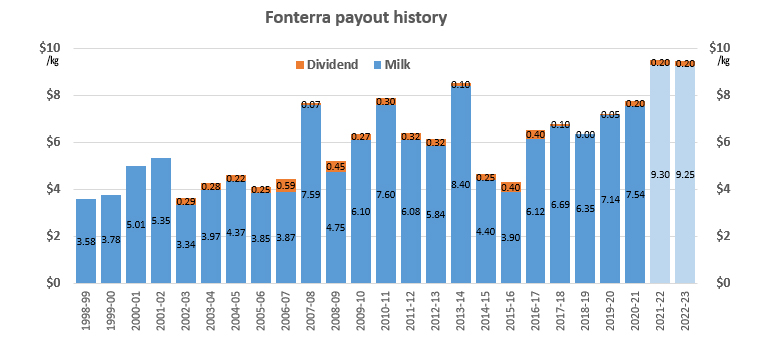

Fonterra has announced it is trimming its milk payout forecast for the 2022/23 season by -25c to a mid-point of 9.25/kgMS.

The new range is $8.50-$10.00/kgMS.

However the current advance payment rate of $5.70 per kgMS remains unchanged.

The dairy giant said “the change in the 2022/23 forecast Farmgate Milk Price will be disappointing for our farmers but it reflects a number of factors, including the recent downward trend in global dairy prices driven by some short-term softening in global demand, and the general impact of inflation on purchasing behaviour. However, we believe the longer-term outlook for dairy remains positive.”

Fonterra will release its financial results for the year ending 31 July 2022 on Thursday, 22 September 2022.

You can compare Fonterra's payout rates with other company announcements here.

8 Comments

The list will be long, but in the next decade I think the essentials in life will become more evident and their ability to make a claim on the average household income vs those that are nice to haves.

How much pass on cost can Fonterra's customers afford whilst transitioning off of coal amongst other parts of their operation that rely on carbon emissions?

How essential is dairy to the average household?

Cannot see quality dairy based baby and toddler formulas going anywhere in the future.

Any particular reason why? FYI, across Asia, local brands of dairy-based IMF are starting to get traction. And there are also some good players out of Japan. Less sophisticated than the MNC brands but there is a strong trust level among Asian consumers with Japanese brands.

Interesting. Was contacted by a dairy mkt intelligence / consulting firm out of Chicago this week to try to understand why exports of milk powder to South East Asia from NZ are so high at the moment. Consumption growth is sold but not spectacular. Furthermore, shelf product of local mnfers appears to be positioned at low margins compared to foreign brands.

China stockpiled through 20/21 as a Covid hedge, Fonterra stockpiled the first 6 months of this year to counter reduced demand and now needs to dump product.

All of that info is publicly available just never mentioned in MSM.

China openly saying they have been stockpiling through 2020/21.

GDT down 10 of the last 11 auctions.

Look to 2015 2016 to where it will end up.

And everyone in denial once again.

Scott, I'm not sure down on the farm we are in denial. Most of us remember all to well what happened after we got $8.40 in 14. In saying that lot's of guys and girls said last year it doesn't matter how it costs $10 payout. I'm interested in where feed prices are going to go, especially the price of grain.

The logical response then is for NZ collectively to reduce the amount of imported feed, move down from system 5 to 4 or 4 to 3.

When you supply 75% of the global trade in WMP, you control the prices.

Lower production will result in a higher farmgate milk payout and higher farm incomes, even with lower production.

We have already seen this over the last couple of years with flat/reduced production.

And don't answer others will pick up the slack. No they won't, at these higher feed costs and with growing environmental backlash in the main exporting countries.

The key is a collective effort, instead of the BS premise each farmer increasing production until the marginal cost of production reaches the marginal revenue will maximise farm profits.

No it won't, collectively it minimises farm incomes.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.