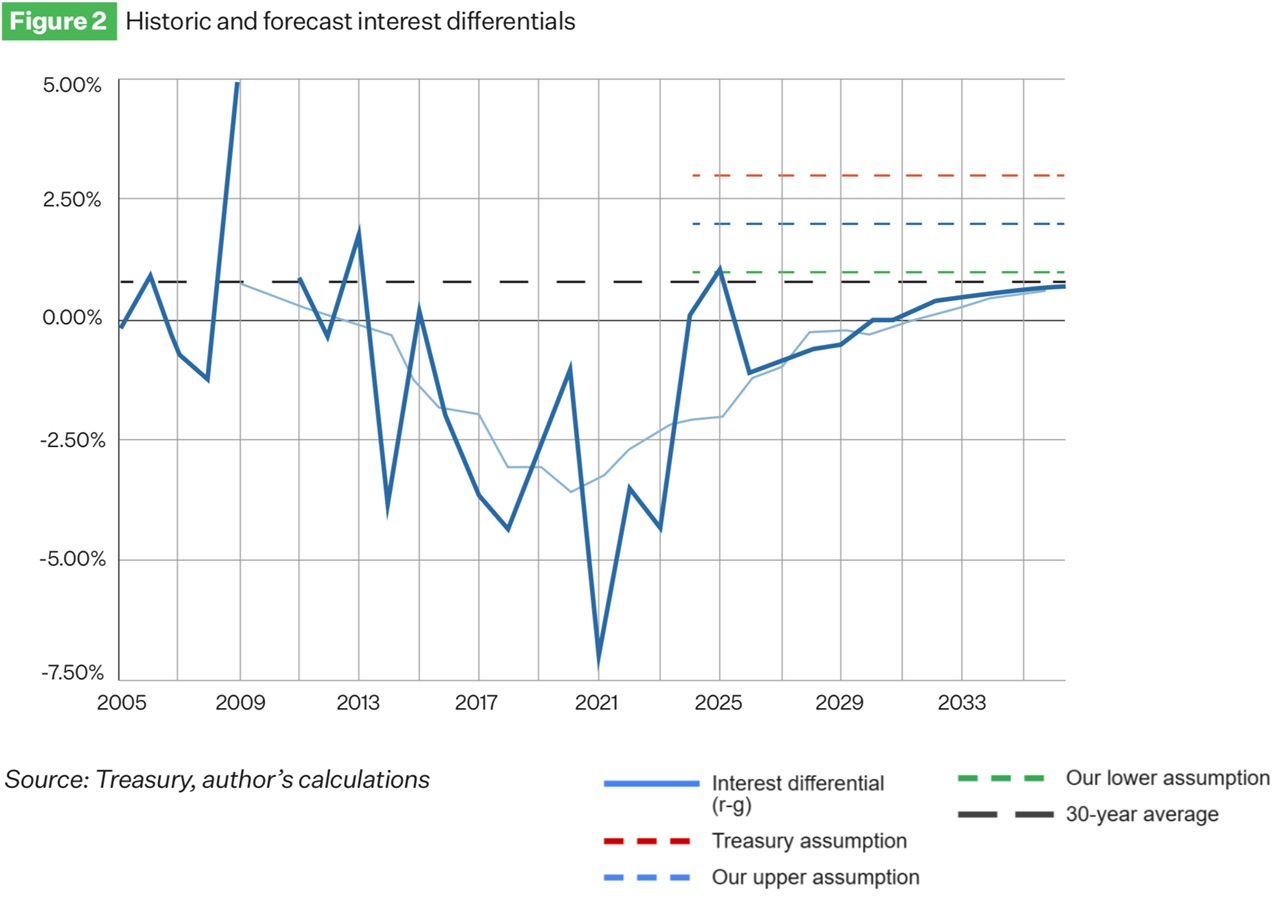

The model it uses to calculate this assumes interest rates could exceed nominal economic growth by 3 percentage points, and that the Government could run a surplus before interest costs of up to 3% of GDP after a crisis to stabilise debt.

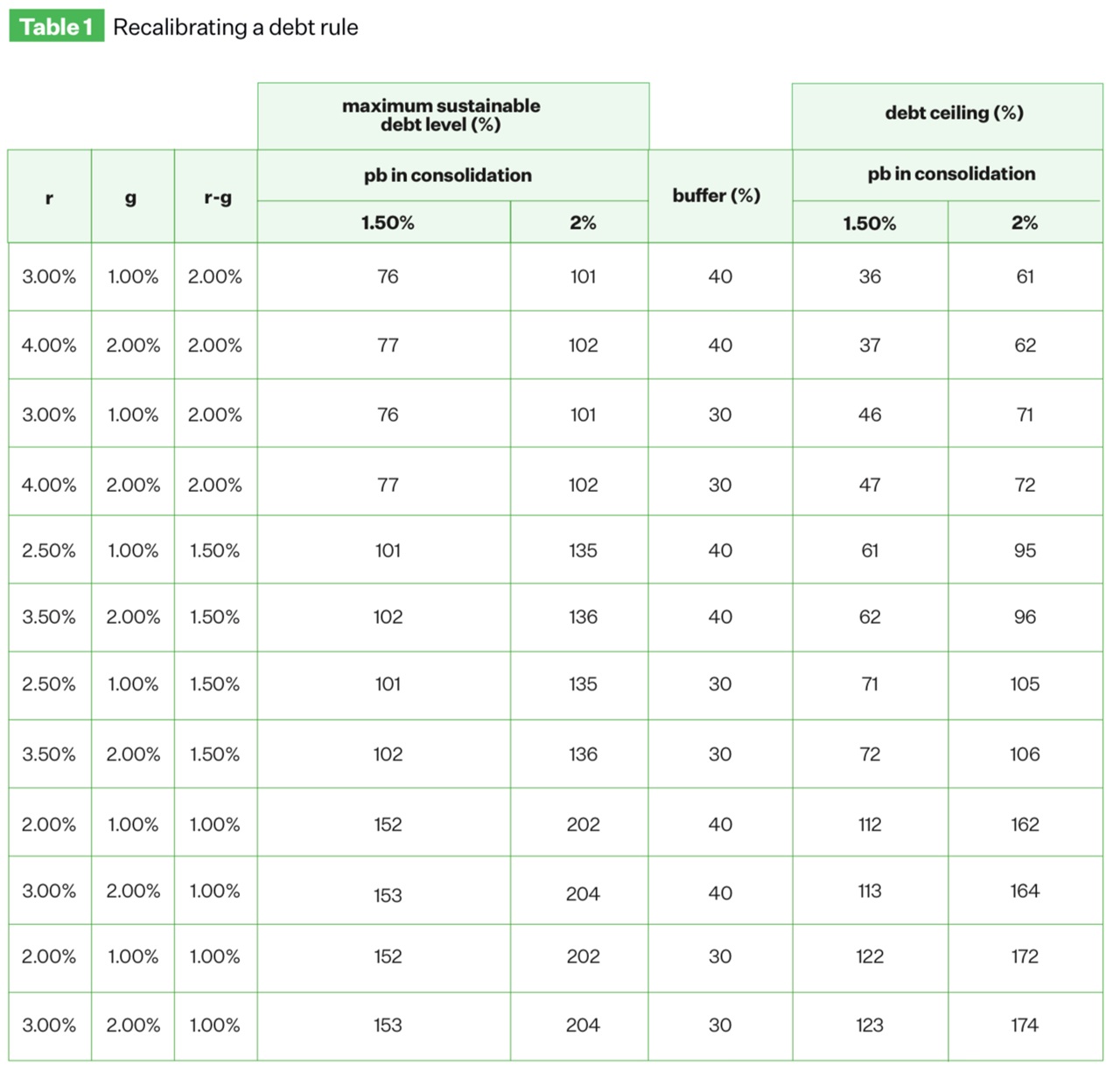

The Green Party argues these assumptions are unnecessarily conservative. A 40% debt buffer would be enough to cover two Covid-19 shocks shocks at once, or more than 23 simultaneous Cyclone Gabrielles.

Additionally, the long-run average interest rate was only 0.8 percentage points higher than growth between 1991 and 2021. Treasury itself described the 3% used in the analysis as “a tail risk scenario”.

Essentially, Treasury’s model prepares for an unprecedented extreme shock. Such as a pandemic, a financial crisis, and a major earthquake all happening in quick succession.

The Green Party says if the buffer were lowered to 30% and the interest–growth differential was set at 1% instead of 3%, the country could theoretically borrow up to 174% of GDP.

It also argues investments which make the economy or infrastructure more resilient to shocks could also help to reduce the buffer needed to respond to them.

The discussion document outlines a range of possible debt ceilings—from 36% to 175% of GDP—depending on the assumptions and risk tolerance applied. Based on long-run averages, the sustainable ceiling could be as high as 122% of GDP.

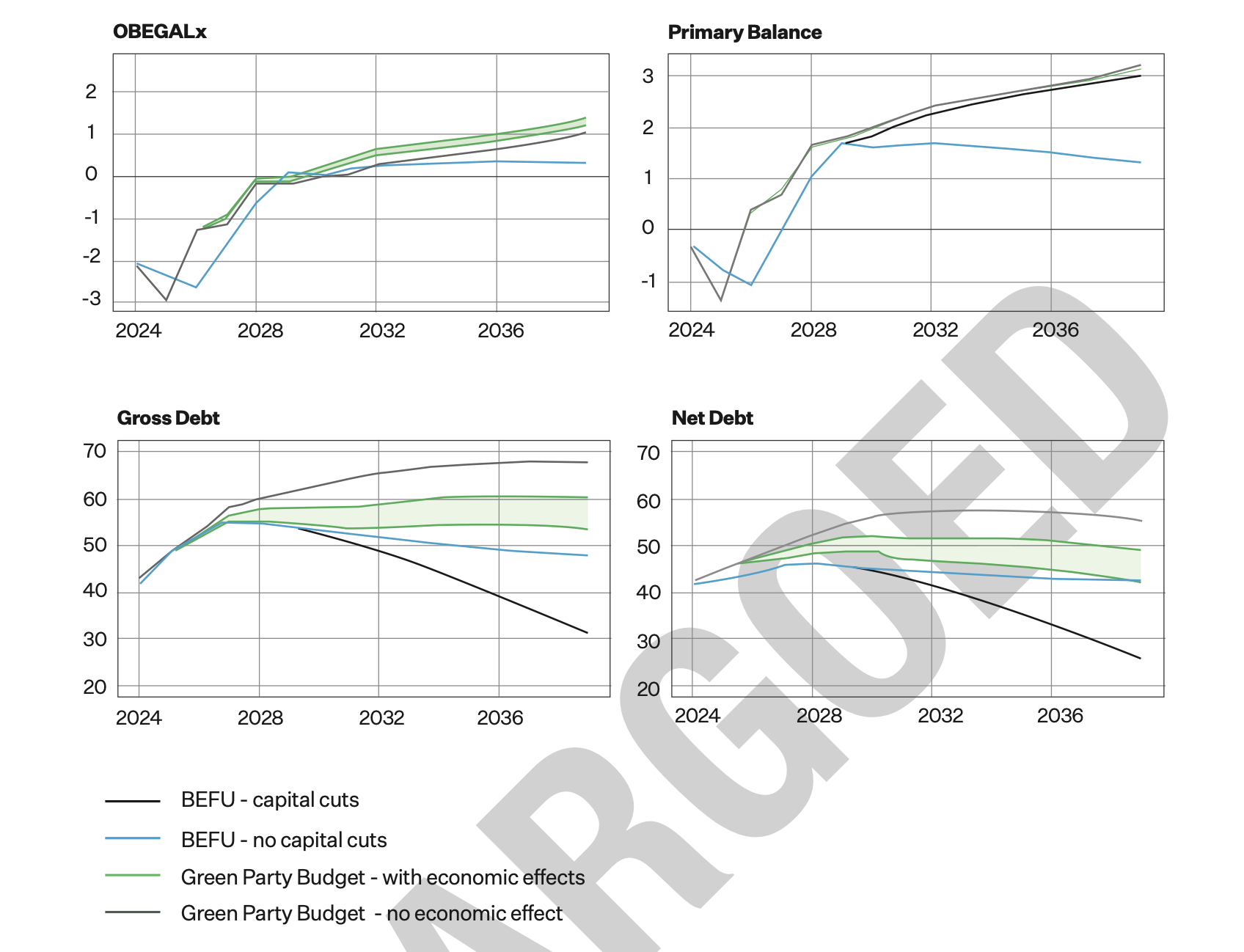

However, the Green Budget released last month only suggests lifting net core Crown debt to 53.8% and well below theoretical limits estimated in the fiscal discussion document.

Systematic pessimism

Beyond the debt ceiling, the Green Party also believes Treasury’s fiscal models don’t properly account for the economic benefits of spending and focuses primarily on the costs.

Models used by Treasury to inform government decisions rarely factor in long-term productivity gains and other “notoriously difficult to quantify” positive externalities — but the short-term fiscal costs are measured with absolute precision.

“These might be more accurately called accounting models, rather than economic models… Public spending is represented in these models as money thrown out the window, having no macroeconomic effect,” the document says.

Public finance laws should be reformed to encourage Treasury to do more analysis of the costs of underinvestment and the possible benefits of spending.

“If meeting fiscal targets results in the productive sectors of our economy shrinking, our planet burning and half a million New Zealanders using foodbanks each week, we need to rethink those targets,” Swarbrick and Marama Davidson said in a statement.

The party acknowledges the fiscal responsibility rules served a legitimate purpose after the 1980s when the government came “dangerously close to defaulting on its debts” but worries the emergency response has become a permanent policy.

The Public Finance Act has no provision for fiscally responsible debt levels, or requiring capacity enhancing investments. A requirement to consider future generations is interpreted mostly as a call to limit the debt burden, not build assets or capabilities.

“This is a one-sided intergenerational accounting that emphasises financial liabilities over the productive capacity, climate resilience, and infrastructure that will have a much more significant impact on future generations’ economic prospects.”

Defending neoliberalism

In an interview this weekend, Ruth Richardson told TVNZ that responsible fiscal management was mostly about not racking up debt or running persistent deficits.

“Controlling spending often comes down to one sheer capacity to absorb hatred, because the public believes if you spend more money, you get more goods, when the reverse is true,” she said.

She argued the country had been on track for another debt crisis, similar to the one in 1984, when she passed her infamous 1991 budget, which is often blamed for a lasting increase in poverty.

“The real poverty was New Zealand's if we had done nothing. If we had done nothing, then New Zealand would have most certainly faced the crisis that the Labour government did in the mid 80s,” Richardson said.

“And, in a crisis, the people who are hurt most are the poorest people, the people on the bottom of the rung.”

Swarbrick and the Green Party disagree. They see an opportunity to broaden the definition of “investment” to include health and education spending, which can lift people out of poverty and save money in the long run.

“These investments generate returns over decades through higher workforce participation, increased innovation capacity, and reduced social service needs,” the document says.

“Conventional fiscal frameworks struggle to capture these long-term benefits, leading to systematic underinvestment in human capabilities”.

21 Comments

They're not GREEN anymore.

They're socialist - tell them to re-name.

And the idea of going deeper into debt is really the idea of spending now, at the expense of future options (this being a finite planet). So it's an advocation for stealing from the future.

Make no mistake about that. But of course, the current Government is more guilty in the same regard. You cannot 'lift people out of poverty', without increasing your physical impacts (extraction, consumption, wastes) on the planet. Which is why this echelon has tacitly abandoned 'environment' from their discussion. The fact that we're all dead without it, seems to escape them. As it does the clowns currently running the show.

Damn. Your first 3 paragraphs took the words right out of my mouth.

...I'd probably say they're more communists than socialists. And they've been watching MMT YouTube clips so trying to steal their parents credit card, using their parents wealth tax to pay interest on the debt

Nothing in the world is more dangerous than sincere ignorance and conscientious stupidity. So said Martin Luther King. What MMP ushered in by means of Jeannette Fitzsimmons and Rod Donald was both worthy and needed. Not anymore, quite the opposite in fact. The party’s movement has simply been hijacked by a set of strident malcontents relying on a spiteful and vindictive doctrine as has been well displayed by the recent fall outs in the ranks. Quite honestly parliament would be a better place without them. Thankfully the electorate is not blind and resultantly the Greens have been sidelined and that will undoubtedly continue.

When Martin Luther King Junior said 'Nothing in the world is more dangerous than sincere ignorance and conscientious stupidity' he might have had you and other commenters here in mind, rather than the Greens.

https://jacobin.com/2023/04/martin-luther-king-jr-mlk-socialism-class-r…

I wish they had been watching mmt clips. They are trying to do progressive economic policy within the constraints of broken dogma. They don't appear to know that:

- Govt debt consists of financial assets (settlement cash and bonds) that the Govt have spent into the economy (creating private sector savings).

- The 'debt' is just the amount Govt has spent minus the amount they have taxed back (aka residual cash).

- NZ Govt has a net positive financial worth and the interest & dividends it collects on the private sector financial assets it owns almost completely cancel out the interest it pays on debt.

- It is our private debt level that is unsustainable - it creates a huge flow of cash from businesses and workers to savers and Aussie bank equity holders.

- Our current account deficit with the rest of the world drains $25bn a year of financial assets from our economy. This is only sustainable if we are increasing private and public debt by more than that. This simple maths should be taught at high school.

The Greens of all the parties should be talking about the economy in real resource terms - i.e. how we use our real resources to improve our quality of life.

Two great comments in a row.

Fitzsimons I think saw the hijack coming, roped in Bradford (and you wouldn't have called them easy bedfellows) and went to the AGM hoping to deflect the Davidson-led putsch. And obviously failed.

Swarbrick represents a young echelon who have no imperative to reproduce, and little hope of affording a nest anyway. Hence rainbow. That deflects from existential to personal comfort - and there you have the complete transformation. 'Rights' and 'we deserve' are the same anthropogenic arrogance that the 3-Clown Circus advocates, both are wrong.

Swarbrick represents a young echelon who have no imperative to reproduce, and little hope of affording a nest anyway. Hence rainbow. That deflects from existential to personal comfort - and there you have the complete transformation

Personally, I think they represent nihilism. They have some parallels with my train of thought about society. They would probably not like that association though.

Debt. You greenies might love it, I don't.

A government should not need to borrow. They are different from you and I, being so big that big chunks are not big chunks for them. More like daily expenditure when a few billion comes along. Those come along weekly.

As an individual getting a mortgage is necessary because a house say is many times my annual income. And houses are not weekly.

Borrowing to pay your weekly bills is madness. A government having debt the same.

(Just so you know, calling interest.co common taters 'greenies' was a joke)

"As an individual getting a mortgage is necessary because a house say is many times my annual income."

Why do people never question this "necessity "? Seems entirely idiotic to push prices up purely to pay banks for the privilege. I guess it's like many things we just accept without question, like endless necessity for growth.

Too true, Redcows.

Comparing the median house price to median salaries as of January 2025, the ratio was a mind-numbing 10.7x. IOWs, the equivalent of 10.7 years of total income.

In the US the ratio is 4-6x annual salary in many regions.

Low interest rates post the Covid scandemic drove price surges in property prices too with NZ's numbers being more a reflection of interest rates which were -14% off the peak, whilst Ausies high migration stats, and US longer-term fixed mortgages supported higher prices.

Median House prices compared to median net salaries paint an even worse picture...

NZ 15.8x

US 8.0x

Australia 15.8x

Regards

Col

I got a mortgage when I first built a house when I was in my early twenties. It cost three times my annual income. Only three times.

But I still needed a mortgage. It was still many times my annual income

When government builds some tunnel or new motor way it might be billions. But that might be only a few days of it's annual expenditure. Equivalent to a trip to the supermarket.

For me to get a mortgage for daily groceries is very stupid. Micawber will tell you that. The government getting a loan for the equivalent of groceries is also stupid.

When government builds some tunnel or new motor way it might be billions.

Correct. They're just numbers. Big numbers. And can only really be interpreted properly by the hoi polloi when expressed in exchange for human labor.

Saying a govt should not need to borrow is the same as saying a Govt should not spend. Govt go into debt when they spend. The $9bn of physical cash in circulation is 'Govt debt'!

I guess what you mean is that Govt should not spend more than they tax back. That would mean relying on a current account surplus and/or expanding private debt to support domestic saving and a functional economy.

Both of you are accounting in the wrong thing.

:)

Governments 'budget' the expenditure of future energy and future resources. They do so mostly in ignorance of whether such will exist and in total ignorance of whether they will exist to do maintenance in the mid-long term.

The 'repayment' will be a tithe - a portion - of the work done to stuff in the future, a process we call 'tax'. Those folk too, are blind to the real stocks of resources and energy available to them in the future. But combined, government and taxpayers are still betting on 'more'in the future, to square the books.

The combined 'debt' (expectation of more in the future) cannot be repaid at some predictable planetary-depleted point, it's a physical demand without a physical underwrite. So it wholly or partially defaults, over short or long time.

Over complicating it there JonnyFoe. You might be right about the two sided accounting.

But certainly. Government needs to spend only what it get in. Or less. No need for the debt.

Even if this is correct you’re assuming that by spending more you will at some stage get to a point where you can then stop the excess spending, and then use the ensuing surplus to either service the debt or pay it down. But if we can’t do that now what makes the future any different. Especially with the aging population?

Can you imagine the kinds of tax payer funded schemes this party would cook up if there were the government. 🙄

Can you imagine the kinds of tax payer funded schemes this party would cook up if there were the government.

This is the problem as I see it. If you take a look at their collective world experience, they have little in creating and / or building things. They would say that it is the responsibility of the public service. But leaders must be visionaries and motivators to see successful outcomes.

But leaders must be visionaries and motivators to see successful outcomes.

Additionally, they must hold those entrusted to do the actual work to account for timeframes, costs etc.

Swarbrick can't see the wood for the trees and in doing so advocates for more of what got this country into a debilitating debt trap in the first place. She completely ignores the fact that as long as NZ borrows from the global private banking cartels and needlessly pays out billions of dollars annually in unearned rent, we will continue to dig our own grave.

Where-ever you care to look in the Western world, the trend is a relentless buildup of hard-core debt as the global moneychangers continually tighten the noose around the neck of the working class, and erode the purchasing power of our fiat token currencies, which have all lost more than 98% of their purchasing power.

Total Debt

Swarbrick preaches from the same book as the rest of the incumbent parties, obfuscating the core problem by focusing on relatively moderate Govt debt rather than talking about total debt* which hovers between 570-670% of GDP over the last 15 years.

*(Total debt is calculated as total liabilities minus equity, investment fund shares, and financial derivatives,

You can see how the rot has set in since the GFC in 2008 - as of December 2024, national government debt was USD 111.4 billion - up by the best part of 600%.

These are based on CEIC figures which are not always updated as quickly as one would like - however, they are independent - IOWs there is 'no book to talk' and as such provide an objective measure of some very sobering trends - clearly, because of NZ's MS creation model, we are digging ourselves a giant debt hole.

All-time high: USD 118.8 billion (September 2024) - 44.3% in Sept 2024

Record low: USD 21.4 billion (September 2008) - 16.6% in June 2008

External debt

As of September 2024, external debt reached USD 246.4 billion (86.4% of GDP), up from USD 227.1 billion in the previous quarter. The all-time high was USD 246.4 billion in September 2024, and the low was USD 36.3 billion in March 1993

Household debt

Household debt was USD 215.0 billion in December 2024, accounting for 89.9% of GDP in September 2024, up from 89.5% in the previous quarter. The peak was 98.5% in March 2021, and the low was 27.9% in December 1990.

Government debt Itemised

#1 National government debt as of December 2024 was USD 111.4 billion, down from USD 118.8 billion in September 2024. This covers sovereign-guaranteed debt only.

Historical data...

The all-time high: USD 118.8 billion (September 2024)

Record low: USD 21.4 billion (September 2008).

As a percentage of GDP, government debt was 44.3% in September 2024, up from 41.9% in the previous quarter.

The peak was 44.3% in September 2024, and the low was 16.6% in June 2008.

#2 Net Core Debt - (Represents gross sovereign-issued debt (GSID) minus core Crown financial assets, excluding NZ Superannuation Fund (NZSF) assets and advances, as these are less liquid or held for public policy reasons).

As of June 30, 2024, net core Crown debt was NZD 175.5 billion (approximately USD 106.0 billion at an exchange rate of 0.6043 USD/NZD), equivalent to 42.5% of GDP. This increased by NZD 20.2 billion from the previous year (39.3% of GDP).

#3 Gross Sovereign-Issued Debt (GSID)... GSID includes debt issued by the core Crown, including government stock held by entities like NZSF, Government Superannuation Fund (GSF), Accident Compensation Corporation (ACC), or Earthquake Commission (EQC), without eliminating internal cross-holdings.

As of February 29, 2024, gross debt was NZD 166.8 billion (approximately USD 100.8 billion), or 41.2% of GDP, which was NZD 5.4 billion higher than forecast due to additional short-term borrowings (e.g., Euro Commercial Paper).

#4 Total Crown Gross Debt - Includes debt from core Crown departments, ministries, Offices of Parliament, the Reserve Bank, and NZSF, but excludes state-owned enterprises (SOEs) and non-guaranteed Crown entity debt.

This represents total borrowings (sovereign-guaranteed and non-sovereign-guaranteed) of the total Crown. As of June 30, 2020, gross debt was NZD 101.5 billion (33.6% of GDP), forecasted to rise to NZD 159.7 billion (43.9% of GDP) by June 30, 2024.

OUTLOOK

None of the incumbent parties have a clue. They all pay homage to the status quo Western system of debt bondage for the working classes. This has created this insidious financialisation of the NZ economy because of the way we outsource the creation of the vast majority of our MS.

This is bad enough, but they all seem to be completely oblivious that ALL Western fiat currencies are being thrown under the bus and that the new global financial paradigm will be built on a system of hard-backed national currencies.

An overwhelming global reserve currency, doubling as a national currency, was always a bad idea, especially since all currencies became fiat in 1971. NZ has had ample warning to get its house in order for the new financial architecture, and like the U$, UK, Australia, and Canada, we have done less than zero to prepare for this monumental change.

Expect some major shocks in July following the enforcement of Basel lII NSFR, and the BRICS Summit in Rio, Brazil, July 6-8th - that's NEXT MONTH!

Add into the mix...

#1 Trump's, tariff/trade war declared on the entire planet.

#2 The Ukraine, Israel, Iran, India/Pakistan, and Taiwan hotspots that the US has orchestrated to try to nobble the BRICS initiatives, which are far and away the most monumental development in trade/payment systems/logistics/security and multipolarity in the history of our species. This adds enormous risk to holding Western sovereign debt, and many of the corporate bonds as well.

#3 The increasing difficulty in the US being able to sell any long-dated debt and the increasing need for risk-weighted yields for buyers of paper with increasing counterparty risk. The entire Ponzi will begin its final collapse as soon as yields reach much beyond the low 5%s. In my lifetime I can recall U$ bonds in the region of 16% and UK Gilts in the mid 15%s. That was an era when total debt figures were exponentially lower than they are today, and allies could club together to avoid a systemic global meltdown.

#4 Ballooning US deficits and bond yields and no tools left in the toolbox, let alone any global entity with the means (plus the inclination) to bail them out.

Hold onto your hats for the wild ride

Col

One mention of productivity - and the GDP per-person figure is actually declining in both relative-to-others terms and absolutely, meaning we are doing less with more, when the reverse is what we desperately need in everything from decarbonising ourselves to building houses to greater income equity. The absolute GDP growth has been propped up by immigration, but that's grinding to a halt - unless the Greens are proposing mass immigration?

Without improving productivity, how in the world could we support high debt levels - or persuade others to loan to us, considering we appear to be slowly sinking under the weight of our own inefficiency?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.