By Eric Frykberg

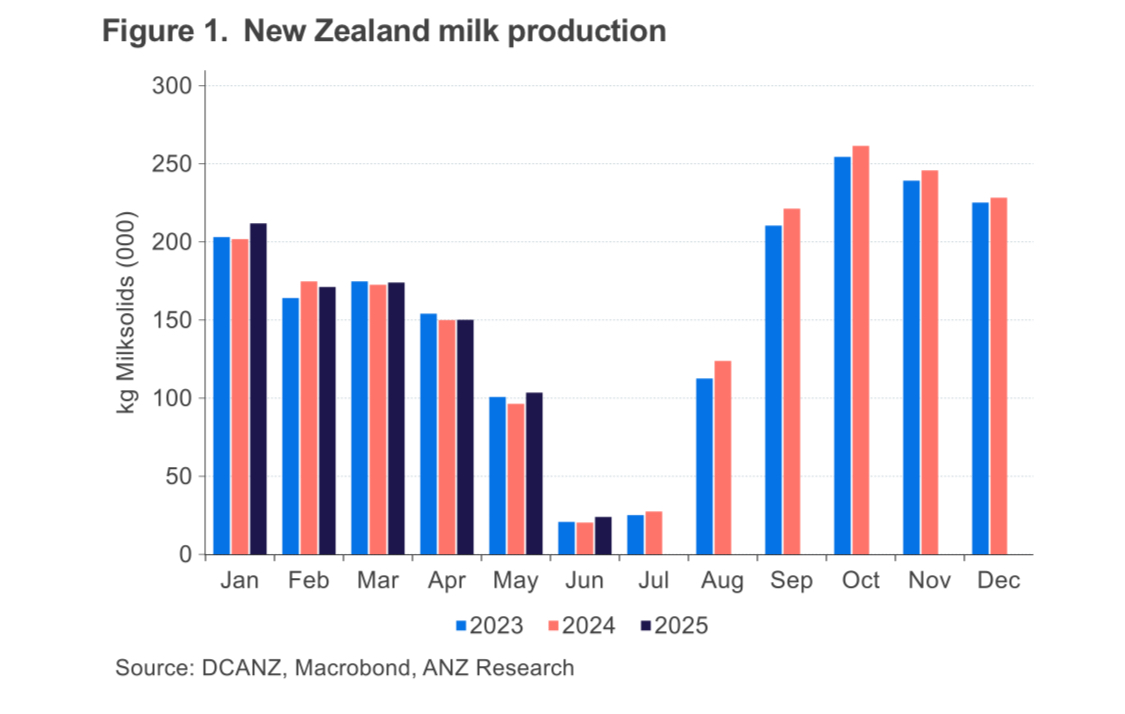

ANZ economists say milk solids production rose sharply in June and are predicting a strong spring.

The production of milk solids for June rose 17.8% compared with the same month last year.

June is usually a poor month in production terms due to cold weather. However, the figures give good grounds for hope that the entire 2025/26 season will be a strong one.

“The stars are aligning for a strong spring – from August to October – led by a signal from the market that the world needs more milk,” they say.

This has helped drive up global dairy prices, which encourages farmers to increase production, and is reflected in Fonterra’s opening price of $10.00 per kilogram of milk solids, up on last year’s figure and up from just $6.69 in 2017 to 2018.

ANZ's economists also point to strong pasture growth, helped by a recovery from the drought conditions that hit Waikato and Taranaki from January to March.

They add more cows are becoming pregnant within the desired time-frame of six weeks, fewer animals are being culled, or are being culled later, and more are being held over for another year’s milk production, which all adds to a positive output from farms.

Another indicator of growing output is a 34% increase in imports of palm kernel expeller (PKE).

These are the dried husks of the fruit of the palm tree, after they have been crushed to extract palm oil. These husks are exported from South East Asia for use as a feed supplement in in New Zealand.

On an annual basis, the ANZ team say last season’s milk production was up 3.0% on the previous year, which was the largest year-on-year improvement since 2014/15.

“It is hard to make large gains two years in a row, but with the stars aligning, growth of 1-3% should be attainable in 2025/26 if the weather co-operates,” the economists say.

The strong outlook for the dairy industry follows a similar robust outlook for the beef industry.

But while beef faces actual and potential problems with rising American tariffs, the dairy industry is relatively safe.

“The US has a relatively small market for New Zealand dairy, but is it is a high value, low volume, market,” says ANZ economist Matt Dilly.

“So, some of that trade will be resilient to potential tariffs, as long as they’re not too high.”

Dilly adds there are other factors assisting the New Zealand dairy industry. Among them is insufficient production elsewhere, creating a global shortage.

“Milk prices have been high for a little over a year now and grain prices have been low.

That doesn’t matter for New Zealand, but it does matter for other milk producers that have more of a feedlot dairy system. Now, if grain prices are low, then the profit signal should be telling everybody to make more milk, but for one reason or another that hasn’t been happening enough over the past year. So, these frictions are starting to build up.”

Dilly say dangers facing producers in other countries may benefit the New Zealand industry.

“There are other markets that have been having trouble with weather or with animals.

"There has been really bad weather in South America. Last year there was bird flu in North America, which affected dairy farms. And in Europe the Bluetongue virus outbreak had an impact.

“So, dairy farms (overseas) are trying to expand production, but in some cases, they are struggling.

"That leaves us in a good situation, where dairy returns are above the cost of production.”

17 Comments

All eyes on rich dairy farmers. If they make one dollar a kg and sell 100,000 kgs that's $100,000 profit on a 5 million +/- investment

You forgot they have to pay tax on that $100,000 profit

My point is that 2 percent return isn't enough for the inherent risks. Still, you can't beat a great day on the land

At the current prices the gross profit should be more like $3-$4.

But yeah you don't make a killing relative to the energy expended.

What about from an investment angle after staff or sharemilker is paid

Depends on the farm. Same farms are profitable at $5.5 a milk solid. Some can't make a profit at $8.

Well managed dairy farms are making excellent returns on investment given current pricing , up from good returns in recent years.

They deserve credit given the weather conditions this year. Farmers who had a drought got off lightly compared to the many in severe drought

Pedant - PKE is the crushed palm kernel - to extract palm kernel oil. The "husk" is palm kernel shell (PKS) which is used as a coal substitute. Five products - palm oil, palm kernel oil, palm kernel expeller, palm kernel shell and empty fruit bunches (EFB).

The shame of having to edit a pedantic comment!

PKE is a different product to all four products you mention here.

Sorry, yes, five products - I forgot to add PKE!

keith,

Another indicator of growing output is a 34% increase in imports of palm kernel expeller (PKE).

Where do you stand on the issue of PKE? Am I right in thinking that we are one of, if not the largest importer? I must assume that there is no suitable alternative for our dairy farmers. Is there a reputational risk?

I could be wrong but from what I have read we are a small player.

June production gives no indication for the coming season. The drivers are quite different.

History tells us that predicting prices for the whole season based on what we are seeing early in the season is a high risk bet. The whole-of-season price could be $8 or it could be $12 or anywhere in between. That is the nature of commodity markets.

KeithW

Hence why dairy farmers are inherently cautious with their spending?

"Another indicator of growing output is a 34% increase in imports of palm kernel expeller (PKE)."

"Each year, New Zealand imports about 2 million tonnes of palm kernel expeller (PKE), a by-product of palm-oil processing in Indonesia and Malaysia, to feed dairy cows, at a cost of NZ$800 million."

https://www.canterbury.ac.nz/news-and-events/news/palm-kernel-product-m….

Thank goodness for our agri sector - all forms from dairy, livestock to horticulture, viti etc etc. NZ would be completely stuffed (versus mainly stuffed) without the export dollars earned by agri. Coupled with our only other major export, tourism, these two activities comprise 90% of our foreign earnings. It is these earnings that the rest of the economy then plays money merry-go-round with and political parties fight over dividing up the cake. Shame those parties dont focus on growing the cake - starting with exploiting our minerals, if we want incomes to rise to match other western countries.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.