Deciding whether to adopt a central bank digital currency (CBDC) or not is a pivotal moment for central banks akin to Britain's Bank Charter Act of 1844, which conferred monopoly rights over paper money on the Bank of England.

That is the view of Andrew Haldane, the Bank of England's departing chief economist who has also been a member of its monetary policy committee.

Media coverage of Haldane's wide ranging speech marking his departure from the Bank of England after 32 years focused on his concerns about inflation. However, he also aired strong views on CBDCs arguing there should be a greater focus on the longer-term monetary and financial stability benefits of new monetary technologies.

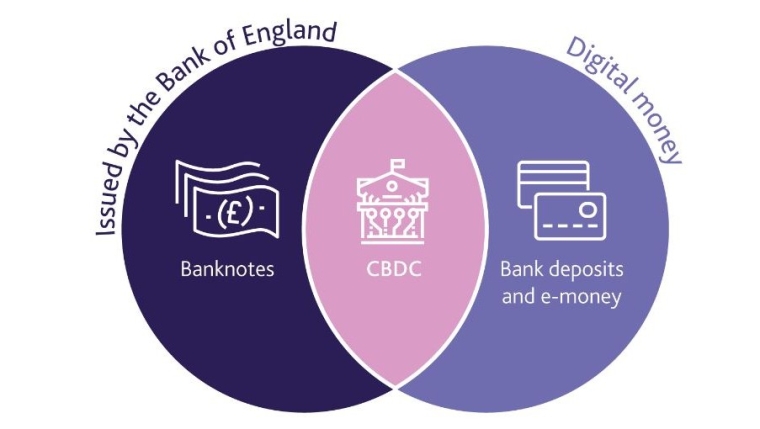

A CBDC would allow households and businesses to directly make electronic payments using money issued by the central bank such as the Bank of England in Britain, or the Reserve Bank in New Zealand. It could see an electronic record or digital token used as the virtual form of a country's fiat currency, which in NZ's case is the NZ dollar. This is against the backdrop of a world awash with cryptocurrencies such as bitcoin, and the development of stablecoins, which are a type of cryptocurrency backed by a reserve asset, such as fiat currency or gold.

"Within the next year or so, the UK will reach a decision on CBDC. It will be pivotal. An earlier pivotal moment was the Bank Charter Act of 1844, conferring on the Bank monopoly rights over paper money. At that point, central banking came of age in the setting monetary and financial stability policy. Tomorrow’s decisions on CBDC rival the 1844 Act in their significance for central banks over the medium term. And that is why a deeper consideration of monetary and financial stability implications is paramount today," Haldane said.

The Reserve Bank is preparing to consult publicly on the pros and cons of a CBDC, and there's more on CBDCs from the Bank of England here. The US Federal Reserve is also mulling a CBDC, and you can see more on CBDCs here.

The winds of technological change are blowing a gale through finance, led by payments, Haldane said, with new technological barbarians appearing at the gates, transferring money cheaper, faster and easier than ever. Against this backdrop with CBDCs under consideration, Haldane says from a financial stability context, a widely-used digital currency could change the banking landscape fundamentally.

"It could result in something akin to narrow banking, with safe, payments-based activities segregated from banks’ riskier credit-provision activities. In other words, the traditional model of banking familiar for over 800 years could be disrupted. While the focus of debate so far has been on the costs of this disruption, largely in the form of disintermediation of existing agents, there are significant potential benefits to be had too."

"Specifically, this could lead to a closer alignment of risk for those institutions, new and old, offering these services - narrow banking for payments, money backed by safe assets, and limited purpose banking for lending, risky assets backed by risky liabilities. This radically different topology, while not costless, would reduce at source the fragilities in the banking model that have been causing financial crises for over 800 years. Given the costs of those crises – large and rising – this is a benefit that needs to be weighed," Haldane said.

In terms of monetary policy, Haldane said the most important constraint facing policymakers today is having interest rates close to the zero lower bound (ZLB).

"At root, the ZLB arises from a technological constraint – the inability to pay or receive interest on physical cash. This is a technological constraint that every form of money, other than cash, has long since side-stepped. Even if you accept cash has other benefits that mean it is the preferred payment method for some, the inability to pay interest on public money is a relic of a bygone era."

"In principle, a widely-used digital currency could mitigate, perhaps even eliminate, this technological constraint. Specifically, CBDC would enable interest to be levied on central bank issued monetary assets or digital cash. The extent to which this relaxed the ZLB constraint depends, in addition, on the elasticity with which physical cash is provided to the public alongside CBDC. Access to physical cash is an issue well above the pay grade of central bank technicians; it is a political-cum-social issue. Nonetheless, the potential macro-economic benefits of easing the ZLB constraint are large and have grown over time," said Haldane.

He went on to say that studies suggest the ZLB constraint can result in significant shortfalls in output relative to potential, of about 2%, and inflation relative to target, of as much as 2 percentage points.

"These are potentially enormous gains in macro-economic terms. To those benefits needs to be added the gains to digital cash users of holding a remunerated instrument, helping protect their purchasing power. These financial stability and monetary-macro benefits should be at the centre of the debate about the desirability and design of digital currencies. To give an example, the design of the remuneration schedule for CBDC will in my view be one of the most significant decisions made by central banks in the next half-century."

"Yet, to date, central banks have scarcely touched the surface of the complexities this issue raises. This needs to change if the potentially transformative benefits of CBDC are to be unlocked," Haldane said.

*This article was first published in our email for paying subscribers early on Tuesday morning. See here for more details and how to subscribe.

22 Comments

The way I feel about govts and central banks after years of wealth transfer policy, they can take their CBDC and shove it right up their block chains. They will debase it when times are tough (which will be all the time) and construct clever lies that they are not.

All this stuff about faster transfers and so on is fluff compared to the real issue - control of monetary supply. I don't trust them.

If it's a digital fiat currency, how will they debase it?

"The Romans debased their currency by clipping coins, thereby reducing the amount of gold or silver in them and expanding the money supply more than the expansion of goods and services, resulting in inflating prices. But thanks to technology CBDC aren't made of gold and silver. Therefore you can't clip them. So gosh, how will you debase the currency? It's literally impossible." - NZ analyst.

The point is that central banks do not consider the public intetest, only their own. It's about control and surveillance. CBDCs can be given a lifespan or date by which they must be spent, and could even be frozen.

Beware how they will package it as convenience.

They are much cleverer than me. They will figure out how to make more numbers.

If it's a digital fiat currency, how will they debase it?

By expanding its supply

Who will manage the ledger for the CBDC?

Who will control the issuance of the CBDC?

Sounds like an even more centralised banking system.. the type of thinking that lead to Bitcoin.

Is this the great reset or a final wealth grab by the elite?

I’m deeply suspicious of the timing of all of this.

The only way I’d get behind this is if they did away with the sovereign monopoly of currency. Let the free market decide which CBDC they shop with and bring in an incentive to govern prudently.

Why is no one asking this question? "A CBDC would allow households and businesses to directly make electronic payments using money issued by the central bank such as the Bank of England in Britain, or the Reserve Bank in New Zealand. It could see an electronic record or digital token used as the virtual form of a country's fiat currency, which in NZ's case is the NZ dollar. " How is this different from what is happening now? On a daily basis I make electronic payments using a currency issued by NZ's central bank. The records of those transactions are held electronically. What is different with a CBDC from the electronic money that is in use now? Is it because the central bank sets the value? If so, how is this substantiated?

Right now, all your digital currency and savings is held by an intermediary (commercial bank). A CBDC (theoretically) enables you to have a direct funnel to the central bank, meaning that you have a wallet that can be directly funded by the central banks. Arguably, a CBDC removes the necessity of commercial banks. The biggest argument against CBDCs is that they would tear down the banking status quo. The ruling elite would never allow that. Too much vested interest. Commercial banks are one of the biggest beneficiaries of money printing. They are one step closer to the money fountain than the hoi polloi. They get to print money themselves (lend into existence) so they're more than happy with the existing monetary system.

The ruling elite may not have a choice. The digital yuan is almost upon us. If everyone is allowed to download the wallet and use, then the US would be left in the cold. Expect the digital yuan and digital US dollars to go head to head as the new global medium of exchange.

For those who want to know more, i'd suggest the George Gammon vids. He's been onto it for many months now.

The ruling elite may not have a choice. The digital yuan is almost upon us. If everyone is allowed to download the wallet and use, then the US would be left in the cold. Expect the digital yuan and digital US dollars to go head to head as the new global medium of exchange.

I disagree. What value is the digital yuan to the ruling elite and hoi polloi outside China?

For China - Global medium of exchange. Control. Alternative to US dollar. The current ruing elite may find they are no longer the ruling elite.

China produces for the world...might be handy to have some digital yuan to buy stuff you not think (wherever you may live)?

OK. If you think digital yuan will be sought after. As a trading currency perhaps.

If you cant buy your stuff off Ali without a few bucks loaded onto your yuan digital wallet will you stop buying?

If you want to export wine/beef/kiwi fruit to China and they will pay instantly to your Yuan wallet will you use it?

I suspect that's the plan...like it or not.

Considering what the private banks have done to us ordinary, not particularly monied folk, I'd welcome the Central bank cutting them out of a lot of the transactions. It'd probably put the cost of borrowing up I'd guess, and this would still have to occur through the private banks. But I'd also hazard a guess that they'd have a lot less control of the process ultimately.

The zero lower bound issue referred to in the article is that interest rates below zero aren't very effective, because if the bank charges you interest for storing your cash with them, you would simply withdraw your cash. Without deposits the banks can't function, so interest rates can't go far below zero before being ineffective. Sounds like CBDCs are the solution to this, because you won't be able to escape being charged interest on your money. It's just some new fresh hell the central banks want to visit on the peasantry.

What if Gen Z / millennials started to withdraw their deposits en masse and kept them in stablecoins? It is definitely in their interests to do so if their savings isn't earning anything. Perhaps you're right and the CBDC is designed to enslave them. This argument would suggest that they would be better off in decentralized currencies like Bitcoin. This is an argument I think the ultra orthodox would support.

FIAT currency is already digital. I honestly don't know how this changes anything.

Yes, it's just rebranding of fiat to buy a bit more time as confidence declines.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.