Understanding China

Lee Jong-Wha advises China's leaders to take advantage of its resilience to address growth-stifling imbalances

30th Jan 26, 9:41am

1

Lee Jong-Wha advises China's leaders to take advantage of its resilience to address growth-stifling imbalances

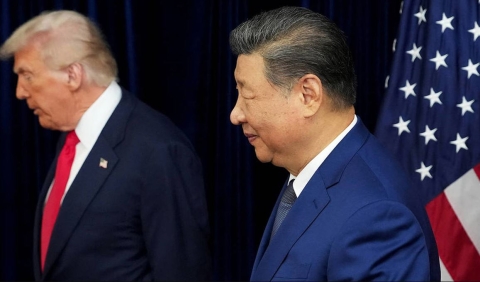

Stephen Roach thinks the move towards personalised leadership blurs the distinction between countries' political systems

30th Jan 26, 9:39am

18

Stephen Roach thinks the move towards personalised leadership blurs the distinction between countries' political systems

Yi Fuxian explains why declining fertility presents Chinese authorities with a uniquely difficult challenge

24th Jan 26, 5:55pm

Yi Fuxian explains why declining fertility presents Chinese authorities with a uniquely difficult challenge

David Mahon sees China growing in confidence it will lead an Asia-centric renewal, even with India included

14th Jan 26, 9:01am

1

David Mahon sees China growing in confidence it will lead an Asia-centric renewal, even with India included

Angela Huyue Zhang explains why techological dominance hinges less on models and chips than on economy-wide dissemination

9th Jan 26, 9:10am

5

Angela Huyue Zhang explains why techological dominance hinges less on models and chips than on economy-wide dissemination

Stephen Roach thinks effective diplomacy will be impossible so long as the current US president is in office

6th Jan 26, 2:08pm

16

Stephen Roach thinks effective diplomacy will be impossible so long as the current US president is in office

Arvind Subramanian explains how both the United States and China are making life harder for developing countries

28th Dec 25, 8:44am

Arvind Subramanian explains how both the United States and China are making life harder for developing countries

Yi Fuxian thinks the positive effects of incentives to boost China's fertility rate will be temporary while more coercive measures are unlikely

7th Dec 25, 4:07pm

1

Yi Fuxian thinks the positive effects of incentives to boost China's fertility rate will be temporary while more coercive measures are unlikely

Ludovic Subran describes how China is positioning itself as a supplier, designer, and powerhouse of the global economy

2nd Dec 25, 9:44am

1

Ludovic Subran describes how China is positioning itself as a supplier, designer, and powerhouse of the global economy

Stephen Roach thinks the China-centric administrative region of Hong Kong has changed irrevocably, despite its booming financial sector

30th Nov 25, 10:35am

Stephen Roach thinks the China-centric administrative region of Hong Kong has changed irrevocably, despite its booming financial sector

Jennifer Lind shows how China defied expectations and became a global technological powerhouse

26th Nov 25, 11:59am

Jennifer Lind shows how China defied expectations and became a global technological powerhouse

Mark Tanner says magic happens in China when brands collaborate in unexpected, fearless ways that likely wouldn't happen in the West

12th Nov 25, 4:38pm

Mark Tanner says magic happens in China when brands collaborate in unexpected, fearless ways that likely wouldn't happen in the West

Stephen Roach thinks the next Chinese five-year plan should set a goal of raising household spending to 50% of GDP by 2035

30th Oct 25, 9:56am

1

Stephen Roach thinks the next Chinese five-year plan should set a goal of raising household spending to 50% of GDP by 2035

Mark Tanner says Chinese consumers are saving more of their paychecks, bruised by their losses in residential property. Conspicuous consumption is lower but there are still many bright spots, especially related to 'experiences'

30th Oct 25, 9:53am

Mark Tanner says Chinese consumers are saving more of their paychecks, bruised by their losses in residential property. Conspicuous consumption is lower but there are still many bright spots, especially related to 'experiences'

David Mahon says China is emerging stronger politically and economically but must learn from the mistakes and naked hubris of the American, Soviet and British empires

14th Oct 25, 9:30am

5

David Mahon says China is emerging stronger politically and economically but must learn from the mistakes and naked hubris of the American, Soviet and British empires