Guest

Latest articles

Michael Pettis explains how tariffs work and their impacts. He shows what matters are the conditions under which such policies are made. The US cannot engage in beggar-thy-neighbour policies because it cannot run a trade surplus

Markets saw last week out on a positive note; NZD has enjoyed rally against the USD over the last few days as USD bulls take a breather and risk appetite has increased; NZD is now back around 0.9160 AUD

10th Jul 18, 1:52pm

by Guest

Markets saw last week out on a positive note; NZD has enjoyed rally against the USD over the last few days as USD bulls take a breather and risk appetite has increased; NZD is now back around 0.9160 AUD

Gareth Morgan debriefs on TOP: 'It was never about having a democratic political party structure where the latest recruit had the same say as those that had spent 10 years building to this – that’s just the naivety of political groupies'

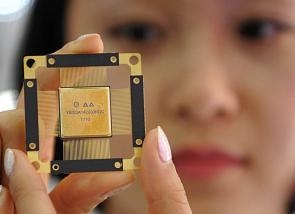

Auckland University's Ilan Oshri argues excessive emphasis on just 'keeping the lights on' is holding firms back from pursuing much-needed, transformational IT initiatives

The shift from a US dollar dominant world to a multipolar one where the Chinese yuan is rising could provoke considerable geopolitical turmoil. For nations seeking to mitigate their risks, gold has much to offer, says Andrew Sheng

Henry Lynch on the foreign buyer data debacle, how chatbots are channelling customers, the Australian banking sector, the FIFA’s World Cup strange connection to toilets, and the meaning of life

While this long-running Rabobank survey found lower confidence among farmers, a record high number assess their business as either 'viable' or 'easily viable'

Paul Buchanan points out New Zealand is facing a very tough choice between our security interests and our economic interests, and that choice may have to be made very soon

Trade-war concerns, political risk in Europe and divergence in monetary policy across the globe remain, some of the ongoing key themes to worry investors; NZD extends its five week decline bumping against 0.6690 with the USD

4th Jul 18, 2:43pm

by Guest

Trade-war concerns, political risk in Europe and divergence in monetary policy across the globe remain, some of the ongoing key themes to worry investors; NZD extends its five week decline bumping against 0.6690 with the USD

Lawyer welcomes insurance contracts law review, citing policies that give insurers discretion to over-ride a medical opinion to avoid paying a claim

Koichi Hamada defends economic openness, while calling for concerted action to address what is fueling opposition to it

Assistant Principal and economics and business teacher Mark Snoad looks at some hot education issues, including is tradition enough? thinking differently, are we preparing students for a future that doesn't exist? prophets of doom, and more

Aussie wholesale funding costs keep on rising, pushing mortgage rates up despite no change in the RBA policy rate. Politicians there won't be impressed

Columbia University's Shang-Jin Wei argues that US criticism of Chinese industrial policy is hypocritical and unfounded

Stephen Roach thinks current US trade, tax and spending policies constitute a classic case of imperial overreach

27th Jun 18, 2:00am

by Guest

Stephen Roach thinks current US trade, tax and spending policies constitute a classic case of imperial overreach

Risk sentiment in the markets is subdued still with the NZD easing lower from the weekly open against the USD; NZDAUD cross has traded in a tight range since last Wednesday; RBNZ cash rate announcement is Thursday and should remain unchanged at 1.75%

26th Jun 18, 2:10pm

by Guest

Risk sentiment in the markets is subdued still with the NZD easing lower from the weekly open against the USD; NZDAUD cross has traded in a tight range since last Wednesday; RBNZ cash rate announcement is Thursday and should remain unchanged at 1.75%

The sheer size of the US Government’s internal budget deficit in 2019, which will require a significant increase in the supply of Treasury Bonds, will be a major US dollar negative in the future

25th Jun 18, 10:01am

by Guest

The sheer size of the US Government’s internal budget deficit in 2019, which will require a significant increase in the supply of Treasury Bonds, will be a major US dollar negative in the future

Tom Maasland & Richard Wells of MinterEllisonRuddWatts take a look at the promises and challenges of open banking for banks

Under-supply and over-supply - the things that drive most markets also drive the online dating 'market', says Joanna Davies. Basic economics, she suggests

A fresh approach to personal savings is the only way to stop our slide into inequality and low productivity, argues Robert MacCulloch

Rabobank says New Zealand's dairy exports are facing brighter export prospects as prices rally on unfavourable weather in other countries, and trade frictions damage supply

Tom Maasland and Richard Wells of MinterEllisonRuddWatts delve into the impacts and influence of the EU's General Data Protection Regulation for banks

22nd Jun 18, 10:00am

by Guest

Tom Maasland and Richard Wells of MinterEllisonRuddWatts delve into the impacts and influence of the EU's General Data Protection Regulation for banks

Tom Maasland & Richard Wells of MinterEllisonRuddWatts put a spotlight on what the Privacy Bill means for New Zealand banks

21st Jun 18, 9:37am

by Guest

Tom Maasland & Richard Wells of MinterEllisonRuddWatts put a spotlight on what the Privacy Bill means for New Zealand banks

Although corporate bond values have nearly tripled in 10 years, much of that growth is in emerging markets. While a correction seems likely as defaults rise, Susan Lund says the shift toward bond financing is actually a welcome development

Markets closed the week out weaker with currencies all down against the USD; NZD remains on the back foot against the USD, from the decline from 0.7050 with further downside expected; NZD making gradual gains against the AUD

19th Jun 18, 2:33pm

by Guest

Markets closed the week out weaker with currencies all down against the USD; NZD remains on the back foot against the USD, from the decline from 0.7050 with further downside expected; NZD making gradual gains against the AUD