The RBNZ Dashboard release late last week enables us to check the score in the Great New Zealand Mortgage Game.

While there has been no change in the overall ranking between banks, there are definitely banks on the move.

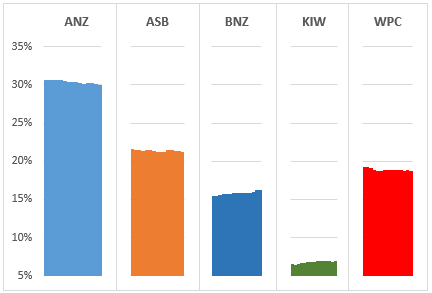

ANZ is still the largest, followed by ASB, then Westpac, BNZ and Kiwibank.

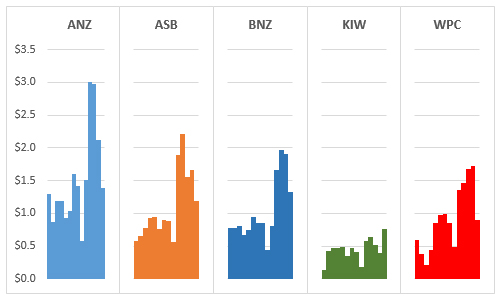

Over the past four years, all the large banks have increased their overall lending, and increased their lending even faster for home loans.

Kiwibank has 86% of all its lending concentrated in home loans. ASB has 72% and a noticeable concentration from 65% four years ago. ANZ has bulked up even more on mortgages, going from under 60% four years ago to 70% now. Westpac have also risen from under 60% to 65% now. And BNZ has gone from 47% then to 55% now.

But things are changing.

In the third quarter of 2021 it was BNZ and Kiwibank taking market share off the others, especially from ANZ and Westpac.

ANZ added $1.385 billion to its overall mortgage book in the quarter when all banks and non-banks added a total $6.3 bln. (C5)

But close on their heels was BNZ adding $1.323 bln, then ASB added $1.195 bln, Westpac $896 mln, and Kiwibank an impressive $758 mln given its much smaller size.

It is not the first time BNZ has bested ASB and Westpac, having also done it in the first and second quarters this year. Kiwibank's gains have been more variable.

Over the past twelve months, BNZ has grown its mortgage book by 17%, ASB and Kiwibank by 14%, ANZ and Westpac by 11%.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

6 Comments

AFR takes on the NZ property bubble with Citi saying it is possible that h'hold spending could fall 20% if IRs rise, thereby fueling and feeding a doom loop.

Incidentally, that fits in with my own doom loop theory, which is never discussed or highlighted in the media, by the RBNZ, and our indomitable leaders of all political persuasions as well as the bureaucrats, or at the neighborhood BBQs or around the water cooler.

https://www.afr.com/chanticleer/why-you-should-be-wary-of-a-kiwi-house-…

Same tune, different words...

“I had to pick between paying the rent, or buying food,” he said. “Then the last few weeks, I’ve just been picking food – that’s why I got this rent arrears notice. I just got sick of starving.”

https://www.stuff.co.nz/pou-tiaki/127126117/food-or-rent-wellington-cou…

This is dreadful. What makes it even worse is that these people are living in public housing. Robbo, Ardern, Woods, Orr, the bureaucrats, the opposition. All of them. They don't give a rats.

But let me suggest that the problem is possibly much bigger. When the mid-income wallets cannot be stretched any more, this will be devastating for businesses right across the supply chain.

It would have been better not have had the bubble at all.

Not surprising that every bankster now wants a piece of the action. When I looked at the sickle of profitability, I can't help but expect a special dividends or major share buy backs from the banks.

Who else in the world is able to pull off the stunt of carving out an 18X rate over OCR during the pandemic from 4X previously?

Also disgraceful. These profits should be redistributed given that the banks have free license on monetary debasement.

Nationalise the banks, make it illegal for foreigners to own NZ Banks, retain the brands to ensure competition remains.

Outcome $10,000,000,000 stays in the NZ economy EVERY SINGLE YEAR... recirculating, being re-invested in NZ, capitalising innovation and businesses.

In just 10 Years thats $100,000,000,000 that would remain in NZ.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.