New Zealand meat exporters have been through their first month of Donald Trump’s tariffs, and appear to have emerged relatively unscathed.

However, industry authorities say it is still too early to make a definitive pronouncement, and an agricultural economist warns there are still dangers ahead.

These comments follow the latest release of export figures for sales of red meat for the month of April by the Meat Industry Association (MIA).

They show sales of red meat to the US fell month on month in terms of both volumes and value. However, the MIA is attributing this to seasonal variations, not to tariffs.

Year on year, sales to the US surged, with earnings for the month worth $344 million, a 39 % increase from April last year. This annual figure is still a monthly fall, from the $398.2 million earned from American sales in March, but the impact of that monthly change is abated by the fact that March 2025 was a global record for any month of any year.

“We’re still determining the full impact of the decision to impose a tariff on exports to the US,” says the chief executive of the MIA, Sirma Karapeeva.

Those tariffs, at 10%, came into effect on April 2. Though their effect is still not clear, there has been speculation that the impact of tariffs will be heavily diluted. Mixing American beef with New Zealand beef for hamburger patties could halve the effect of tariffs on the final price of a hamburger. Adding the cost of the bun and the wage and capital costs of a hamburger restaurant would dilute the impact of the tariffs still further.

But the final verdict is still unclear.

Overall, the MIA is pleased with global sales levels.

The figures show the red meat sector earning $1.21 billion in the month, a 34 % increase year-on-year. They reveal growth in almost all major markets. After the US, the next biggest market was China, with sales worth $253 million, up nine per cent, the UK at $81 million, up 56 %, the Netherlands at $60 million, up 96 %, and Germany at $54 million, up 160 %.

The overall figure was a slight fall on March, from 1.26 billion, to $1.21 billion, though that came off a record month.

“This is great news for the New Zealand economy, especially for those rural and regional communities across the country that rely on the meat processing and exporting sector,” Karapeeva says.

“There is a strong demand for red meat globally.”

Breaking the figures down further, sheepmeat volumes and earnings rose year on year. By contrast, beef volumes fell year on year, but earnings rose 21 %, due to big price rises.

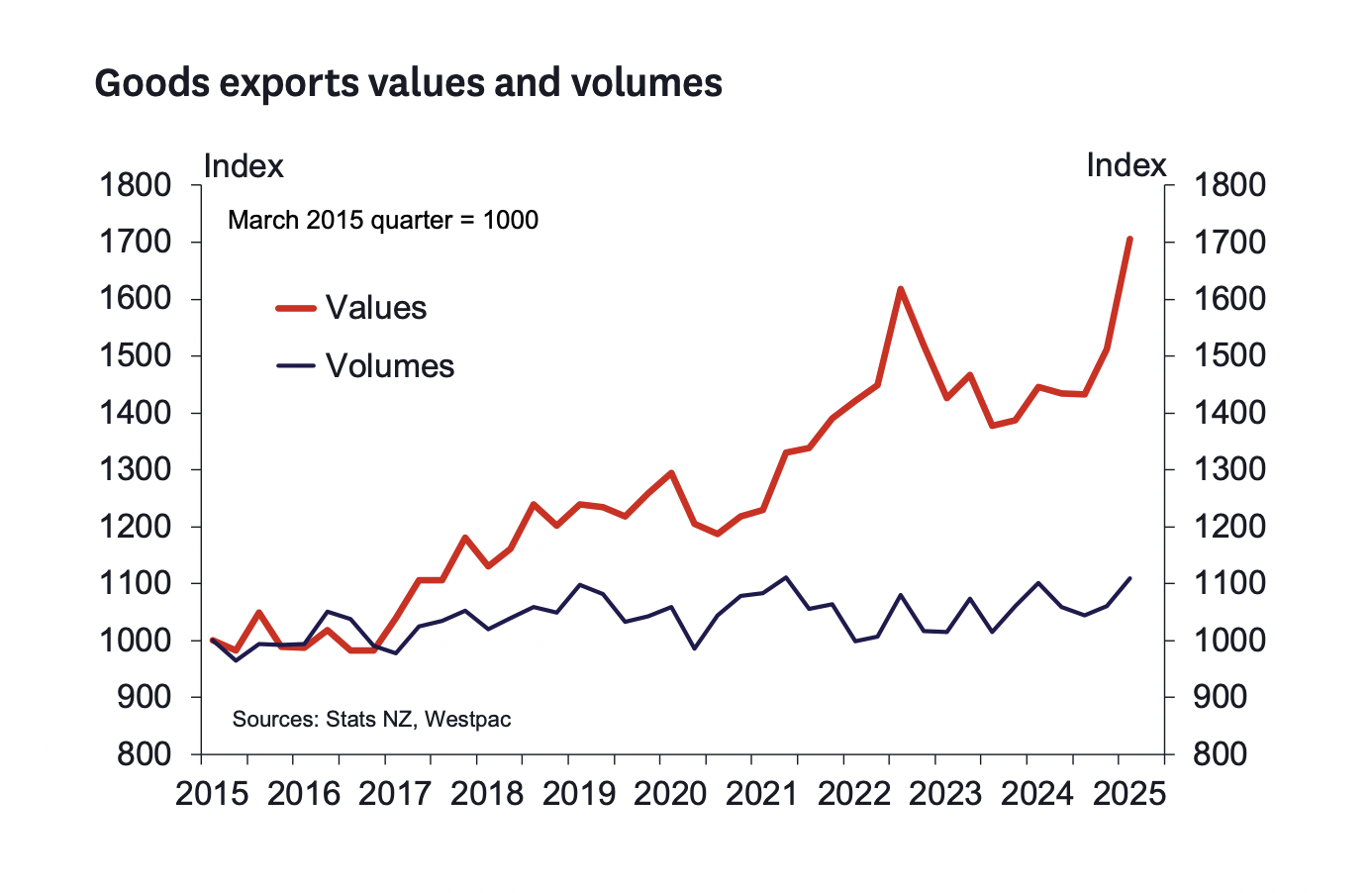

This follows a process that dates back a decade or so, with prices surpassing volumes in New Zealand’s agricultural trade.

The news from the MIA comes after Westpac’s agricultural economist Paul Clark warned of the need for New Zealand farmers and processors to work hard to overcome any potential impact of the US tariffs.

“At first blush, revenue from New Zealand’s agricultural exports could fall as much as $500 million directly because of the imposition of tariffs,” he says.

“But actual direct impacts are likely to be a lot smaller. How much smaller depends on a several factors, including how the (exchange value of) the New Zealand dollar performs. Currency weakness could partially offset the impact of tariffs. The opposite is also true.”

Clark says another factor could be changing demand in the US for specific goods, and he thinks lean New Zealand beef is unlikely to figure in such changes. He adds that the effect of the tariff is likely to be shared, with the US importer and more likely the final customer paying the lion’s share.

Clark meanwhile adds a warning.

“The redefining of global trade relations following changes in US tariff policy that could well dampen commodity prices over the coming year, placing downward pressure on on-farm profitability. To see off this threat, the sector should diversify into new markets….and transform farming practices through the adoption of new digital technologies."

1 Comments

The ratio of the ingredients that make up the final cost of a hamburger have not changed. In other words the percentage of it that is blended in from NZ lean beef will be increased by the tariff if it is paid by the importer and then passed on to the end user. NZ’s supply of grinding meat to Nth America is established, trusted and needed. It would be interesting to canvass the various NZ exporters to ascertain whether they or the importer are meeting the cost of the tariff or perhaps even sharing it? A simple question but highly doubtful that a simple answer would be forthcoming. But if the NZ exporters are in fact paying 100% of it then obviously it reduces their return and the cost of producing that hamburger is unaffected.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.