About

Suraj Varma

Latest articles

LGFA Bond Tender Number 54; weighted average yield accepted was 2.92% and coverage ratio was 2.73x

4th Apr 18, 2:23pm

by Suraj Varma

LGFA Bond Tender Number 54; weighted average yield accepted was 2.92% and coverage ratio was 2.73x

NZ Govt Bond Tender #630; weighted average accepted yield down to 3.14%; coverage ratio down to 2.4x

29th Mar 18, 2:08pm

by Suraj Varma

NZ Govt Bond Tender #630; weighted average accepted yield down to 3.14%; coverage ratio down to 2.4x

A review of things you need to know before you go home on Thursday; NZ GDP; fair dealing; child poverty reduction; Minginui; royal banking commission; PIMCO; world's largest jet engine; rates lower; NZD slightly lower

15th Mar 18, 3:59pm

by Suraj Varma

6

A review of things you need to know before you go home on Thursday; NZ GDP; fair dealing; child poverty reduction; Minginui; royal banking commission; PIMCO; world's largest jet engine; rates lower; NZD slightly lower

A review of things you need to know before you go home on Wednesday; mortgage rate changes; REINZ - February results; America's Cup venue; balance of payments; Indonesian President in NZ; bond offer; core banking system; rates lower; NZD higher

14th Mar 18, 3:59pm

by Suraj Varma

8

A review of things you need to know before you go home on Wednesday; mortgage rate changes; REINZ - February results; America's Cup venue; balance of payments; Indonesian President in NZ; bond offer; core banking system; rates lower; NZD higher

A review of things you need to know before you go home on Tuesday; food price index; takeover update; employment outlook; Smartpay partners with Alipay; interest rate caps inch closer; value of Australian home loans; rates mixed; NZD stable

13th Mar 18, 3:59pm

by Suraj Varma

10

A review of things you need to know before you go home on Tuesday; food price index; takeover update; employment outlook; Smartpay partners with Alipay; interest rate caps inch closer; value of Australian home loans; rates mixed; NZD stable

A review of things you need to know before you go home on Monday; deposit rate changes; ANZ inflation gauge; guest nights; AML/CFT; Tower rating; South Korea on Trump tariffs; 'no deal' Brexit; rates higher; NZD higher

12th Mar 18, 3:59pm

by Suraj Varma

5

A review of things you need to know before you go home on Monday; deposit rate changes; ANZ inflation gauge; guest nights; AML/CFT; Tower rating; South Korea on Trump tariffs; 'no deal' Brexit; rates higher; NZD higher

A review of things you need to know before you go home on Friday; mortgage rate changes, CPTPP signed; electronic card transactions; TradeMe declined; China CPI; Australian wool; rates lower; NZD stable

9th Mar 18, 3:59pm

by Suraj Varma

4

A review of things you need to know before you go home on Friday; mortgage rate changes, CPTPP signed; electronic card transactions; TradeMe declined; China CPI; Australian wool; rates lower; NZD stable

September 2040 Government inflation-linked tender #629; weighted average accepted yield up to 2.20%; coverage ratio up to 2.03x

1st Mar 18, 2:12pm

by Suraj Varma

September 2040 Government inflation-linked tender #629; weighted average accepted yield up to 2.20%; coverage ratio up to 2.03x

NZ Govt Bond Tender #628; weighted average accepted yield rises to 3.34%; coverage ratio rises to 3.2x

22nd Feb 18, 2:08pm

by Suraj Varma

NZ Govt Bond Tender #628; weighted average accepted yield rises to 3.34%; coverage ratio rises to 3.2x

NZ Govt Bond Tender #627; weighted average accepted yield rises to 2.77%; coverage ratio lower at 2.8x

15th Feb 18, 2:08pm

by Suraj Varma

NZ Govt Bond Tender #627; weighted average accepted yield rises to 2.77%; coverage ratio lower at 2.8x

LGFA Bond Tender Number 53; weighted average yield accepted was 3.13% and coverage ratio stable at 3.89x

14th Feb 18, 2:29pm

by Suraj Varma

LGFA Bond Tender Number 53; weighted average yield accepted was 3.13% and coverage ratio stable at 3.89x

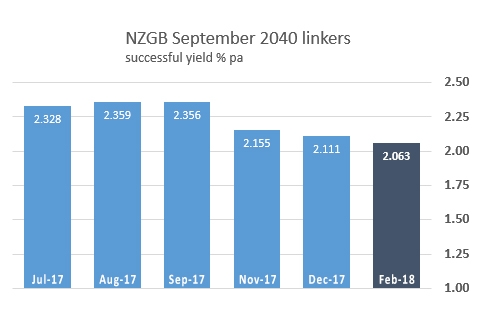

September 2040 Government inflation-linked tender #626; weighted average accepted yield down to 2.06%; coverage ratio down to 1.89x

1st Feb 18, 2:24pm

by Suraj Varma

September 2040 Government inflation-linked tender #626; weighted average accepted yield down to 2.06%; coverage ratio down to 1.89x

NZ Govt Bond Tender #625; weighted average accepted yield rises to 3.26%; coverage ratio rises to 3.0x

25th Jan 18, 2:13pm

by Suraj Varma

NZ Govt Bond Tender #625; weighted average accepted yield rises to 3.26%; coverage ratio rises to 3.0x

NZ Govt Bond Tender #624; weighted average accepted yield rises to 2.69%; coverage ratio slightly lower at 3.3x

18th Jan 18, 2:11pm

by Suraj Varma

NZ Govt Bond Tender #624; weighted average accepted yield rises to 2.69%; coverage ratio slightly lower at 3.3x

A review of things you need to know before you go home on Wednesday; mortgage and deposit rate changes; home loan affordability; current account; migration; overseas visitors and travel; overseas trade; rates higher; NZD lower

20th Dec 17, 4:01pm

by Suraj Varma

8

A review of things you need to know before you go home on Wednesday; mortgage and deposit rate changes; home loan affordability; current account; migration; overseas visitors and travel; overseas trade; rates higher; NZD lower

A review of things you need to know before you go home on Friday; deposit rate changes; NZ PMI; economic outlook; labour force; skills shortages; tourism funding; bond issue; swaps and NZD lower

15th Dec 17, 3:58pm

by Suraj Varma

8

A review of things you need to know before you go home on Friday; deposit rate changes; NZ PMI; economic outlook; labour force; skills shortages; tourism funding; bond issue; swaps and NZD lower

NZ Govt Bond Tender #623; weighted average yield drops to 2.56%; coverage ratio rises to 3.86x

15th Dec 17, 2:09pm

by Suraj Varma

NZ Govt Bond Tender #623; weighted average yield drops to 2.56%; coverage ratio rises to 3.86x

A review of things you need to know before you go home on Wednesday; six year low house sale volumes, food prices up +2.3%, teachers win more funding, LGFA gets strong demand, swaps and NZD stable

13th Dec 17, 3:59pm

by Suraj Varma

4

A review of things you need to know before you go home on Wednesday; six year low house sale volumes, food prices up +2.3%, teachers win more funding, LGFA gets strong demand, swaps and NZD stable

LGFA Bond Tender Number 52; weighted average yield accepted was 3.34% and coverage ratio was up to 3.94x

13th Dec 17, 2:21pm

by Suraj Varma

LGFA Bond Tender Number 52; weighted average yield accepted was 3.34% and coverage ratio was up to 3.94x

September 2040 Government inflation-linked tender #622; weighted average accepted yield falls to 2.11%; coverage ratio down to 2.14x

7th Dec 17, 4:07pm

by Suraj Varma

September 2040 Government inflation-linked tender #622; weighted average accepted yield falls to 2.11%; coverage ratio down to 2.14x

A review of things you need to know before you go home Tuesday; deposit rate changes; fee-free education; potential rate cuts; Barfoot numbers; ANZ Commodity Index; Crown accounts; building work; Trump's travel ban; rates and NZD higher

5th Dec 17, 4:01pm

by Suraj Varma

4

A review of things you need to know before you go home Tuesday; deposit rate changes; fee-free education; potential rate cuts; Barfoot numbers; ANZ Commodity Index; Crown accounts; building work; Trump's travel ban; rates and NZD higher

NZ Govt Bond Tender #621; weighted average yield accepted falls to 3.13% and coverage ratio falls to 2.48x

23rd Nov 17, 2:11pm

by Suraj Varma

NZ Govt Bond Tender #621; weighted average yield accepted falls to 3.13% and coverage ratio falls to 2.48x

NZ Govt Bond Tender #620; weighted average yield accepted down to 2.67% and coverage ratio slightly down to 2.62x

16th Nov 17, 2:09pm

by Suraj Varma

NZ Govt Bond Tender #620; weighted average yield accepted down to 2.67% and coverage ratio slightly down to 2.62x

September 2040 Government inflation-linked tender #619; weighted average accepted yield falls to 2.16%; coverage ratio up to 3.0x

10th Nov 17, 2:16pm

by Suraj Varma

September 2040 Government inflation-linked tender #619; weighted average accepted yield falls to 2.16%; coverage ratio up to 3.0x

LGFA Bond Tender Number 51; weighted average yield accepted up to 2.93% and coverage ratio down to 1.55x; insufficient bids for the April 2025 bond offer

8th Nov 17, 2:25pm

by Suraj Varma

LGFA Bond Tender Number 51; weighted average yield accepted up to 2.93% and coverage ratio down to 1.55x; insufficient bids for the April 2025 bond offer